Market Notes – May 18/22

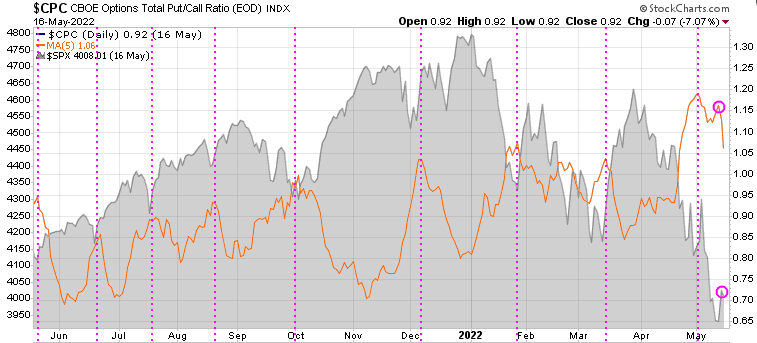

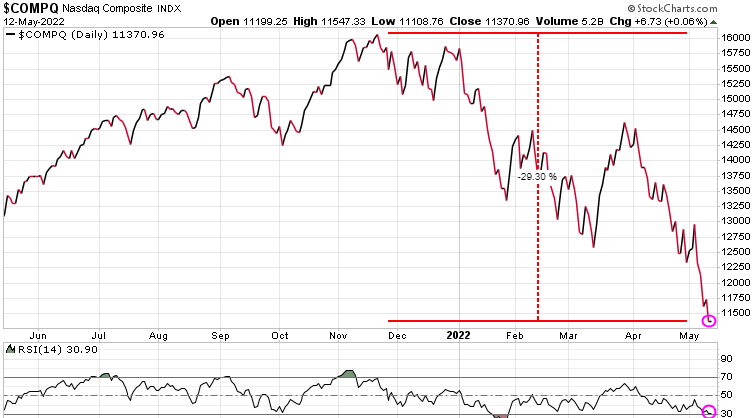

In yesterday’s issue of Today’s Charts we warned that in bear markets there is a lot of volatility, with violent moves both up and down. Today we saw what a violent move down in stocks looks like. We also warned that most relief rallies in a bear market fail. It is another reminder to ensure you have a hedging strategy, especially in times like these.

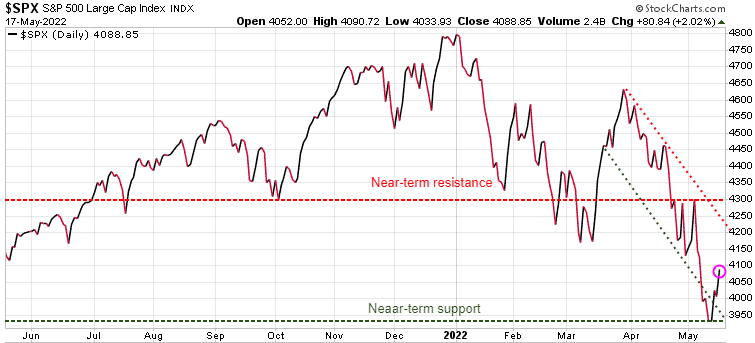

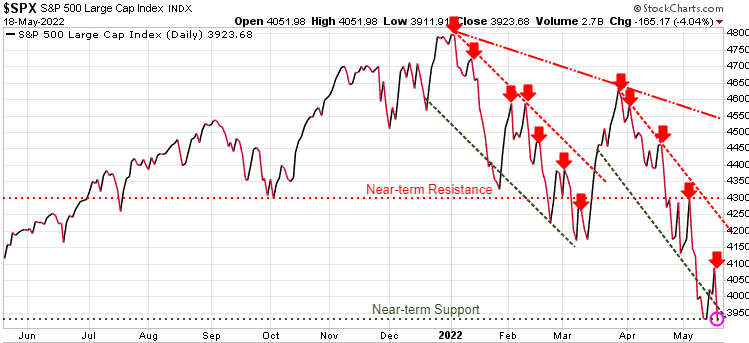

How far does this market fall? Below is a chart we showed Trend Letter subscribers recently. A 38% fibonacci retracement of the bull market run from 2009 would drop the S&P 500 to 3233, for a decline of over 32% from the January high. A 50% fibonacci retracement would take the S&P 500 down to 2750, a decline of over 42% from the January high.

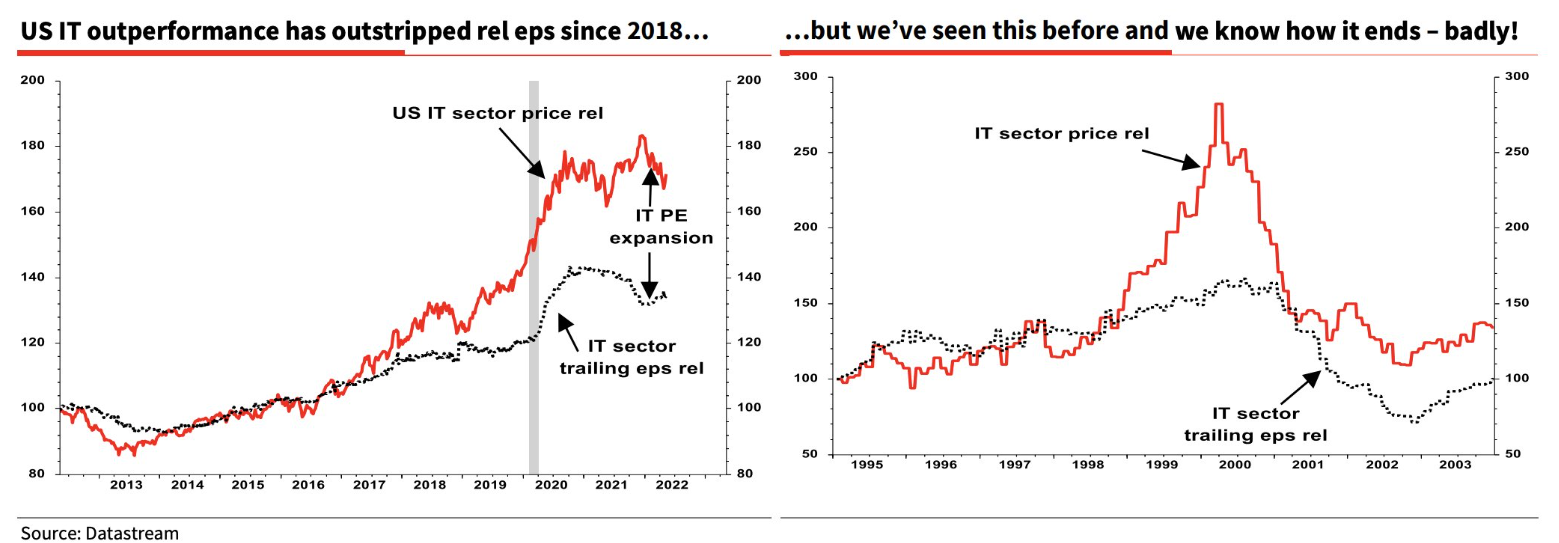

Tech stocks continue to be the big losers in this market sell-off, with the Nasdaq 100 dropping over 5.1% today and is now down 28% since its all-time high in Nov’21.

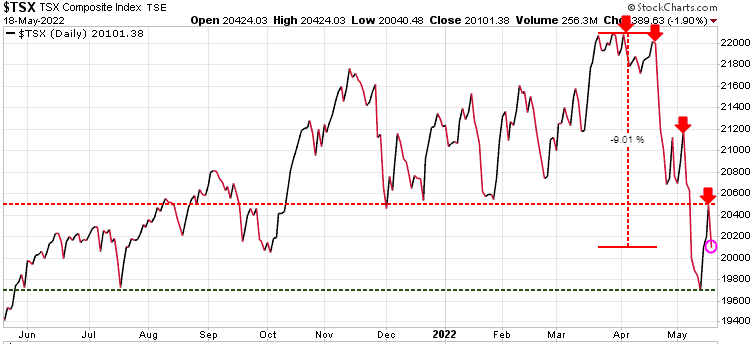

The Canadian TSX is also struggling but the energy is reducing the pain somewhat. TSX is down 9% from its all-time high.

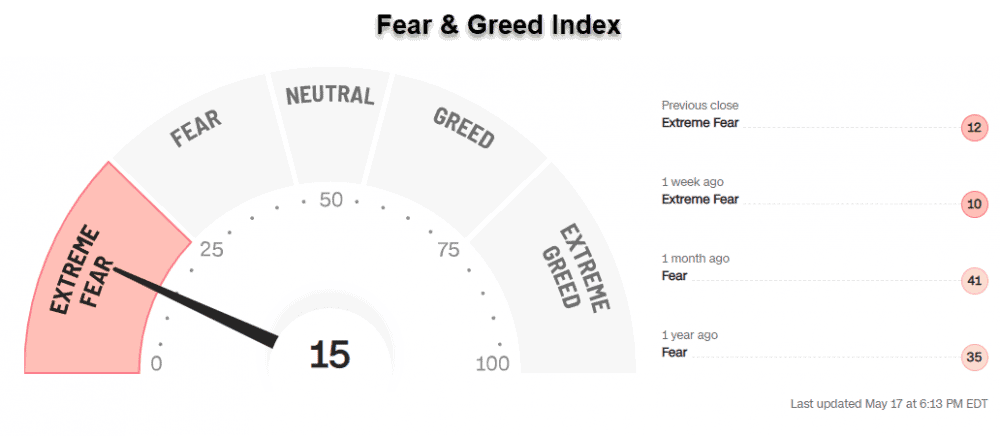

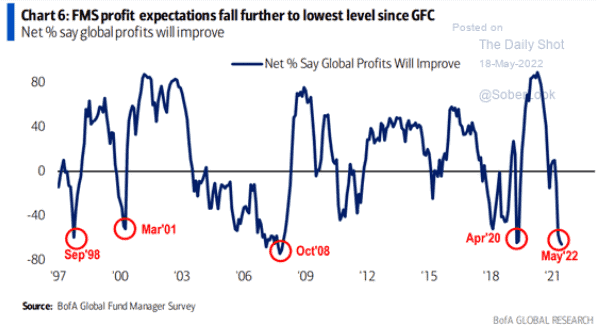

Based on the Bank of America’s Global Fund Manager Survey, fund managers haven’t been this gloomy about corporate profits since 2008.

Note that all three of our services have created target lists of excellent stocks that once we see the bottom of this bear market each service will be jumping in on those stocks. We are not there yet, but certainly getting closer to a bottom. We are offering the same great specials that we offered attendees of the World Outlook Financial Conference recently, where each service is 50% off and you can bundle two or all three services for even greater discounts. If interested, click on the button below. It’s your money – take control!