Market Notes – May 12/22

Stocks rebounded sharply in the final hour of trading, with the S&P 500 almost erasing a selloff that pushed it to the brink of a bear market earlier Thursday.

The turnaround came as Federal Reserve Bank of San Francisco President Mary Daly told Bloomberg News that a 75-basis-point increase in rates is “not a primary consideration,” while adding that the US is in a strong place and should be able to withstand monetary tightening. For a market that’s been haunted by fears that restrictive policy by major central banks will cause a recession, those comments offered a degree of comfort at the end of a session marked by wild volatility.

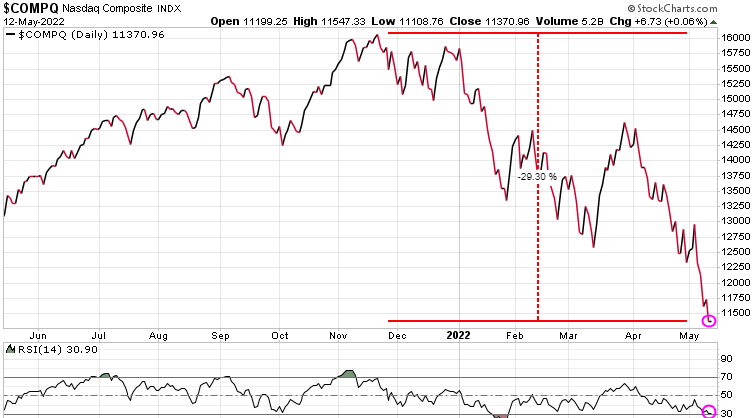

A small glimmer of hope as the S&P 500 was down 76 points at one point, but came back to close down just over 5 points. The S&P is now down over 18% from the high to start the year. At the bottom of the chart note that based on RSI the S&P 500 is getting close to being oversold, so at least a relief rally should be expected soon. Loading up here would be like trying to catch a falling knife – be careful!

The tech heavy Nasdaq is now down almost 30% from its November and is also very close to being technically oversold.

Cryptocurrencies have been hit hard and Coinbase, the largest crypto exchange is getting hammered, down 55% in just the last 5 days, and down 85% since the November high.

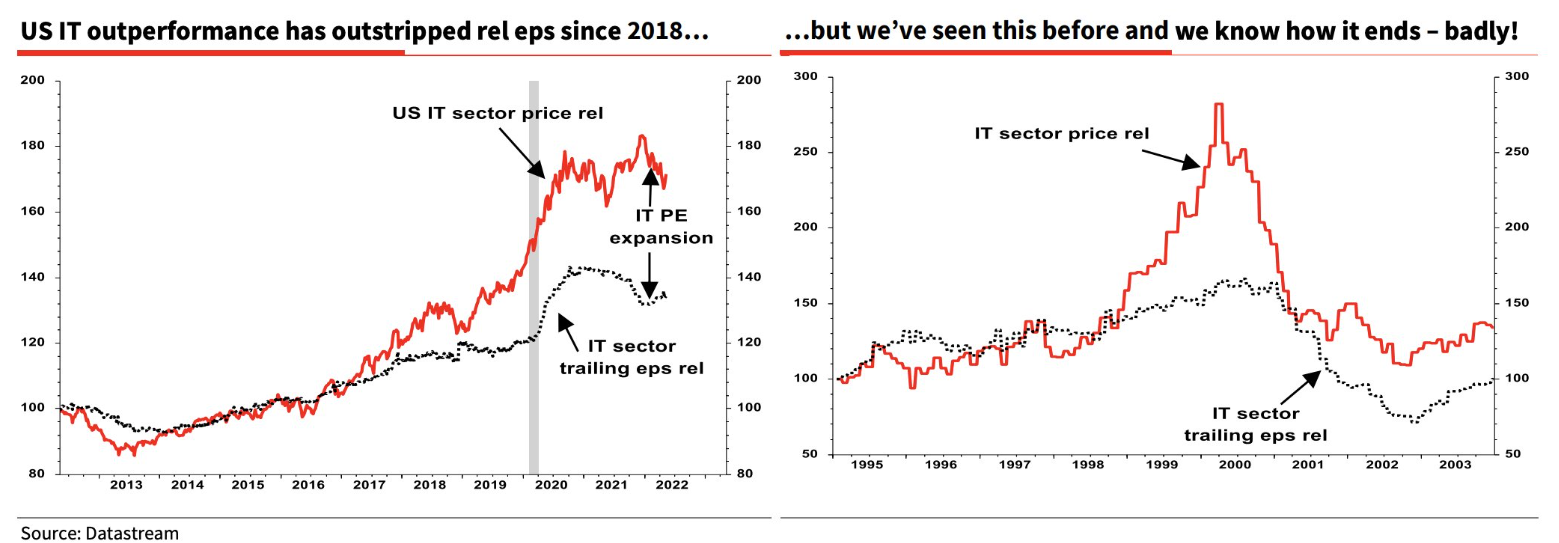

Tech now experiencing something similar to what was seen in 2000. Back then Tech collapsed as recession flushed out cyclical stocks masquerading as growth stocks. Profit disappointments in Tech during ’01 recession brought sector to collapse. Look familiar?

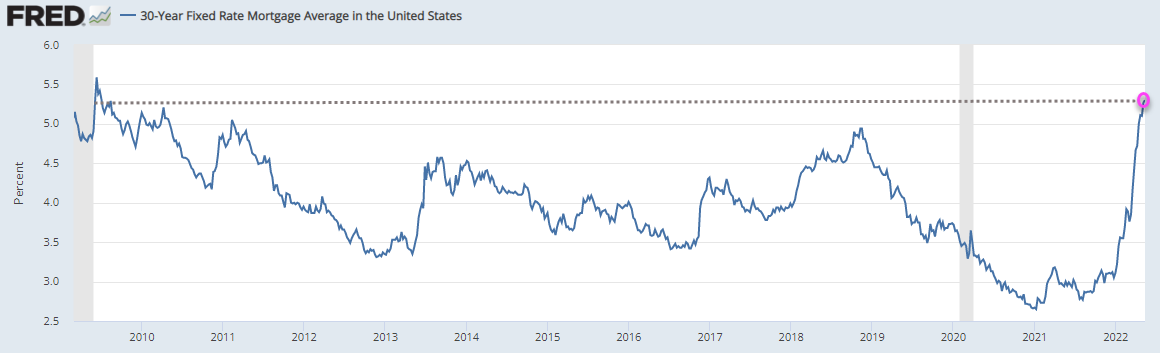

US 30-year mortgage has now jumped to 5.30%, almost double the Dec’20 rate of 2.67%.

Since the start of the year we have warned investors to have a hedging strategy for what we anticipated would be a very volatile year in 2022. The market action in these last 4 months is exactly the reason investors need a strategy to protect their wealth in volatile markets. Our Trend Technical Trader (TTT) service was originally a hedging service and although it now recommends long positions as well, TTT is still a hedging service with many hedging strategies that are doing very well as the market crashes.

If you do not have a hedging strategy, seriously consider subscribing to TTT which offers numerous hedging options. Note also, TTT includes the Gold Technical Indicator (GTI).

To ensure all readers have access to this hedge service, we temporarily reduced the price by 50%. Click button below to subscribe. It’s your money – take control!