Market Notes – July 27/22

This afternoon the Federal Reserve announced its latest policy, raising interest rates by 0.75% for the second consecutive month. Afterward, Fed Chair Jerome Powell answered a number of questions from the press gallery.

First, Powell was asked whether he agrees with the White House that ‘we won’t be in a recession.’ He then replied…

‘We think it’s necessary to have growth slow down. We need a period of growth below potential… We think it’s probably necessary if we’re going to get inflation down to a path to 2%… We’re going to be focused on getting inflation back down.’

At that point someone asked him ‘ ‘Why should we believe you when you said inflation was ‘transitory’?’

We thought that was a good question.

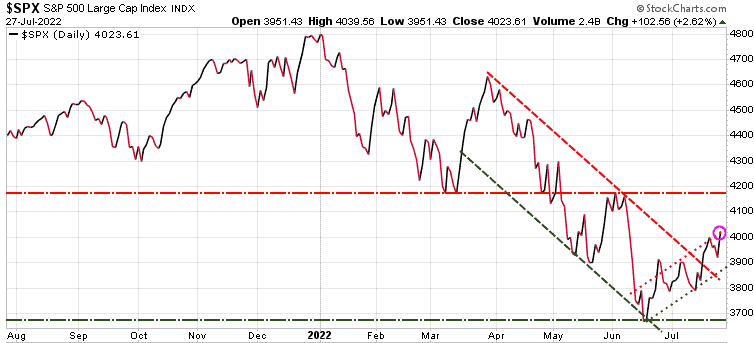

For some reason the markets loved this rater announcement, with the S&P 500 closing the day up 102 points or 2.62%. There is serious resistance near the 4200 level.

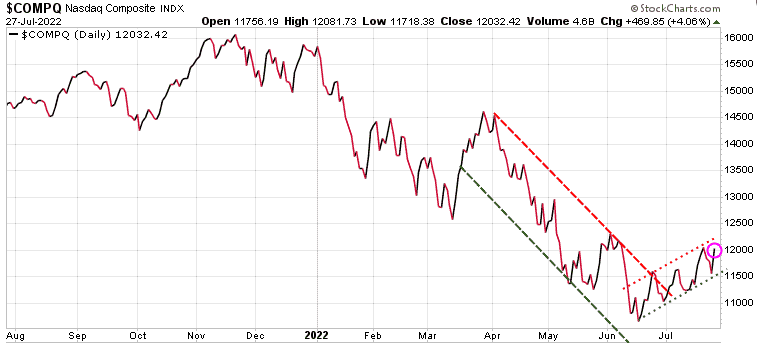

The tech heavy Nasdaq did even better, rising 4.06% for the day.

With such a positive move in the markets, many are asking if the bottom is now in. Our answer is ‘no.’

In our weekly issues of Trend Letter, we highlight to subscribers a number of key indicators our models follow and the bottom line is, that even though sentiment has been very bearish until recently, it has further to go before we get the final bottom. We are still seeing far too much bullish commentary from the mainstream media calling every one of these bear market rallies the start of the next bull market.

So many investors today have never experienced a true bear market; all they know is ‘buy the dip.’ Bear markets are different than simple corrections, they like to punish over enthusiastic investors. We will know the bottom is in when no one wants to talk about the stock market. For those old enough, it will be like in 2000 and 2008, when the markets just kept going lower. Sure, there were bear market rallies, but every one of them was a bear trap, sucking in the ‘buy the dip’ players.

This bear market will end when investors are sick of hearing about the stock market.

Now, this does not mean that we will not continue to see bear market ‘relief rallies’, and some of these can be very strong. Typically, they get stronger the closer we get to a bottom. But in almost every case, these ‘relief rallies’ fail to make new highs and instead typically see lower highs and lower lows.

Here is what our models are telling us:

Stocks: rally into August, then head down into September

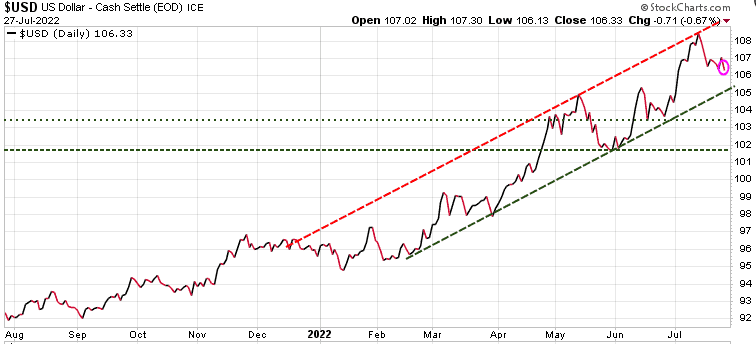

Currencies: $US has had a huge run up and is now overbought. Look for a pullack over the next month and then move higher in September. This means most other currencies will trade sideways or higher over the next month, then head lower after August.

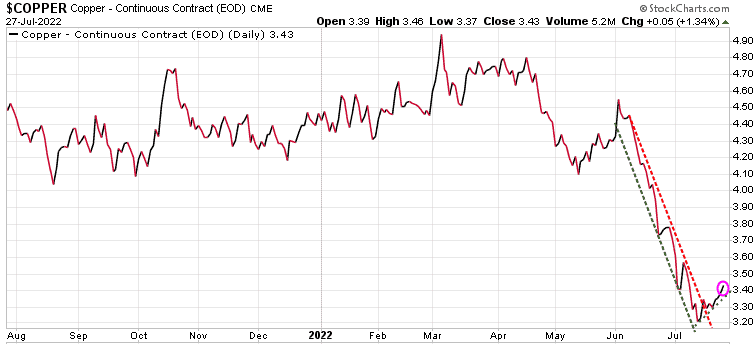

Commodities: Most commodities were red hot up until April on inflation, supply chain and war concerns. Then as they became overbought and recession fears have pushed prices down. We called for a rally in many commodities a few weeks ago and expect that could last through August, but after that, we will likely see another downturn in most commodities.

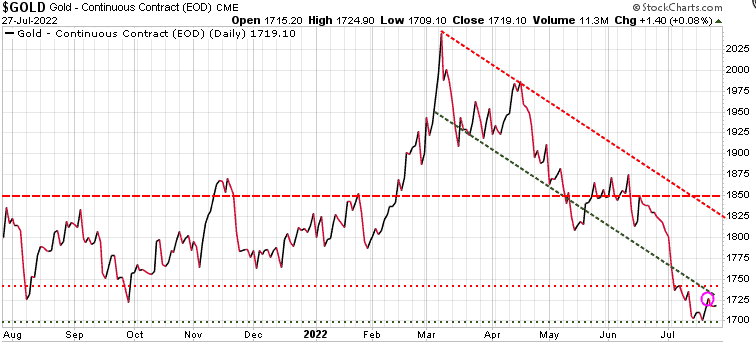

Gold: Gold and silver have been hit hard since the high in early March. We are getting a bit more optimistic that gold may be able to make a longer-term rally in the next few months.

Stay tuned!