Market Notes – October 28/22

US equities rallied Friday, as an earnings beat from Apple helped stocks push their way past a week of Wall Street misses for Big Tech.

The S&P 500 gained 2.5%. The Dow Jones Industrial Average bounced more than 800 points, or 2.6%, to a two-month high, as it also notched a fourth-straight week of gains and its best week of the year. The tech-heavy Nasdaq Composite rose 2.9%. The moves came even as Treasury yields climbed back above 4%. The Dow closed October as the best month for in 46 years and the best October ever.

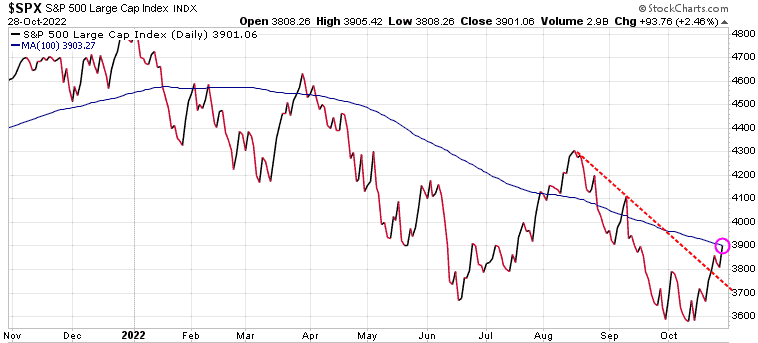

For the S&P 500, we see this as a near-term relief rally. Next week we get the Fed rate hike announcement and it will be interesting to see if they raise by the expected 75-bps, or if they follow the Bank of Canada lead and only raise by 50-bps. If they only raise 50-bps we should see a boost to the markets.

The US has its mid-term election on November 8, so the result of that could also have a big impact on the markets, especially if the Republicans gain control. Our initial target for this rally was at the 100-DMA at 3903. Today’s close at 3901.06 is very close to that initial target.

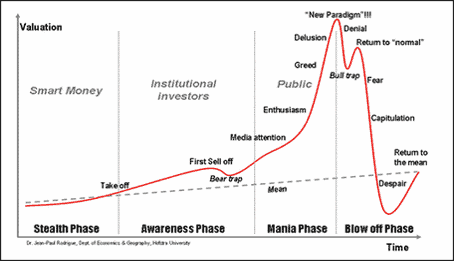

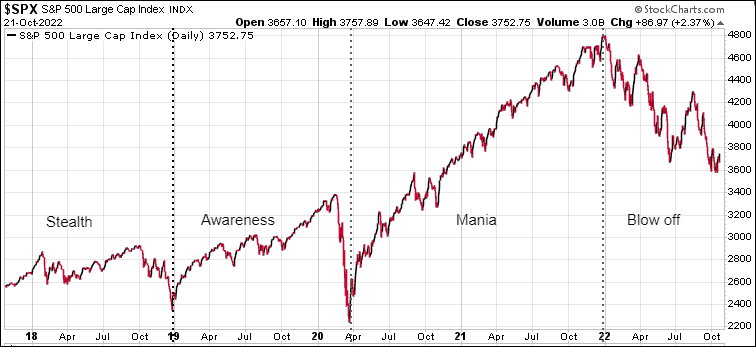

We are still in a bear market, although we are now in the strongest seasonal period, from mid October to almost May. Bear markets typically have 4 stages or phases:

- Stealth – where the Smart Money enters the market

- Awareness – sees Large Speculators enter the market

- Mania – this is where the retail or what we like to call the Masses buy in

- Blow-off – Where the market starts to turn down

At the top of the mania phase, everyone wants in, even those who haven’t ever followed the stock market…FOMO – Fear Of Missing Out. The 2021 REDDIT crowd pushing up ‘meme’ stocks like GameStop and AMC was a classic example of a Mania Phase top.

When we look at those phases and overlay the current S&P 500 chart, it suggests we are the Blow-Off phase. This would tell us that any rally here would be another short-term relief rally, maybe a few weeks, taking us the US election on Nov 8th. We still need to see ‘capitulation’ and ultimately ‘despair’ kick in to finally hit the bottom. Once we see that, we will be firing out BUY Alerts to subscribers

Stay tuned!

We publish 3 investment services:

- Trend Letter – Started that back in 2002, so over 20-years ago… publishes every Sunday, covers equites, currencies, precious metals, commodities,& bonds.

- Each weekly issue is about 50 pages, mostly charts, with key bullet points to make easy to understand

– Focus is for longer term investors who want to get a better understanding of what drives these markets - Trend Technical Trader – Online service that started as a hedging service, which has been a very timely service this year helping subscribers protect their wealth during this nasty bear market. It also now covers many sectors including commodities, equities & precious metals

- – Focus here is for more active investors but long-term investors can also benefit, especially with these hedging strategies

- Trend Disruptors – a monthly publication with new disruptive ideas in Artificial Intelligence, Virtual Reality, Augmented Reality, 5G, Cloud, Internet of Things etc. Very speculative sector and we have not added any new recommendations in this bear market, but are building our Watch List which is at about 25-30 companies right now

– Focus on those wishing to speculate, with risk capital they can afford to lose.

Special Offers

| Service | Regular Price | Special Price | Saving | Subscribe |

|---|---|---|---|---|

| Trend Letter | $599.95 | $349.95 | $250 | Trend Letter $349.95 |

| Technical Trader | $649.95 | $349.95 | $300 | Trend Technical Trader $349.95 |

| Trend Disruptors | $599.95 | $349.95 | $250 | Trend Disruptors $349.95 |

| Better Deals | ||||

| Trend Letter + Technical Trader | $1,249.90 | $549.95 | $699.95 | Trend Letter & Technical Trader $549.95 |

| Trend Letter + Trend Disruptors | $1,199.90 | $549.95 | $649.95 | Trend Letter & Trend Disruptors $549.95 |

| Technical Trader + Trend Disruptors | $1,249.90 | $549.95 | $699.95 | Technical Trader & Trend Disruptors $549.95 |

| Best Deal | ||||

| Trend Suite: Trend Letter + Technical Trader + Trend Disruptors | $1,849.85 | $649.95 | $1,199.90 | Trend Suite: TL + TTT + TD $649.95 |