Market Notes – January 20/23

Stocks rallied on Friday to finish the week strong after briefly losing the momentum of the January rally.

The Dow Jones Industrial Average added 330.93 points, or 1%, to close at 33,375.49, while the S&P 500 advanced 1.89% to 3,972.61. Both indexes snapped a three-day losing streak. Meanwhile, the Nasdaq Composite rose 2.66%, with help from Netflix and Alphabet, to end the day at 11,140.43.

The Nasdaq was also the outperformer for the week, posting a 0.55% gain and its third positive week in a row. The Dow finished the week lower by 2.70%, and the S&P posted a 0.66% loss, both breaking two-week win streaks.

All of the major averages are still in positive territory for the year.

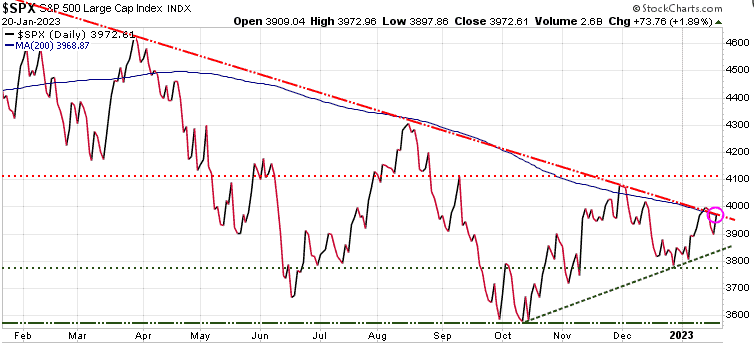

With the S&P 500, we can see it is forming a wedge pattern and is testing the upper rail, which coincides with the 200-DMA (blue wavy line). That 4000 level is near-term resistance, with 4100 being key resistance. Near-term support sits at 3850, with key support at 3570, which was the Sept & Oct double bottom.

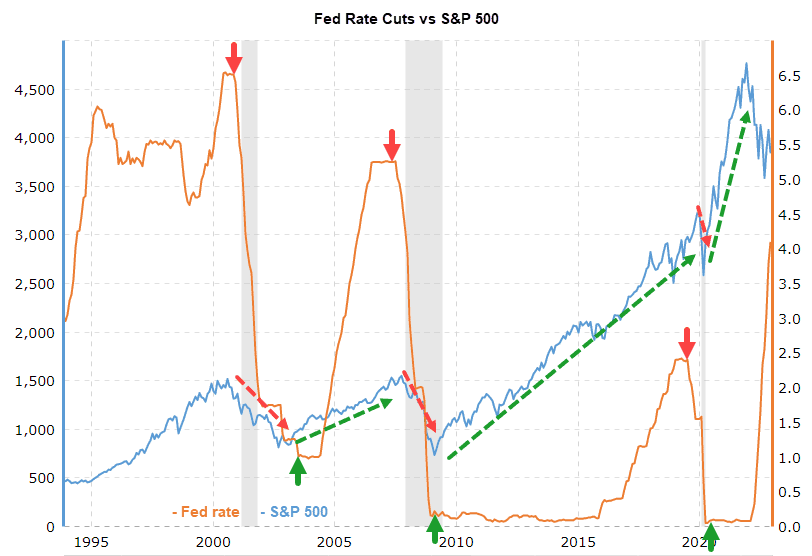

One thing investors should know is that typically, the bottom in the market aligns with when the Fed STOPS CUTTING rates, not STOPS RAISING them. As is clearly evident on the chart below highlighted by the green arrows, in the last few Fed rate cut cycles (2003, 2009 & 2020) it was when the Fed finished cutting rates that the stock market started its next bullish move. Aso clearly evident by the red arrows, when the Fed started their rate cuts, the market started to decline.

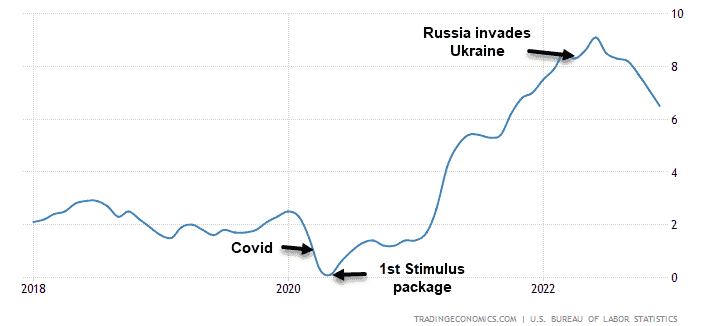

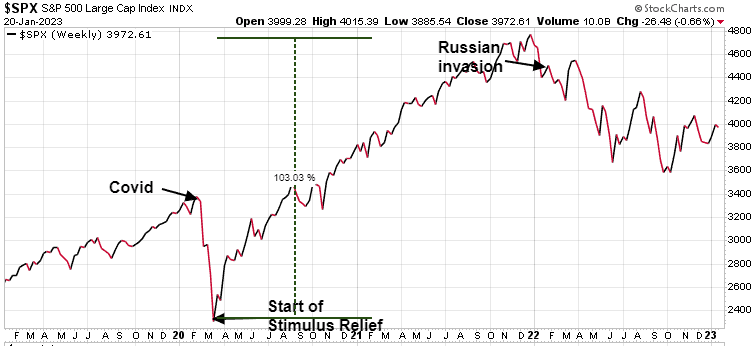

Many have assumed that the root cause of the inflation problem that we are in today was the Russian invasion of Ukraine. But in reality, one of the prime root causes was the amount of government stimulus that was pumped into the economy. Governments started handing out stimulus cheques like they were candy. As a result, US personal saving went from $1.45 trillion in late 2019 to a whopping $4.85 trillion in mid 2020. That’s an increase of $3.40 trillion or 234% in just 6 months.

All of the money handed out created new demand…too much money, chasing too few goods. As a result, inflation started to rise dramatically. By the time Russia invaded Ukraine, inflation was already ~8%.

All that increase in personal savings created a whole new group of investors. The Reddit crowd started investing the meme stocks such GameStop and AMC. That infusion of over $3.4 trillion created a ‘wealth effect’ and resulted in the S&P 500 rising over 100% in 2021.

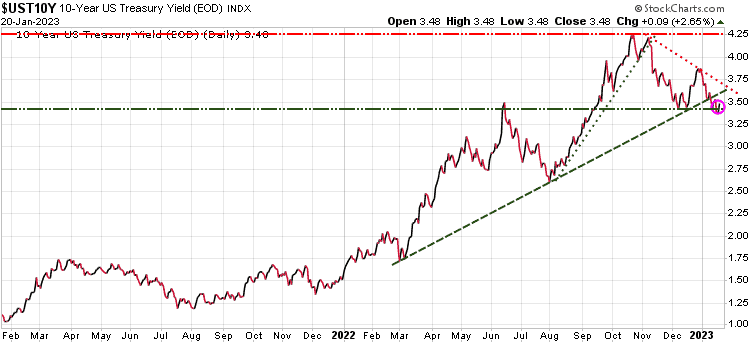

The bond market continues to ‘fight the Fed’ buying bonds, pushing 10-year yields down, expecting the Fed to PAUSE or even PIVOT soon on their rate increase policy.

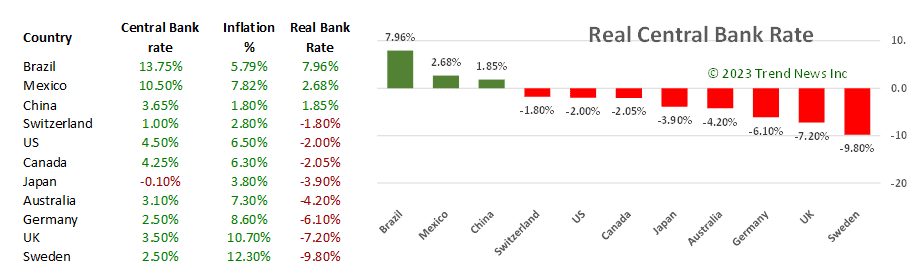

Both the Fed and Bank of Canada have stated that they want a ‘positive real rate’, meaning they want the central bank rate HIGHER than the inflation rate. As we can see on the chart below, both Canadian and US real rates are still negative. The mantra for 12+ years has been ‘don’t fight the Fed.’ Will fighting the Fed work this time?

Stay tuned!

Howestreet Special Offer

In case you missed it, the Trend Letter’s Martin Straith was a guest Friday on Howestreet’s ‘This Week in Money’. The interview with Martin begins at 1:00:17. In the interview Martin disucced the following topics:

- The AI ChatGPT app

- How the root cause of the inflation problem started long before the Russian invasion of Ukraine

- Why the market treat bad news as good news

- What is happening in the bond markets

- Currencies: $US, $CAD, Euro, Yen

- Outlook for gold, silver & oil

- Key technical triggers for when to buy stocks

- What will Bank of Canada do this week?

- What is the biggest obstacle for people being success investors

After the interview Martin offered listeners some Special Pricing for our three services. We are keeping these offers open for this week. Find them at the bottom of this page.

Trend Letter:

Since start-up in 2002 Trend Letter has provided investors with a great track record, giving exceptionally accurate information about where the markets are going, and it has explained in clear, concise language the reasons why. Using unique and comprehensive tools, Trend Letter gives investors a true edge in understanding current market conditions and shows investors how to generate and retain wealth in today’s climate of extreme market volatility.

A weekly publication covering global bonds, currencies, equities, commodities, & precious metals. Over the 20 years Trend Letter has been published, it has achieved an incredible average return of 65% on its closed trades.

Timer Digest says: “Trend Letter has been a Timer Digest top performer in our Bond and Gold categories, along with competitive performance for the intermediate-term Stock category.”

Technical Trader:

Trend Technical Trader (TTT) is a premier trading & hedging service, designed to profit in both up and down markets. Included is our proprietary Gold Technical Indicator (GTI).

TTT had another excellent year in 2020 averaging +27.3% per closed trade with an average holding time of 9.5 weeks, or +149% annualized overall.

Over the past 5 years TTT’s closed trades have averaged +40% annualized.

Trend Disruptors:

Disruptive technology trends will propel our future and the reality is that no industry will go untouched by this digital transformation. At the root of this transformation is the blurring of boundaries between the physical and virtual worlds. As digital business integrates these worlds through emerging and strategic technologies, entirely new business models are created.

Trend Disruptors is a service for investors seeking to invest in advanced, often unproven technology stocks on the cheap, with the objective to sell them when masses finally catch on. Covering Artificial Intelligence (AI), Virtual Reality (VR), Augmented Reality (AR), 5G, Quantum Computing & many more.

Trend Disruptors has realized average annualized gains of 178% over its 5 years of service.

Special Offers

| Service | Regular Price | Special Price | Saving | Subscribe |

|---|---|---|---|---|

| Trend Letter | $599.95 | $349.95 | $250 | Trend Letter $349.95 |

| Technical Trader | $649.95 | $349.95 | $300 | Trend Technical Trader $349.95 |

| Trend Disruptors | $599.95 | $349.95 | $250 | Trend Disruptors $349.95 |

| Better Deals | ||||

| Trend Letter + Technical Trader | $1,249.90 | $549.95 | $699.95 | Trend Letter & Technical Trader $549.95 |

| Trend Letter + Trend Disruptors | $1,199.90 | $549.95 | $649.95 | Trend Letter & Trend Disruptors $549.95 |

| Technical Trader + Trend Disruptors | $1,249.90 | $549.95 | $699.95 | Technical Trader & Trend Disruptors $549.95 |

| Best Deal | ||||

| Trend Suite: Trend Letter + Technical Trader + Trend Disruptors | $1,849.85 | $649.95 | $1,199.90 | Trend Suite: TL + TTT + TD $649.95 |