Market Notes – March 13/23

US stocks finished Monday mixed as volatile trading gripped Wall Street after federal banking regulators took aggressive actions to stem the fallout of Silicon Valley Bank’s failure.

First Republic Bank led a decline in bank shares Monday that came even after regulators’ extraordinary actions Sunday evening to backstop all depositors in failed Silicon Valley Bank and Signature Bank and offer additional funding to other troubled institutions. First Republic is now down ~80% since February 2/23.

Many of the bank stocks were halted repeatedly for volatility throughout the day.

With fear of a banking crisis, bonds spiked as investors ran to safety.

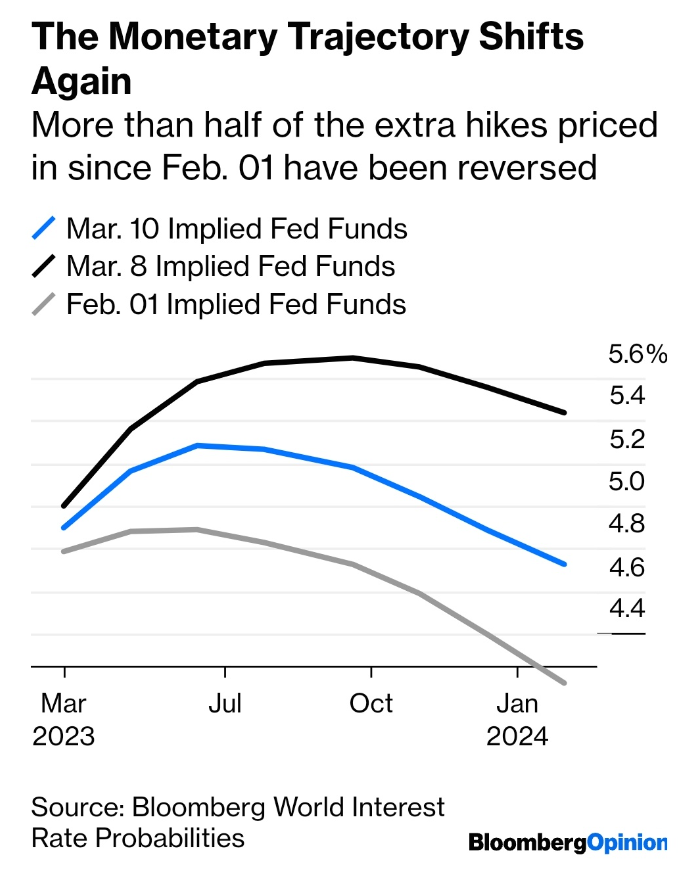

With the collapse of these banks, the market is now changing its tune on Fed rate hikes.

The $US was down with expectations that the Fed will slow their rate hike efforts. We will see.

Gold spiked higher as a safe-haven play.

Oil continued its decline. Could be seeing a great buying opportunity soon.

US CPI data is out tomorrow.

Stay tuned!