Market Notes – March 15/23

US stocks fell Wednesday as two economic prints showed a slowdown in the US economy in February, while fresh turmoil at Credit Suisse renewed investor concerns over the banking sector.

The S&P 500 dropped 0.7%, while the Dow Jones Industrial Average lost 0.9%. Contracts with the technology-heavy Nasdaq Composite pared earlier losses and ended just above the flatline.

The banking sector has been in free fall, with a benchmark KRE Bank ETF down more than 30% in the last 6 weeks.

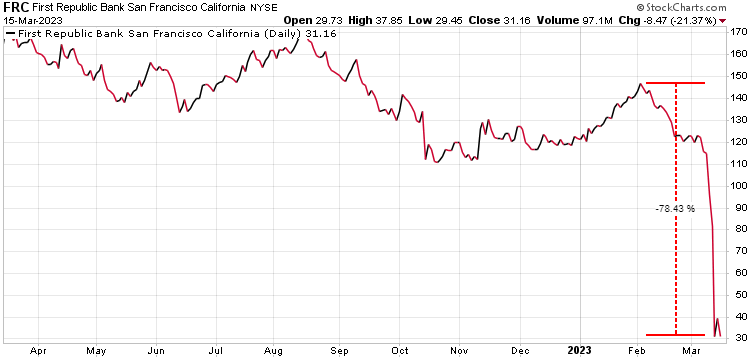

Half a dozen of these regional banks have seen their shares drop 50-80%.

Many are asking if they should buy these oversold stocks. If you are contemplating that, understand that these stocks has crashed for a reason. There is still high risk of contagion in the global banking sector, as Credit Suisse struggles today highlighted.

Oil fell to new lows on the year, with WTI falling below $70 a barrel. Over the last couple of months the Trend Letter has been telling subscribers to watch for oil to drop below $70, and that oil in the mid $60 range would be a great buying opportunity. Today, oil dropped as low as $65.65. Subscribers of Trend Letter were sent 6 new energy trades today. If you are not a subscriber but would like to be, subscribe here and save $250.

Stay tuned!