Market Notes – July 7/23

Wall Street’s main indexes ended lower on Friday in a seesaw session, as investors digested a US jobs report that showed weaker-than-expected growth and awaited more economic data and corporate earnings in the weeks ahead.

The benchmark S&P 500 was solidly higher for most of the afternoon, but stocks sold off toward the end of the session.

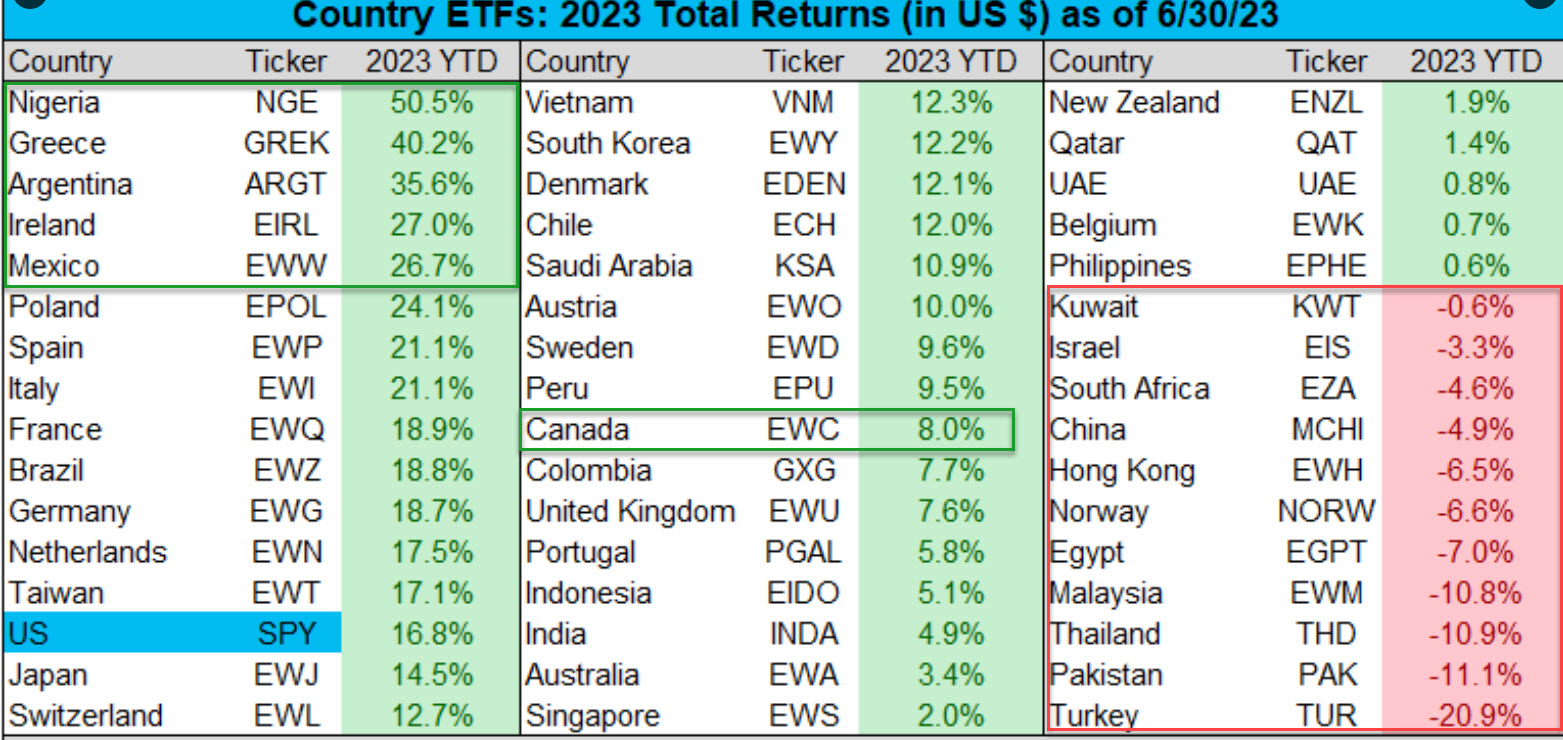

In reviewing the performances of the world’s Exchange Traded Funds (ETFs) most would be surprised by the results. Note that while Argentina was the 3rd ranked ETF, its inflation rate is at 114%.

Here is a 6-month heatmap of the S&P 500 where size represents market capitalization and colour represents performance. Clearly, the Big 7 stocks have led this AI frenzy.

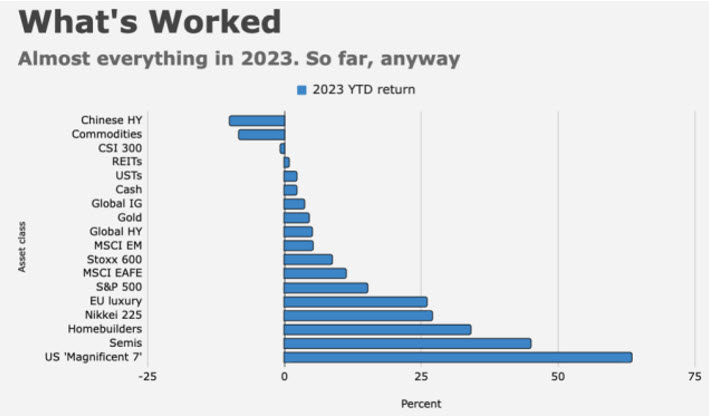

So far, 2023 has been the Great Rotation, the inverse of 2022. In 2022, the areas of the equity market that fared the poorest, namely Nasdaq, Technology and Growth stocks, have turned out to be the strongest performers so far in 2023. Conversely, the sectors that performed exceptionally well in 2022, such as Energy, Value stocks and Equal-weighted indexes, have been the weakest performers.

Big winners other than the BIG 7 were Semiconductors, Homebuilders, Japanese Nikkei, EU luxury along with North American stocks.

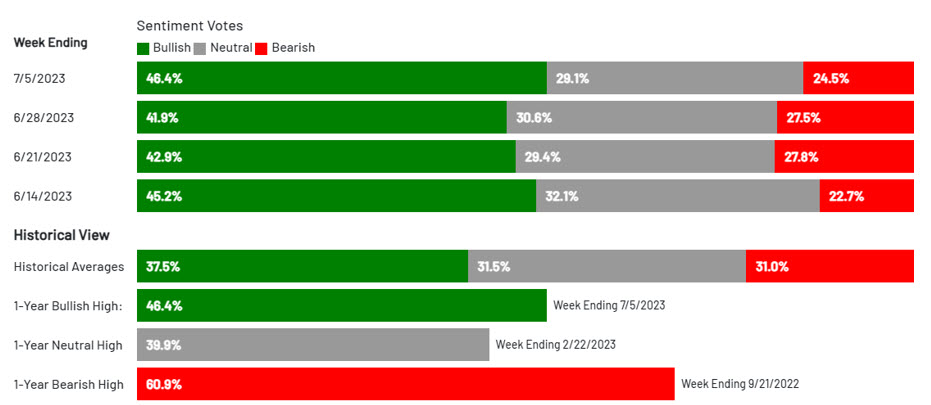

Market sentiment

Every week the American Association of Individual Investors (AAII) does a survey asking their members ‘what are your expectations that stock prices will rise over the next six months?’

Historic average of bullish expectations is 37.5%. This week it is 46.4%, the highest it has ever been.

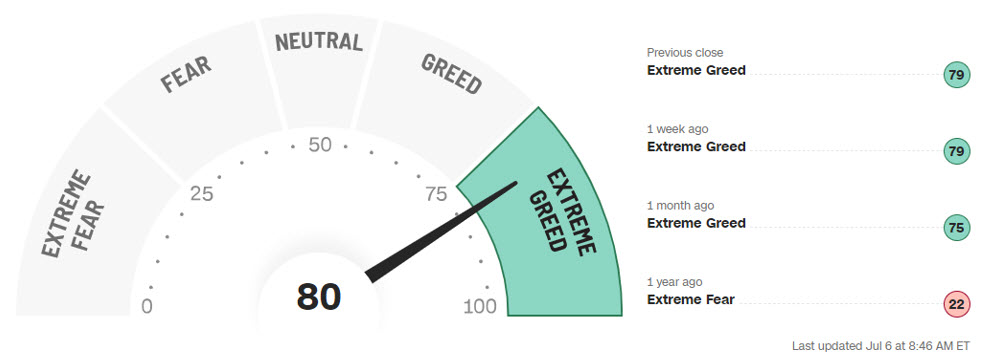

CNN’s Fear & Greed is another indicator that gives a sense of where investor sentiment is. They use 7 indicators from Moving averages, put/call ratios, Vix Volatility etc, so a fairly broad range of indicators.

Sentiment is at the Extreme Greed level, as the Fear Of Missing Out or FOMO is in full swing.

Warren Buffet: ‘Be fearful when others are greedy & greedy when others are fearful’

Central Bank Watch:

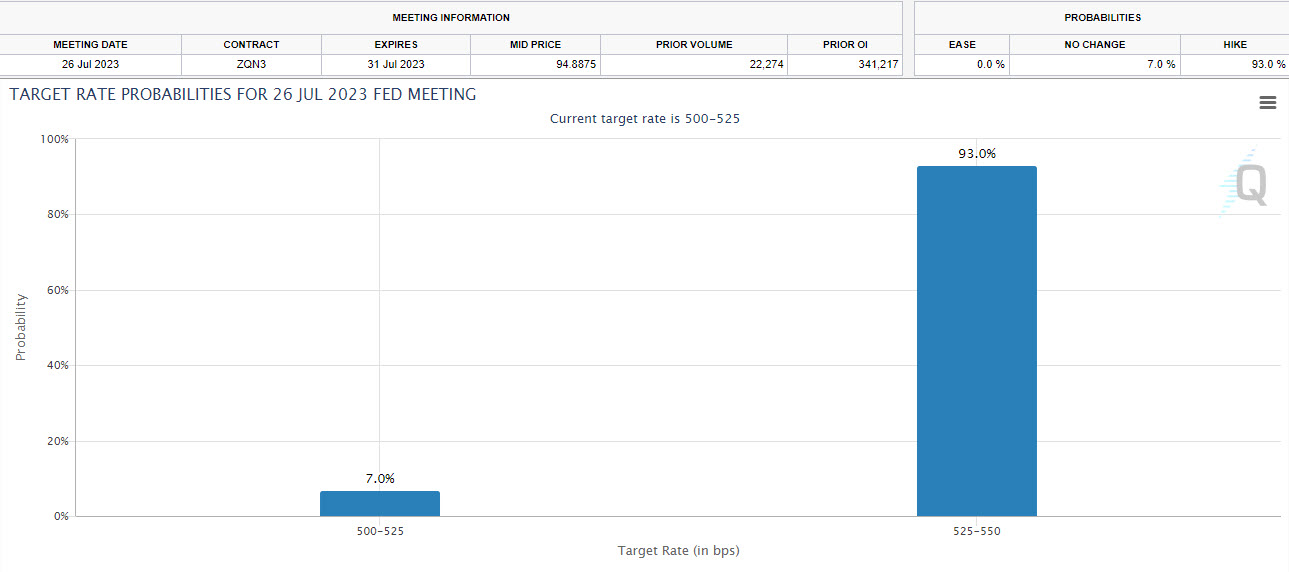

Based on the CME FedWatch Tool, there is 93% chance the Fed will raise rates .25% at their July meeting, and just a 7% chance for another PAUSE.

Consumer confidence, strong wage gains and a tight labour market continue to keep inflation ‘stickier’ than the central bankers would like.

On Thursday we saw US ADP data (based on actual payrolls) added 497,000 jobs in June, that is massive. On Friday US government data (based on phone surveys) showed 209,000 jobs; the 30h consecutive month of job growth in the US. Certainly, fuel for more rate hikes to come

In Canada on Friday, we got the jobs data which showed 60,000 new job, which was triple the expectations. BOC governor Macklem seems pretty adamant on crushing inflation, so we expect both the Fed & BOC to raise rates this month.

Debt Ceiling?

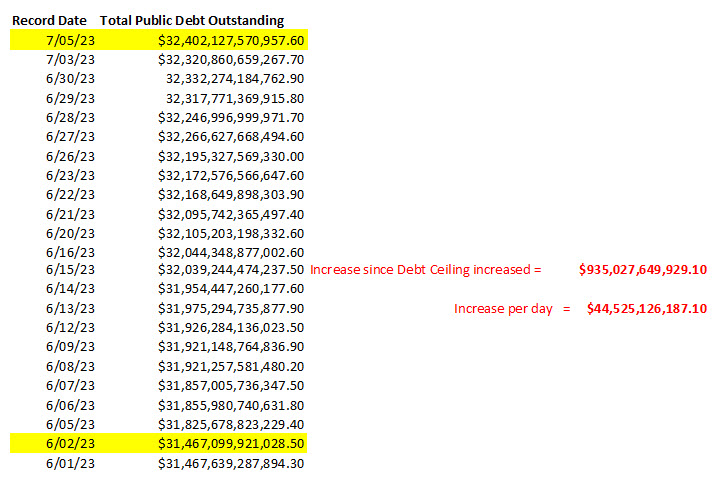

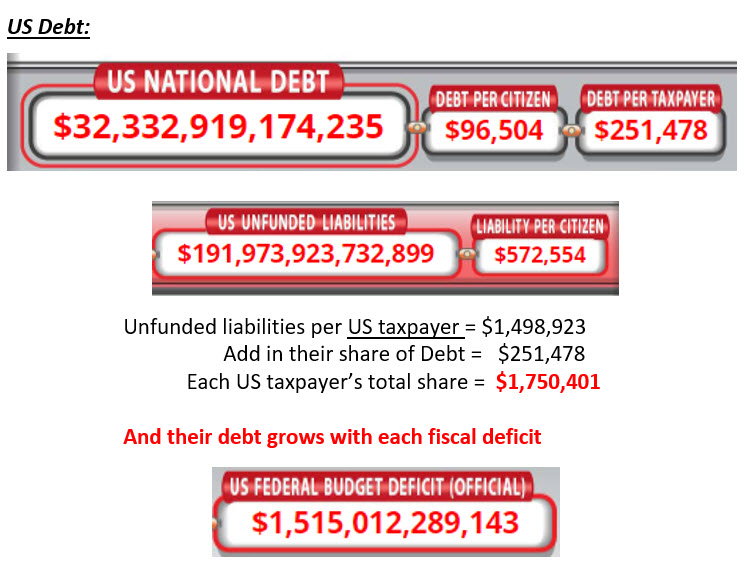

Since the Debt Ceiling debate was settled, the US government got back to doing what they do best….spend taxpayers’ money.

From June 2/23 when debt ceiling was raised, till the end of July 7/23, so 21 business days, the US has added $935 billion to their debt. That is over $44.5 billion per day. These numbers are straight from the US Treasury site.

The Bad & Good of Recessions:

Stock markets do NOT do well in recessions as investors become risk-averse and pessimistic about the economy. Sell-offs can be significant and panic can become a real strong force. As investors, we need to have a plan to protect our wealth should these recession warnings come true.

On the positive side, recessions can present excellent buying opportunities once the bottom is in. If we get another recession, after the SELL OFF, it will present a fabulous time to buy stocks.

Martin did a 30-minute interview with Jim Goddard on Howestreet’s This Week in Money. In the interview Martin offered listeners some special offers below. Also, Martin said Trend News will donate $100 to Special Olympics for every new subscription this week.

All subscriptions in $US

Special Offers

| Service | Regular Price | Special Price | Saving | Subscribe |

|---|---|---|---|---|

| Trend Letter | $599.95 | $349.95 | $250 | Trend Letter $349.95 |

| Technical Trader | $649.95 | $349.95 | $300 | Trend Technical Trader $349.95 |

| Trend Disruptors | $599.95 | $349.95 | $250 | Trend Disruptors $349.95 |

| Better Deals | ||||

| Trend Letter + Technical Trader | $1,249.90 | $549.95 | $699.95 | Trend Letter & Technical Trader $549.95 |

| Trend Letter + Trend Disruptors | $1,199.90 | $549.95 | $649.95 | Trend Letter & Trend Disruptors $549.95 |

| Technical Trader + Trend Disruptors | $1,249.90 | $549.95 | $699.95 | Technical Trader & Trend Disruptors $549.95 |

| Best Deal | ||||

| Trend Suite: Trend Letter + Technical Trader + Trend Disruptors | $1,849.85 | $649.95 | $1,199.90 | Trend Suite: TL + TTT + TD $649.95 |