Extreme fear translates to opportunities

We are an investment newsletter and we strive to bring the best information to assist those who want to become better, more successful investors.

The mainstream media is freaking out as US long bonds are selling off and yields skyrocketing. The 10-year bond yield has climbed to 4.81%, the highest level since 2007. This surge has triggered alarmist predictions of 12% to 13% yields, fueling even more panic among the masses.

The VIX Volatility Index just popped to very close to the 20.00 level, which is a key resistance level.

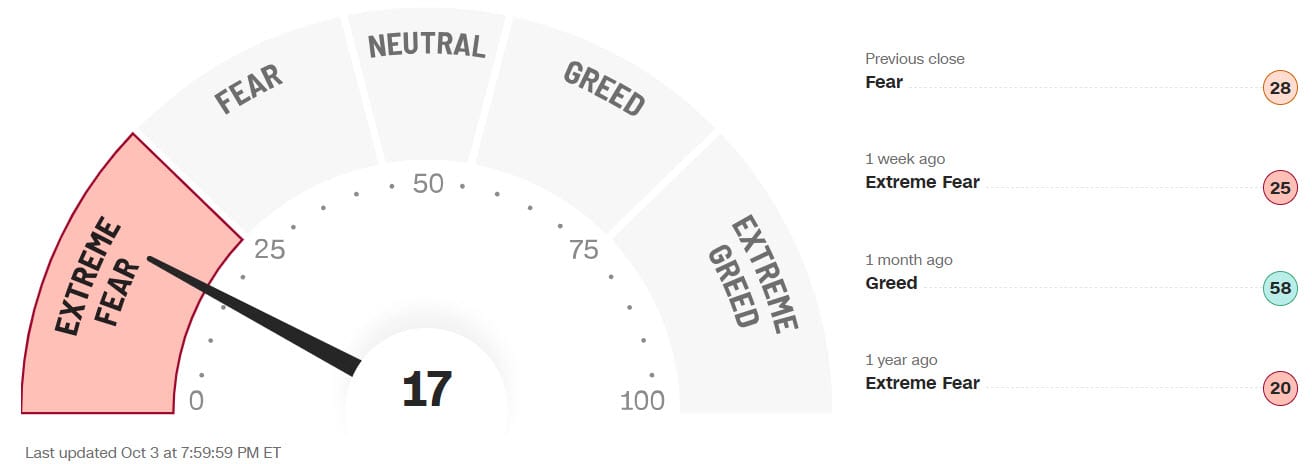

The CNN Fear & Greed Index is now firmly into the Extreme Fear level at just 17. Fear and greed swing like a pendulum, from one extreme to the other.

We are contrarian investors and when we witness widespread fear and negativity engulfing the markets, it’s like a flashing beacon that we’re nearing a potentially lucrative entry point. Much like when a crowded boat tilts dangerously when everyone piles to one side, markets often exhibit similar tendencies.

We know that August, September and the first week or two of October is the poorest performing period for equities, and this year has adhered to that pattern seamlessly.

Now we wait for the indicators that confirm we have reached at least a temporary bottom, with the potential for a strong rally extending into year-end. While we continue to anticipate a recession in 2024, it doesn’t preclude the possibility of a strong rally preceding that impending economic downturn.

However, it’s crucial to recognize that we’re trend traders, and we need more than just an oversold market. The market must demonstrate a compelling ability to rally convincingly. We believe we are close, but still need confirmation.

Once we receive that confirmation, we’ll promptly notify our subscribers. If you haven’t subscribed yet, our exclusive Special Offer, offering discounts of between 40% to 65% off regular prices, remains available until this Saturday.

Stay tuned!