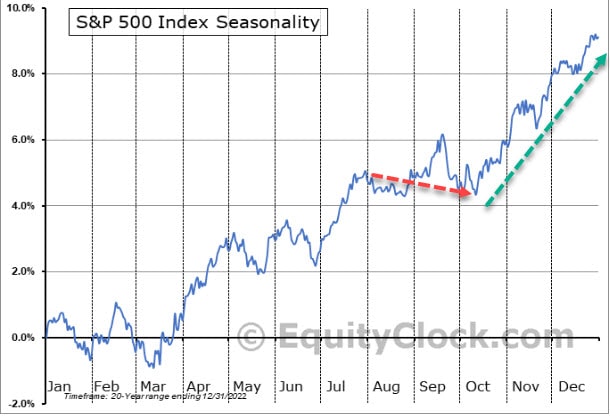

Seasonality suggests BUYING time is almost here

As an investment newsletter our role is to identify and present investment opportunities for our subscribers. We warned our subscribers to be very cautious as we approached August and September because based on seasonality, these months represent the weakest period for stocks. That weakness often extends into the first half of October, at which point we frequently see significant lows, which present some great buying opportunities.

We are looking for a final capitulation selloff in the markets, one extreme enough to flush out the last of the sellers and give us a look at the whites of their eyes. This selloff at ~8% has been relatively orderly, which is typical for a bull market. However, we are looking for one final blast to the 200-DMA at 4200 for the S&P 500. That level also aligns with the year-long uptrend line, serving as a critical support test. Should that level be breached, then we could see one final intense market low.

Either way, we have our powder dry, ready to release a sequence of BUY Signals to our subscribers in the coming week or two. Our focus will be on specific sectors including energy, uranium, cannabis, home construction, and technology stocks, provided that each sector experiences a decline to our predefined target levels.

Subscribers, please make sure to regularly check your inbox to ensure that you don’t miss our forthcoming BUY Signals. If you are not currently a subscriber, you can still take advantage of the Special Offers that we presented to listeners of Martin’s recent interview on This Week in Money.

Stay tuned!