No BUY Signal just yet

As an investment newsletter, we strive to bring the best information to assist those who want to become better, more successful investors.

Bond yields:

Investing in bonds. The recent market turmoil is predominantly driven by concerns over long-term bonds and their elevated yields, as investors brace for the prospect of enduring high borrowing costs. The underlying issue for the long bond market stems from the ongoing accumulation of substantial deficits and debt by the US government, compounded by the fact that China and Japan, historically the largest purchasers of US bonds, are now sellers of them.

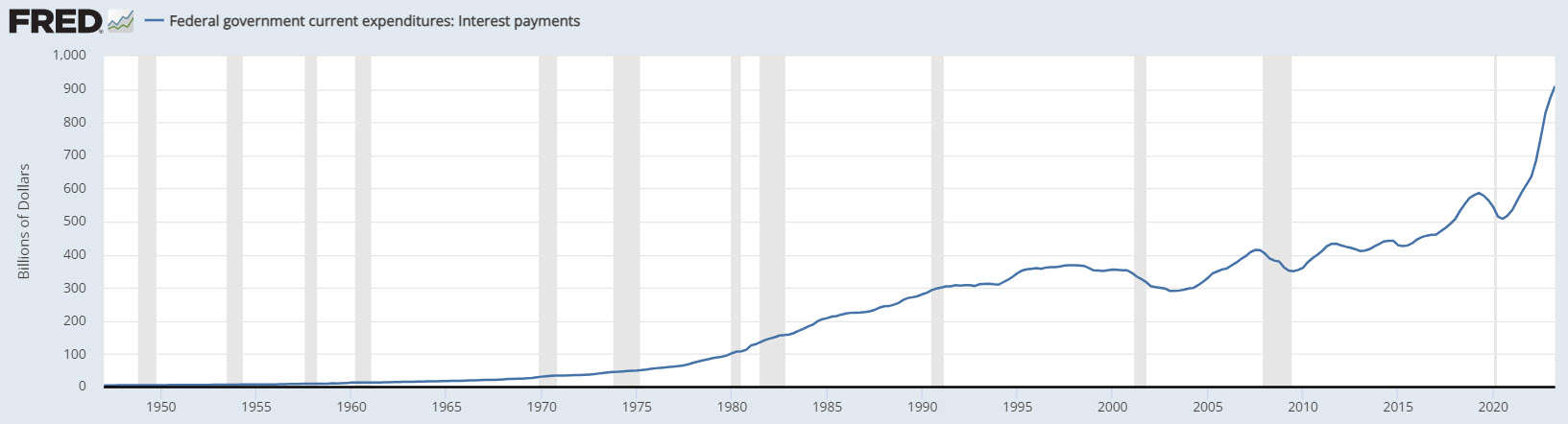

Currently, the US is making interest payments of $909 billion on its debt, as reported by the Federal Reserve. With the primary buyers of US debt transitioning into sellers, a pressing question emerges: who will step in to purchase this debt? As potential buyers remain on the sidelines, market dynamics are pushing yields higher in an attempt to attract new investors.

Remember, the Fed only controls the short-term rates, the market controls long-term rates.

Equities:

Investing in stocks. Although the recent selloff in equities showed some signs of slowing down on Wednesday, investors remain vigilant for any potential resurgence in volatility, particularly if the upcoming US non-farm payrolls data on Friday exceeds expectations. On Wednesday, the S&P 500 made a noteworthy rebound, surging by 34.30 points to reach 4,263.70, thanks to early buyers stepping in. However, as of this moment, it has started the day with a lower opening and has retraced much of those gains, currently down by 25.39 points.

Oil:

Investing in oil. In our previous Trend Letter last week, we anticipated a retracement in oil prices from their peak at 94.00, prompted by an elevated Relative Strength Index (RSI) reading of 78.00, with any reading above 70 indicating an extreme overbought condition. Subsequent to reaching that high, oil has experienced a decline of approximately 10.00, settling around our initial support marker at $86.00, concluding Wednesday’s session at 84.22. This morning, there has been a slight uptick, but at the time of this writing, the market remains relatively flat. Our next anticipated support level for oil stands at 79.70, and we expect it to test that level in the near future.

Gold:

Investing in gold. Gold continued its struggles Wednesday, down ~7.00 to 1834.80. Over the past few months our projected lower target for gold has been 1825. At the time of this writing gold is trading at 1828 and is exhibiting oversold conditions. We are on the verge of our models issuing a BUY Signal, but it hasn’t triggered it yet.

It’s essential to emphasize that we are trend traders, requiring more than just an oversold market condition. The market must exhibit a convincing rally potential. While we believe we are approaching that point, confirmation is still pending.

As soon as we receive that confirmation, we will promptly notify our subscribers. If you haven’t subscribed yet, our exclusive Special Offer, providing discounts ranging from 40% to 65% off regular prices, remains accessible until this Saturday. It’s your money, take control!

Stay tuned!