Optimism abounds!!

Investing in Stocks

We won’t dispute the momentum in prices. The S&P 500 has surged approximately 16% since October 27, a rally that would typically be considered substantial for an entire year. The Russell 2000 has experienced an even more significant increase of 25% during the same period. Incredibly, the equal-weight S&P 500 Index swiftly transitioned from a 52-week low to a 52-week high in just 33 trading days.

Market sentiment is being swayed by the anticipation of up to three rate cuts in 2024. If you watched our short video on what the stock market typically does when the Fed cuts rates you will understand that when the Fed cuts rates, history suggests that is not a good time to buy stocks. See short video here.

The markets are extremely overbought here with the 14-day Relative Strength Index (RSI) for the S&P 500 reaching an elevated reading of 87.19, surpassing the generally considered overbought threshold of 70.

Mean reversion is a trading or investing strategy that suggests that prices tend to revert to their historical average over time (eg: 200-dma). In other words, if a security’s price deviates significantly from its historical average, it is expected to move back toward that average. When we look at the current deviation of the S&P 500 from its 200-dma, it is getting near levels that are considered extreme, suggesting that it will need to revert closer to that average.

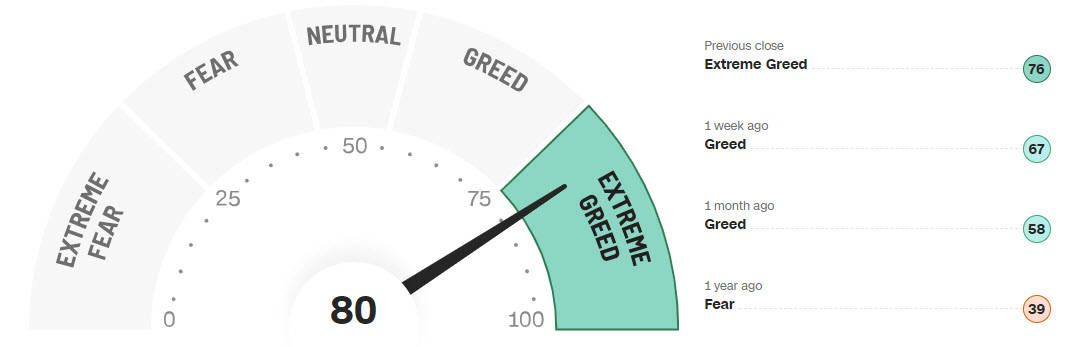

Another indicator flashing that the market is overbought is the Fear & Greed Index which monitors 7 indicators to determine where on the pendulum of extreme fear to extreme greed the markets are at. Today, the Fear & Greed Index is at an Extreme Greed reading.

While the markets can certainly continue to run hot through the rest of the year, investors should brace themselves for a potential pullback soon.

Investing in Oil

The recent overbought condition of oil (RSI reading on lower chart) prompted our models to trigger a new trade to capitalize on a potential oil rally. The current seasonally strong period for oil, coupled with escalating geopolitical tensions in the Red Sea, builds a case for a potential uptick in oil prices.

Contrary to these bullish factors, the significant oil production by the US, Iran, and a few other countries continues at a high pace, maintaining elevated output levels.

Stay tuned for further developments!