Why the Bond Market Fears Inflation Despite Fed Rate Cut?

Why Retail Investors Should Pay Attention to the Bond Market

Many retail investors overlook the bond market, dismissing it as too complex or less exciting than stocks. However, bonds hold the key to understanding broader economic trends, especially interest rate movements. Ignoring them means missing out on critical insights that could enhance your investment decisions

The Unexpected Rise in Long-Term Rates

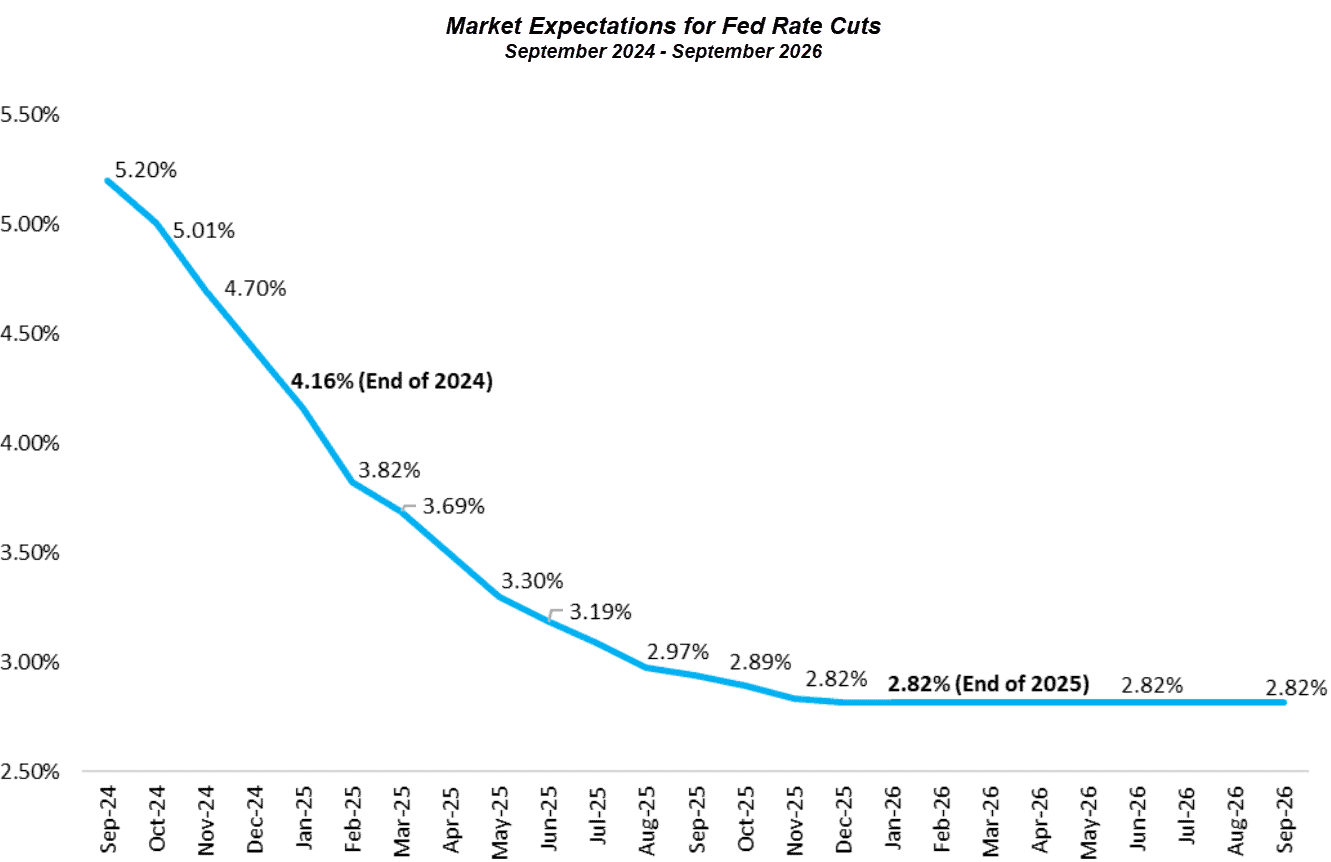

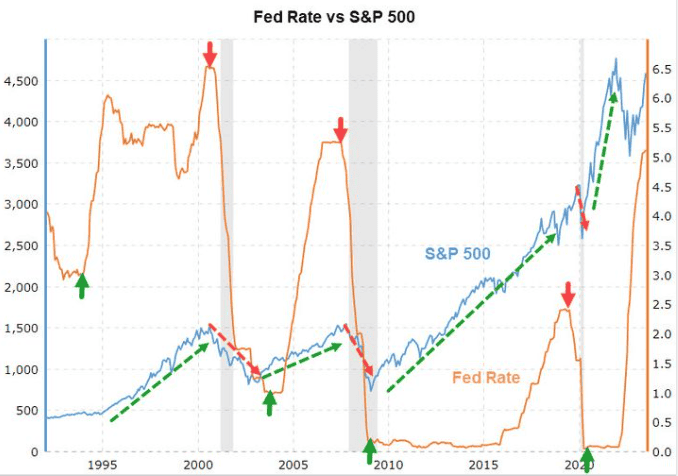

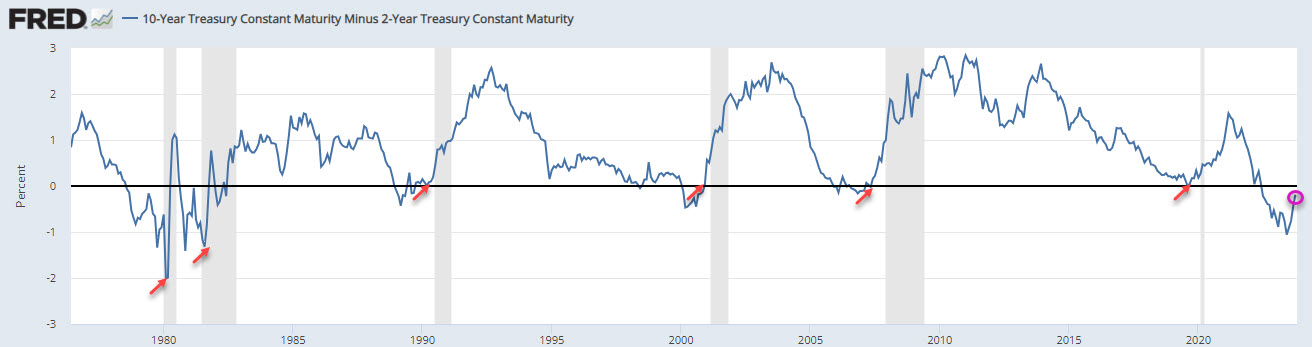

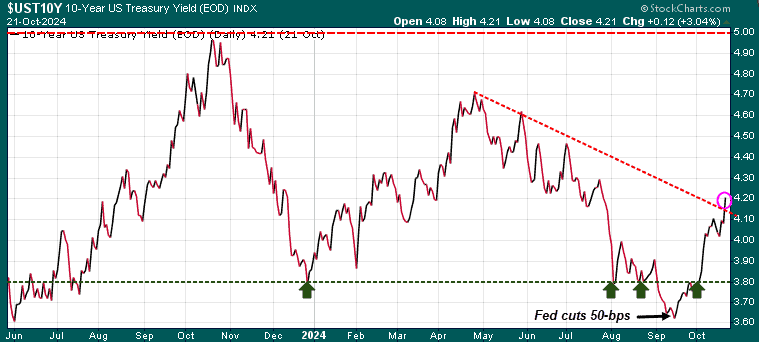

On September 18, 2024, the US Federal Reserve announced a significant 50-basis-point rate cut, the first since July 2023. Typically, rate cuts are designed to lower borrowing costs, leading to a drop in bond yields. However, this time, the opposite happened—interest rates on 10-year bonds went up, not down. So, why are these longer-term rates rising?

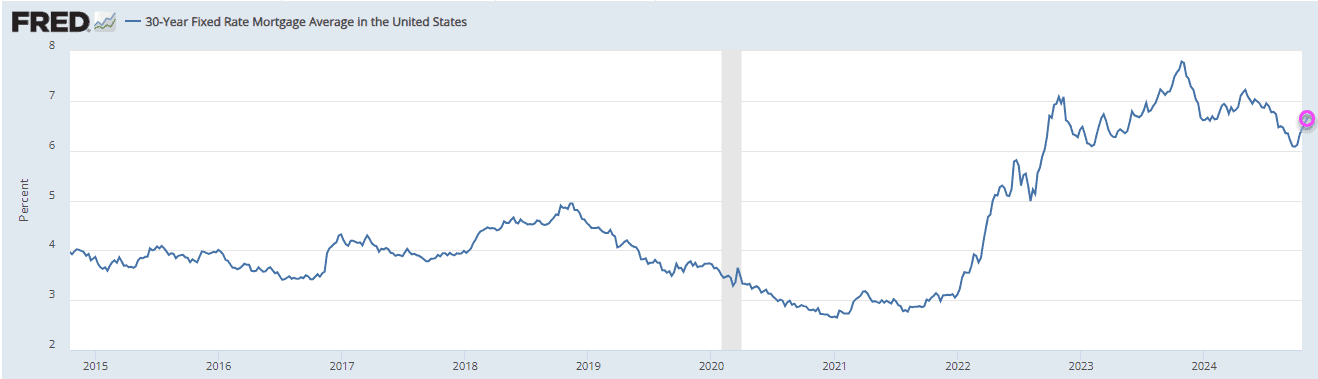

The impact was also felt in the real estate sector. The 30-year US mortgage rate jumped back to 6.69%, a surprise to many who expected lower mortgage rates following the Fed’s rate cut. This spike has left homeowners and real estate professionals rethinking their expectations.

Why Inflation Expectations Are Rising

To understand why bond yields and mortgage rates are rising, we need to look at the underlying factors driving these movements. One major reason is long-term inflation expectations. While the Fed may believe inflation is under control, the bond market seems to think otherwise. One of the key reasons why is related to soaring government deficits:

- Reckless Government Spending: The US government’s increasing debt levels mean more bonds are issued, leading to a flood of new supply.

- Replacing Maturing Bonds: New bonds must be issued to replace those that are maturing, adding more supply.

- Funding New Debt: Continued high levels of government spending require new bonds to finance the debt, driving yields higher as investors demand more to take on increased risk.

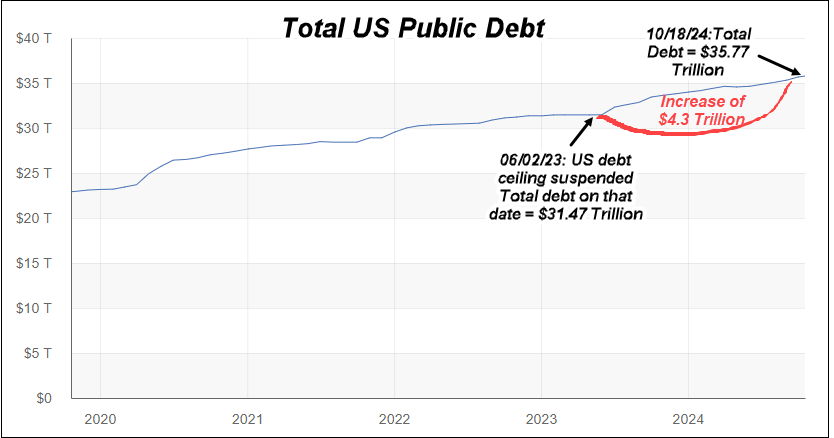

Since the debt ceiling was suspended on June 2, 2023, the US has added a whopping $4.3 trillion to its debt total, with national debt fast approaching $36 trillion. To put it into perspective, the $600 billion increase over the last two months is nearly three times the annual budget of NASA.

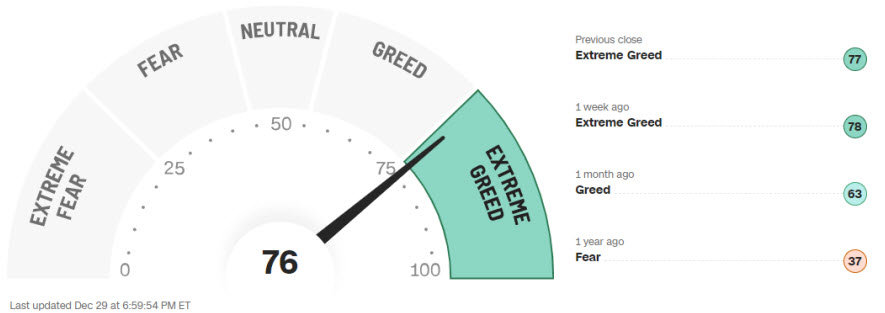

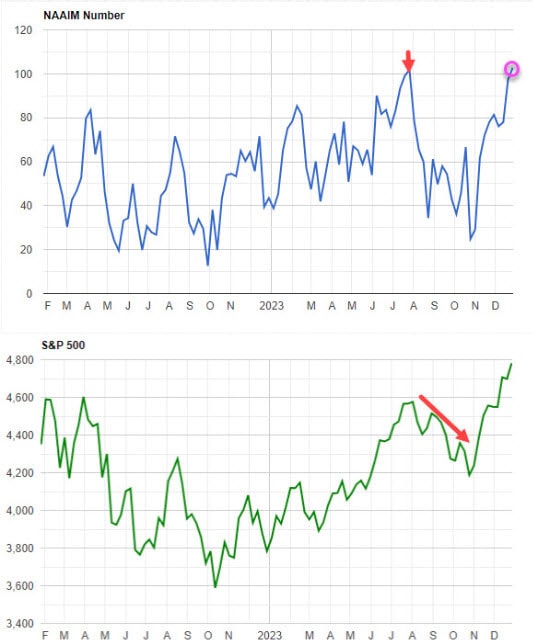

Navigating the Current Investment Landscape

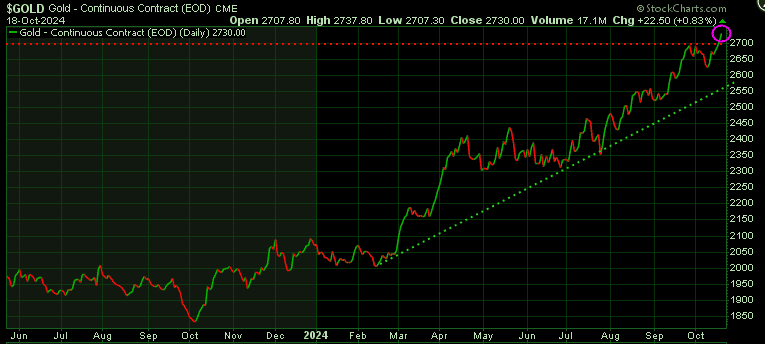

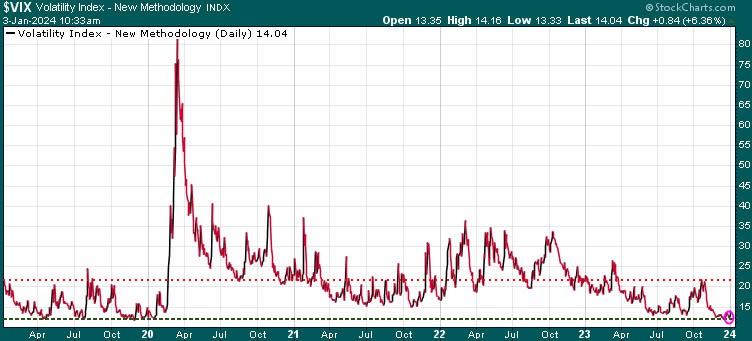

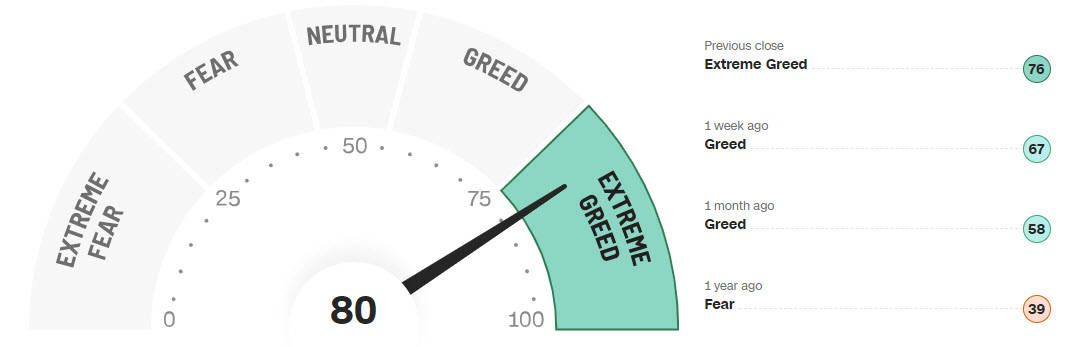

Clearly, the bond market is sending a warning signal: inflation is not as controlled as we might like to believe, and expectations are that it will continue to rise. As inflation erodes the purchasing power of the dollar, many investors are turning to alternative assets like gold and Bitcoin. Gold closed at a new all-time high today.

These assets offer a limited supply, making them less susceptible to devaluation. Unlike paper dollars, governments cannot print new gold or bitcoins out of thin air, which is why they remain popular as inflation hedges.

Why You Should Stay Informed

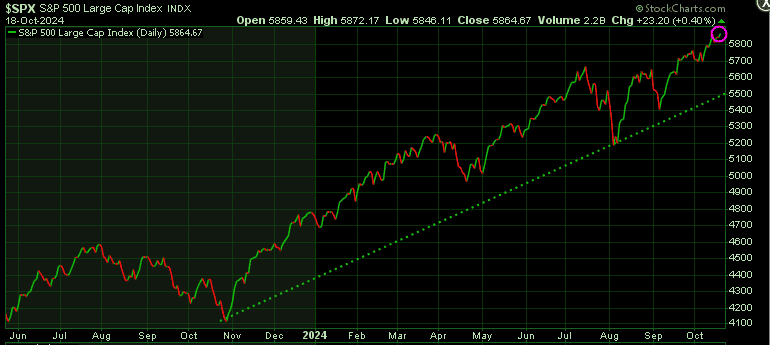

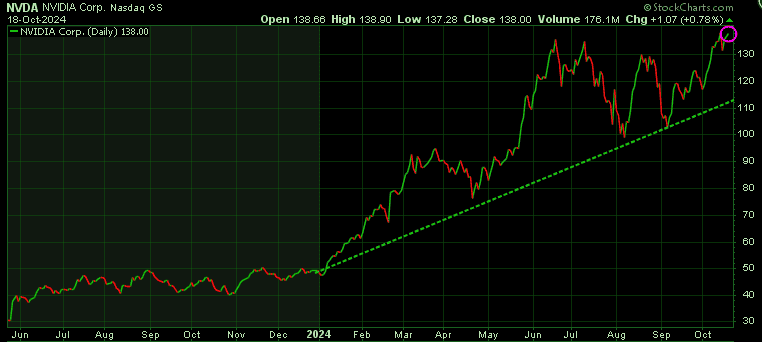

Our team at the Trend Letter has been monitoring these developments closely. We’ve been publishing insights for over 22 years, helping our subscribers stay ahead of market shifts with timely alerts and data-driven analysis. Our models have consistently alerted us to key changes in the market, and our current portfolio is up 39% this year.

We provide our subscribers with weekly reports every Sunday evening, covering all major sectors, key events and trends to watch, including:

- The effects on the markets of the upcoming US election

- Central bank actions

- Inflation trends

- Potential recession risks

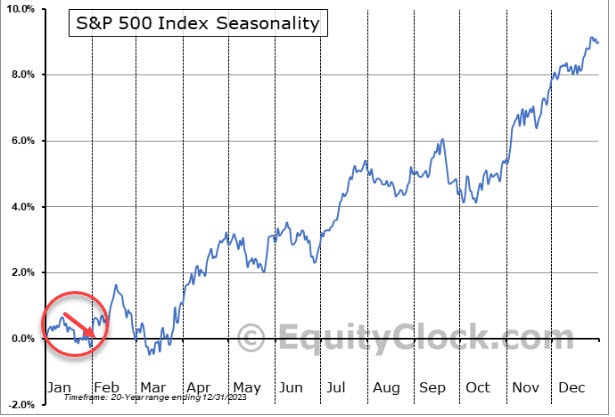

- Seasonal market movements

Special Subscription Offer

Our subscribers don’t just read market updates—they gain exclusive insights that help them navigate complex financial landscapes. Subscribe now to get expert analysis, weekly updates, and timely alerts straight to your inbox. We’re offering a Special Discount of 33% off all our services, with even greater savings when you bundle two or more.

Our goal is to keep you informed and prepared for any market scenario. Join our community of savvy investors and stay on top of the trends that matter most.

Click button below to view our special offers and join now.

Stay tuned!