October 10/18

We follow the trends and capital flows. Remember, this is a global market, it is all connected.

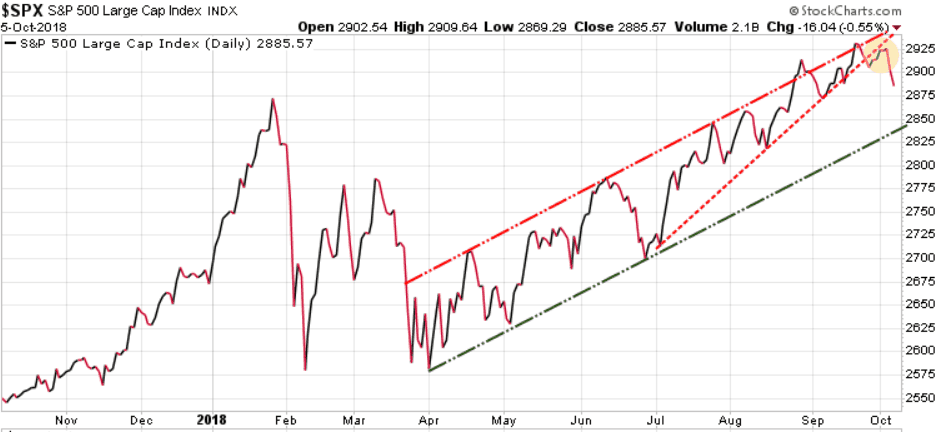

In our Sunday issue of The Trend Letter we posted the following chart highlighting how the S&P 500 had broken below immediate support (yellow highlighted area) and warned that a break below 2825 (green line) would open the door for a deeper correction.

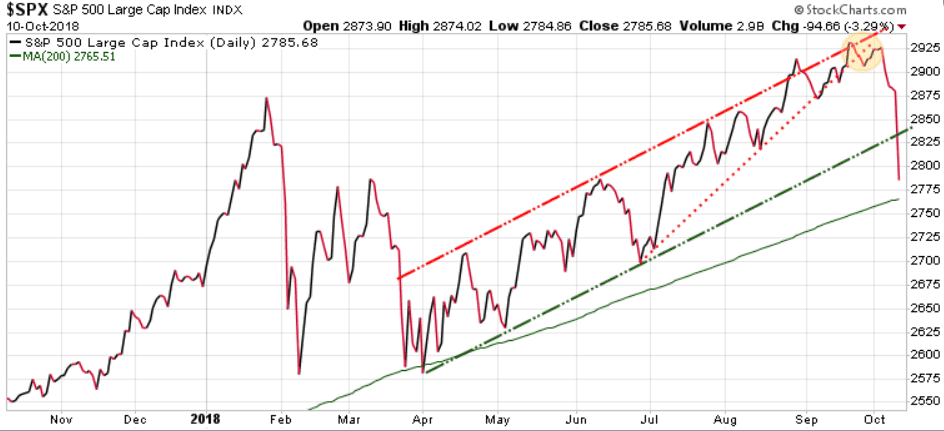

Well, today the S&P 500 dropped a whopping 94.66 points or 3.29% and in doing so blasted through that 2825 support level. Note, the NASDAQ fell a massive 4.1%, the largest decline of the year. The 200-day MA for the S&P 500 (lower green line) is a key support level, so we will watch to see if it holds. It is currently at 2765.51.

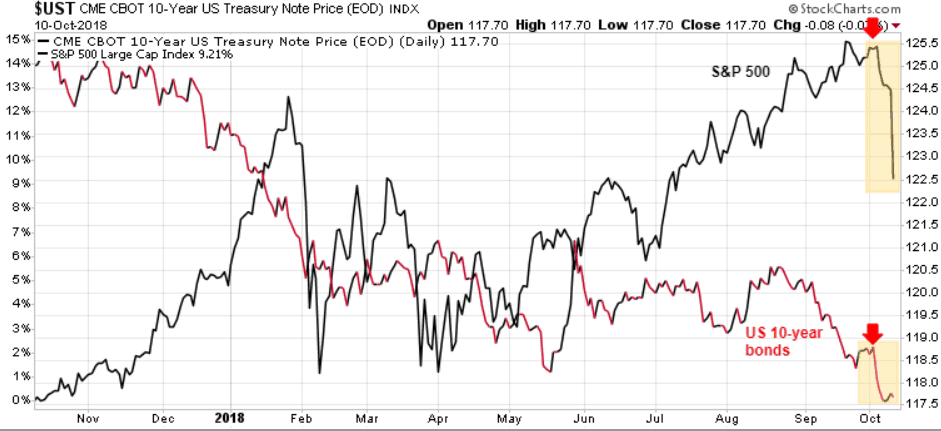

A key reason for this sell-off is the rising interest rates. After a decade of global central banks artificially keeping interest rates low (even negative), rates are starting to rise. Typically, when we see a big sell-off in the stock markets, capital flows into bonds, driving up bond prices and pushing yields lower. That did not happen today!

As we can see, for the last couple of weeks, both the S&P 500 and the US 10-year bonds have been falling.

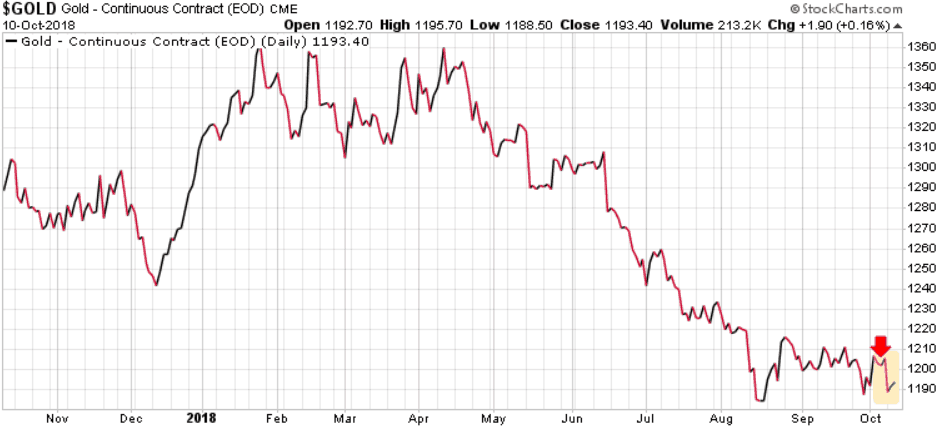

What about gold, that other ‘safe haven’ play? Similar story, gold has been absolutely hated by investors, and cannot seem to get any momentum, even with a massive equity market sell-off. Should we see this correction in the equities accelerate, watch for gold to rally.

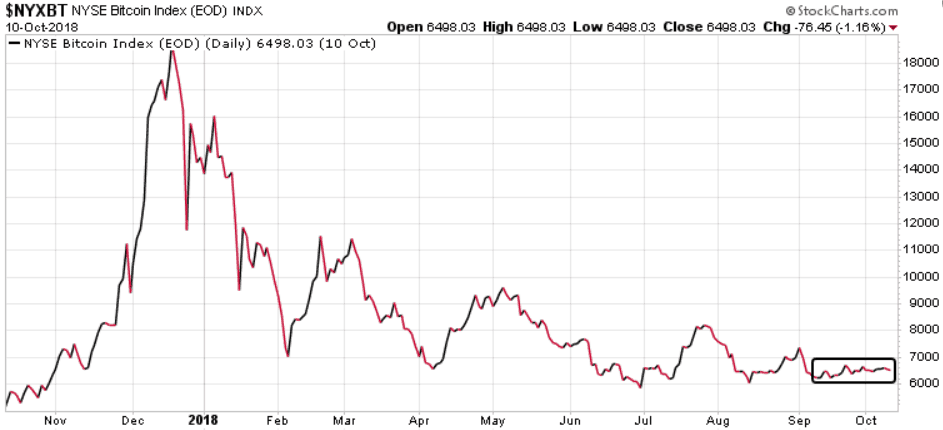

Not even crypto currencies could catch a bid with the equity market sell-off. Bitcoin was flat today and even showed some selling in the last hour.

There are tons of opinions out there, but we will continue to let the markets tell us which of these sectors will rise, and which will fall.

Trend Letter subscribers, be sure to check your inbox for a new position today.

Stay tuned!