October 12/18

We follow the trends and capital flows. Remember, this is a global market, it is all connected.

Stocks

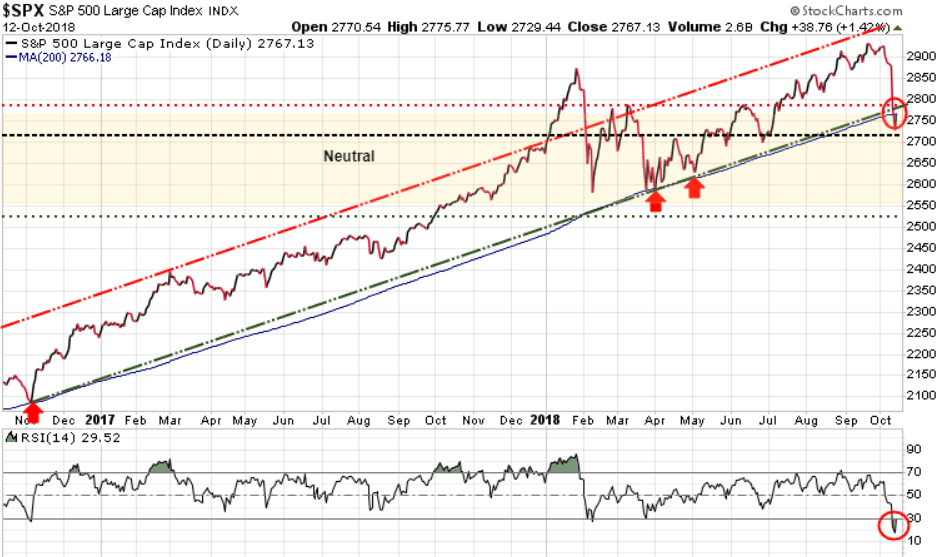

A wild ride today for all core indices. The S&P 500 hit an early high at 2775.77, only to give it all up and drop to 2730.23 by noon, and then recover and close at 2767.13, ending up 38.76 points or 1.42% for the day. While the bounce today was good, as we showed in yesterday’s update, the S&P 500 was technically very oversold, so today’s rally was no surprise to our readers. We said…

the Relative Strength Index (RSI) is now at 17.66 and whenever it is below 30 it is considered oversold, suggesting that the S&P 500 could soon rally back above its 200-day MA.

Looking at today’s chart we see that the S&P 500 did indeed rally and is within a whisper of testing that 200-day MA (blue line on chart). Even though the S&P 500 rallied today it is still down 4.39% for the week, suggesting that we are not out of the woods yet, and that more volatility should be expected next week.

This weekend’s issue of The Trend Letter will have full coverage of how this week’s action affected all markets, including the equity, bond, currency, precious metals, and commodity markets. If you are not a subscriber but would like to be, we are offering a special discount of $200 off the regular price of $599.95, so you only pay $399.95. To take advantage of this offer, click here.

Also, how was your sleep factor this week? If this week’s market volatility kept you up at night, it means that you are overexposed or most likely do not have a strategy to protect your wealth in such volatile times.

If you have a substantial portion of your portfolio in stocks, consider ‘hedging’ that long exposure. This week was a wake up call for those who are not prepared for a significant correction.

We do not know of a better hedging service than Trend Technical Trader (TTT) which is designed to make money in a down market. TTT uses a combination of conservative and aggressive strategies to position subscribers to profit in a declining market. These TTT trades are simple to action, the same as any trade recommended in Trend Letter. We are offering a subscription to TTT for only $399.95 (regular price is $649.95). Click Here to take advantage of this offer. It’s your money – take control.

Stay tuned!