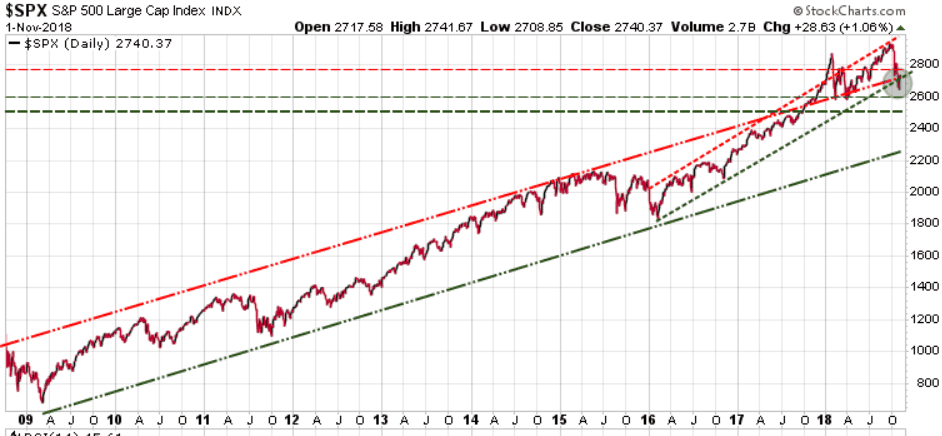

Market cycles tend to happen in waves, and technology companies have become a bigger and bigger part of recent market waves. Since about 1989, many tech companies have pushed their way into the top ranked firms in terms of capitalization, profits, and investment success. In the early days, it was just IBM and Microsoft. As internet developments matured there was much more success spread around, with the likes of Bing, Amazon, and Yahoo joining in. This was the First Wave, and it gave us the internet boom of the 1990’s and those wild boom and bust investments in the technology sector.

The first wave was exciting – a time of over-the-top speculation, but the innovations eventually caught on with consumers, in a very big way, and profits started to roll in, also in a very big way. This paved the way for a second wave.

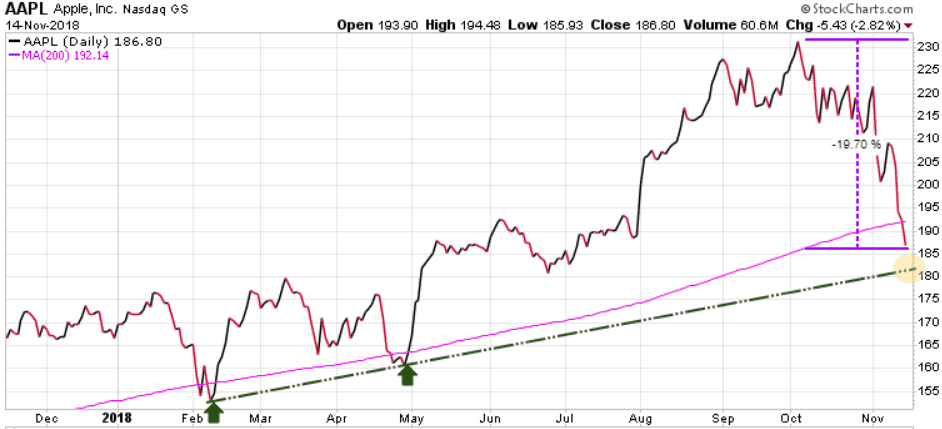

The iPhone was the catalyst and poster child for the Second Wave, as tech companies are all striving to greatly improve their communication networks and the convenience of being constantly “in touch”. There are also great efforts being made for information to be more convenient, more personal, and more manageable. Making sense of all the available data is a huge challenge, as there has been a gigantic tidal wave of data produced recently. IBM estimates that 90% of the data in the world has been produced in the last 2 years, so how do we figure out what to read, what to believe, what to trust?

A part of the solution is to make the data more personal, so that systems get to know you, and vice versa. Examples include:

- NEST thermostats that learn when you are home or away, and what temperature you’re comfortable with when you are home

- Music systems like SPOTIFY and PANDORA that learn your listening preferences and help you discover new music you will probably like

- Trip planning websites that learn your travel adventure interests and devise specific trip plans just for you

- GOOGLE Home and Amazon Alexa / Echo devices that interact personally with you and make efforts to help you through your busy day

And then there are all those APPS that help us to manage our day, like UBER , LYFT, Weather Channel, or communicate with others via Snapchat, Instagram, Twitter etc. All are trying to lessen the effort and worry about everyday tasks, although there is a growing concern about the surrendering, stealing, and mismanagement of such a large amount of our personal information – advertisers, scammers, and governments want more of it every day. When technology does its job well, users benefit in that they spend less time managing tasks and chores and spend more time doing things they really like. As the Second Wave matures, innovations come along that assist and support us in decision making, critical thinking (information discernment), and time management. The Second Wave brings us a plethora of helpers that ease our everyday lives with small and useful touches.

So what about the next wave – The Third Wave? We are now seeing this wave starting to form. Each wave starts with an innovative catalyst, leading to more innovation, speculation, and investment opportunities. There will be winners and losers along the way, but when the wave breaks, huge profits will be made by those who have the best information and analysis. A possible catalyst for starting this Third Wave is Augmented Reality (AR), with innovations that could transcend the iPhone and all Smartphones, making them obsolete. AR is different than Virtual Reality (VR) in that AR overlays graphics and images on top of the real world around you, something like the Pokemon Go game that became wildly popular on Smartphones a few years ago. AR is also the technology that fighter pilots use for the Heads-Up-Displays (HUD) in the cockpit of their jet fighters. If you put advanced AR capability into a pair of glasses, with voice, gesture, or eye movement controls, then every current Smartphone capability could be accomplished with a pair of glasses. Google glasses first appeared in 2013 and the project morphed into Google Glass Enterprise in 2017. Recently, a highly valued private company, Magic Leap, released an AR headset called Magic Leap One. These are first generation devices and have yet to achieve significant consumer adoption. Much like waves One and Two, Third Wave innovations can sound like science fiction, but we tend to always underestimate the speed of progress and the depth of amazing ideas and devices that are bound to change our lives.

The Trend Disruptors team analyzes new technologies and identifies the companies that stand out in terms of investment potential. These companies may be large or small. The best and most promising generate Trend Disruptors Premium recommendations. We are watching a broad range of companies and technologies, all striving to disrupt specific market segments and/or be part of the next wave.

Let Trend Disruptors be your guide to the future, as we continue to identify technology investment opportunities that can lead to financial success. Subscribe today for just $599.95 $399.95, a $200 savings. Click Here to subscribe at this special rate.

Stay Tuned!