Market Notes – September 15/21

Wall Street ended in the green following a few wobbles in the morning. The economic data of the day was in line or better than expected, but other than that there wasn’t much in the way of catalysts for investors to get excited about.

After a small sell-off to start the month, the S&P 500 has managed to turn higher and stay above its 50-Day Moving Average (DMA), the red wavy line on chart. As we can see, that 50-DMA has been strong support since the start of the year (green arrows).

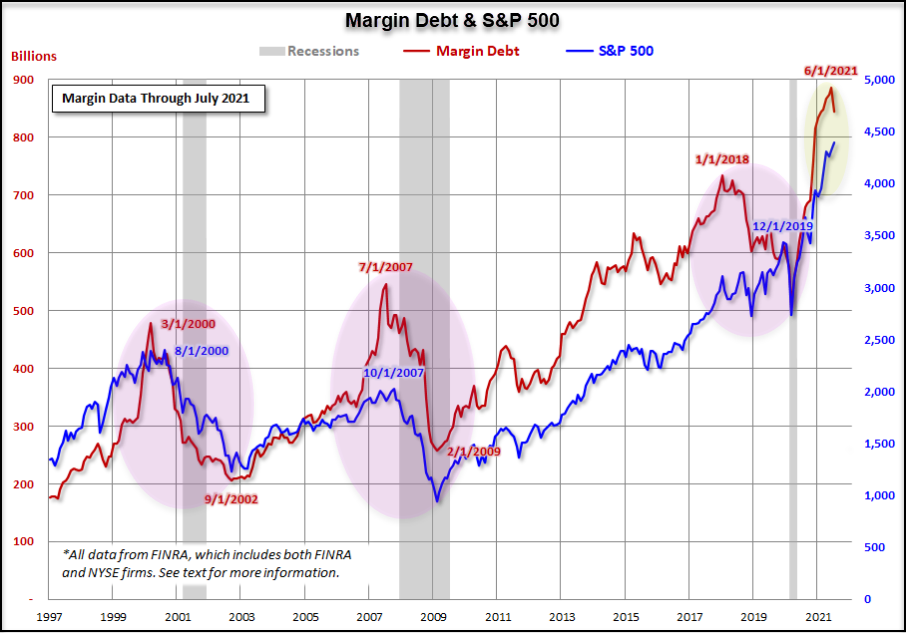

Something we are keeping an eye on for our subscribers is the level of margin debt investors have taking on to purchase stocks. As we can see, the margin debt – money borrowed from brokers to buy stocks – set a record in June at $882 billion (red line). July marked the first time margin debt declined since pre-COVID. The S&P 500 rose 2.3% in July, but margin debt dropped by 4.3%. As highlighted by the shaded areas, in previous times when margin debt declined, we saw significant corrections in the S&P 500.

Gold was down 12.30 today, basically giving up yesterdays gains. Gold has been in a downtrend channel since August’20 and has been unable to break out of near-term resistance at 1838 (horizontal red dotted line).

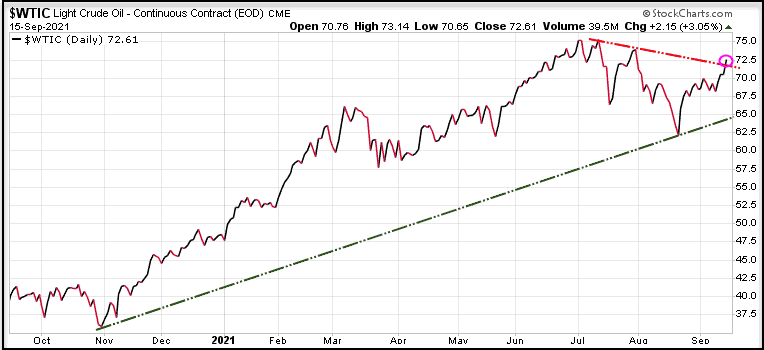

Oil prices rose over $2 a barrel on Wednesday after government data showed a larger-than-expected drawdown in US crude inventories, and on expectations demand will rise as vaccination roll-outs widen.

US crude oil stockpiles fell last week to the lowest since September 2019, the US Energy Information Administration said, extending their drawdown after Hurricane Ida late August shut numerous refineries and offshore drilling production.

Stay tuned!