Today’s Charts – September 16/21

The latest set of US economic data out Thursday painted a more upbeat than anticipated picture of the US consumer. August retail sales posted a surprise increase as consumers turned back towards goods spending amid the latest wave of the Delta variant. And while weekly new jobless claims rose in the Labor Department’s latest report, the level of new claims still held near its lowest since March 2020.

But September, especially the second half, has been an historically weak period. In addition to the historic concerns, investors have eyed the latest data with ongoing caution about the outlook going forward, especially given lingering uncertainties around the coronavirus, supply chain challenges and next moves on monetary and fiscal policy.

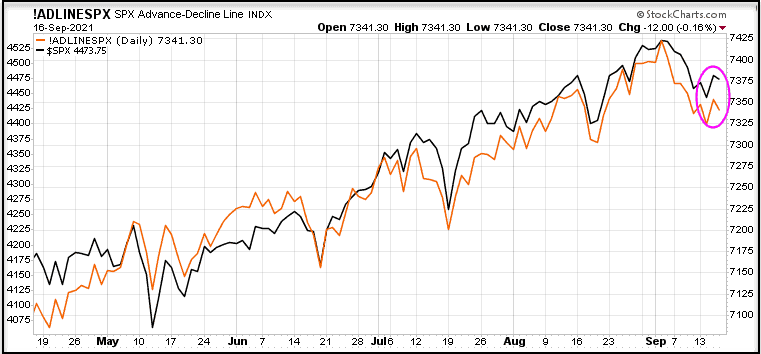

The S&P 500 has seen poor breadth lately, with the advance/decline line (orange line) declining. This tell us that more stocks in the S&P 500 are declining, pulling down the overall index. That pattern will need to change soon, if we are to see a resumption of new highs.

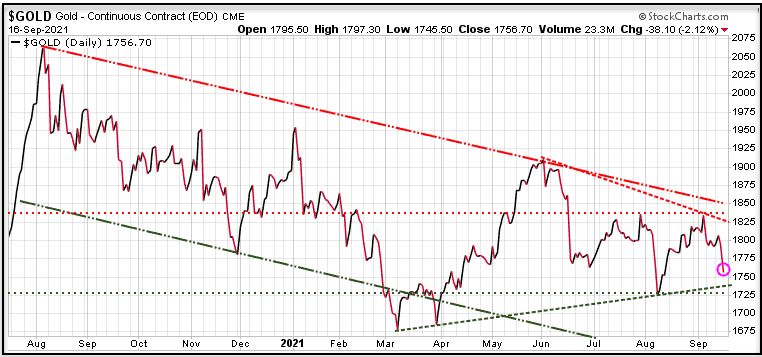

Gold got hit hard today, down $38.10 or 2.12%. As we can see on the chart, gold has been in a downtrend channel since August’20. Our models are targeting November as a potential bottom for gold. We will issue a BUY signal to subscribers when our models trigger the bottom is in.

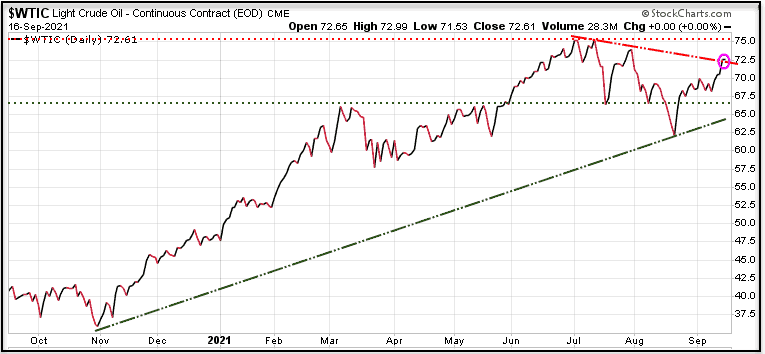

Oil was flat today, and it is unclear how far this current rally can move. Our models had tagged 77.00 as a high and so far that level has held. Our models called for a pullback to the 60.00 range and in August we did hit 61.60. We will see if yesterday’s move to 73.00 is anything more than a quick pop at the end of its run. We do expect to see oil heading lower through the Fall.

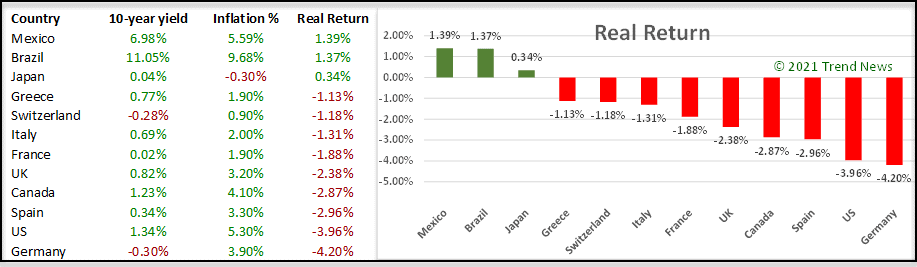

Real return is the nominal 10-year yield – inflation for each country. We have been updating this chart each week for subscribers. Of the twelve countries shown, the only 10-year government bonds that are paying a positive real return are Mexico, Brazil, and Japan; all the rest are negative If bonds rally here (yields lower), these real returns will drop even deeper into the negative.

Stay tuned