Market Charts – February 10/22

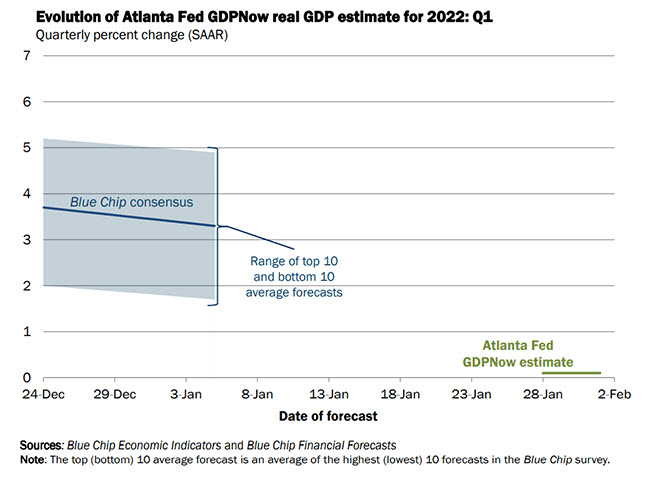

Stocks sold off and yields climbed after the Bureau of Labor Statistics’ January Consumer Price Index (CPI) showed the biggest annual jump in inflation since 1982.

The surging 7.5% jump in prices escalated calls for the Federal Reserve to raise interest rates more aggressively than previously expected and begin rolling assets off its balance sheet, in moves that would curb liquidity in the financial system and dampen soaring consumer demand and prices. St. Louis Federal Reserve President James Bullard told Bloomberg News on Thursday he wanted to see interest rates be raised by a full percentage by July and start the Fed’s balance sheet run-off process in the second quarter, in one of the most hawkish paths so far telegraphed by a Fed official.

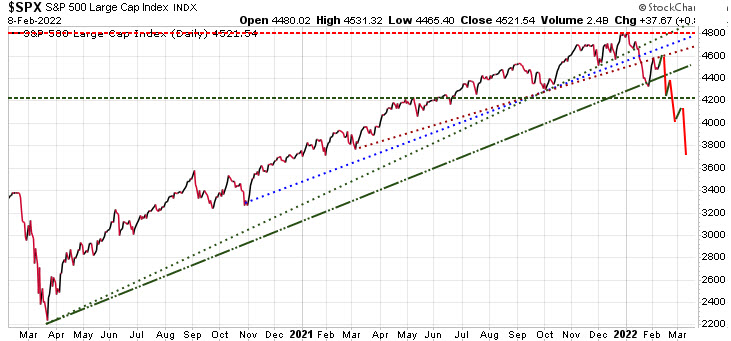

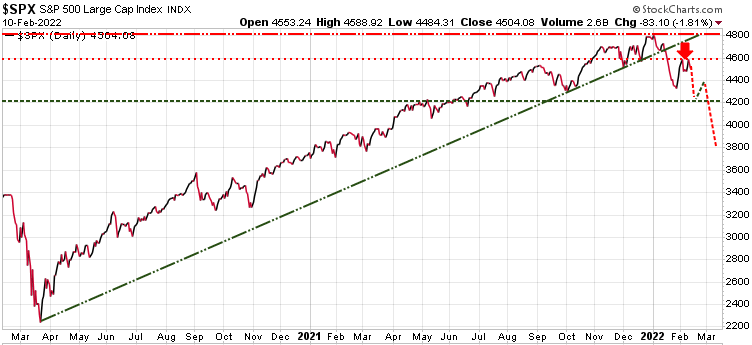

On Tuesday, for the S&P 500 we said ‘Watch the 4600 level as near-term resistance as our model sees this as a key short-term resistance level and if we can’t push past this level we could see the market start to break down with a potential near-term low in the next 6 weeks.’

So far that 4600 has held, so the scenario laid out on Tuesday is still very valid.

This is a chart of the VanEck Semiconductor ETF and it is suggesting that we are at a potential key inflection point. As we can see, this ETF is in a rising wedge pattern where both the upper level (red lines) and lower level (green lines) have acted a key short-term resistance and support levels. As the wedge narrows, one of these levels is going to give way. We are now testing the lower level, and if it breaks then the high today may have been the top for a few weeks at least.

On the other hand, if SMH bounces off this support level, then we could see one more test of the upper level of the wedge.

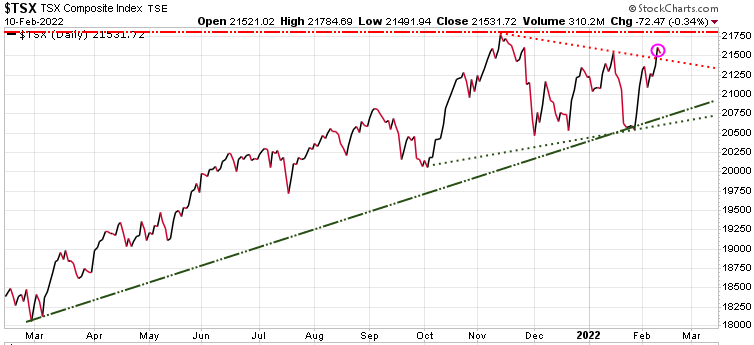

The Canadian TSX has been one of the best performing indexes in the world lately and is within a hair of a new all-time high.

Stay tuned!

Again, if the near-term high is in, seriously think about subscribing to our hedging service Trend Technical Trader. We are offering it at a $300 discount so all investors can have access to these great hedging strategies.

Stay tuned!