Markets continued their decline today after Federal Reserve Chairman Jerome Powell said that as the national economy begins to reopen, “we will see inflation move up through base effects. That could create some upward pressure on prices.” While the Fed is expecting some inflation, Powell said he does not expect to raise interest rates this year until employment and inflation are back to sustainable levels.

Nasdaq

Another big down day for the markets, with the techs again leading the way down. The Nasdaq dropped another 274 points or 2.11% today and is now trading down 164 points for the calendar year. After breaking below its 50-DMA yesterday (red wavy line), the Nasdaq has now breached its uptrend line (green diagonal line) dating back a year ago.

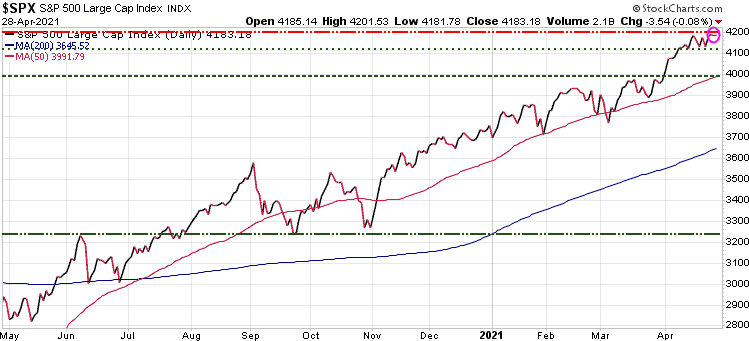

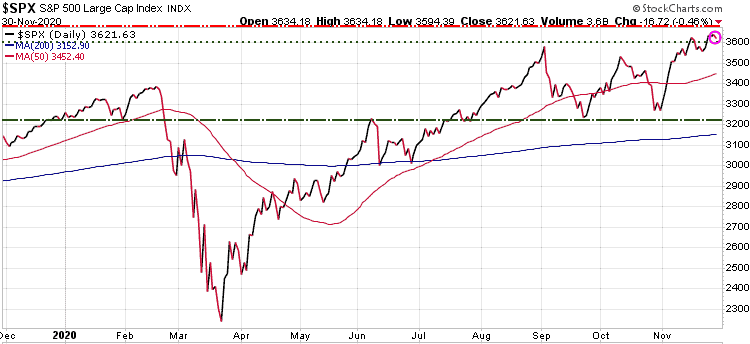

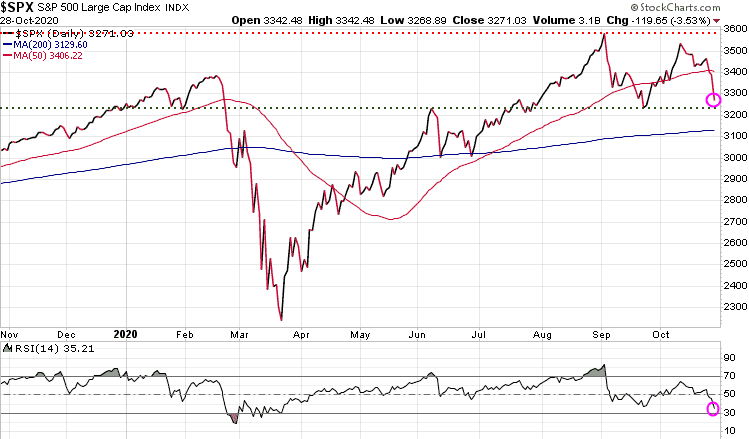

S&P 500

The S&P 500 lost another 51.25 points today or 1.34%. The S&P 500 broke below its 50-DMA today, which had acted as a strong support level when tested late January and late February (green arrows).

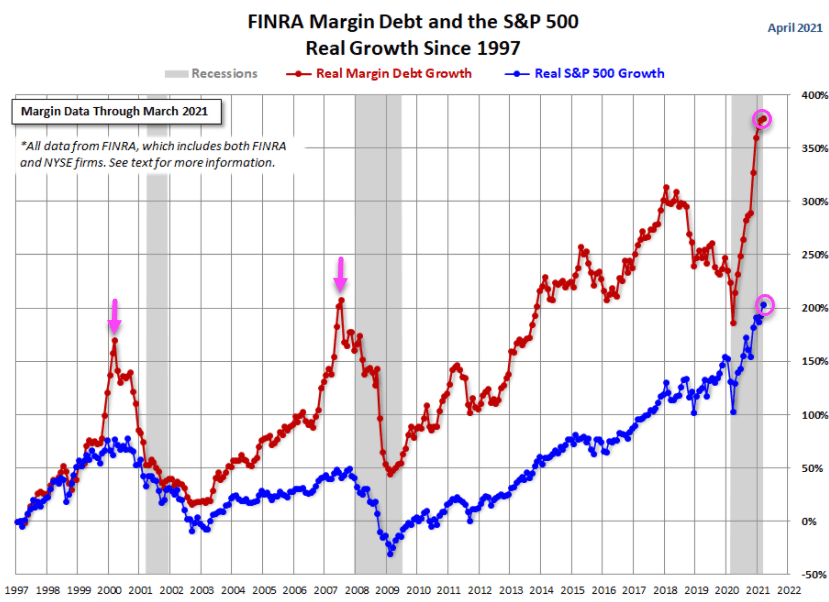

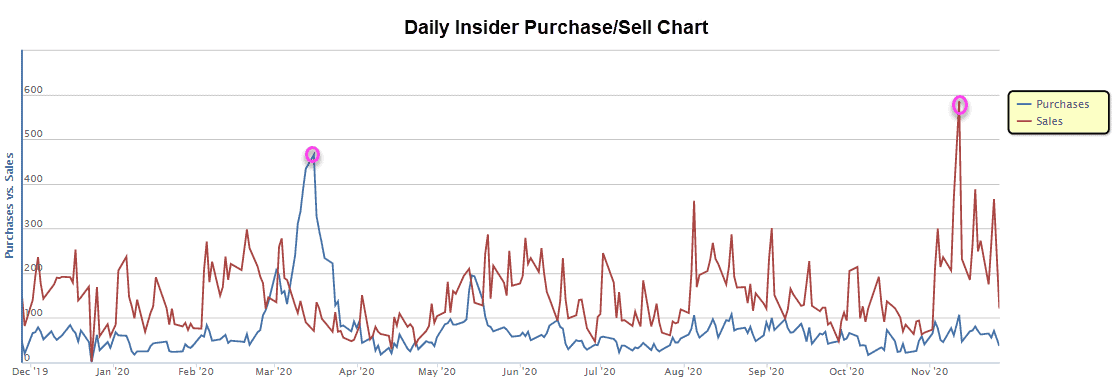

Insiders are selling

The chart below shows that insiders have clearly decided to sell shares.

Canadian equities

The TSX Index was down as well, but held up better as oil prices surged today.

Bonds

The bond vigilantes continue to challenge the Fed’s policy of low rates and dovish outlook. When investors perceive that inflation, or credit risk is rising, they demand higher yields to compensate for the added risk. The term refers to the ability of the bond market investors to serve as a restraint on the government’s ability to overspend and over-borrow. It will be interesting to see who wins this battle. Trend Letter subscribers have benefitted handsomely with a recommendation made in August, betting on yields rising. As we can see on the chart, that recommendation was very timely, hitting the turn within days. That trade recommendation is up 38% since August.

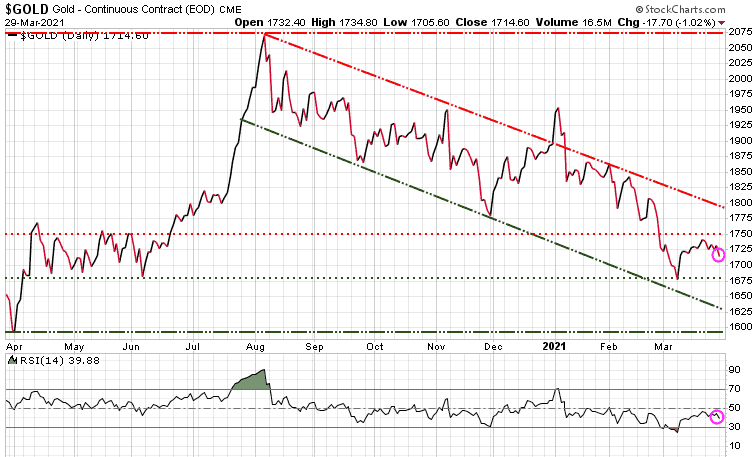

Gold

Gold had another rough day, down 15.15 for the day. The only optimism for gold right now is that it is now oversold technically based on RSI (bottom of chart) so we should see at least some consolidation soon, if not a bounce off these levels.

Bitcoin

Bitcoin continues to be volatile, falling below the $50,000 level today.

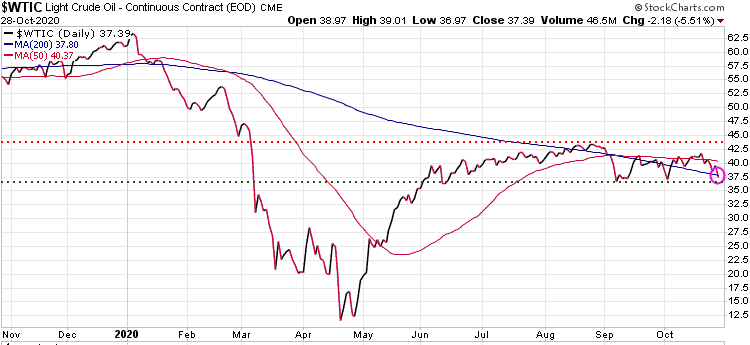

Oil

Oil surged to the highest level in nearly two years after closing at 62.83, up 2.55 or 4.15% after the OPEC+ alliance surprised traders with its decision to keep output unchanged, signaling a tighter crude market in the months ahead.

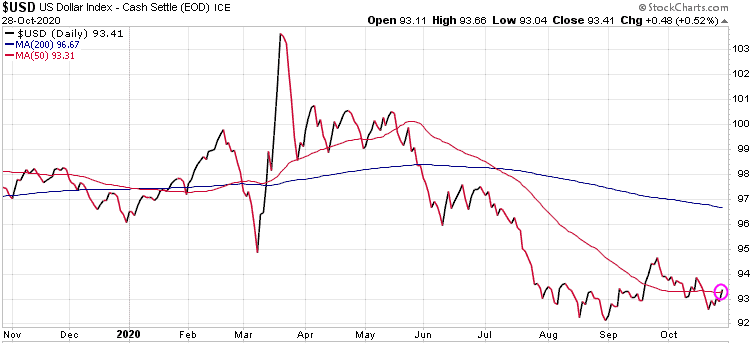

US dollar

The US dollar continues to gain momentum on equity weakness and capital flows, especially from Europe. With expected increased volatility in the equity markets this year, the US dollar could see a significant rally going into 2022.

Do you have hedge or exit strategy?

Hedging is a useful practice that every investor should know about.

It’s a way to protect your portfolio, and protection is often just as important as portfolio appreciation. Even if you are a beginner, you can learn what hedging is and put it to work for you.

The best way to understand hedging is to think of it as a form of insurance. When people decide to hedge, they are insuring themselves against a negative event to their finances. This doesn’t prevent all negative events from happening, but when something does happen and you’re properly hedged, the impact of the event is reduced.

Risk is an inherent part of investing. Regardless of what kind of investor one aims to be, having a basic knowledge of hedging strategies will lead to better awareness of how investors can protect themselves.

While typically the goal of hedging is to protect from losses rather than to make money, with Trend Technical Trader (TTT) we take it one step further. Cycles will always occur, and we seek to profit greatly from those cycles.

TTT is a hedging service that is designed to profit during stock market declines, and the bigger the decline, the bigger the gains TTT trades can generate. Our objective is to help serious investors avoid losing a significant portion of their wealth in the next downturn, and position them for the next big buying opportunity.

It is also possible to make a lot of money during a market downturn, not just mitigate losing money. It’s even possible to have typical long positions that stay flat or go higher when markets collapse, if they’re properly and prudently chosen.

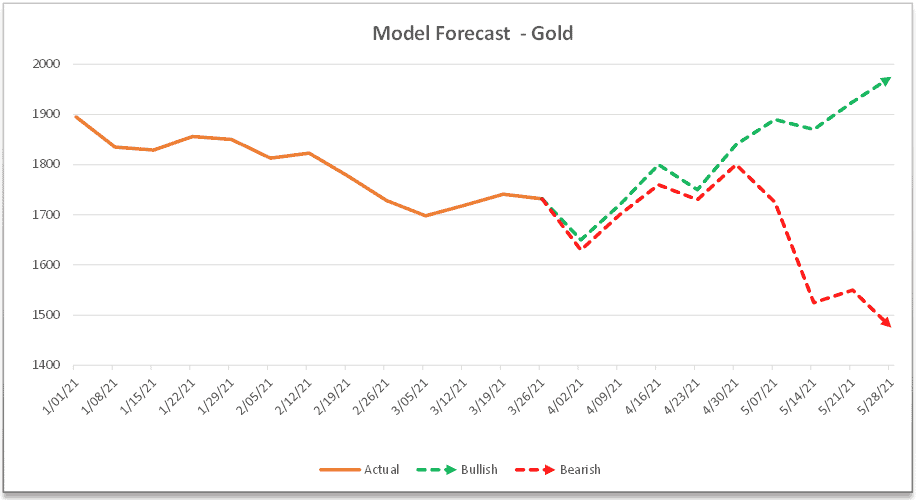

Trend Technical Trader is not just for hedging, or seeking to profit when markets plunge. TTT has made phenomenal gains when it was prudent to be bullish – in stocks, gold, oil, currencies… whatever is compelling at the time. In fact, our proprietary Gold Timing Indicator (GTI) has a record better than any other we’ve seen.

Why is timing so important? Those who rely on “fundamentals” are ignoring history, unaware of how creative corporate accounting often is, and at best basing their valuations on quarterly-reported numbers and metrics that are already months old. We believe a timing element is essential to successful speculating and investing over time, so while we consider fundamentals, we also heavily factor technical and sentiment measures.

TTT had another excellent year in 2020 averaging +27.3% per closed trade, with an average holding time of 9.5 weeks, or +149% annualized overall.

Over the past 5 years, TTT’s closed trades have averaged +40% annualized.

If you do not have a hedging or exit strategy, seriously consider subscribing to Trend Technical Trader at this special discounted rate.

For other special pricing, click button below.