Martin was the guest on This Week in Money with Jim Goddard and they covered a wide range of topics. Below are notes from that interview. To listen to the interview, click here. The interview starts at 13:30.

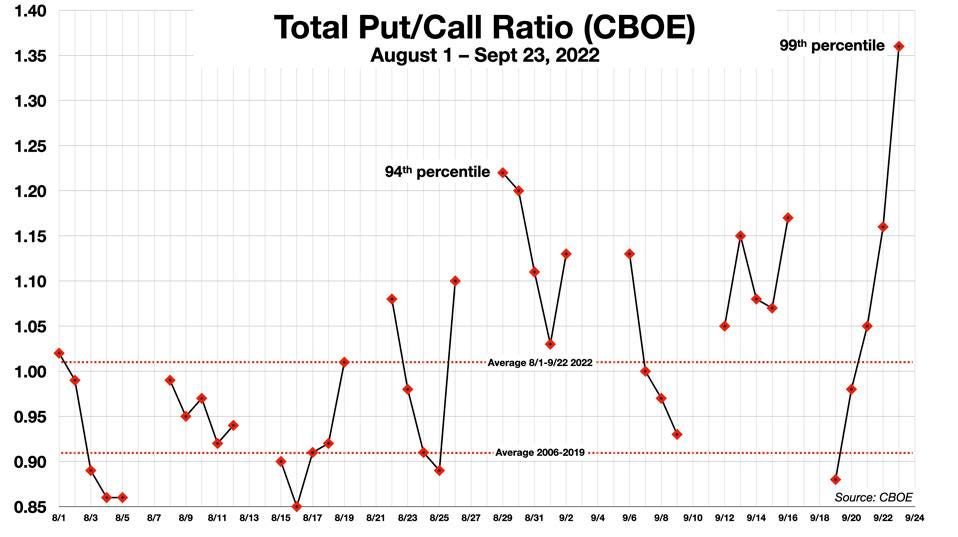

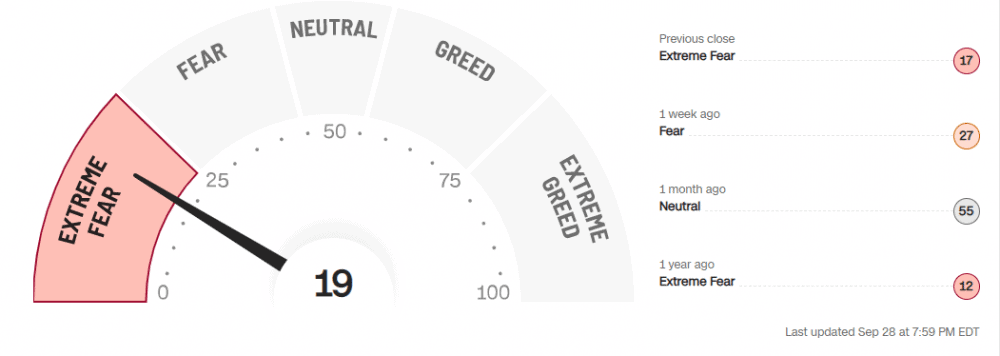

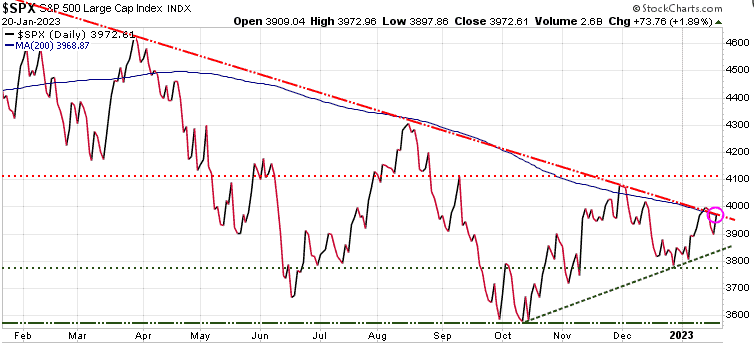

Q. What is the market sentiment?

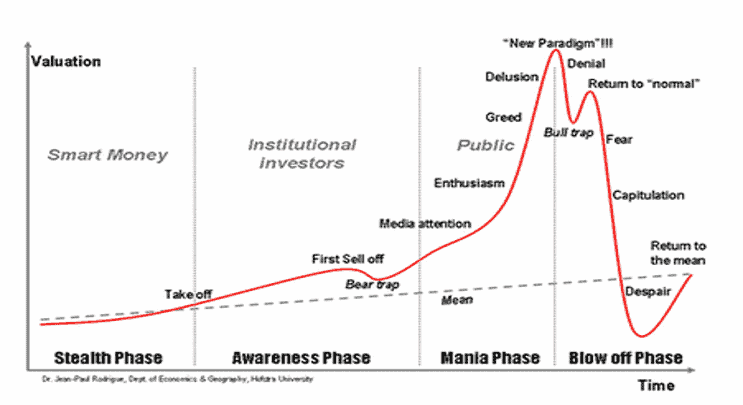

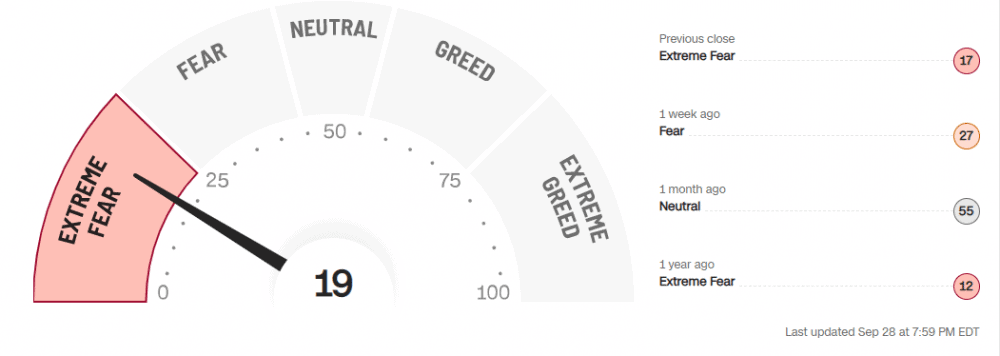

Wow…how about frightful, panicked? We had the Fear/Greed index at Extreme Fear

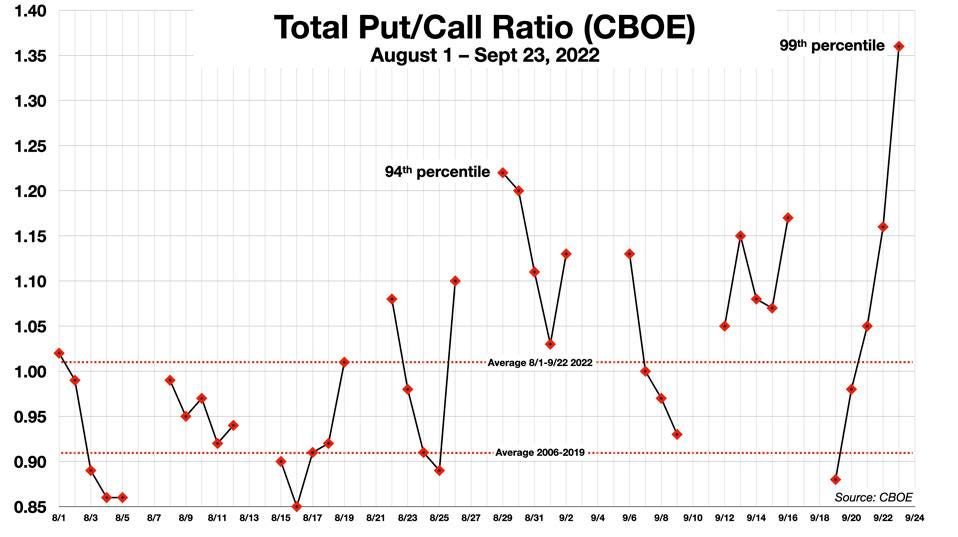

Put/Call ratio also at extreme high

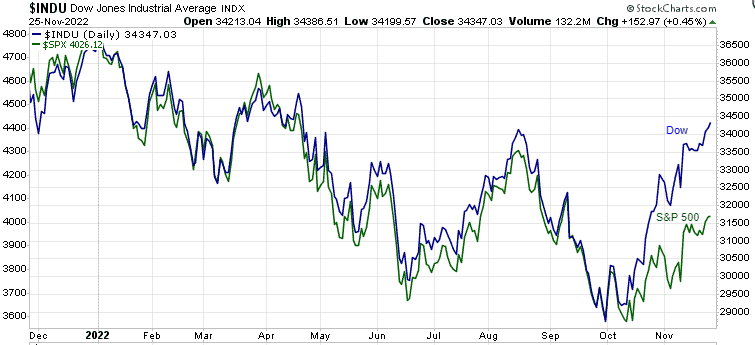

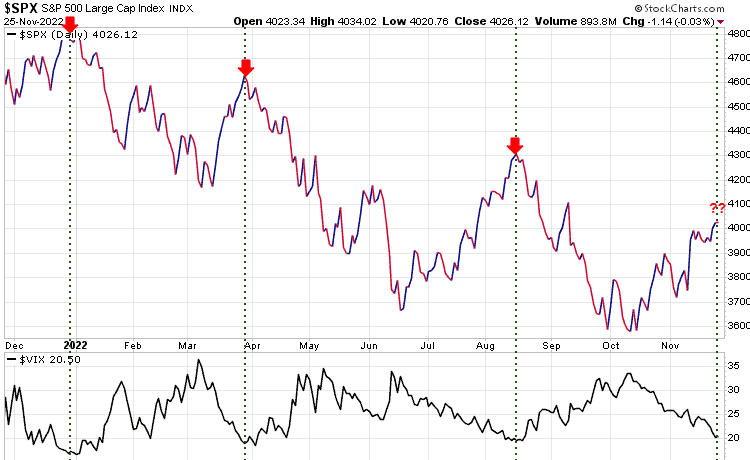

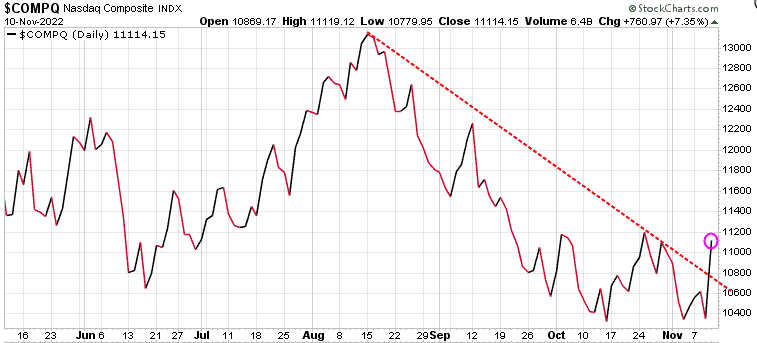

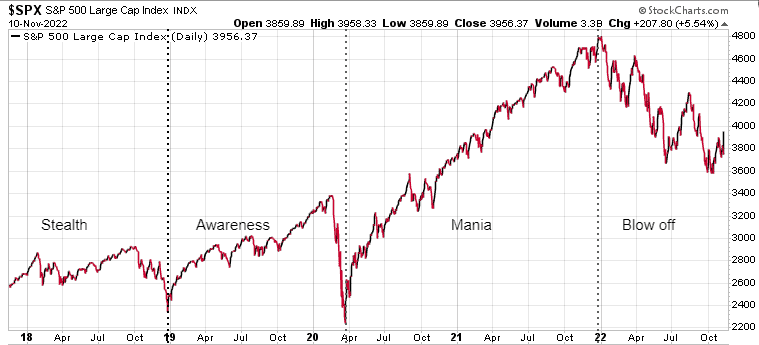

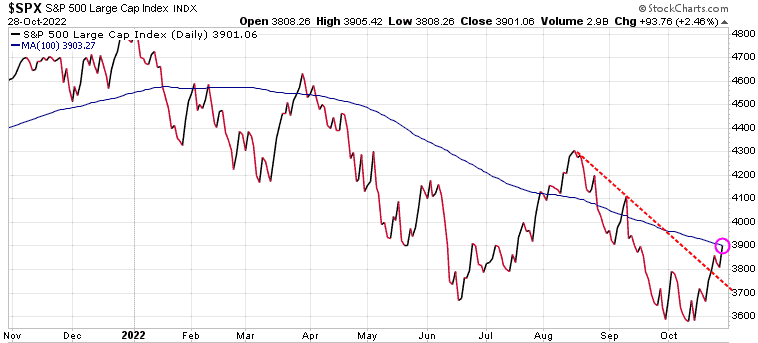

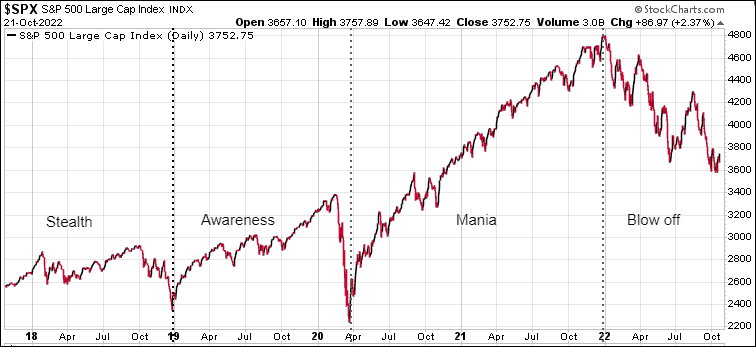

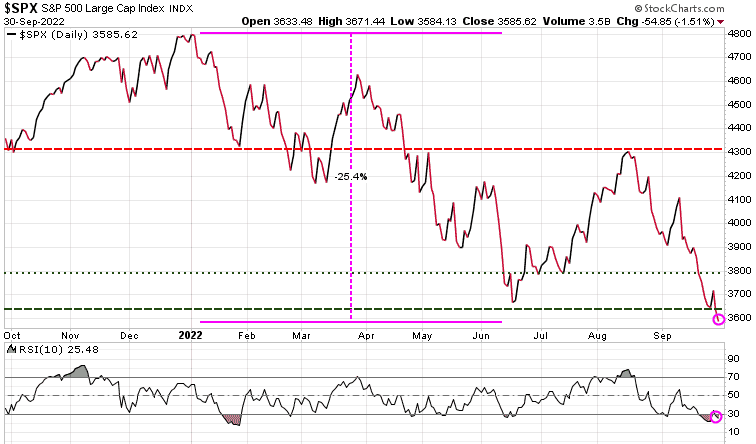

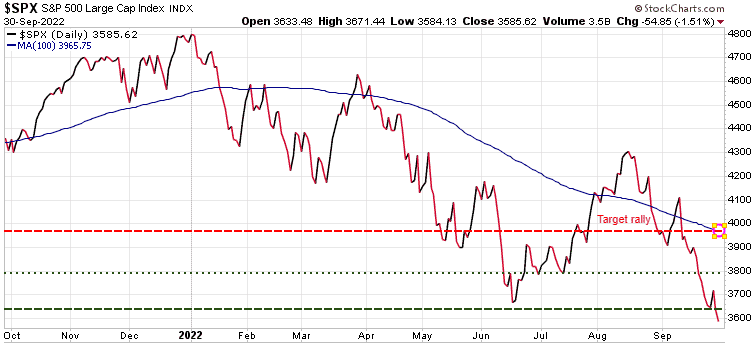

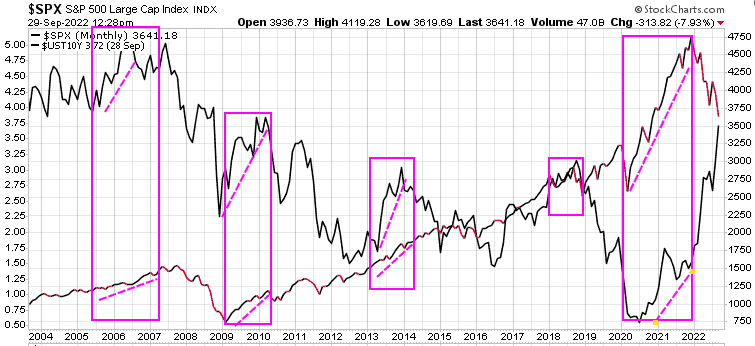

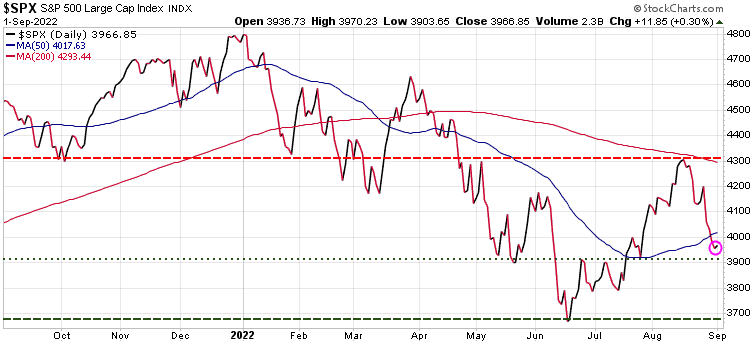

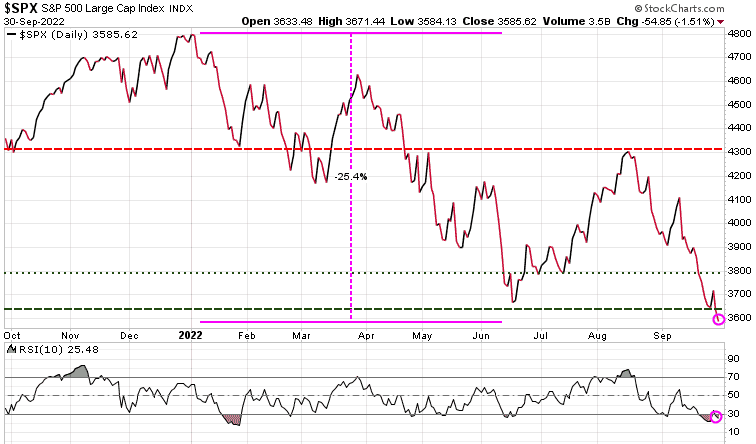

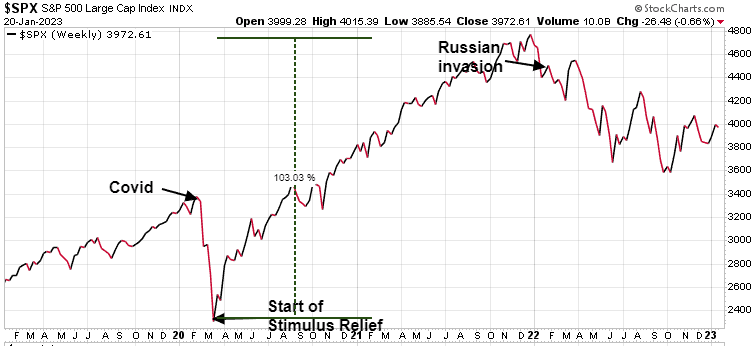

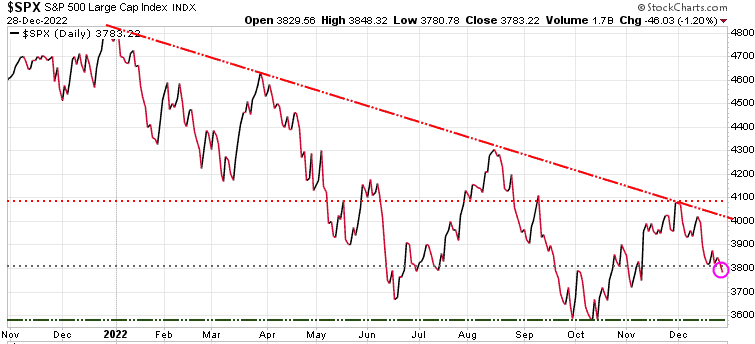

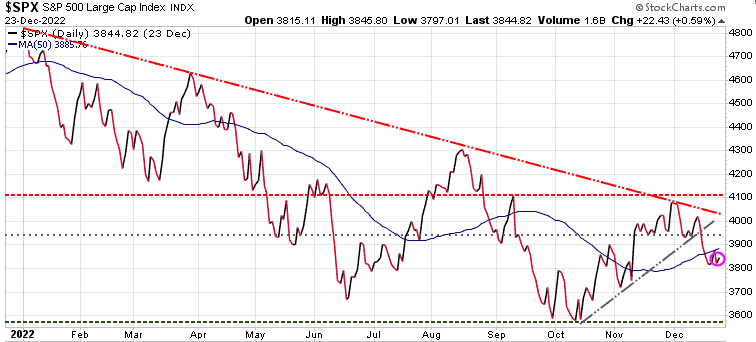

S&P 500 down ~25% since January, tested June low this week, at the 3640 level & pushed lower. Short-term…relief rally likely as market is oversold (RSI on bottom of chart).

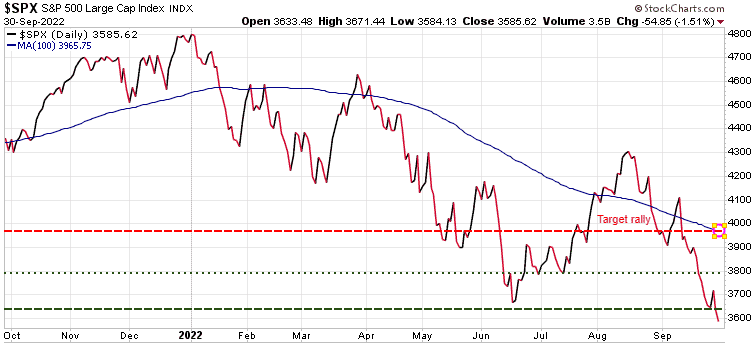

Watch for a rally to the 100-dma at 3965 range

Q. Does it look like stock markets have put in a double bottom ?

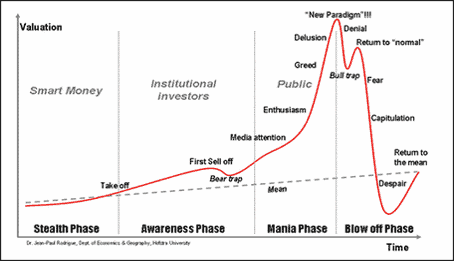

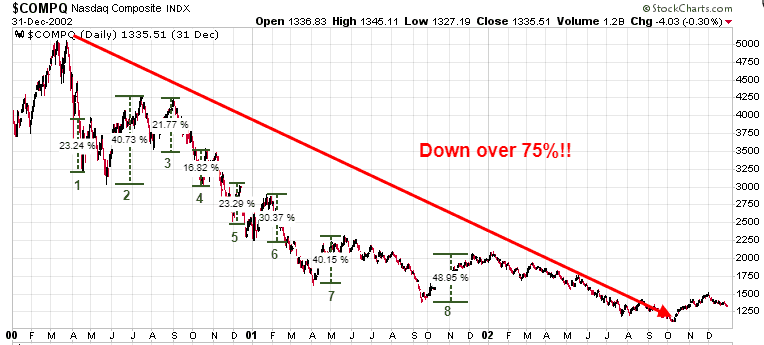

Possible…NOT Likely. More likely is that Short-term rally I just mentioned…relief rally to 3970. Then we expect another leg down, where hedge positions would be prudent.

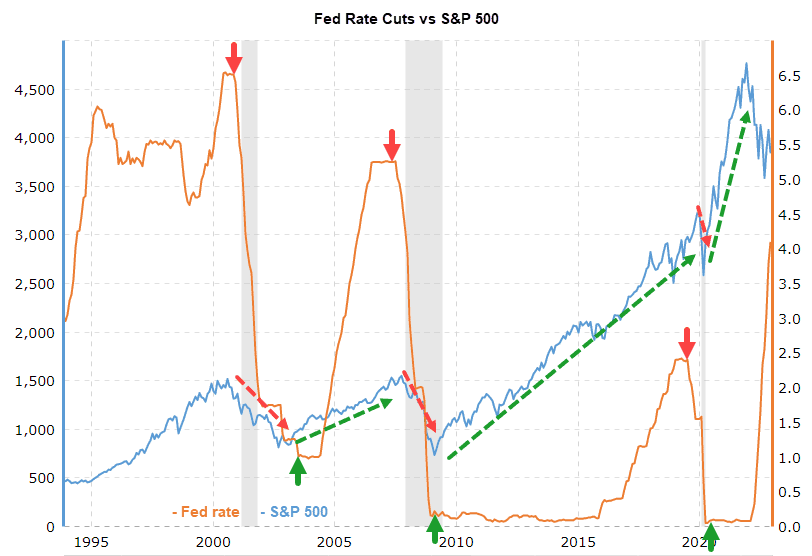

The problem is that over the past 15 years, most investors have been conditioned to the Fed coming to the rescue on the slightest economic weakness, we have a US election which creates pressure for Fed to continue to fight inflation vs save stocks. Democrats say they are there for lower & middle class…not many lower class heavy into stock market.

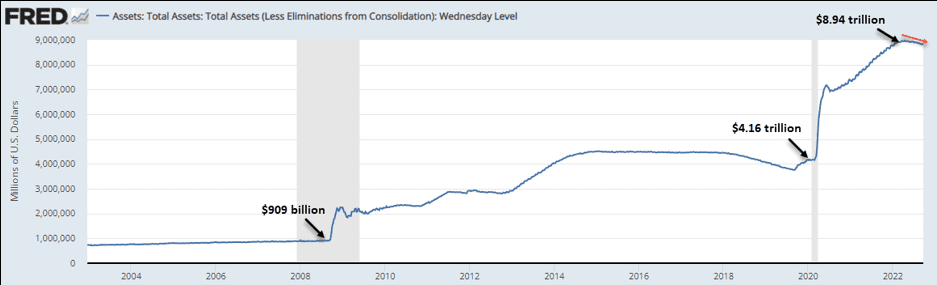

Central banks will continue to raise rates & reduce balance sheets – opposite the conditions that fueled bull market.

Many are waiting for the Fed to ‘pivot’& become ‘dovish’ – not happening anytime soon.

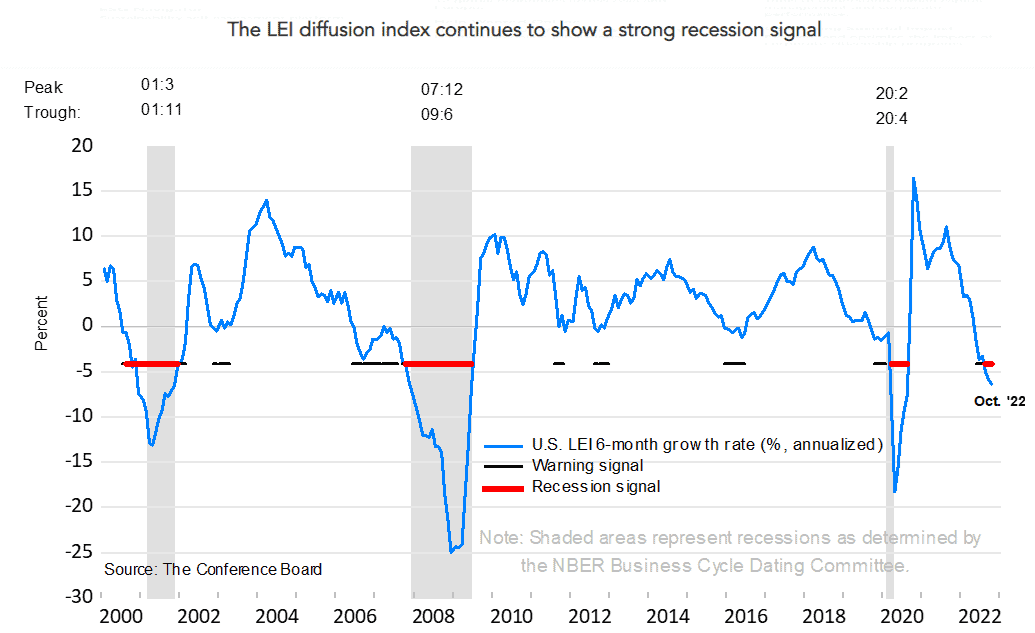

Market drivers: inflation, rising rates, slowing global economy, likely recession.

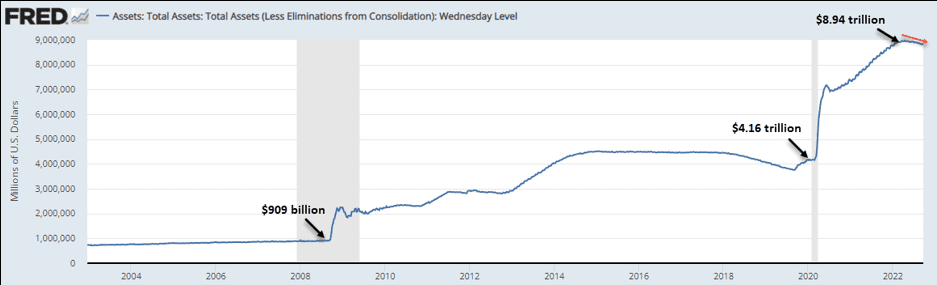

During 10-year bull market, Fed was keeping rates near 0% for over a decade. They also added $Trillions to balance sheet…from $900 billion in 2009 to ~$9 trillion this year

TODAY…they rising rates, currently 3.25% in US & Canada, plus QT, where the Fed is now SELLING $95 billion of bonds each month

Economy slowing…US just had 2 consecutive negative growth quarters. Last time that happened & there was NO recession was 1947

Recession is coming, & will escalate the bear market.

Look to use this next relief rally to reduce risk, add hedge strategies. Don’t fight the Fed!

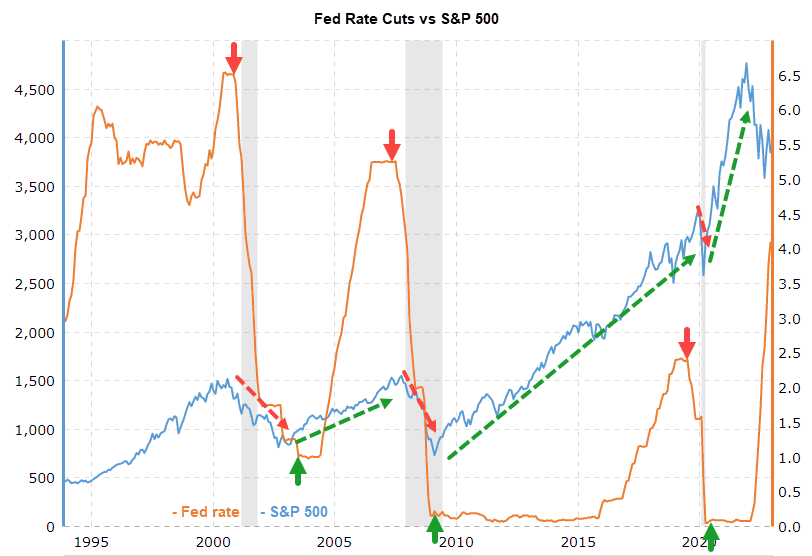

Q. Do stock markets tend to rise alongside interest rates?

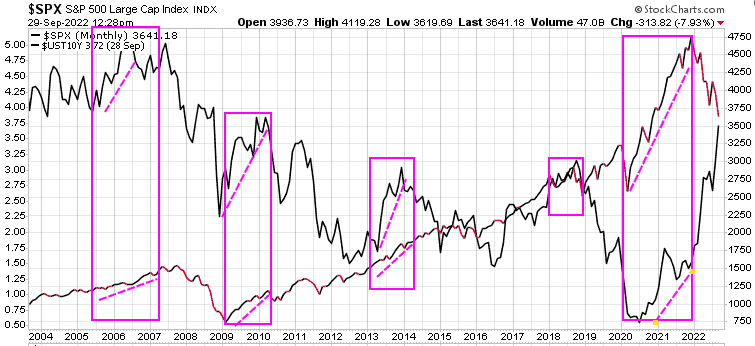

To many people’s surprise – they can rise together.

Low, steady predictable inflation is a a good sign for an economy, it means that the economy is growing. Employment is rising, wages are rising as well.

So, many times we have seen interest rates & stocks rise together…2005-07, 2009-10, 2013-14, 2018, 2020 -2022

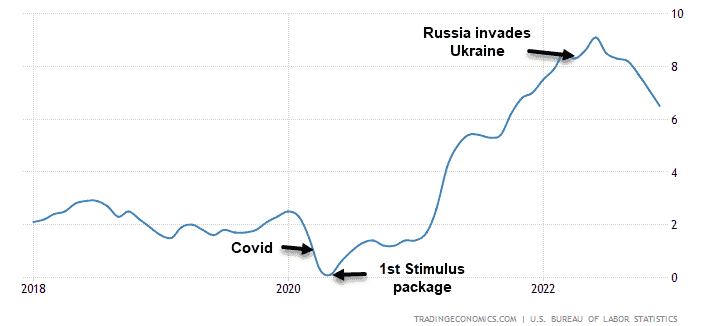

The problem today is inflation jumped too high, way too fast. The Fed had been trying to juice the economy for over a decade trying to get inflation up to 2%. Central banks flooded the markets with $trillions of QE programs. Add the supply chain issues due to global COVID lockdowns…then add the Russian invasion of Ukraine. Perfect storm!

Inflation rising too fast

Central banks scrambling to catch up

Rates rising so fast

Investors are spooked

Result…Markets crashing as rate soar

Q. What do you see ahead for stock markets heading into 2023?

Well, if we get a recession, then that will hurt the equity markets. In recessions, people hold back, prices are falling, why buy now, wait for cheaper prices. That hurts companies, lower sales, less profit etc.

It will really depend on the central banks, particularly the Fed

Today the Fed is signalling there are all-in on crushing inflation

Key point … what do they do when they see that they are also crushing the economy? They are really between a rock & a hard place

Debt levels held by governments, & homeowners is extremely high. High rates are hurting everyone.

After the US election, we will see the Fed come under increasing pressure to ease off the rate increases

We see inflation as being ‘sticky’ lingering longer than most expect

But as soon as the market senses the Fed might ‘pivot’, ease off the rate increases, we will see the markets jump. The markets are forward looking.

The is a saying on Wall Street.. ; “Central Banks decide when to raise rates, markets decide when to lower them.”

We suspect that around March/April we will see the Fed ease up

We do expect to see lower lows in the stock markets, but we have our lists of stocks that we will be looking to jump into when our models give the BUY signal

Understand, this bear market could last well into 2023 if not longer

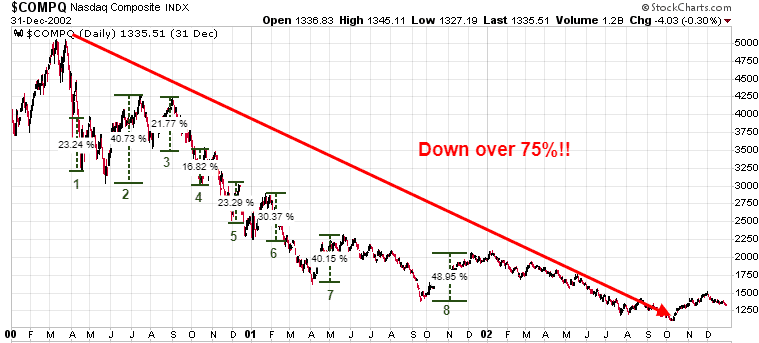

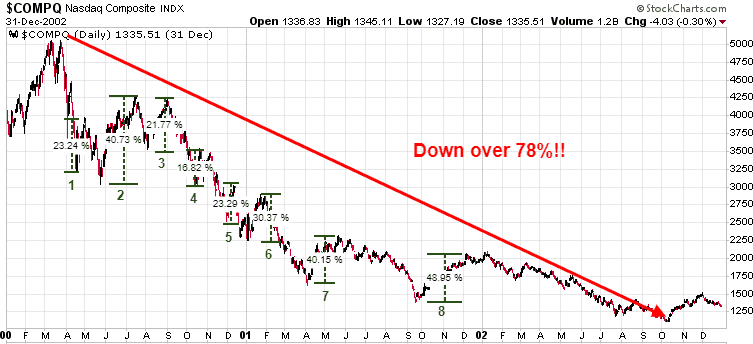

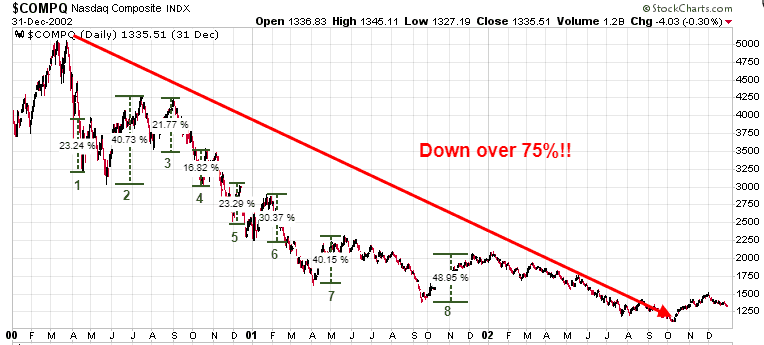

From early 2000 to mid 2002, the NASDAQ had 8 strong relief rallies over 15%, but lost over 75% during that bear market.

For be careful, watch the technical charts – that’s what we do!

Q. Is Britain’s central bank in trouble ?

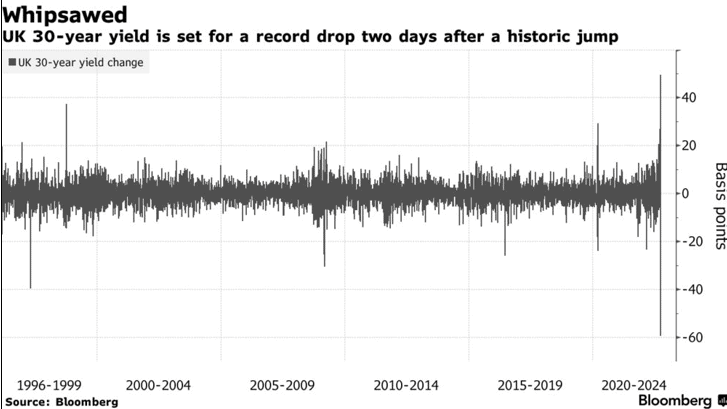

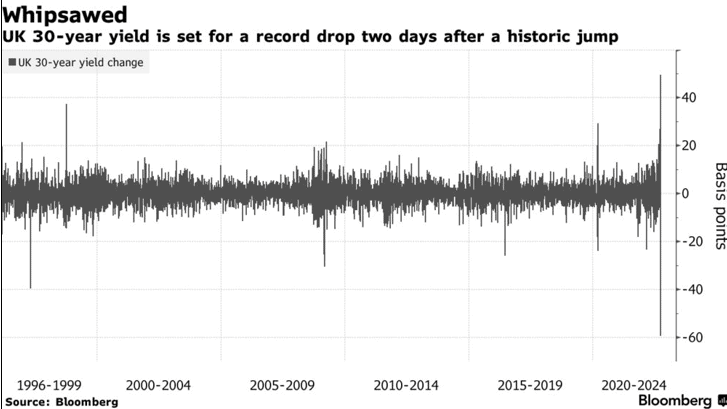

Like all central banks, the Bank of England is fighting inflation. But when the new UK government lowered taxes, the market reacted negatively, seeing the move as inflationary (which all government stimulus is).

That created a ‘panic’ that BoE would have to raise rates higher & faster. Investors then started dumping the British long bonds. That created potential real problems for UK Pension Funds, as these UK funds were buying bonds on leverage. As bond prices fell, Pension Funds had to liquidate to meet margin calls, driving bonds even lower.

BoE had to step in to ‘stabilize’ the British bond market. When bonds sell off, it threatens a country’s ability to borrow. This is a BIG global concern.

We have been warning of a coming global sovereign debt crisis for years & this event in the UK tells us we are getting closer to that reality.

When the public loses confidence in government’s ability to manage the economy, they will question if they want to own government bonds.

Once we see the first sovereign debt default, we will see contagion..investors will then look around and ask ‘who’s next’??

We have warned our subscribers to stay out of long-term government bonds, short-term is ok, but not long-term.

What just happened in Britain is just a glimpse of what we are going to see on a big scale soon. Europe is primed for this disaster.

By keeping their rates negative for so long, the ECB has destroyed the European bond market

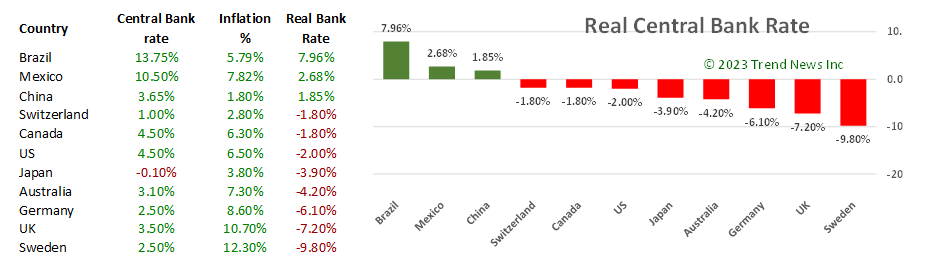

Q. How high do you think The Fed could take interest rates ?

Predicting what central banks will do is a real challenge because they are almost always wrong is their forecasts

The US federal Reserve has over 400 PhDs & a budget of over $6 billion, yet, with all those resources, they said inflation was ‘transitory’. If you look at all of their forecasts, they are almost ALWAYS wrong.

One of the real challenges for central banks fighting inflation is that their governments keep piling on more stimulus, which itself is inflationary. The Biden administration passed their 796 page Inflation Reduction Act… but it is full of stimulus spending..inflationary. The Trudeau government is doing the same thing, they keep increasing government spending, while the Bank of Canada is trying to fight inflation.

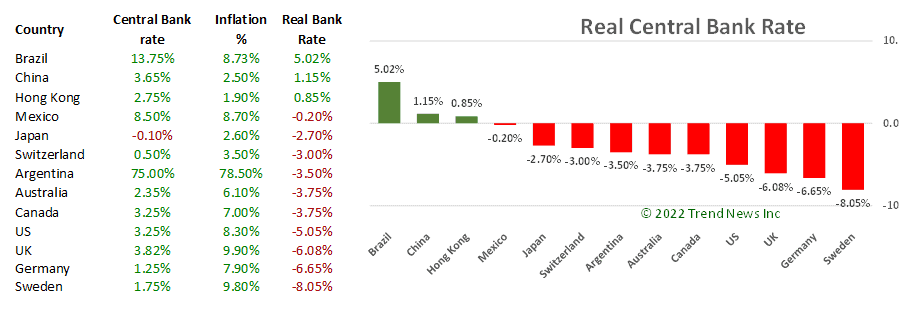

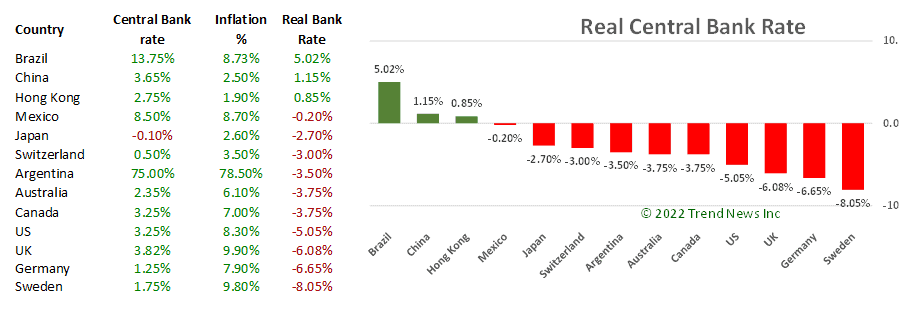

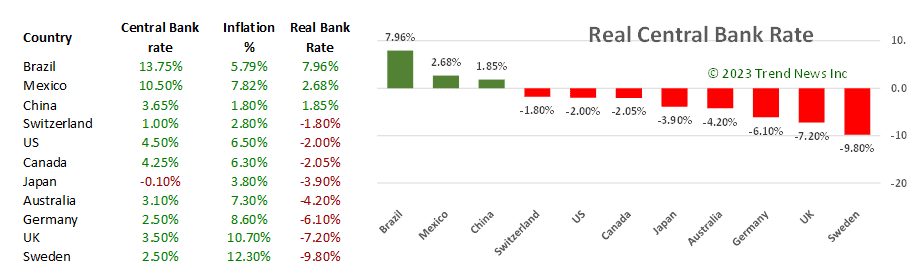

Jerome Powell recently stated that they expect to raise rates to 4.6%, from the current rate of 3.25%. Powell says benchmark lending rate must be higher than the inflation rate, or until “real” rates are positive.

The Fed rate is now 3.25% & depending what inflation figure used CPI (Consumer Price Index) at 8.3% or PCE (Personal Consumption Expenditures which doesn’t include food or energy) at 6.3%, the REAL fund rate is ~-3.0% – -5.0%

So, if he sticks to his guns, he will need to keep raising till they get to 0% REAL rate. A combination of lower inflation & higher rates will need ot happen.

Employment rate is another key factor but so far, US unemployment at historic low levels.

While there is lots of noise that the Fed has to back off to save the stock markets, I think they will continue to raise rate until they are at lease close to 0% REAL Fed rate.

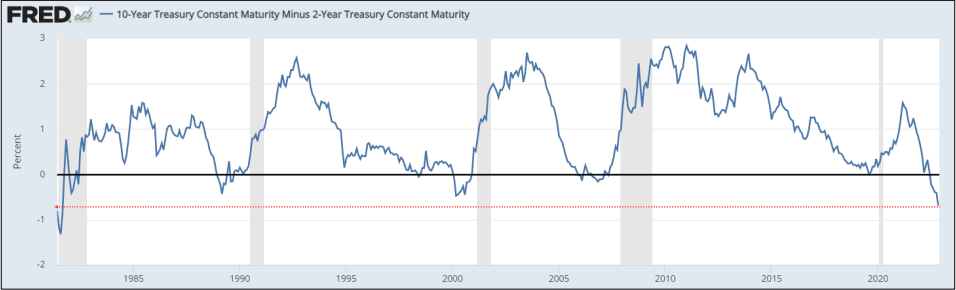

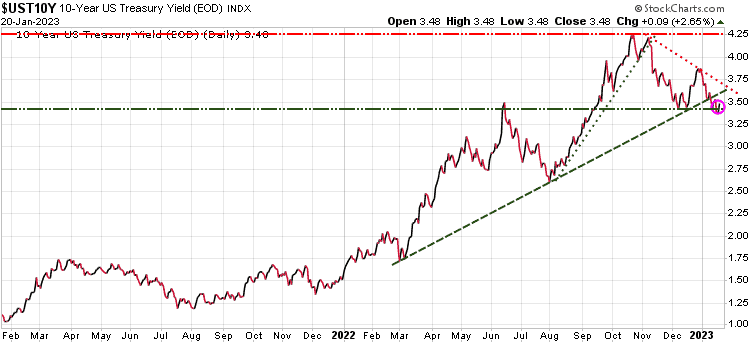

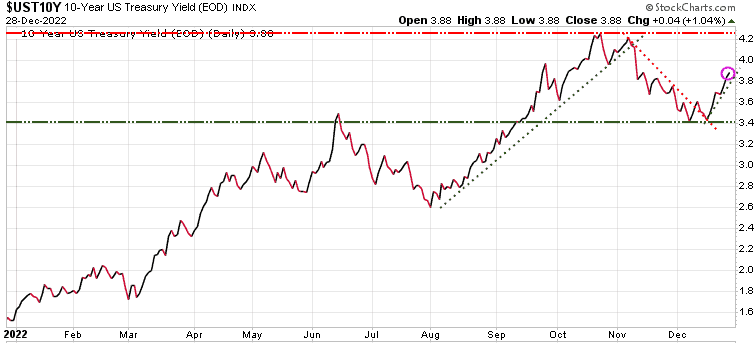

Q. Could the Bond Market Bubble be bursting ?

- It’s a great question

- Governments need to sell bond to finance their massive deficits & debts

- The problem for bonds is as rates rise, the bond prices fall & no one wants to buy a falling asset

- In Canada, a 10-year bought a year ago pays 1.2% yield vs the 7% inflation…losing 5.8% each year

for another 9 years

Today Canadian 10-year is paying ~3.0%, with 7.0% inflation, still a negative return of ~4.0%

So, why own these bonds when you are losing purchasing power every year for 10 years??

Central banks have been the major purchasers of their own bonds for over a decade…to keep rates low

The Fed was buying $120 billion bond per month ($80 bln in Treasuries, $40 bln in MBS)

BUT, now they have committed to shrinking those holdings by $95 billion per month

The big question is.. ‘Who is going to step in and fill that massive void’???

The value of global bonds has plunged by another $1.2 trillion last week

The total loss from the all-time high is now $12.2 trillion

We have been warning of a global sovereign debt crisis for years & we are certainly getting closer to that reality.

When the public loses confidence in government’s ability to manage the economy, they will question if they want to own government bonds. Once we see the first sovereign debt default, we will see contagion.

Investors will then look around and ask ‘who’s next’??

We have warned our subscribers to stay out of long-term government bonds.

Short-term is ok, but not long-term.

So, what just happened in Britain is just a glimpse of what we are going to see on a big scale soon

And Europe is prime for this disaster

By keeping their rates negative for so long, the ECB has destroyed the European bond market.

Q. Is the Bank of Canada likely to continue raising rates ?

The Bank of Canada has been very aggressive in raising rates. It was the first of the top 10 countries to hit 3.25%

Very focused on bringing down inflation

The REAL Bank Rate in Canada I -3.75% (3.25% rate – 7% rate of inflation)

Much like the Fed, BoC needs to see inflation drop & rates rise until they get close to a 0% gap

We suspect the Bank of Canada will pretty much keep in step with the US Fed.

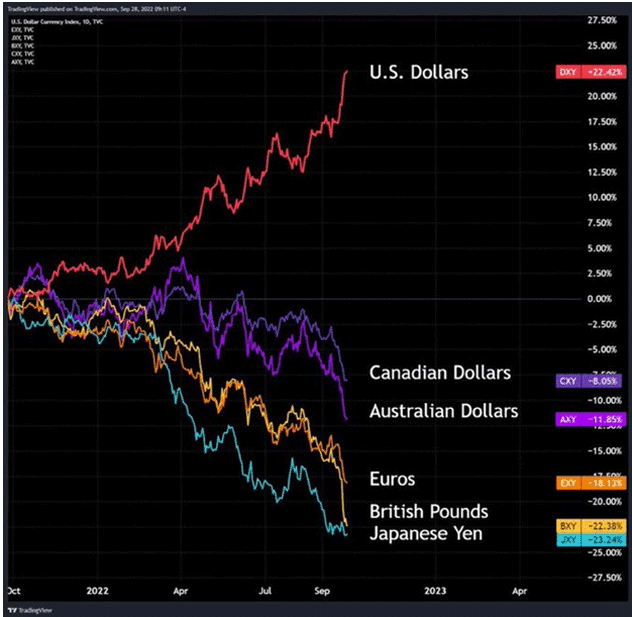

Q. Does it look like the US Dollar put in a top this week ?

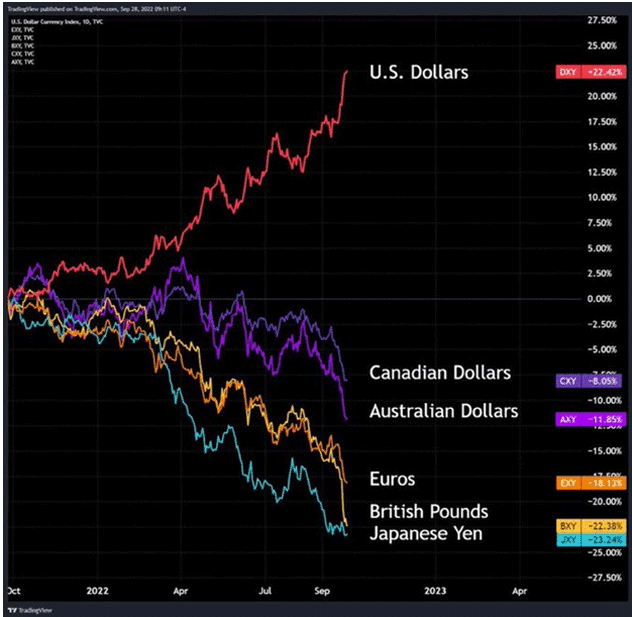

The $US has been driving all markets. A strong $US means weaker other currencies, assets, & commodities.

$US higher = lower $CAD, copper, oil, gold etc.

$US …hit a 20-year high.

$Can down ~12% since Jun’21 high from .83 to .73

Pound down to 37-year low

Yen at 24-year low

18 months ago we predicted the Euro would be at par in 2 years…it only took 18 month

Last week we told subscribers that Near-term, the $US was overbought & overdue for a pullback.

Central banks such as BoJ, ECB are looking to slow the rise of $US by selling US debt & $US. That boosts other currencies & asset classes,

Expect a pullback in the $US to last a few weeks

Longer-term we see the $US trading up to the 120 level

For $CAD we have .72 as near-term support & if that fails, .68 is next target

Note that currency moves tend to run longer than seems logical.

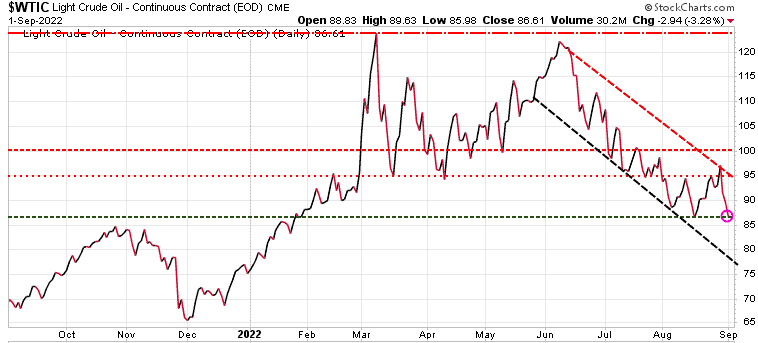

Q.at do you see ahead for Crude Oil and Gasoline ?

For oil we see much higher prices in 2023.

Governments all over are pumping ‘anti-inflation’ packages which are inflationary & ultimately will keep demand high.

There is a saying ‘the solution to high oil prices is high oil prices’.

On the supply side the US Strategic Reserve is being depleted, was supposed to end in October, but they have pushed that back to after the election.

Windfall taxes, severe regulations are major disincentives for produces to invest

So long term we see oil up in the $150-$200 level in the next year

Very short-term oil could rise if we see a pullback in the $US

Then recession & China shutdowns to push demand down

That could push oil below $70

When we get a BUY signal from our models, we will be sending out ALERTS to subscribers.

Q. Automakers are making more and more electric vehicles. Is this bullish for the battery metals ?

Eventually!!

What I mean by that is that in a recession, combined with a strong $US, commodities are getting hit. But once we get through all that, yes battery metals & all commodities related to building EVs plus all the infrastructure will do well.

Just for reference. A single industrial-size wind turbine can require as much as three metric tons of copper and permanent magnets composed of rare earths.

Complicated formula as the pro-green activists that want to push for green only vehicles, also don’t want any mining – they haven’t quite figured out the connection just yet.

Plus, we need to create a whole new power gird that can handle intermittent power

When the sun don’t shine & the wind don’t blow…there is no power.

You can’t just wish for a green economy. That can be the objective, but you need a detailed, sustainable PLAN to actually achieve it..

My background is in systems & project management.

It is mind boggling to me there doesn’t seem to be a coordinated, sustainable transition PLAN to go total green.

All we hear are these dreams of total green in 8 – 12 years

We can’t just shut down fossil fuels & put everyone in an EV & expect to have the power to charge these vehicles

California is already having severe power issues & told EV owners to refrain from charging their vehicle

What happens when there are another 10 million EVS on the streets in California?

Did no one in these meetings on green energy put up their hands and ask how are we getting there??

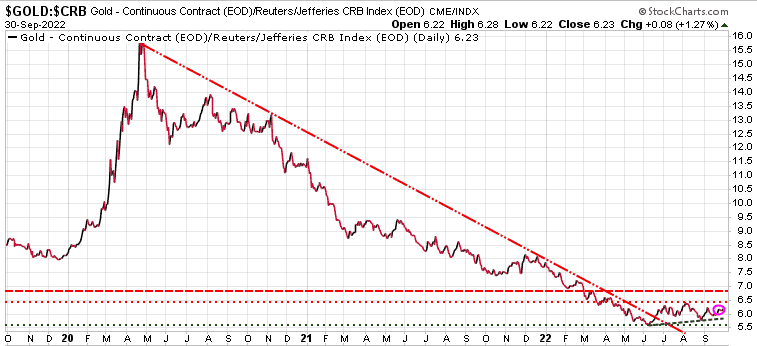

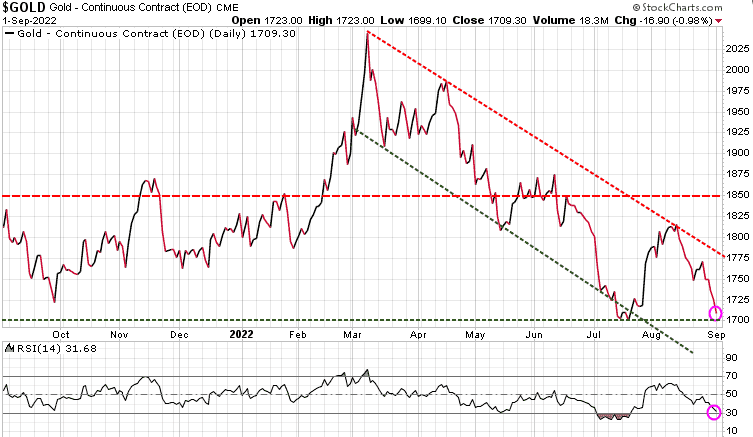

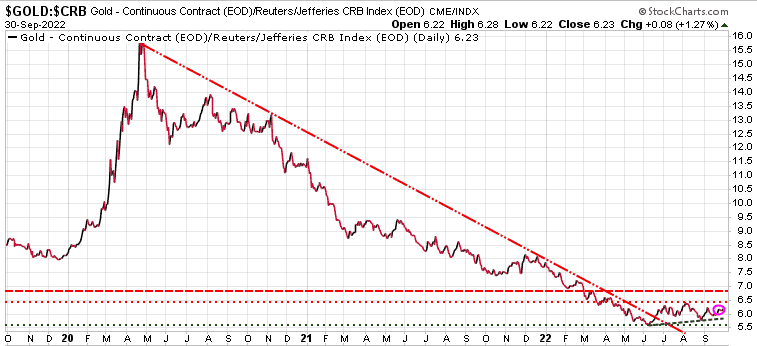

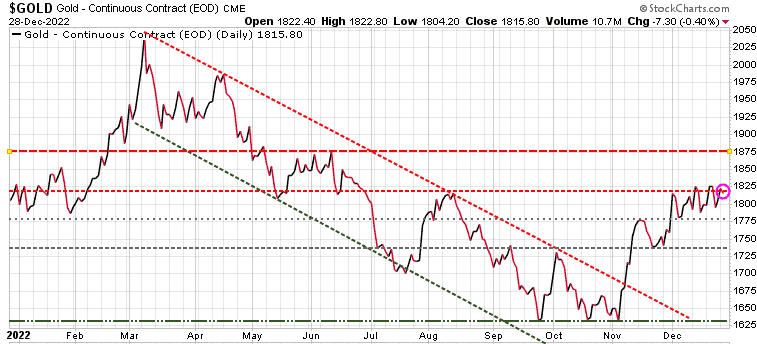

Q. What are your thoughts on Gold ?

Precious metals have been very frustrating since March, not being an inflation hedge at all

The $US strength has been the massive headwind for gold, as are new higher yields on bonds.

Gold broke below key support at 1675, & as now recovered back to that level. Coming off an oversold technical levels so a rally here is likely

Our models have signalled gold is due for a sustained rally in the fall, so this could be the start

Needs to break above 1700, 1740, 1815

Compared to the commodity index gold has been crushed

But since June, gold is trying to turn that ratio around

If it can form a bottom here, then it could lead to a solid rally

We like gold & silver at these levels…we have given subscribers about 5 plays for gold & silver

GDXJ would be a consideration

Q. Is Silver in sync with Gold

Silver generally follows gold,

Tends to rise more in bullish markets

Declines more in bearish markets

Silver also really struggled since the high in March, but also looking good here

Initial resistance at 19.85, then 20.70, & 22.25

We publish 3 investment services:

- Trend Letter – publishes every Sunday, covers equites, currencies, precious metal, commodities,& bonds. Mostly charts, with key bullet points to make easy to understand

– Focus is for longer term investors who want to get a better understanding of what drives these markets - Trend Technical Trader – Online service that started as a hedging service, which has been a very timely service these days for subscribers during this nasty bear market. TTT also now covers many sectors including commodities, equities & precious metals, EVEN Psychedelic Therapies, a very exciting new sector which we recently booked a nice 45% gain in just 3 months. – Focus here is for more traders but investors can also benefit, especially with these hedging strategies

- Trend Disruptors – a monthly publication with new disruptive ideas in Artificial Intelligence, Virtual Reality, Augmented Reality, 5G, Cloud, Internet of Things etc. Very speculative sector and we have not added any new recommendations in this bear market, but are building our Watch List which is at about 25-30 companies right now

– Focus on those wishing to speculate, with risk capital they can afford to lose.

Special Offers

See great Black Friday Specials at end of this post

See great Black Friday Specials at end of this post