Market Notes – May 9/22

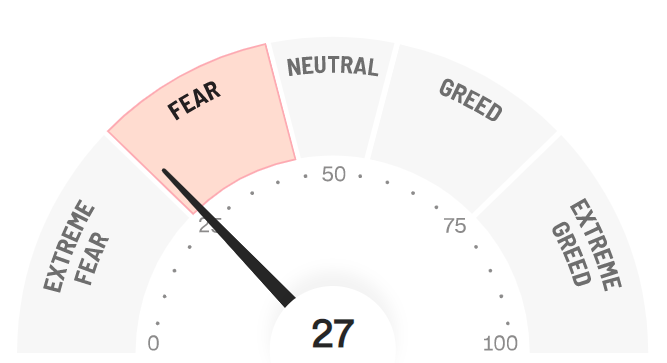

Global markets got hit hard today with investors refocusing on the Ukraine war, a global energy shock and the risk asthe Fed tries to fight the supply-driven inflation. “I’ve been in the markets for 25 years and I’ve never seen anything like this,” said Danielle DiMartino Booth, CEO and chief strategist for Quill Intelligence, a Wall Street and Federal Reserve research firm. “It’s violent not just volatile.”

In the weekend edition of the Trend Letter we showed this updated chart, highlighting what a correction vs a bear market would look like. A move down to the 3800 level would be a decline of ~20% from the December high, signalling a correction. We would expect a relief rally from that level. If we then re-test that level, a bear market would likely take the S&P down to the 2730 level which would be a 50% retracement of the rally from 2009 to the recent high in December.

The tech heavy Nasdaq was down a whopping 4.29% on Monday. Now down ~28% so far this year!

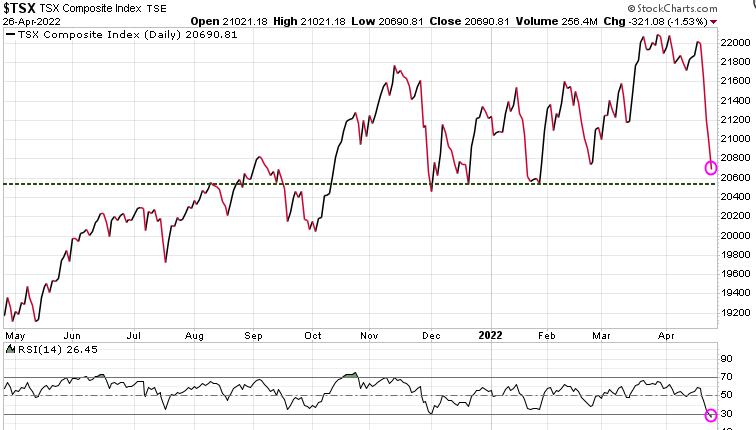

The Canadian TSX was down 3.07%

Silver has really struggled recently, and dropped another 2.46% today. Based on RSI (bottom of chart), silver is now oversold.

Since the start of the year we have warned investors to have a hedging strategy for what we anticipated would be a very volatile year in 2022. The market action in these last 4 months is exactly the reason investors need a strategy to protect their wealth in volatile markets. Our Trend Technical Trader (TTT) service was originally a hedging service and although it now recommends long positions as well, TTT is still a hedging service with many hedging strategies that are doing very well as the market crashes.

If you do not have a hedging strategy, seriously consider subscribing to TTT which offers numerous hedging options. Note also, TTT includes the Gold Technical Indicator (GTI).

To ensure all readers have access to this hedge service, we temporarily reduced the price by 50%. Click button below to subscribe. It’s your money – take control!

Stay tuned!