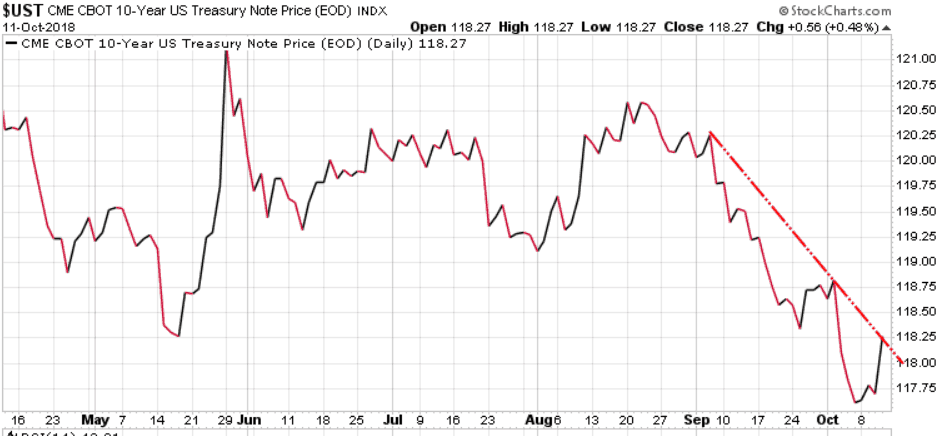

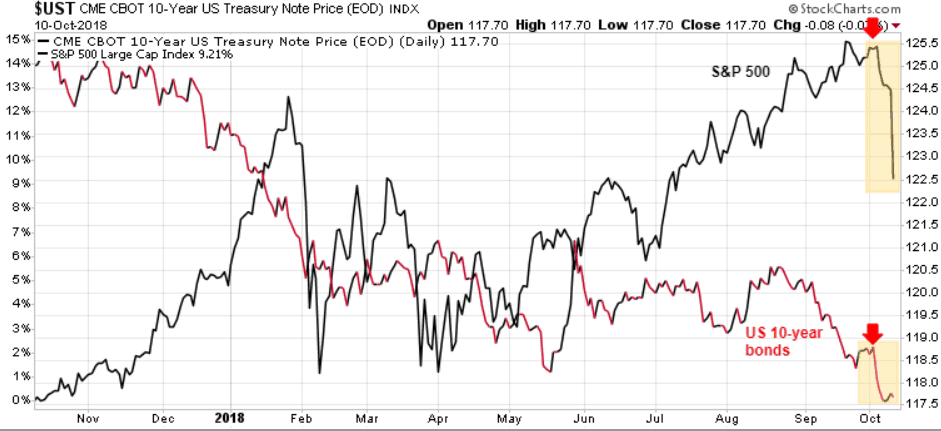

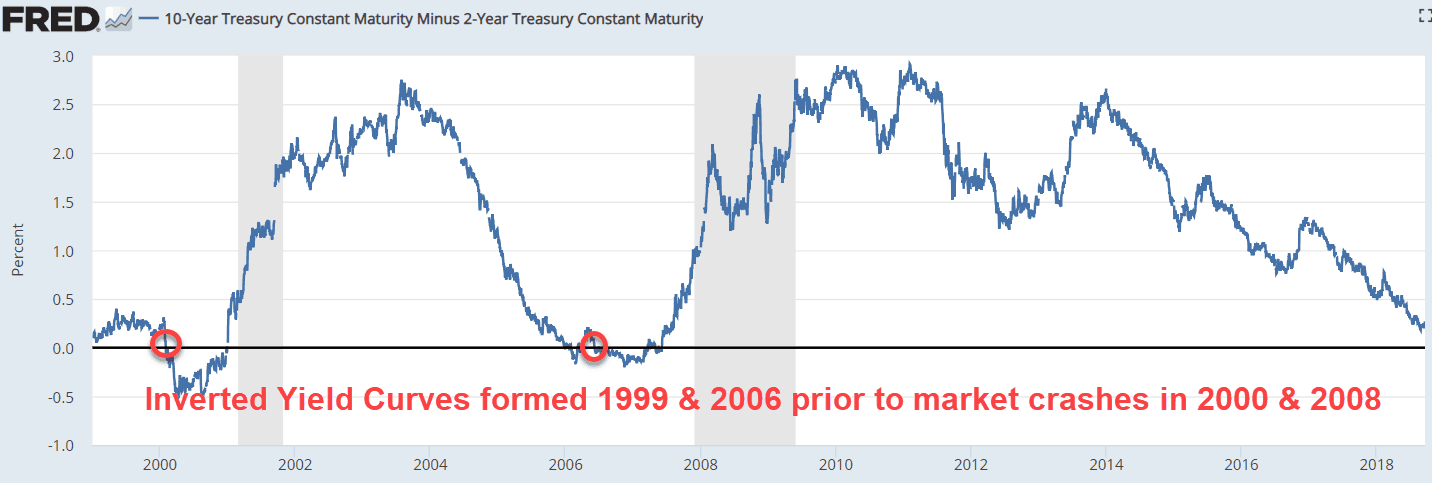

To be a successful investor today you must understand what is happening in the markets globally, one cannot simply look at what is happening domestically. Capital flows out of perceived risky areas, and into perceived safer areas. The current perceived risky area is the emerging market debt, and in particular, emerging market debt denominated in $US. This is a theme that subscribers to The Trend Letter are well aware of, and one that could well be the start of the global debt crisis that we have have warned about for a couple of years now. We recently posted a blog on this issue which you can read here.

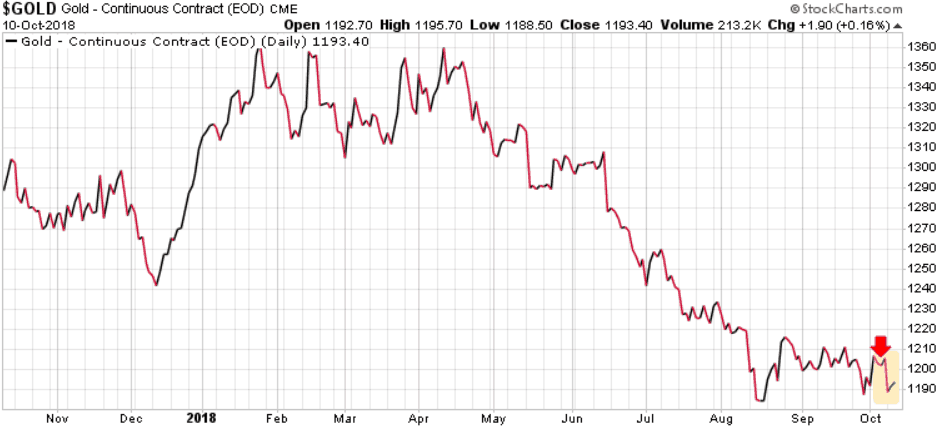

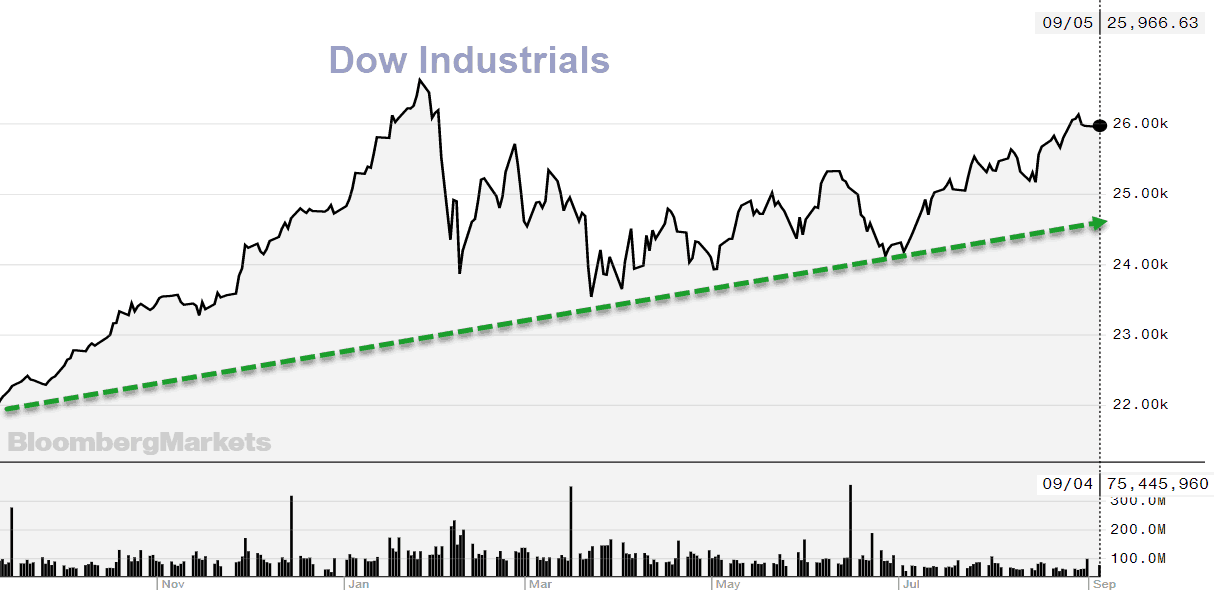

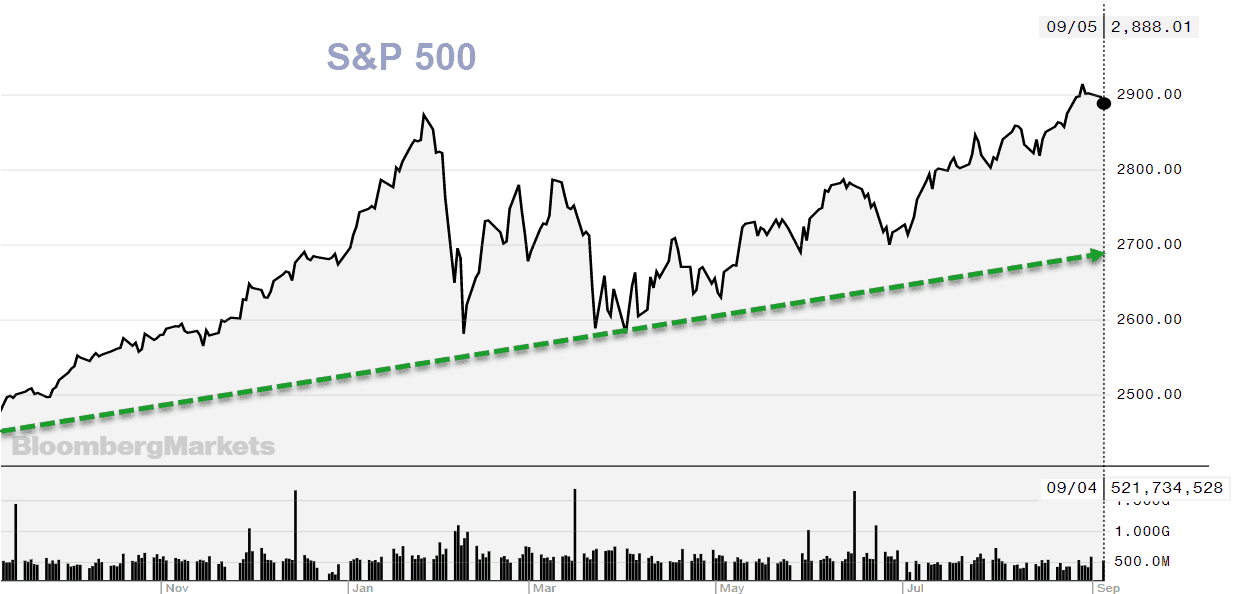

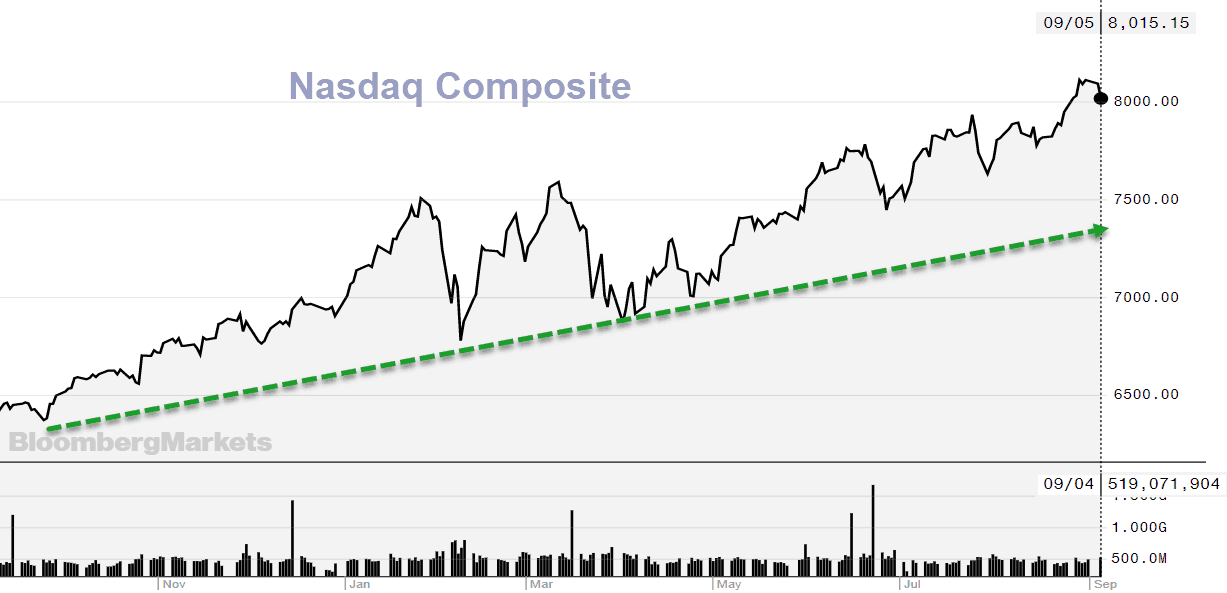

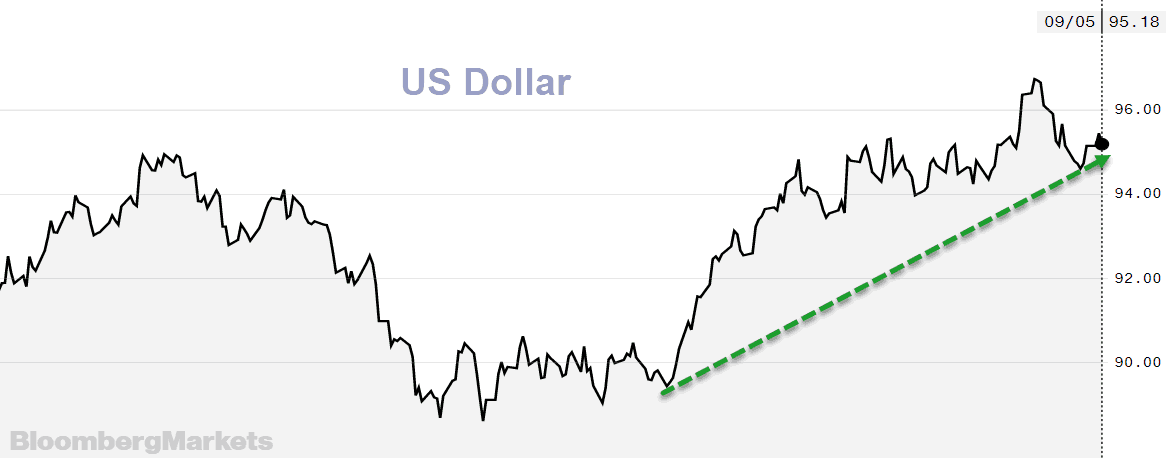

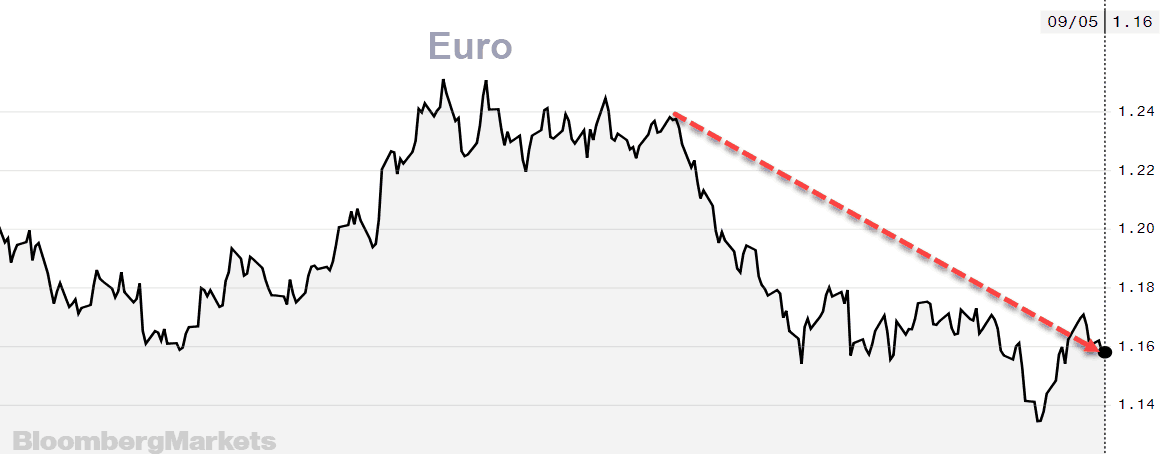

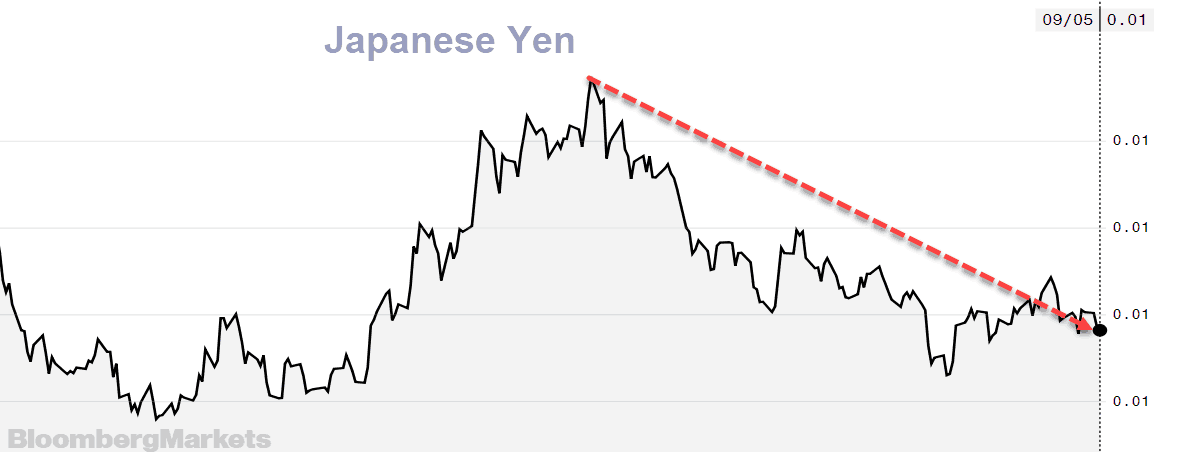

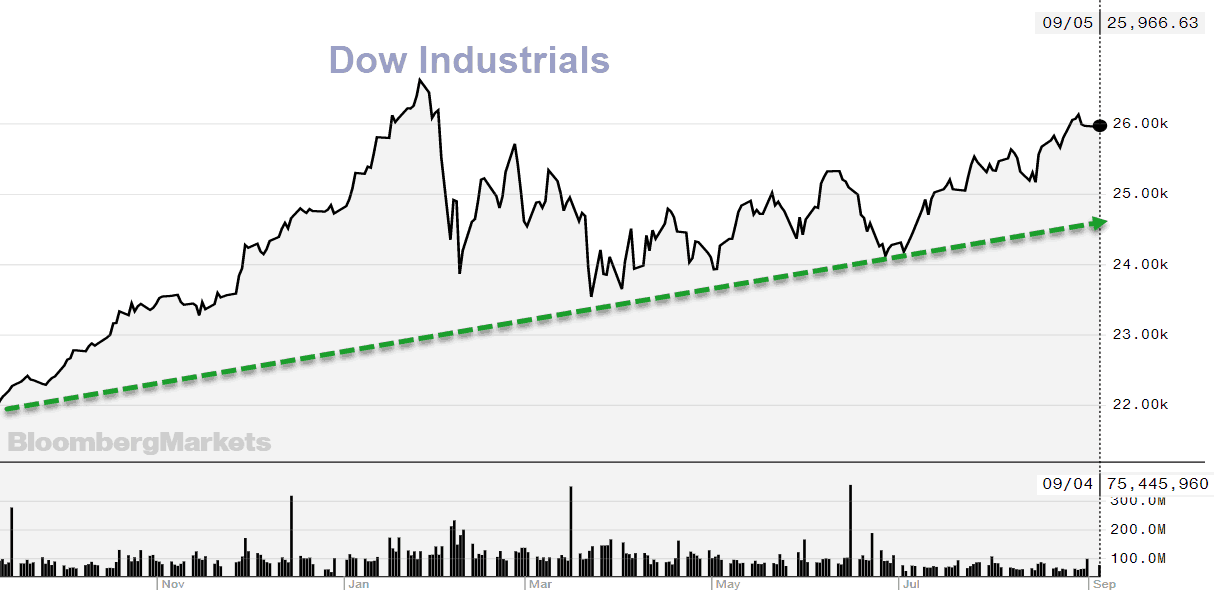

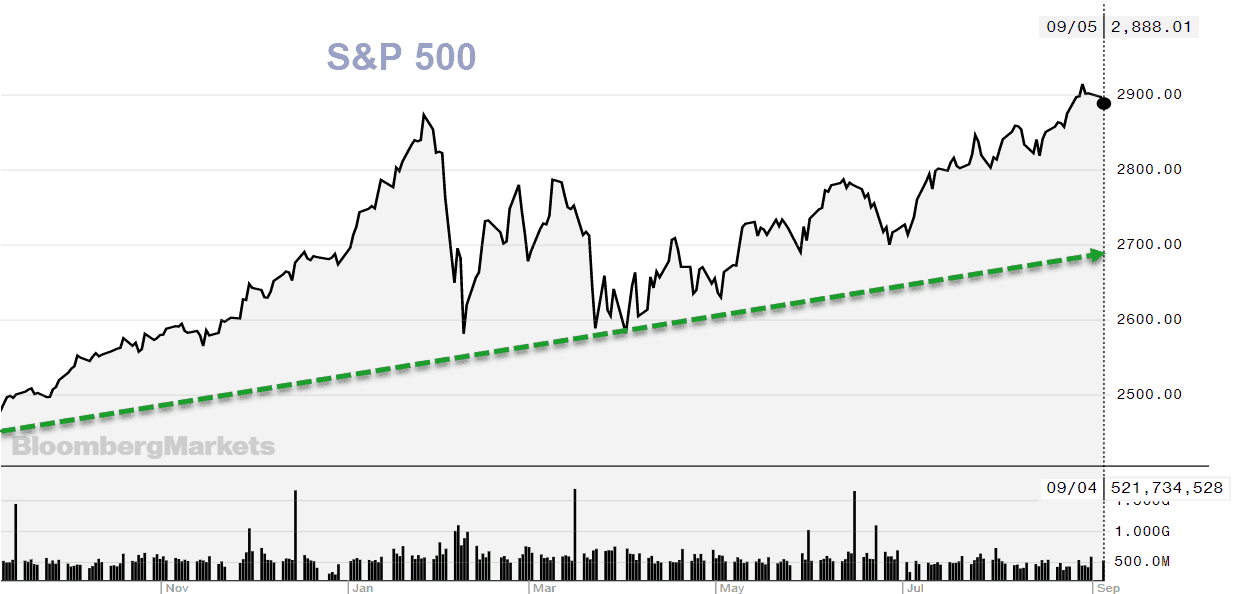

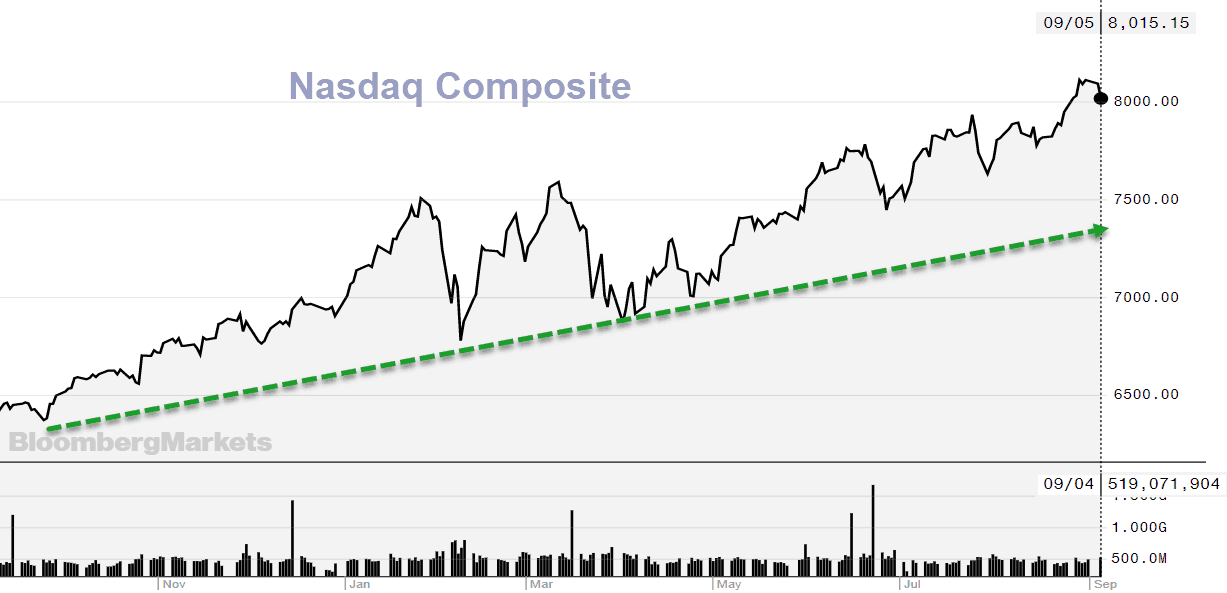

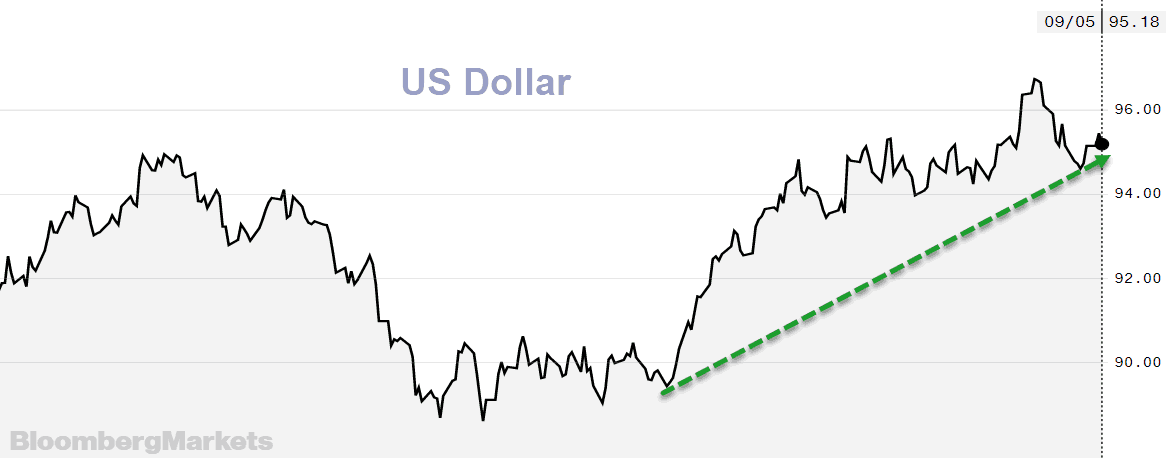

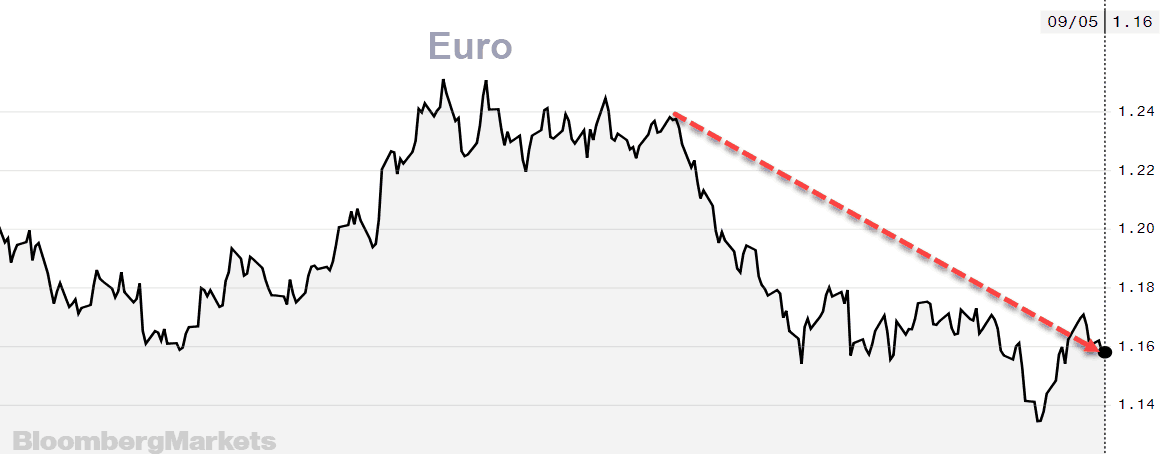

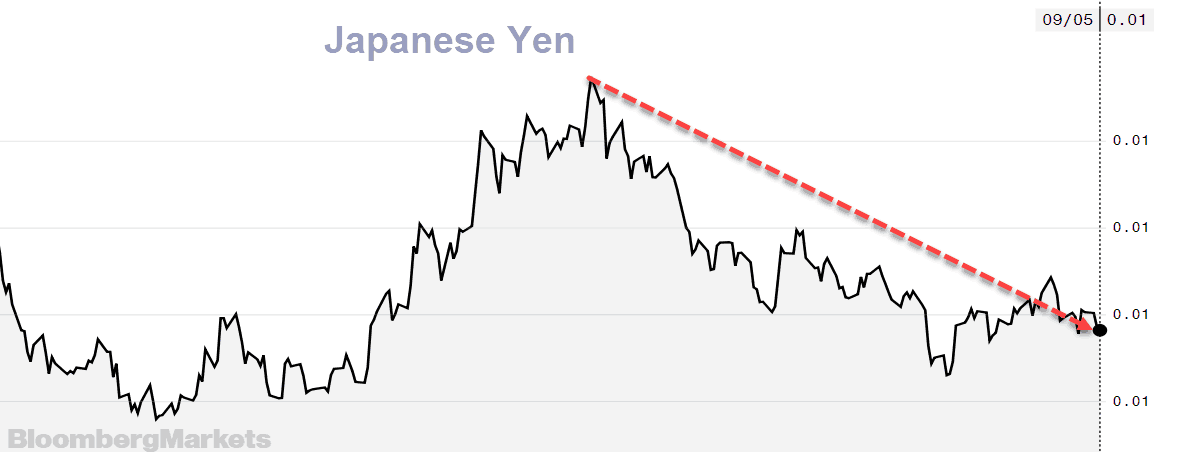

When viewing the following charts, note how it is only US equities, and the US dollar that are in uptrends.

Global Equity Markets

Asia

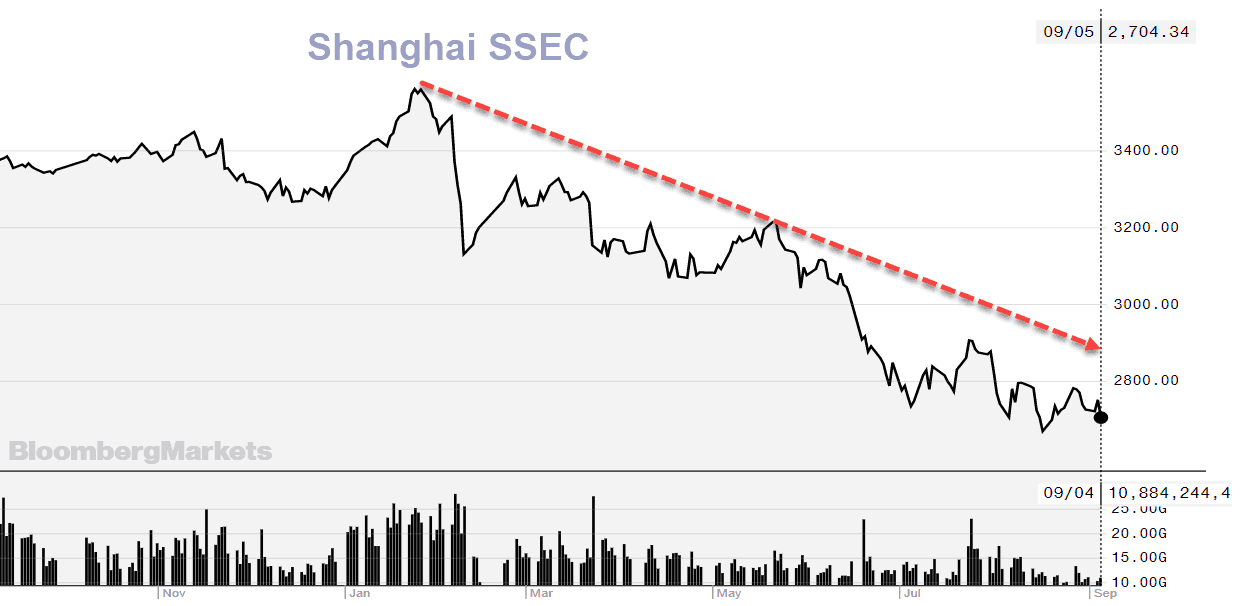

The Asian markets opened first and sold off on light volume, as concerns continue to grow over US dollar denominated debt in emerging market countries.

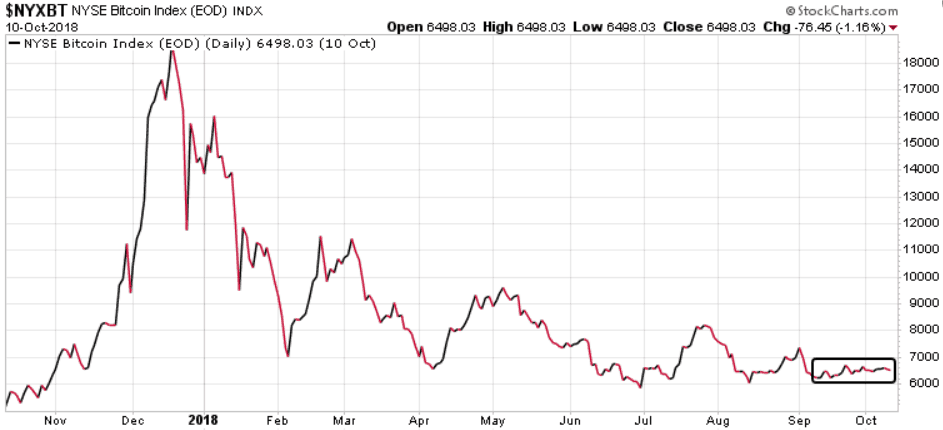

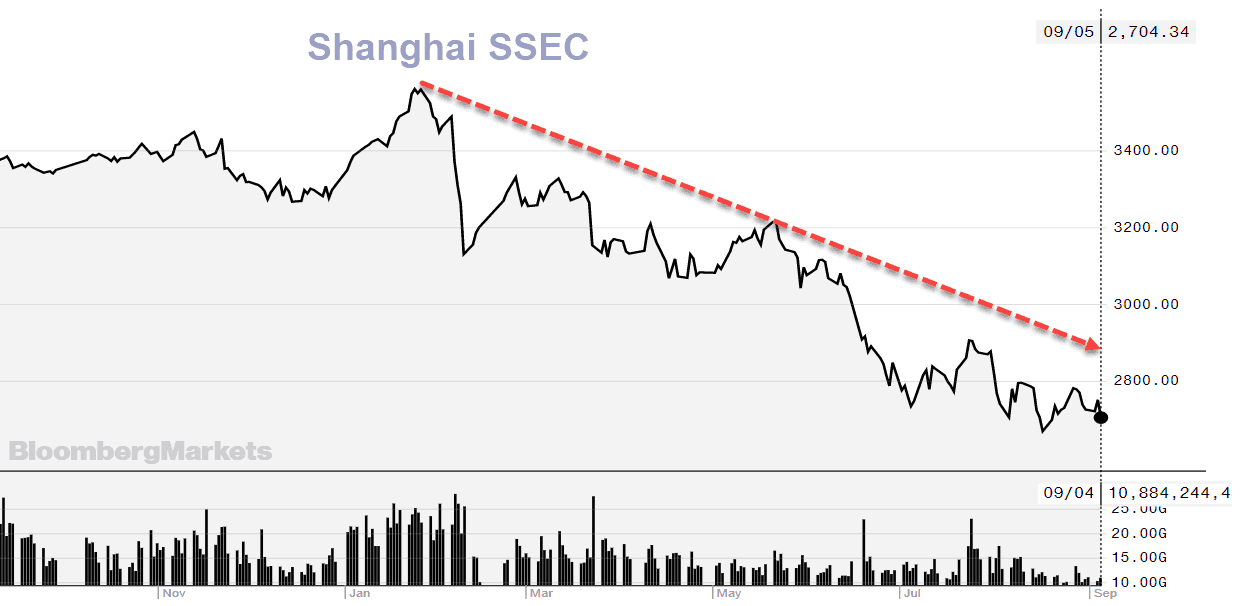

Shanghai was down 1.68% on light volume. Down 24% since January

The Japanese Nikkei was also down, but only .82%. Down 9% since January.

Europe

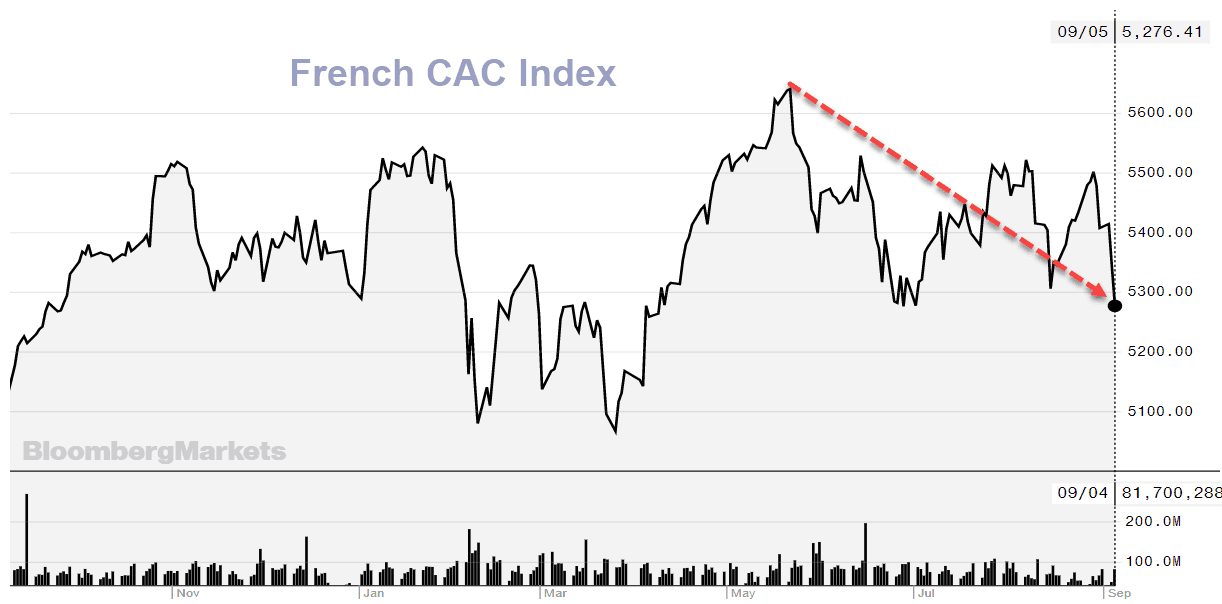

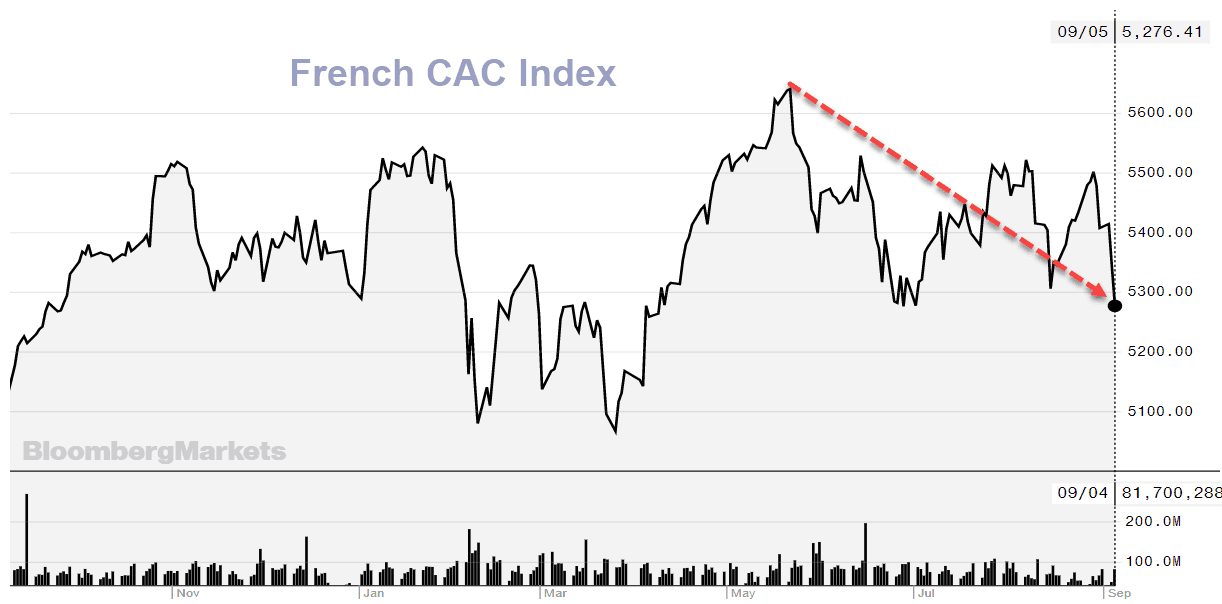

European markets were the next to open and they too felt the tension over emerging market debt, as well as trade concerns. The UK FTSE, German DAX, Italian MIB, Spanish IBEX, were all down about 1%, but the French CAC lead the decline at -1.57%. CAC down 6.7% this year.

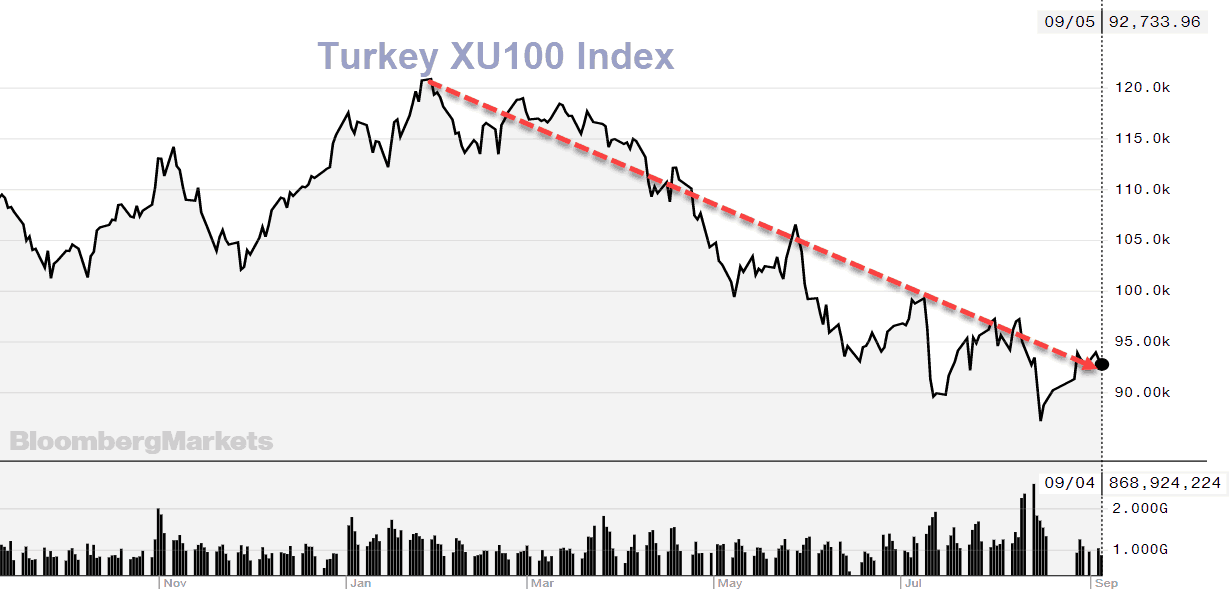

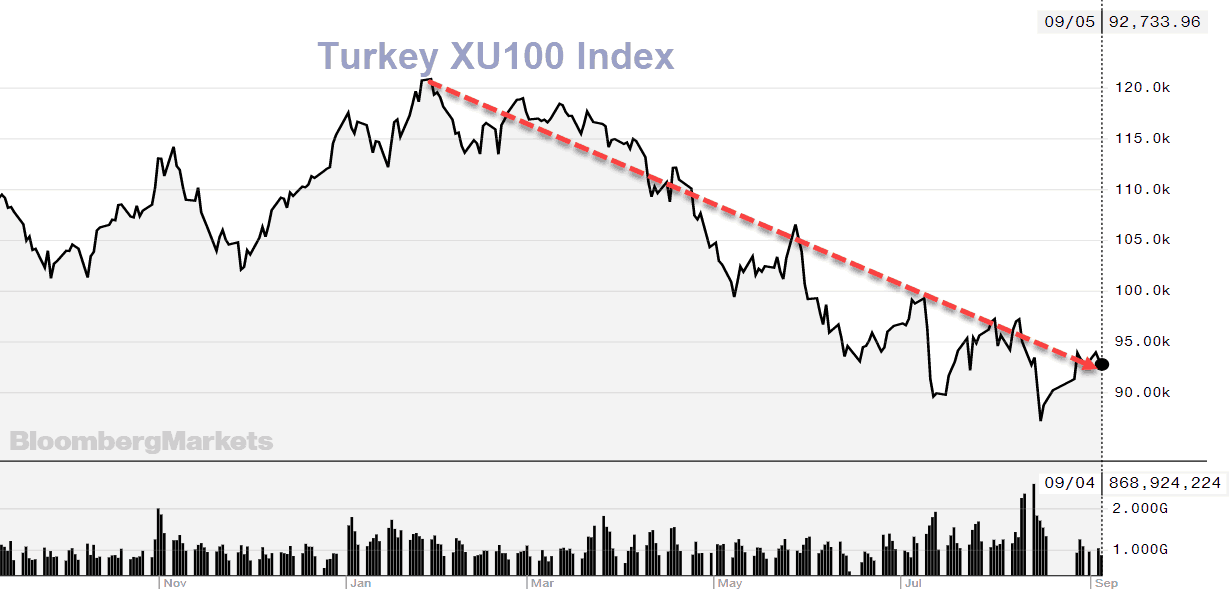

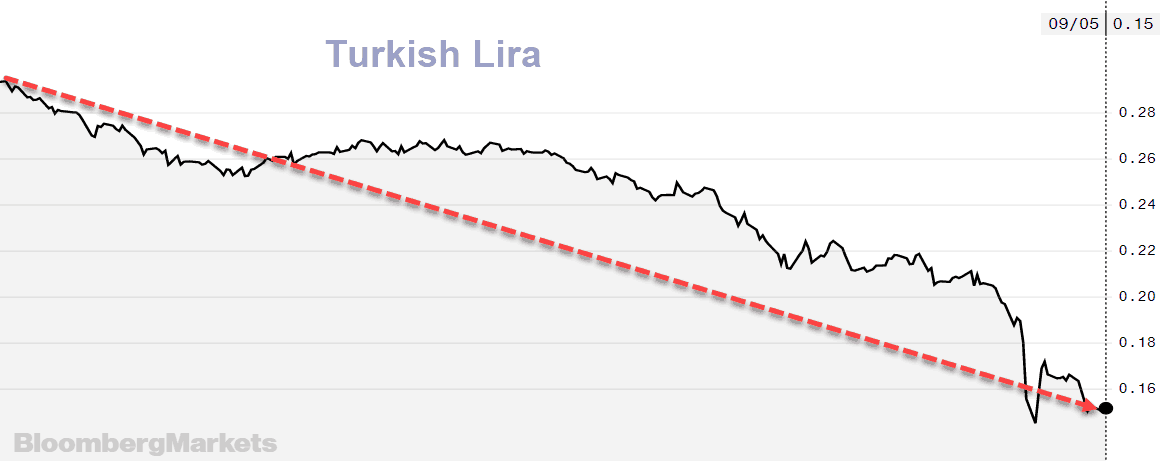

Turkey saw its stock market drop .43% today, and is down about 24% this year.

North America

North American stocks were mixed today, with the Dow Industrials up slightly by .09%, but remains in a solid uptrend, up 19.4% year over year.

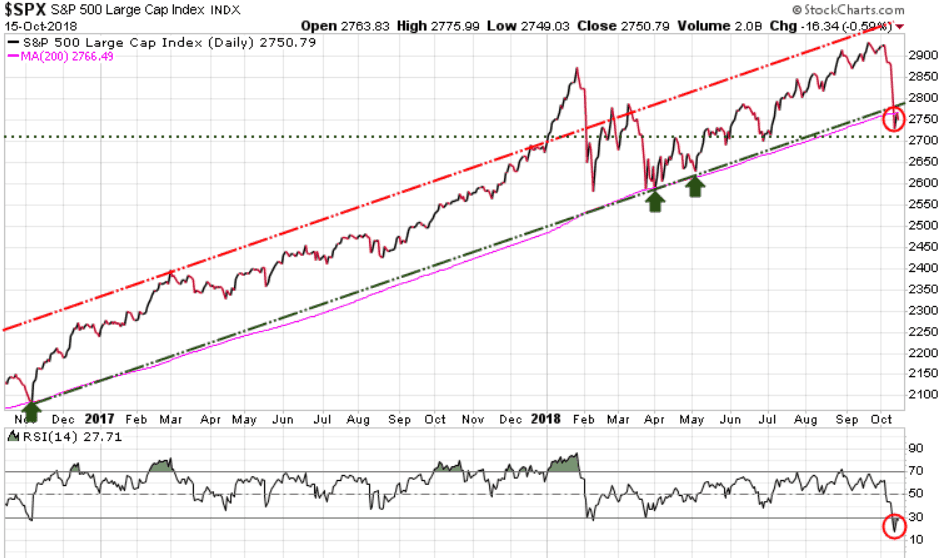

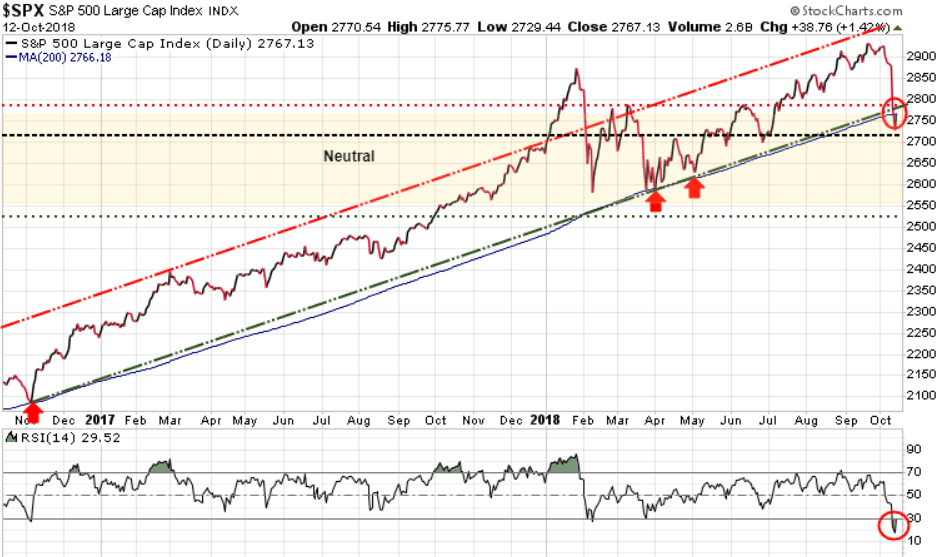

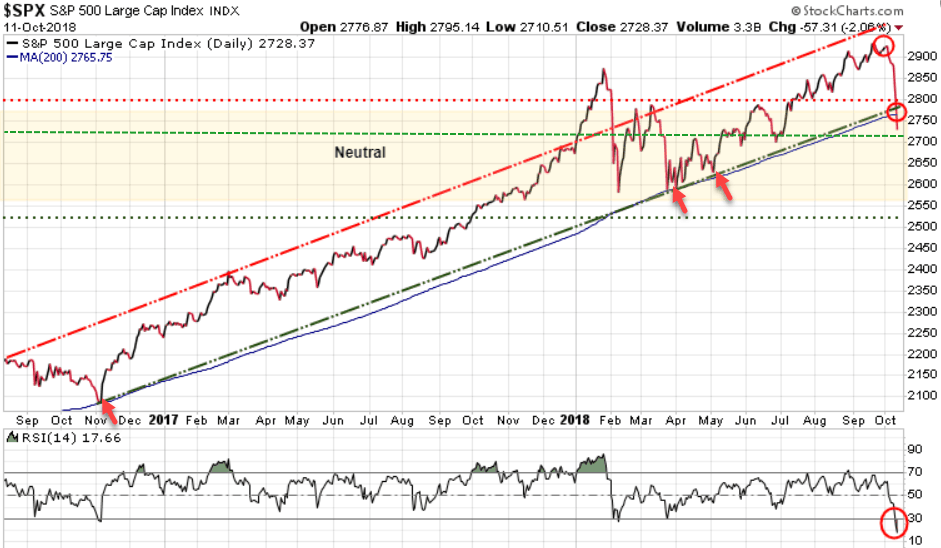

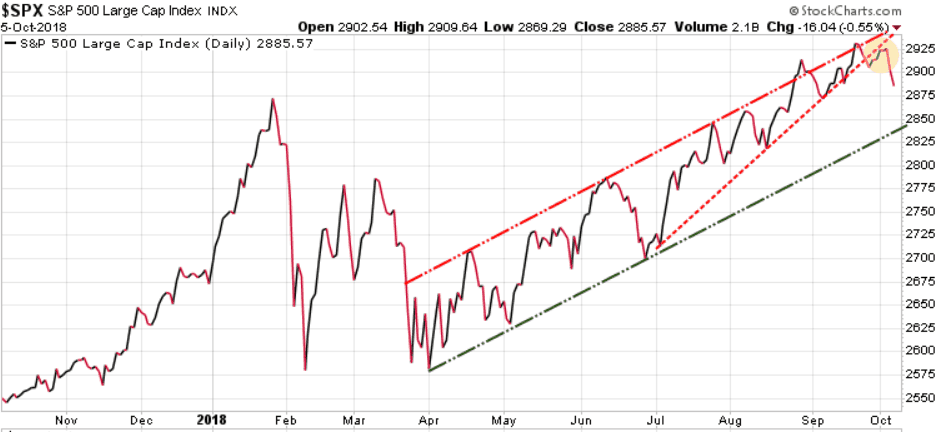

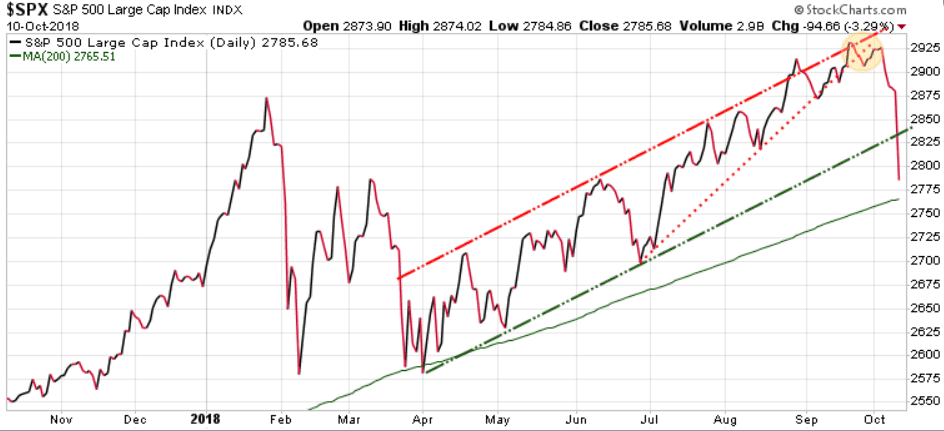

The S&P 500 was down slightly by .28% for the day, but is also in a strong uptrend, up 17.5% year over year.

The Nasdaq was the big loser in the US, down 1.16% with Netflix leading the decline, down over 6% on the day. Tech stocks have been the biggest gainers, up 25.7% in a year. But they will also take the biggest fall in a correction.

Global Currencies

US dollar was down slightly on the day. Expect the $US to remain strong against most currencies for the foreseeable future.

Euro struggling to gain traction. We expect the Euro to go into crisis mode in the next year.

Japanese Yen can be a ‘safe haven’ play, but concerns over Japanese debt is well founded. Ultimately, the Yen will decline steeply.

British Pound will continue to struggle with BREXIT noise. We are bearish long-term.

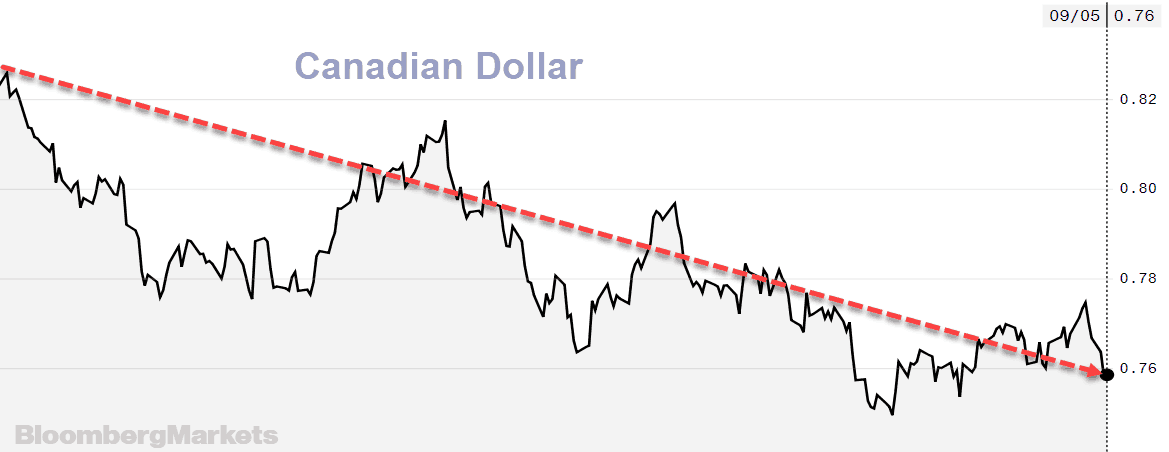

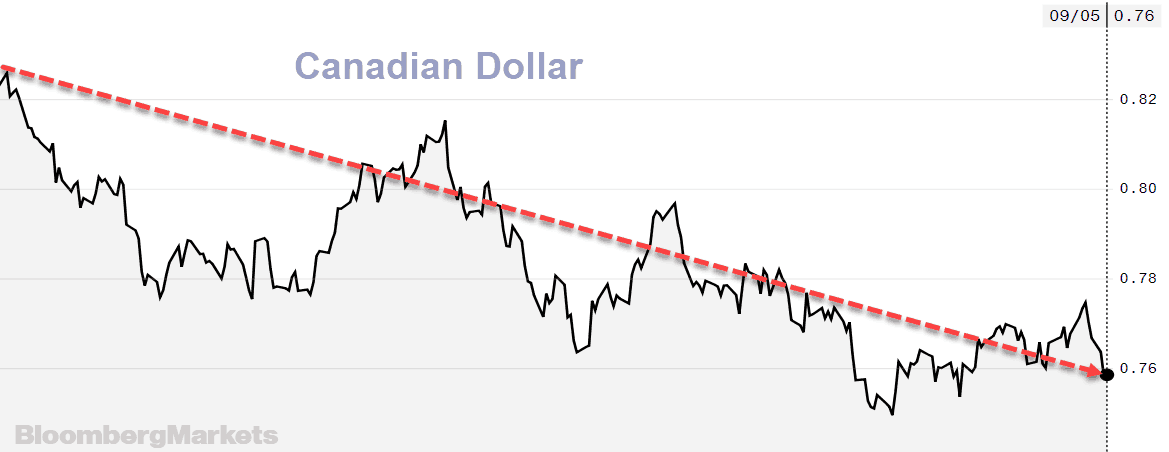

Canadian dollar heavily impacted by NAFTA concerns. Will rise when commodities rise.

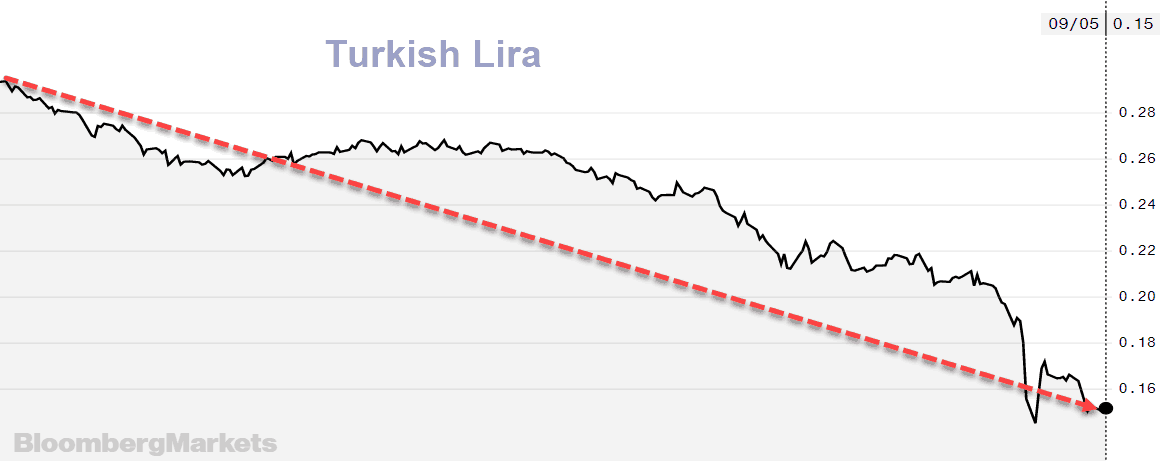

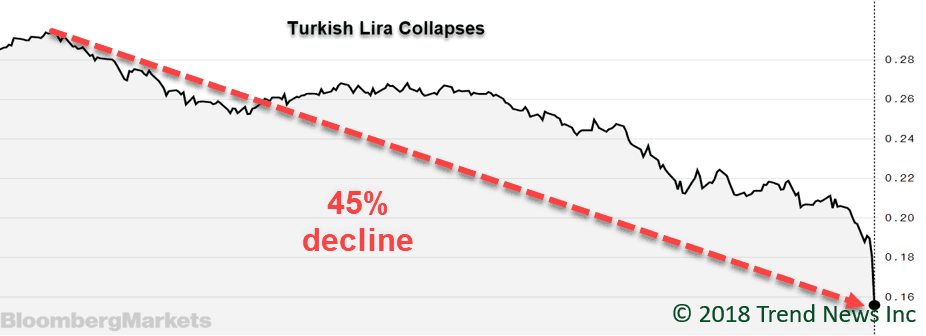

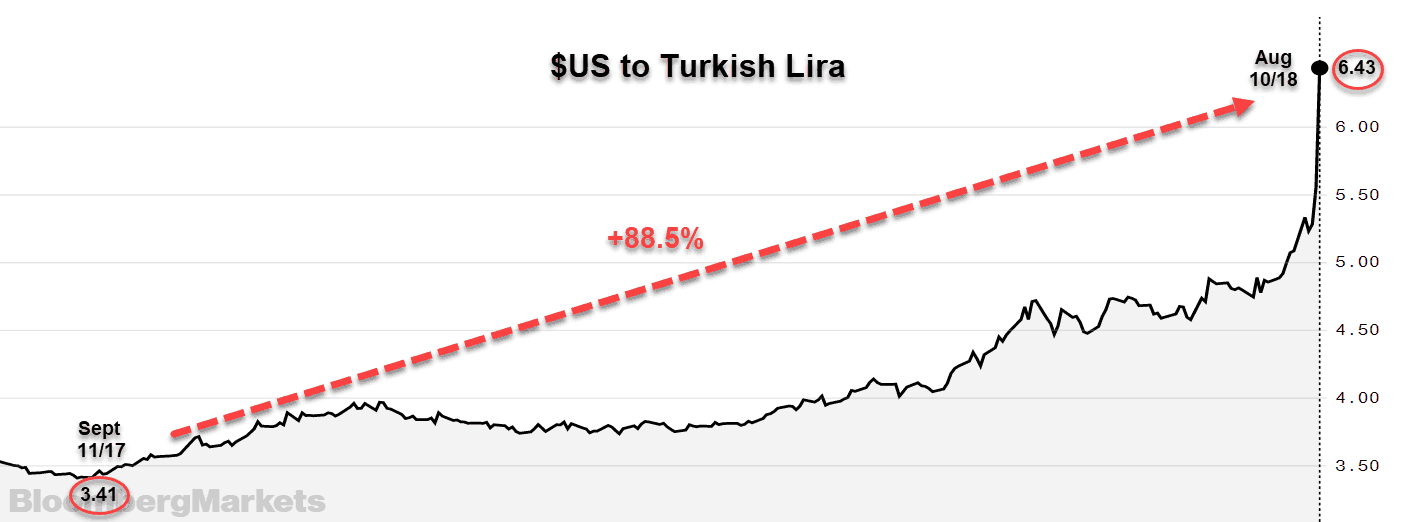

Turkish Lira down over 47% in the last year. Could be the canary in the coal mine regarding emerging market debt crisis.

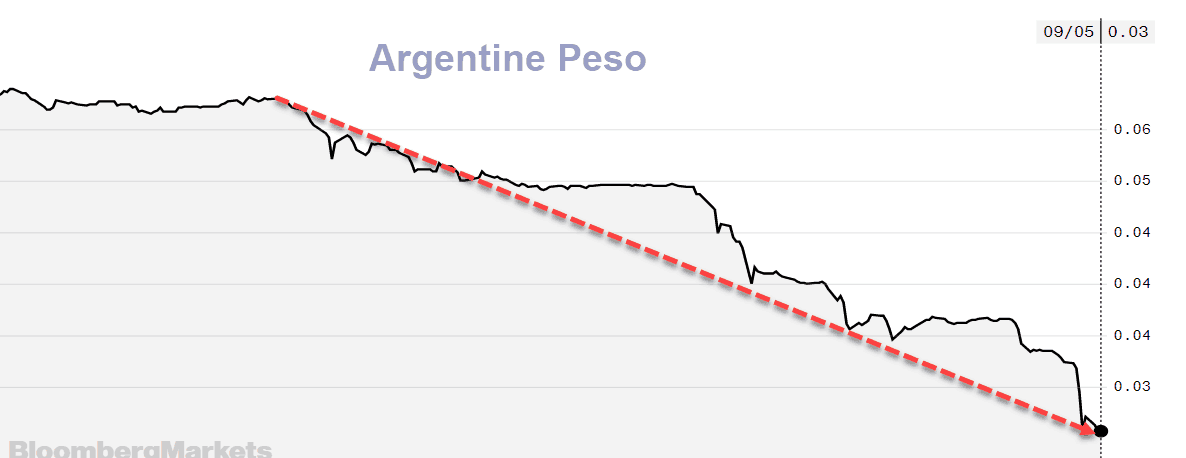

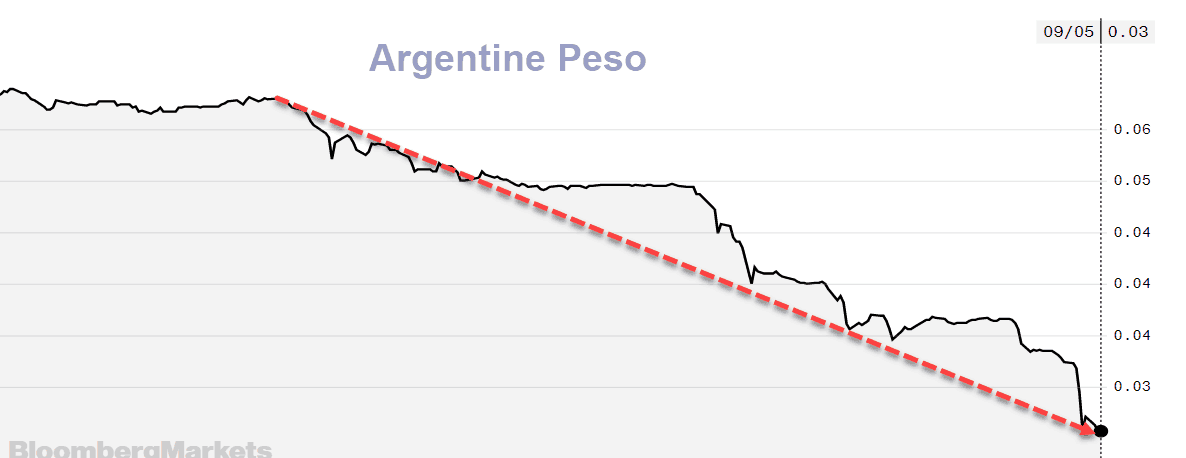

Argentine Peso down 56% in the last year. Another leading candidate for debt default.

In addition to the very real and legitimate concerns over emerging market debt, we have the coming US elections, and the concerted effort to take down Trump. Whatever one’s feelings are for Trump the person, his policies have been very good for the markets. If Trump goes down, so will the markets. If you don’t have a strategy to protect yourself in a severe market decline, check out Trend Technical Trader.

Stay tuned!

The selected Optin Cat form doesn't exist.