How shall we communicate?

There are many ways to communicate, and big improvements are underway to dramatically increase the overall volume and speed of data communications. Starting with the volume of information to be communicated, there are several technologies that will potentially process more data at higher speeds than ever thought possible. Quantum computing is a holistically new way to solve difficult problems based on the principles of quantum physics. This is where high-end computing is heading, giving us a sense of how super computers, super data centres, and super cloud networks will look and operate. The research investment already tops $10b US, being led by USA, China, Australia, the European Union, and many other countries. Google, IBM, and Intel all want to transition the technology into commercial services and products, targeting applications in data analytics, logistics, engineering, and software automation. Today’s best quantum computing systems are being developed in research laboratories; however, they have not yet succeeded in justifying long-term growth or producing commercially viable products and services. Like many new technology developments, some will be in our hands tomorrow, some next week, some next decade. And some may not ever get off the test bench – that is the nature of disruptive technology.

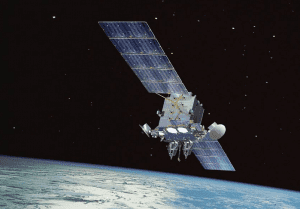

One way or another the amount of data we will have at hand is going to increase and the ongoing challenge is to manage all that data effectively. Managing it requires effective storage and communication solutions. The preferred method for data storage is the cloud, and the preferred method for global data communications is satellite transmission. New technologies that can improve on the status quo will be in high demand. In the processing and storage field there are several developments that hold promise, such as new and more efficient enterprise database designs, and new cloud networking solutions, some based entirely on satellite networks. Amazon’s Web Services (AWS) segment needs all these new solutions in order to grow their business around the globe. As partnerships form to seamlessly integrate these services, global expansion becomes more efficient and a must-do for many multi-national corporations.

The Trend Disruptors team is watching new technologies and identifying the companies that stand out in terms of investment potential. These companies may be large or small, and some of the small start-ups will make the grade and succeed, either on their own or by being acquired by larger organizations. The best and most promising will generate Trend Disruptors recommendations. We are watching a broad range of companies and technologies, all striving to disrupt specific market segments and industries.

Let Trend Disruptors be your guide to the future, as we continue to identify technology investment opportunities that can lead to financial success.

Note we will be posting a couple of new recommendations this week to subscribers of Trend Disruptors Premium. If you would like to subscribe to Trend Disruptors Premium and receive all of the recommendations we are offering a discount rate of $399.95, a discount of $200. To take advantage of this special rate Click Here

Stay Tuned!