Trend Letter Blogs

Market update – September 21/20

The markets opened down on fears of COVID-19 spreading again, the gridlock in Washington, and of course fears that the results of the US election won’t be known for weeks, or even months after the election. In addition, word was out that a number of major financial institutions, including JPMorgan Chase, HSBC, and Deutsche Bank, […]

Canadian Health Experts Speak Up About The Decision to Lockdown

Dealing with COVID-19: An open letter to Canada’s prime minister and provincial and territorial premiers Date: July 9, 2020 Authors: Robert Bell, David Butler-Jones, Jean Clinton, Tom Closson, Janet Davidson, Martha Fulford, Vivek Goel, Joel Kettner, Onye Nnorom, Brian Postl, Neil Rau, Richard Reznick, Susan Richardson, Richard Schabas, Gregory Taylor, David Walker, Catharine Whiteside, Trevor Young Dealing with COVID-19: A balanced response COVID-19 is a serious public health threat and will remain so until […]

Market Update – July 8/20

The Canadian government just released its updated deficit projections and they were mind boggling. The government now projects the federal deficit for this fiscal year to be $345 billion. That is approximately 18 times larger than the 2019 deficit. PM Justin Trudeau then made this statement. “As a Federal Gov’t we decided to take on […]

Market update – 06/11/2020

In yesterday’s update we discussed how the US Federal Reserve pledged to maintain at least the current pace of asset purchases and projected interest rates will remain near zero through 2022. We also showed how most indexes were overbought based on the RSI. Overnight the market had a chance to digest that commitment from the […]

Market Update

US Fed sees 0% rates through 2022 The US Federal Reserve pledged to maintain at least the current pace of asset purchases and projected interest rates will remain near zero through 2022, as Chairman Jerome Powell committed the central bank to using all its tools to help the economy recover from the coronavirus. “We’re not […]

Is this the bottom?

In a recent blog we discussed the importance of having a hedging strategy. It’s a way to protect your portfolio, and protection is often just as important as appreciation. Since February 21st, we have seen a significant stock market crash, with the S&P 500 dropping 35% from the high, blindsiding most investors. Fortunately for subscribers […]

Bond crisis near!

Our BUY Stop was triggered today for a new trade in the bond market. We suggested this trade because our models have been detecting some abnormalities in the markets. For a few years we have warned of a coming global credit and liquidity crisis. We are now moving deeper into this crisis. Europe and Japan […]

Market update – March 16/20

Wall Street suffered its biggest drop since 1987 on Monday, with the S&P 500 closing at its lowest level since December 2018, as investors fear the coronavirus pandemic is proving a tougher opponent than central banks, lawmakers or the White House are currently capable of battling. US – S&P 500 The S&P 500 dropped another […]

Social distancing: What it is and why it’s the best tool we have to fight the coronavirus

By Thomas Perls, Professor of Medicine, Boston University As the coronavirus spreads into more and more communities, public health officials are placing responsibility on individuals to help slow the pandemic. Social distancing is the way to do it. What is social distancing? Social distancing is a tool public health officials recommend to slow the spread […]

Market update – March 11/20

This market environment was primed for the kind of volatility that we are experiencing, and the coronavirus just gave it an excuse. Wave after wave of negative news flooded the markets today. First we hear that the CV-19 virus continues to explode outside of China, especially in Italy, where the country is now in a lock-down. […]

Why every investor should have a hedge strategy

Hedging is a useful practice that every investor should know about. It’s a way to protect your portfolio, and protection is often just as important as portfolio appreciation. Even if you are a beginner, you can learn what hedging is and put it to work for you. The best way to understand hedging is to […]

Market update – a good hedging strategy makes all the difference

For most investors last week was a disaster! Global stock markets got absolutely hammered last week, with the S&P 500 down almost 13% since its recent record high. But subscribers to the Trend Letter & Trend Technical Trader greatly reduced any losses and in fact could have made significant gains by simply following the recommended […]

Market update – February 24/20

In last week’s update we drew attention to the fact that for most of last week, we saw the equity markets moving to new highs at the same time as bonds, gold, and the $US were rising. This was telling us that the much larger bond and currency markets were very concerned regarding the coronavirus […]

Market update – February 19/20

China has pledged to support small businesses and this was responsible for triggering today’s rally. This perceived positive news has overshadowed the global disruption to supply chains from the coronavirus which the mass media has pushed to the back burner, at least until we see the next level of concern. Here is a look […]

Market update

The coronavirus continues to drive markets, and has business activity in China near a standstill. With China’s streets, restaurants and flower markets bare, a miserable Valentine’s Day is expected on Friday. Yesterday, the Chinese province at the center of the coronavirus outbreak reported a record rise in deaths and thousands more infections using a broader […]

Special Offers

In a recent interview Martin offered listeners the following special prices for Trend services. We are extending this offer to all readers of our free updates. Here is a brief overview of each service. Trend Letter: Since start-up in 2002 Trend Letter has provided investors with a great track record, giving exceptionally accurate information about where the […]

The Looming Repo Crisis

We have been warning our subscribers for a few months of a looming crisis that could be the first domino to fall in what we expect to be a liquidity crisis that would affect the global financial system. Back on September 16/19 the overnight Reno rate jumped from 2% to 10%. The Repo market is […]

Money Talks Specials

Martin was the featured guest on the Money Talks investment radio show today. In the interview they discussed the looming Repo crisis that could seriously impact the financial markets and create panic in the global bond, currency and equity markets. To listen to the interview CLICK HERE. The interview with Martin begins at 20:00. In the interview Martin […]

Where is the euphoria?

In December each year Timer Digest asks investment newsletter editors to make their predictions for the following year. In December when we were asked to make our predictions the stock market was coming off its biggest correction since 2008. Our December forecast surprised many, as there was a lot of doom and gloom at the […]

Democracy Requires Discomfort: Agreeing to disagree is a civic virtue.

Merriam-Webster’s definition of bigotry: obstinate or intolerant devotion to one’s own opinions and prejudices We now live in a society of intolerance, where rather than having enlightened and measured debate over complex issues, those with opposing views are marginalized, their opinions are instantly labelled as wrong, and they should be silenced using whatever tactics necessary. Politics […]

Trend Technical Trader Subscriber Only Blogs

Nothing Found

Sorry, no posts matched your criteria

Trend Disruptors Blogs

The key is to get in early

Clearly, the crypto world is still in its initial stages of development and adoption. The role of Trend Disruptors is to provide impartial information, so investors can better weigh the dangers and the future potential of this very volatile sector, one that we have labelled the “wild west.’ If you’re willing to accept the risks, you can look forward to serious profit opportunities.

Crypto currencies hold great promise for the future. They can revolutionize money, infusing discipline into monetary policy. Unfortunately, the crypto space also has a dark side. It suffers from loose standards, questionable operators, excessive hype, and occasional market crashes. Also, buying the actual crypto currencies can be a cumbersome process, and as noted below, governments are now stepping in, trying to figure out how they can take a chunk of that action as taxes, fees, or some yet to be created method of taking your money from you.

If buying the actual CCs is not your cup of tea, understand that over the next few years we expect that the majority of the recommendations in the Trend Disruptors Premium service will come from blockchain, and other technological advances that will change the way we do business, much the same way that the internet has revolutionized our lives.

Times change, technologies evolve. Ten years ago there were no mobile apps, or data clouds. Today we have robots, which are changing the way people do business, in everything from manufacturing to drones. In China, face-detecting systems can now authorize payments, provide access to facilities, and track the movements of every single person in a smart city. Soon we will be passengers in driverless buses and cars.

We will also see cloud-based AI services, which will make artificial intelligence tools available to a wide range of businesses. And even “Dueling Neural Networks”, a breakthrough in artificial intelligence that allows AI to create images of things it has never seen, giving AI a sense of imagination.

There will be some serious privacy, security, and other issues that will need to be addressed as we step into the next evolution of technology advances, but as an investor, each of these advancements gives you the opportunity to make massive gains. The key is to get in early with the right companies, in the right technological trend.

Be clear here, while some of the stocks we will be recommending in Trend Disruptors Premium will be known leaders in their field, other stocks will be unknown and unproven technology stocks that are not on the radar of the masses.

Many of these companies you’ve never heard of will be household names in just a few years.

If you would like to join us, as we ride the wave of the next technological trends, we have re-opened our Special Offer where you can subscribe to Trend Disruptors Premium and save $175 and pay only $525. Click here to take advantage of this offer.

————————————————————————

It’s tax time – are you ready for CC craziness?

Crypto currency (CC) investors have a lot to think about with the tax implications of buying and selling crypto coins. Many governments are still deliberating about how to get in on the action – in the form of taxation. They know there is big money at stake, and they know they are going broke, so they sure don’t want to miss out. There seems to be no simple answer that all governments can agree on. Should CC’s be treated as currency, as a commodity, as a security, as property, or some combination thereof?

For example, here is what’s happening in the USA. In 2014 the Internal Revenue Service (IRS) determined that “convertible virtual currency”, such as Bitcoin, will be treated as property. This decision means that purchases using CC’s are subject to capital gain (or loss) and investment tax treatment, with all the associated reporting requirements. Given that there are many retailers who now accept CC’s as payment, this means that the IRS requires everyone to do all this when spending their CC:

- record the amount of coins spent

- allocate the cost basis of the coins spent

- subtract the cost basis of the coins spent from the actual price paid

- report the difference to the IRS, and calculate the capital gain or loss, factoring in the date of when the coins were purchased

This all goes in your annual tax return, and you must pay the taxes owed, or claim the capital loss. All this work is generated by the consumer’s choice of “payment method”. Many analysts and commentators are calling this a prohibitive, crazy, quagmire. Can you imagine the nightmare if you purchased two cups of coffee every day, using Bitcoin as your payment method? You might need an army of accountants.

In the USA there are going to be other problems, as there are four departments that want to treat CC’s in their own special way:

- The Commodity Futures Trading Commission views CC’s as a commodity

- The Securities Exchange Commission (SEC) is treating “some” coins as a security

- The Treasury Department’s Financial Crimes Enforcement Network (FinCEN) has stated that “certain activities involving convertible virtual currency constitute money transmission”

- as shown above, the IRS insists on treating CC’s as property

So here we have four different, inconsistent categories for the same thing, which prompts us to remind you to carefully check what’s happening with the CC tax rules in your jurisdiction. We can’t promise you that it will make sense, or be easy to understand. It is another example of the “wild west” nature of this market space.

Stay Tuned!

Will crypto currency ever be stable?

Investors in crypto currency (CC) are a brave bunch, and are still relatively few in number. CC investor reluctance is based on several fears and misgivings, such as:

- extreme volatility

- unknown or unfavourable tax treatment by governments

- tenuous legality imposed by governments

- complex access to, & use of, brokerages for CC transactions

- complexity & lack of understanding of Blockchain technology

- short history of Blockchain technology & trust in it

We have in past articles discussed some of these issues, however, the extreme volatility issue has never had a proposed solution – until now. A group of famed economists & financial innovators have proposed the creation of “the first non-anonymous blockchain-based digital currency” … named SAGA (SGA). It is being developed by The Saga Foundation, a Swiss non-profit. The advisory board members have some very impressive credentials:

- Jacob Frenkel, former Governor of Bank of Israel, & Chairman, JP Morgan International

- Myron Scholes, economics Nobel laureate

- Dan Galai, co-developer of VIX, the leading measure of market volatility

- Leo Melamed, chairman emeritus of CME & pioneer in financial futures

Think of SAGA as a CC without those things that cause regulators, central bankers, & most people to be nervous – wrenching volatility – an ambiguous notion of value – anonymity. So, how could SAGA possibly work to contain the extremes of CC volatility?

To achieve low volatility & notional value SAGA will use some traditional finance methods, such as fractional reserves & deposit reserves. SGA will be pegged to the IMF’s Special Drawing Right, an international reserve asset that is a basket of currencies, dominated by the $US & the Euro. SGA’s money supply will be adjusted algorithmically, based on the size of its economy, so that when its economy expands a smart contract will increase SGA token supply. There will also be a “price band” that will act as another check on volatility.

SGA holders must complete “know your customer” & anti money laundering documents under Swiss national law, which will eliminate anonymity. This may seem contrary to some initial CC objectives, however, many CC exchanges already have strict customer identification measures, & are under some form of government control. Anonymity is a 2-sided coin, & mainstream investors almost always agree to being identified.

SAGA coin (SGA) sales are predicted to start in quarter 4 of 2018, & can be purchased with ETHER or bank transfers. We will monitor progress on the foundation’s website.

Another coin trying to achieve price stability is TETHER, whose makers claim is fully backed by $US reserves. There is about $2.3 billion worth of TETHER circulating in the CC markets, but it is unknown whether the cash reserves actually exist. TETHER has fired the auditor hired to verify their cash reserves claims, so there is suspicion. And there are other players in the “stable coin” market, such as BASECOIN and DAI Token, both trying algorithm-based methods to gain stability & credibility.

It remains to be seen if traditional financial processes will be successful in stabilizing any part of the CC market space – – we all know that these very same methods have led to crashes, failures, and massive bailouts in the past. Let Crypto Trend be your guide to the winning technology investments in this emerging market sector.

Will crypto become a safe-haven play?

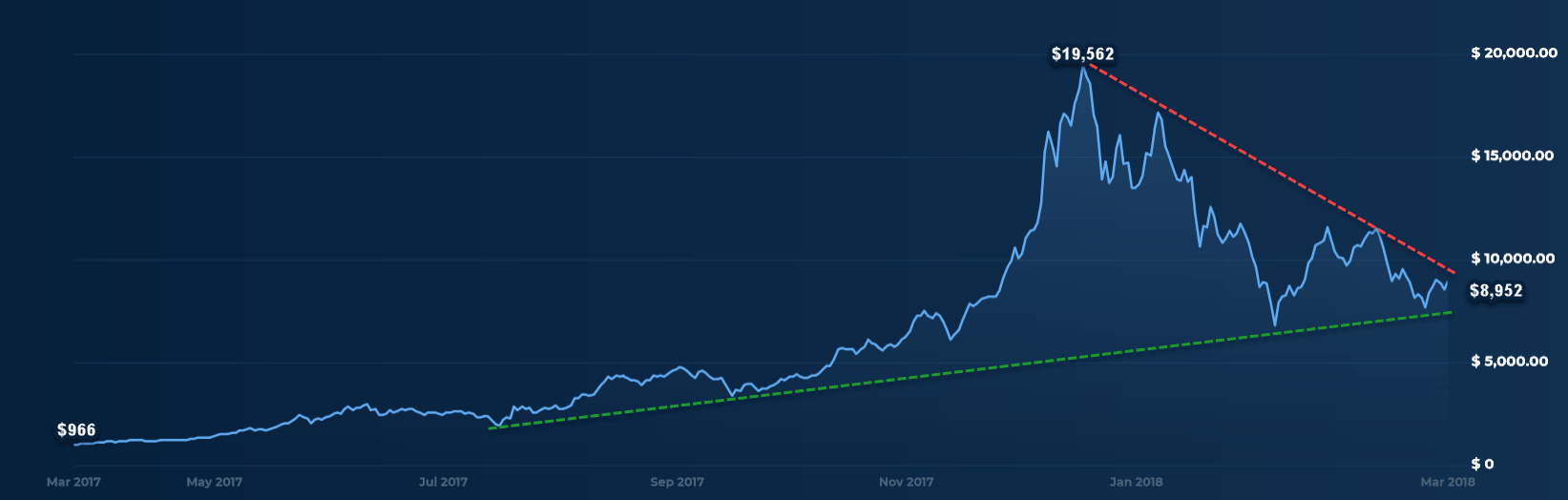

We have labeled the crypto sector as the ‘wild west’ for a good reason, it has displayed an enormous level of volatility. Looking at the following chart of bitcoin, we can see that within the last year we saw bitcoin rise over 1925% from March 2017 to mid-December, then decline 54% from that December high to today’s level at $8.952.

Bitcoin remains volatile today but has been trading in a tighter and tighter wedge pattern in the last two months, where we should get an idea of which direction it will move.

The more conservative equity markets have not been acting well since the highs in later January, with the S&P 500 down over 10% since that high. It’s not just trade war fears either, we also saw the Federal Reserve Bank of Atlanta recently lower its growth forecast from over 5% to under 2%. Also, tensions in the Middle East are heating up. All in all investors have been getting more and more concerned and have been moving their capital out of equities.

On a day where equity markets declined over 2% we saw bitcoin up .50%. It is still very early in the crypto sector, but it will be interesting to see if crypto ultimately becomes a safe-haven play.

Stay tuned!

What is YOUR government going to do about crypto?

Many nations are now actively considering what to do about crypto currencies (CC’s), as they do not want to miss out on tax revenue, and to some degree they think they need to regulate this market space for the sake of consumer protection. Knowing that there are scams and incidences of hacking and thievery, it is commendable that consumer protection is being thought of at these levels. The Securities Exchange Commission (SEC) came into being in the USA for just such a purpose and the SEC has already put some regulations in place for CC Exchanges and transactions. Other nations have similar regulatory bodies and most of them are working away at devising appropriate regulations, and it is likely that the “rules” will be dynamic for a few years, as governments discover what works well and what does not. Some of the benefits of CC’s are that they are NOT controlled by any government or Central Bank, so it could be an interesting tug-of-war for many years to see how much regulation and control will be imposed by governments.

The bigger concern for most governments is the potential for increasing revenue by taxing the profits being generated in the CC market space. The central question being addressed is whether to treat CC’s as an investment or as a currency. Most governments so far lean towards treating CC’s as an investment, like every other commodity where profits are taxed using a Capital Gains model. Some governments view CC’s only as a currency that fluctuates in daily relative value, and they will use taxation rules similar to foreign exchange investments and transactions. It is interesting that Germany has straddled the fence here, deciding that CC’s used directly for purchasing goods or services are not taxable. It seems a bit chaotic and unworkable if all our investment profits could be non-taxable if we used them to directly buy something – say a new car – every so often. Perhaps Germany will fine tune their policy or re-think it as they go along.

It is also more difficult for governments to enforce taxation rules given that there are no consistent global laws requiring CC Exchanges to report CC transactions to government. The global and distributed nature of the CC marketplace makes it almost impossible for any one nation to know about all the transactions of their citizens. Tax evasion already happens, as there are several countries that provide global banking services that are often used as tax havens, sheltering funds from taxation. By there very nature CC’s were born into a realm of scant regulation and control by governments, and that has both upsides and downsides. It will take time for governments to work through all this by trial and error – it is still all new and it is why we tout CC’s and Blockchain technology as “game changers”.

Trend Disruptors Premium

If you are ready to make a speculative investment into these disruptive technologies and want to receive all current and future recommendations from Trend Disruptors Premium, we are keeping our Early Bird Special offer to give our readers the opportunity to get started at a $175 discount, meaning you pay only $525.00. To take advantage of this special offer, click here

Stay tuned!

Acceptance and Volatility – are they related?

Governments and institutions all over the globe are increasingly paying attention to Crypto Currencies (CC’s) and the technology that underpins them all – Blockchain. Some of the attention is negative, but on balance, it is clear that more and more of the attention is positive, supportive, and exploitive. As the business and investment world becomes more aware of having a disruptive force in its midst, it becomes imperative to examine business processes in this new frontier and compare them to the relatively old, slow, and expensive processes they have now. New technologies need new investment capital to grow, and with such growth comes spurts, false starts, and controversy.

Developments in the world of CC’s and Blockchain are coming along fast and furious as governments and institutions make efforts to harness the technology, tax all profits, protect their investments, and protect their constituents and customers – – a complex balancing act that goes a long way in explaining why many seem to be going in different directions, and changing directions frequently. Here are a few of the latest developments that serve to illustrate that CC’s and Blockchain are gradually being accepted into the mainstream, but still grappling with regulation, control, and stability:

- Uzbekistan will publish its plans to regulate Bitcoin in September 2018, with a Blockchain “skill center” set to begin operation in July.

- Kazakhstan has signaled its desire to copy Singapore’s Blockchain permissiveness.

- Belarus has announced it wishes to create a hospitable environment for Blockchain, as an innovative financial transactions technology.

- Venezuela has created the “PETRO”, a CC created to raise cash as Venezuela approaches economic collapse. The hope is that it will be a way around sanctions that prevent Venezuela from raising money in the global bond markets. President Nicolas Maduro claims that the PETRO raised $735 million on its first day, a claim that has not been substantiated. Maduro sees the PETRO as “the perfect kryptonite to defeat SUPERMAN” – his analogy of the US imposed sanctions, thinking that this currency frees his country from the grip of banks and governments. Perhaps he does not see that the PETRO was initiated by a government – his.

- TD Canada Trust has become the first Canadian bank to join with some UK and US banks in banning the use of credit cards to purchase CC’s.

- South Korea is heading towards legalizing Bitcoin, indicating that it will be considering Bitcoin as a liquid asset. Being that South Korea is at the forefront of the CC marketplace, the impact of their decisions will be significant and global. Japan has already taken those steps, making Bitcoin trades more transparent, more regulated, and 100% legal.

- BlackRock, the world’s largest investment company, continues its bullish forecast for CC’s, saying it sees “wider use” in the future.

- Romeo Lacher, chairman of Switzerland’s stock exchange, believes there are a lot of upsides to releasing a crypto version of the Swiss franc, and his organization would be supportive, adding that he “doesn’t like cash.”

- China’s largest online and brick and mortar retailer JD.com has announced the first four startups for its Al Catapult Blockchain incubation program. The Beijing-based program, which has seen candidates from as far afield as Australia and the UK, aims to use the company’s vast Chinese infrastructure to develop new Blockchain and artificial intelligence applications.

With all of the global to and fro activity, it is clear that Blockchain is the disruptive technology of this era, and CC’s are just a facet of the possibilities enabled. Just like the Internet investment explosion of the 90’s, Blockchain and CC’s investments will have winners and losers, however, we do not want this to turn into the huge bubble that burst destructively with many early DOT COM investments in the 90’s. What we do want to see is a well reasoned approach to Blockchain developments and investments. Crypto Trend will serve as your guide in this young market space, providing well reasoned recommendations and appropriate cautions.

Volatility will continue to be the norm in this market space for some time, as we see increasing acceptance, innovation, and regulation. Failures will happen and successes will emerge, driving governments, institutions, investors, and innovators, to continually adjust their processes and their thinking. Volatility is normal and healthy at this stage.

Trend Disruptors Premium

If you are ready to make a speculative investment into these disruptive technologies and want to receive all current and future recommendations from Trend Disruptors Premium, we are keeping our Early Bird Special offer to give our readers the opportunity to get started at a $175 discount, meaning you pay only $525.00. To take advantage of this special offer, click here

Stay tuned!

Can government really shut down crypto currencies?

Crypto Currencies (CC’s) are making inroads into the daily lives of more and more people every week. While China has taken a contrarian stance, trying to curtail Crypto Coin marketplaces, most other countries are finding ways to embrace this market or at least consider positive ways to deal with it. Clearly, most governments around the world do NOT want to miss out on the CC market as a rich source of revenue, so it is surprising that China has chosen to head in an authoritarian direction, perhaps believing that strict controls and prohibitions will be better for them. History has taught us that prohibition does not work, especially when it provides the masses with something they really want – wine, beer, & spirits are still with us – under reasonable control worldwide.

Here is some of the latest evidence that CC’s are rapidly heading towards mainstream status in the investments marketplace:

- Many Daily News shows now include a market recap segment with a full screen on Crypto Currencies, typically right after the Commodities recap screen.

- Arizona, Wyoming, and Colorado are preparing to accept CC’s for tax payments.

- In January, KFC Canada launched a limited time offer of the “Bitcoin Bucket” of chicken – the first major restaurant organization to utilize CC’s.

- Two entrepreneurs in the UK have sold 50 new luxury apartments in Dubai for Bitcoin.

- The Canadian Securities Exchange (CSE) has proposed a new blockchain based system of clearing and settling the purchase and sale of securities, aiming to provide real-time clearing and settlement, with low costs and fewer errors, compared to conventional services.

- Ripple has an agreement with the Saudi Arabian Monetary Authority (SAMA) to support cross-border payment technology with banks in Saudi Arabia, to enable instant settlement of cross-border transactions, lowering barriers to trade and commerce.

- Western Union is testing transactions with the use of RIPPLE’s (XRP) blockchain based settlement system, anticipating faster, cheaper, and more accurate money transfers.

Of course there are some who fear the integration of traditional fiat currency systems with the newly minted virtual currency systems. One of those is Augustin Carstens, general manager of the Bank for International Settlements (BIS) who believes that Bitcoin is a bubble, a Ponzi scheme, a speculative mania, and an environmental disaster. He also believes that CC’s are used a lot for money laundering and other criminal activities. He therefore is recommending strict regulation by all Central Banks, as CC integration could threaten the stability of financial institutions.

We see that we still have a “wild west” range of opinions and views about the CC market space, but we note that there is more and more evidence that the mainstream media and governments at all levels are acknowledging CC’s as a significant part of the financial landscape, a part that cannot be ignored or stifled. We see the trend is toward having CC’s and Blockchain technology company stocks in a well balanced, forward looking investment strategy.

Investing in Blockchain & other new technologies

Even with all the wild swings in the crypto space, our Crypto Trend Premium portfolio is still up an average of 30.82% at the time of this writing. As the sector goes through its growing pains of weeding out the weaker players, just like in the internet boom, most of the of these players will fall by the way side, but in the end some real winners will emerge.

While there is a great deal of volatility in the crypto space, as an investor, you need to understand that the underlying blockchain technology is a disruptive technology that will impact a great many sectors. As highlighted in our February 3rd blog, there are currently over 36 industries that are heavily investing in blockchain technology today.

Remember, disruption doesn’t happen overnight. Blockchain technology is still in its infancy, and a lot of the actual technology has yet to be perfected. Blockchain technology will supplement traditional industries, making them more efficient. We are certain that blockchain will transform the banking industry.

As investors, we believe that as blockchain, 5G, and other new disruptive technologies mature, solid long-term gains will be realized for those who are bold enough to be early participants. We have evaluated dozens of blockchain and new tech companies and have a short-list that we are ready to pull the trigger on as soon as we see more stability in the general markets.

Thanks to the very timely warnings of both The Trend Letter and Trend Technical Trader for a global equity market pullback and/or correction, we have held off issuing any new recommendations until we get a BUY Signal for the general market, which could come anytime in the next few weeks.

If you are ready to make a speculative investment into these disruptive technologies and want to receive all current and future recommendations from Crypto TREND Premium, we are keeping our Early Bird Special offer to give our readers the opportunity to get started at a $175 discount, meaning you pay only $525.00. To take advantage of this special offer, click here

Stay tuned!

Visa says you can buy almost anything, except crypto currencies

The news this week is that several banks in the USA and the UK have banned the use of credit cards to purchase crypto currencies (CC’s). The stated reasons are impossible to believe – like trying to curtail money laundering, gambling, and protecting the retail investor from excessive risk. Interestingly, the banks will allow debit card purchases, making it clear that the only risks being protected are their own.

With a credit card you can gamble at a casino, buy guns, drugs, alcohol, pornography, everything and anything you desire, but some banks and credit card companies want to prohibit you from using their facilities to purchase crypto currencies? There must be some believable reasons, and they are NOT the reasons stated.

One thing that banks are afraid of is how difficult it would be to confiscate CC holdings when the credit card holder defaults on payment. It would be much more difficult than re-possessing a house or a car. A crypto wallet’s private keys can be put on a memory stick or a piece of paper and easily removed from the country, with little or no trace of its whereabouts. There can be a high value in some crypto wallets, and the credit card debt may never be repaid, leading to a declaration of bankruptcy and a significant loss for the bank. The wallet still contains the crypto currency, and the owner can later access the private keys and use a local CC Exchange in a foreign country to convert and pocket the money. A nefarious scenario indeed.

We are certainly not advocating this kind of unlawful behavior, but the banks are aware of the possibility and some of them want to shut it down. This can’t happen with debit cards as the banks are never out-of-pocket – the money comes out of your account immediately, and only if there is enough of your money there to start with. We struggle to find any honesty in the bank’s story about curtailing gambling and risk taking. It’s interesting that Canadian banks are not jumping on this bandwagon, perhaps realizing that the stated reasons for doing so are bogus. The fallout from these actions is that investors and consumers are now aware that credit card companies and banks really do have the ability to restrict what you can purchase with their credit card. This is not how they advertise their cards, and it is likely a surprise to most users, who are quite used to deciding for themselves what they will purchase, especially from CC Exchanges and all the other merchants who have established Merchant Agreements with these banks. The Exchanges have done nothing wrong – neither have you – but fear and greed in the banking industry is causing strange things to happen. This further illustrates the degree to which the banking industry feels threatened by Crypto Currencies.

At this point there is little cooperation, trust, or understanding between the fiat money world and the CC world. The CC world has no central controlling body where regulations can be implemented across the board, and that leaves each country around the world trying to figure out what to do. China has decided to ban CC’s, Singapore and Japan embrace them, and many other countries are still scratching their heads. What they have in common is that they want to collect taxes on CC investment profits. This is not too unlike the early days of digital music, with the internet facilitating the unfettered proliferation and distribution of unlicensed music. Digital music licensing schemes were eventually developed and accepted, as listeners were ok with paying a little something for their music, rather than endless pirating, and the music industry (artists, producers, record companies) were ok with reasonable licensing fees rather than nothing. Can there be compromise in the future of fiat and digital currencies? As people around the world get more fed up with outrageous bank profits and bank overreach into their lives, there is hope that consumers will be regarded with respect and not be forever saddled with high costs and unwarranted restrictions.

Crypto Currencies and Blockchain technology increase the pressure around the globe to make a reasonable compromise happen – – this is a game changer.

Crypto Trend Premium

If you are ready to make a speculative investment into these disruptive technologies and want to receive all current and future recommendations from Crypto TREND Premium, we are keeping our Early Bird Special offer to give our readers the opportunity to get started at a $175 discount, meaning you pay only $525.00. To take advantage of this special offer, click here.

Stay tuned!

36 major industries heavily investing in blockchain

For 2018, the markets started off in a mostly positive direction, and have now started heading in reverse. A correction is overdue, as discussed in recent editions of The Trend Letter. The Dow plunged over 665 points, posting the steepest weekly decline in over two years. As mainstream markets decline, investors immediately start re-assessing their risk tolerance, and Crypto Currency (CC) investors are re-assessing risk even more, given all the discussion about how volatile this market space can be. It is not the usual mainstream economic drivers causing the CC plunge – it is fear, which is wildly contagious across all investment categories. Markets are largely driven by human fear and greed, two emotions that cause most investors to be unsuccessful over the long term. Cold hard analysis, coupled with “smart” Buy/Sell strategies, removes emotion from your investment decisions and paves the way to success. Strong bull markets need to correct once in a while, to restore balance and set the stage for the next run up.

CC Exchanges can be significantly less nimble than the mainstream stock market exchanges; however, there are several CC Exchanges that accommodate BUY and SELL LIMIT orders. Using those facilities as part of an “Entrance and Exit” strategy is highly recommended.

The news in the CC markets throughout January was mainly focused on the declining prices of almost all the coins. CC price declines preceded the overall stock market decline and are a reaction to more and more national governments indicating that they want to either ban CC’s, or increase their means to control and tax them. With all the fear that is now being generated in the mainstream stock markets, this is a perfect storm wherein CC investors have multiple sources generating fear.

Welcome to the world of cryptos, where you can make a fortune in months, and see things crash even faster. Clearly, investing anything more than a small portion of your portfolio in cryptos is a risky proposition. But if you believe, as we do, that the concepts behind Bitcoin and other cryptos, specifically the blockchain distributed database – are sound, then it makes sense to invest in cryptos, and especially indirectly in the blockchain infrastructure that supports Crypto Currencies, a technology that is expanding into many other sectors.

Today, there are over 36 major industries heavily investing in blockchain technology to revolutionize their industry, by cutting or eliminating costs, and dramatically improving efficiency and transparency. We are talking about a wide spectrum of industries including:

- banking

- law enforcement

- messaging apps and ride hailing

- IoT (internet of things)

- cloud storage

- stock trading

- insurance

- healthcare

- elections

- global forecasting

- retail

- supply chain management

- gift cards and loyalty programs

- government and public records

- charity

- credit history

- wills and inheritances

- and many other industries

We believe that we have years of incredible change ahead of us before this market finally settles on a standard. Yes, we will see many cryptos come and go, but much like Amazon, Apple, Google, and Facebook, there will be a few giant winners.

Let Trend Disruptors be your guide to understanding and successfully investing in this new, exciting, and game changing technology.

Trend Disruptors Premium

Subscribers to Trend Disruptors Premium will soon see new recommendations in their inbox to capitalize on the blockchain technology, as well as the revolutionary 5G mobile network technology. We have held off on these new recommendations as we have adhered to The Trend Letter & Trend Technical Trader warnings of a global equity market pullback and/or correction. We have seen the Dow drop 4% this week, and the S&P 500 lose 3.8%, the worst declines in 2-years, so that caution was well warranted.

These recommendations will use BUY Stops, similar to those used in both The Trend Letter & Trend Technical Trader, so when you receive these recommendations, do not purchase these stocks until the stocks reach those BUY Stops.

If you are ready to make a speculative investment into these disruptive technologies and want to receive all current and future recommendations from Trend Disruptors Premium, we are keeping our Early Bird Special offer to give our readers the opportunity to get started at a $175 discount, meaning you pay only $525.00. To take advantage of this special offer, click here.

Stay tuned!

5G – the new era for mobile

As stated in our last update, we are increasing our scope to include discussion of new technologies, and those companies that benefit directly and indirectly from them. We will cover blockchain projects, and other projects and companies that are involved with today’s game changing technologies.

One of those game changers is 5G – the 5th generation of mobile communication networks, and it looks to be revolutionary. More than all previous network upgrades, 5G will take us to a completely NEW era in mobile technology. New phones will be needed in order to use 5G, and here’s what’s in store:

- more data and higher download speeds – 100 times faster than 4G

- reliance on cloud storage, reducing the need for and use of internal memory

- pervasive connectivity, to access the cloud from everywhere

- latency improvements resulting in 30x the responsiveness of 4G, reducing the need for memory buffers (RAM).

Given that hardware memory needs are reduced significantly, the pricing model for 5G phones could change from being based on hardware memory needs, to being based on cloud memory needs. The speed improvements alone should tempt us dramatically, and may lead to everyone buying new 5G phones.

We note that several companies are poised to benefit from new technologies like blockchain and 5G, as they are providers and developers of the enabling hardware, software, and firmware. There is even more technology expansion on the horizon, and we will be zeroing in on the companies that are in the best positions to harness all this activity and innovation, generating potential great returns for investors. We will include discussion of more emerging and expanding technologies in future editions of Crypto Trend.

Let Crypto Trend be your guide to successful investing in today’s world, where the speed of change continues to accelerate, being made possible by new and exciting technologies.

Crypto update

Another wild day in the world of crypto currencies as Coincheck, one of Japan’s largest crypto currency exchanges, was hacked and had 526 million of the crypto currency XEM ($400 m) stolen, Lon Wong, President of the NEM.io Foundation stated.

“As far as NEM is concerned, tech is intact. We are not forking. Also, we would advise all exchanges to make use of our multi-signature smart contract which is among the best in the landscape. Coincheck didn’t use them and that’s why they could have been hacked. They were very relaxed with their security measures,” Wong said.

Coincheck is looking into compensating its customers, its executives announced.

Just a note that even with all this volatility, the average return for our 5 recommendations is still 62% at the time of this writing.

As we have constantly stated, the crypto currencies are very volatile, and although they can produce massive gains, many of them may be worthless in the years ahead, much like most internet start-ups no longer exist today.

What today’s story highlights is that not all exchanges are the same, and if they do not use all the tools that blockchain provides, they are vulnerable to these kinds of attacks.

It is why we believe it is the underlying blockchain infrastructure and applications that will give subscribers to Crypto Trend Premium the best long-term gains. Our team is actively analyzing dozens of companies, looking to identify the ones that we believe could be real winners in this game changing technology. Announcements of new recommendations will be sent out to subscribers soon.

If you are ready to make a speculative investment into these disruptive technologies, and want to receive all current and future recommendations from Crypto TREND Premium, we are keeping our Early Bird Special offer open for a little longer, to give our readers the opportunity to get started at a $175 discount, meaning you pay only $525.00 . To take advantage of this special offer, click here.

Stay tuned!

Crypto update – January 24/18

Last week’s volatility is more proof that the crypto currency (CC) markets are indeed the “wild west” … or the “wild east”. This volatile week was mainly a reaction to government statements and actions. Both China and South Korea have been pondering what to do about crypto currencies for a while and last week began issuing statements that clearly indicate that they are concerned. It doesn’t seem to matter if the government is democratic or socialist, they all want to control the money, in order to levy taxes, control markets, and stay in power.

Crypto currencies are resistant to manipulation, so China has now banned CC trading and South Korea is moving to implement strict regulations and implement proper taxation. The CC markets reacted to these government activities by moving sharply downward. Up until recently, South Korea and China were home to some of the largest CC exchanges in the world, and this is now changing, as many exchanges are relocating offshore. Many clients simply use the internet to continue doing business with these same exchanges, now located offshore, but China goes even further by piling on additional internet restrictions that block access to the offshore exchanges.

From the outset, we have cautioned readers about extreme volatility in this market, while acknowledging the other side of the crypto coin – – very real opportunities to generate extreme profits. Crypto Trend is your guide to avoid the pitfalls and zero in on the winners, remembering that all markets are volatile to a degree. With the CC market, the degree is high, but downturns are inevitable in every market, and even “healthy” – – like a forest fire, that on first blush looks to be all devastation, but in reality provides some crucial benefits, like removing dead and decaying vegetation, stimulating new growth, and triggering some plants to release seeds. The CC marketplace is frenzied, and we have seen moves in this market that are extraordinary, with projects initiated that have no long-term future, yet they generate market values in the millions of dollars. This is the kind of market where a guide is essential in order not to invest in deadwood projects. This is also the kind of market where a good fire once in a while serves to rid us of the deadwood. With a competent guide, frenzy is set aside, and useful, actionable assessments and research are provided, leading to understanding, confidence, and investment success. There is no need to just throw a few frenzied darts at the wall – let Crypto Trend be your guide.

Crypto Trend Premium

The volatile week had a negative impact on our portfolio, but we are still on average, up 61% for our 5 recommendations to date.

We are increasing the scope of Crypto Trend & Crypto Trend Premium to include technology companies that may not be directly involved in blockchain projects, but are positioned indirectly to benefit from the blockchain technology. In addition, we will include companies that are positioned to profit from other game changing technologies such as 5G, which will revolutionize mobile communications.

We are currently evaluating a number of companies and hope to have more recommendations out to subscribers soon.

If you are ready to make a speculative investment into these disruptive technologies, and want to receive all current and future recommendations from Crypto TREND Premium, we are keeping our Early Bird Special offer open for a little longer, to give our readers the opportunity to get started at a $175 discount, meaning you pay only $525.00 . To take advantage of this special offer, click here.

Stay tuned!

Crypto Update – January 19/18

A question that many readers ask is “why do we need or want crypto currency – isn’t there already enough currencies in the world?“

Understanding some of the benefits of crypto currency (CC) in a world of fiat currency helps us to see why developers came up with it in the first place, and keep coming up with more and better CC’s. Let’s start with some of the problems with fiat currencies:

A. Governments can print as much fiat currency as they want, and throughout history there are many examples of currencies that have been inflated to death. There are two reasons this cannot be done with crypto currencies …

1. there is an upper limit on the amount of each coin that can ever be made. With Bitcoin this upper limit is set at 21 million – no inflation possible here.

2. governments do not control the issue of crypto currencies.

B. Fiat currency transactions are all centralized, and we all have to trust that our bank teller, our cheque clearing house, our currency broker etc, will do their job honestly and fairly, and at a reasonable cost. There are several examples where this trust has been violated, and thus, the desire for something better was created.

Here is an illustrative example of a clear violation of consumer trust. Wells Fargo, a banking giant in the USA, created about 3.5 million ghost accounts so that they could charge customers for services they did not ask for or need. The unwary customers who did not notice the unwanted extra accounts would continue to pay the fees, trusting that their bank was taking good care of them. It was later discovered that Wells Fargo was also signing up customers for unwanted insurance policies and again charging customers for services they did not ask for. This is fraud on a large scale, and here is what was learned … We Cannot Trust the “Trusted” Intermediaries.

We also see that financial institutions have been making record profits for a long time, levying transaction fees that generate large profits. It’s not hard to see the need for a new technology to enable secure, reliable, cheap, and transparent transactions without the potential for manipulation and rip-offs by governments and large financial institutions. All of this is what blockchain technology can bring to the realm of financial transactions.

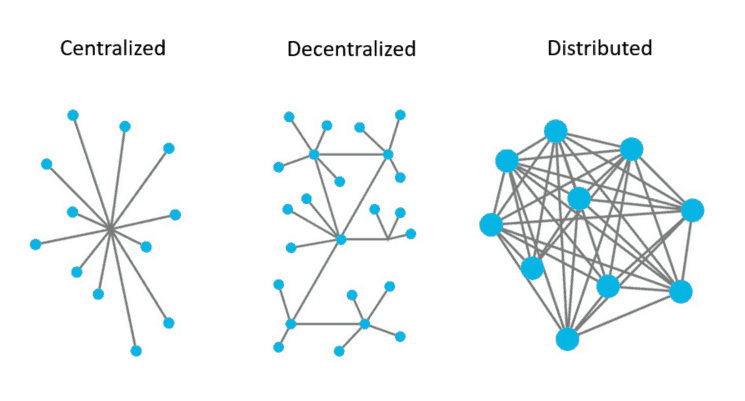

The key difference is that current systems are “centralized”, whereas blockchain is “distributed”. What really matters is that “trust” is 100% transparent in the distributed model. Blockchain technology is based on a distributed ledger (a distributed database). It is distributed in the sense that there are complete copies of the whole database scattered all around the world.

In today’s world, almost all financial institutions, companies, governments, and individuals keep their records in a centralized database, usually with a centralized back-up of that one database. You only get to see the parts of that data that concern you, and you must trust that “privacy policies” are strong and that data integrity standards are high. These centralized databases can be manipulated, records can be altered, hard drives can fail, data can be lost, and the records represent only one party’s view of any given transaction.

In the world of blockchain (distributed ledger technology), the opposite is true. The transactions recorded on the ledger represent a transaction that takes place between the parties involved, and is confirmed by the blockchain network via a consensus. This is “trust” on a LARGE scale. Once a transaction is written to the ledger, it is immutable – it cannot be changed. The details of each transaction are visible to everyone, but the identification of the individual parties is protected by the use of private keys. Private Key owners can identify their own transactions in the ledger, but cannot determine the identity of the parties in any other transaction. The conceptual diagram below shows the difference between a centralized, a decentralized, and a distributed network.

Vive le difference !!

It wasn’t long ago that the LIBOR scandal uncovered that many of the most “trusted” financial institutions in the world were manipulating interest rates for their own benefit. Banks like Barclays, Deutsche Bank, JPMorgan Chase, UBS, Citigroup, Bank of America, and the Royal Bank of Scotland were found to be right in the middle of these manipulations. The corruption and violations of trust are seemingly endless. Blockchain to the rescue !!

Crypto crash!

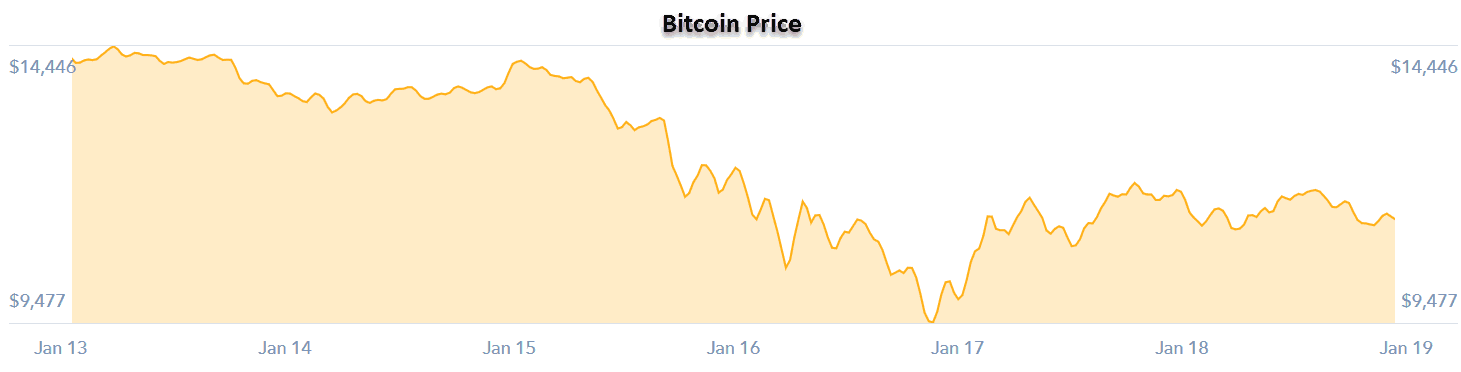

We have called the crypto sector the “wild west” and this past week was another great example of the volatility in this space. We saw how governments are paranoid about crypto currencies, as both China and South Korea expressed plans to clamp down, or even ban crypto currency trading.

The South Korean government officials warned that crypto currencies encourage illicit behavior, such as money laundering, tax evasion, and gambling. It also stated that it needed to protect these investors from losing their money.

South Korea is one of the largest crypto currency traders alongside the US and Japan, and the news of a ban set off panic in the South Korean crypto markets. As we can see, the bitcoin price dropped from $14,444 to $9,477 before recovering some of the losses and trading at $11,275 at the time of this writing.

But it turns out South Korea is still evaluating the situation and has not made a decision. It is expected to deliver a decision sometime next week.

The threat of a ban has caused quite an uproar from the masses. As of today, an online petition on the website of the presidential Blue House had drawn more than 221,000 signatures opposing the move. Heavy internet traffic briefly crashed the site.

While we welcome a proper regulated oversight, we are not of the belief that politicians and bureaucrats are better qualified to tell the people what they can or cannot do with their hard earned money.

This “wild west” show is going to remain volatile for quite a while. For those who do wish to invest in crypto currencies, this volatility just gave them another opportunity to get in at much lower prices.

If you are ready to make a speculative investment into this disruptive technology, and want to receive all current and future recommendations from Crypto TREND Premium, we are keeping our Early Bird Special offer open for a little longer, to give our readers the opportunity to get started at a $175 discount. To take advantage of this special offer, click here.

Stay tuned!