October 24/18

Stocks:

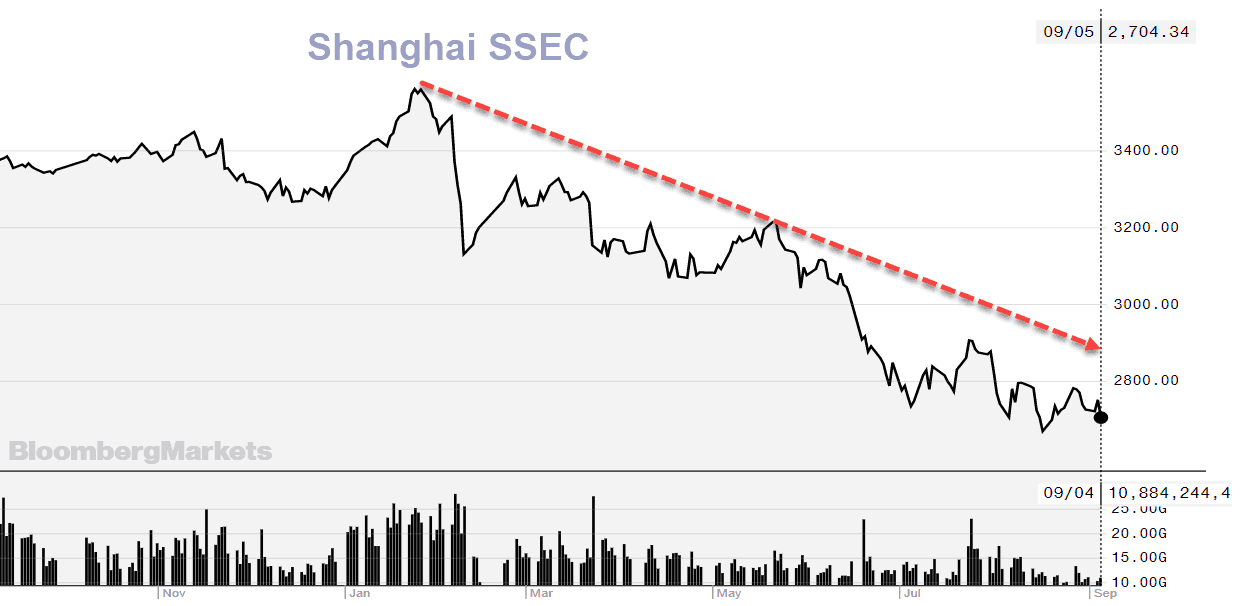

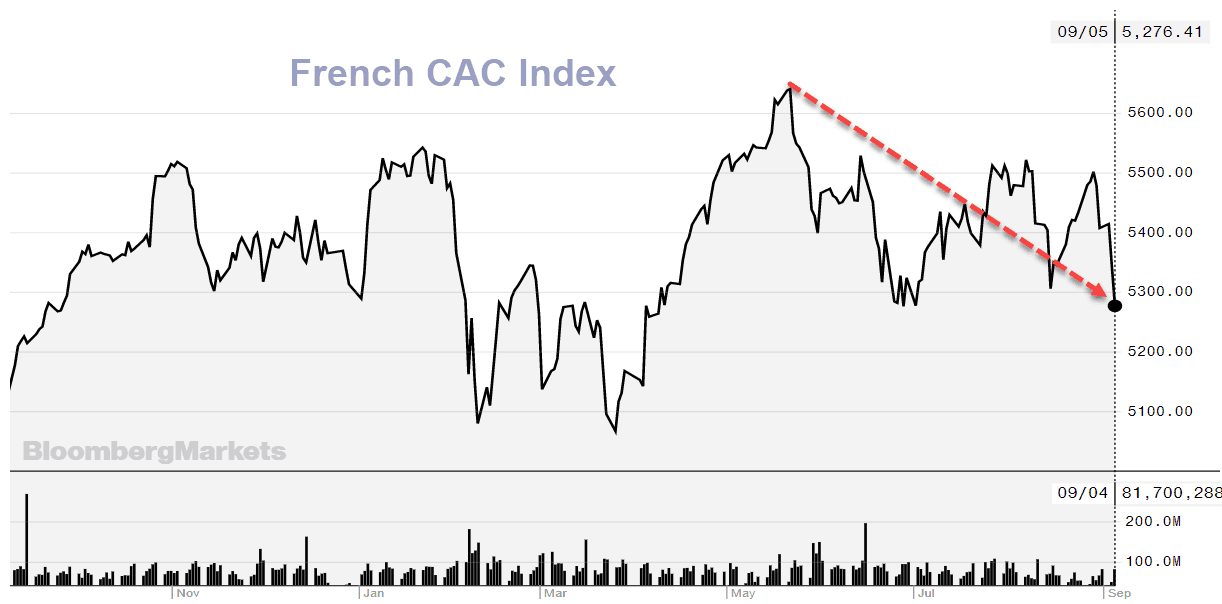

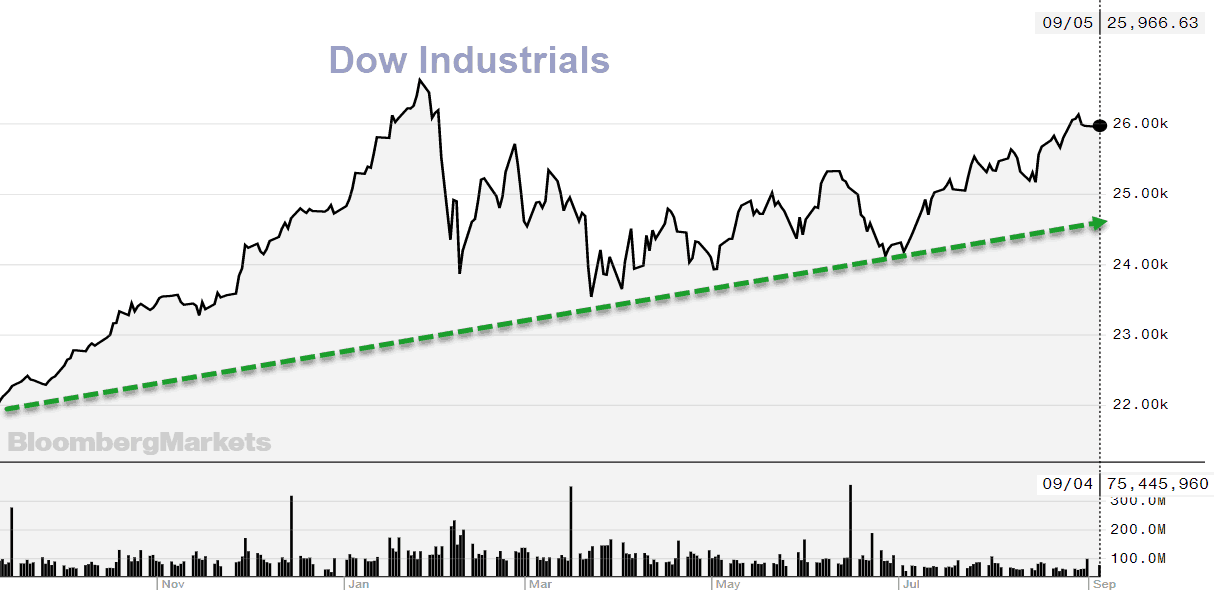

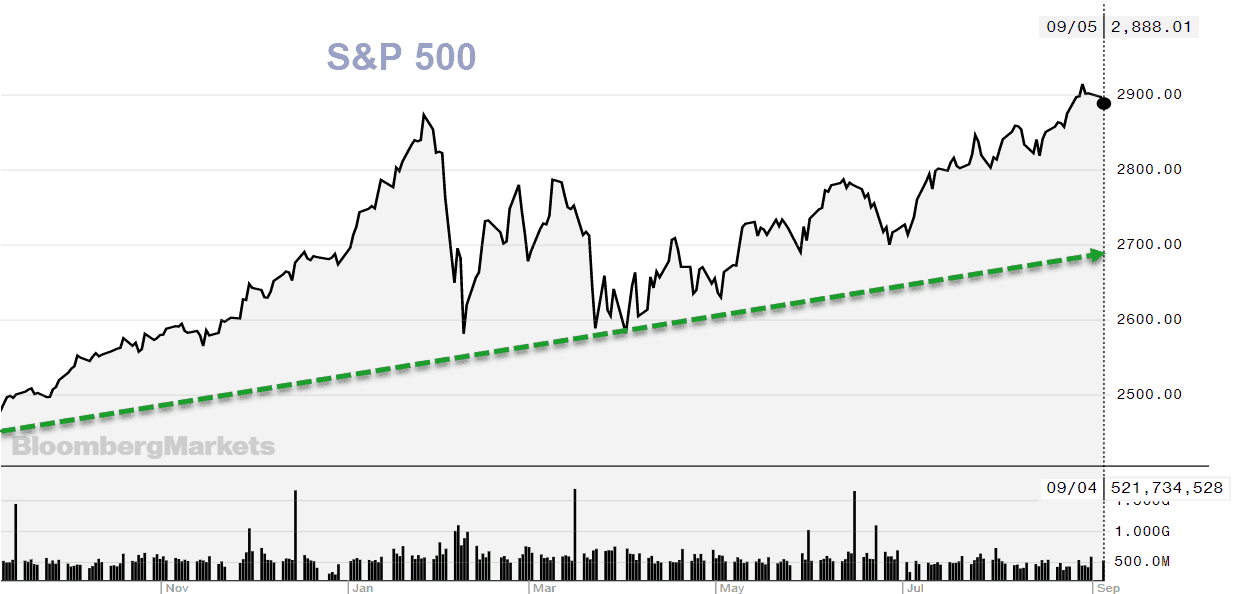

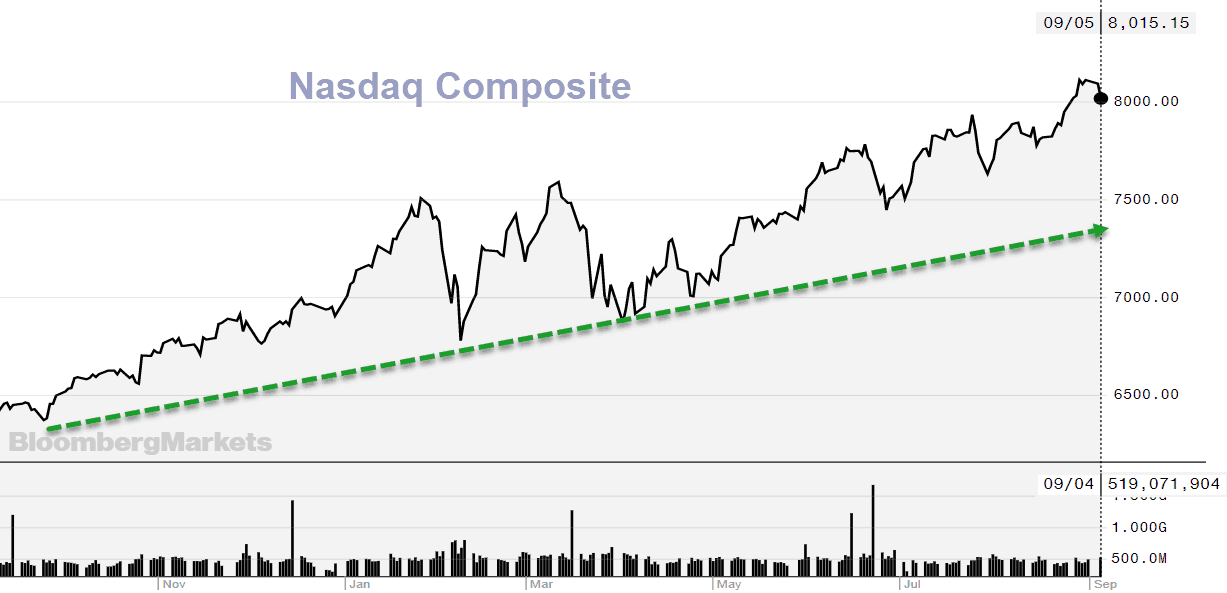

Today stocks fell sharply lower as losses accelerated into the close, which put both the Dow and the S&P 500 into the red for the year, and the Nasdaq into correction territory (10% decline). The S&P dropped whopping 84.59 points or 3.09%.

There are lots of news items driving this decline, but we believe that politics is now moving front and centre. It is already ugly, but this US election is going to be very destructive. We live in Canada and have no vote in the US election. Our role is to help investors understand what is happening in the global economic environment and to help subscribers protect and grow their wealth.

What we do know is that whatever your opinion of Trump the person, his policies of lower taxes and reduced regulations have been very good for US businesses, and they have been key drivers for this bull market. The market right now is very concerned that if the Democrats win the election, these tax breaks and reduced regulations will be rolled back, hurting the profitability of these companies, so they are selling off.

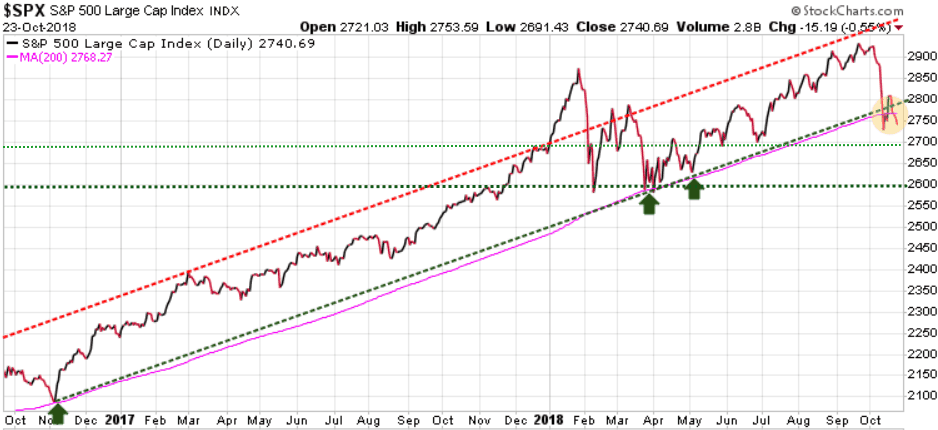

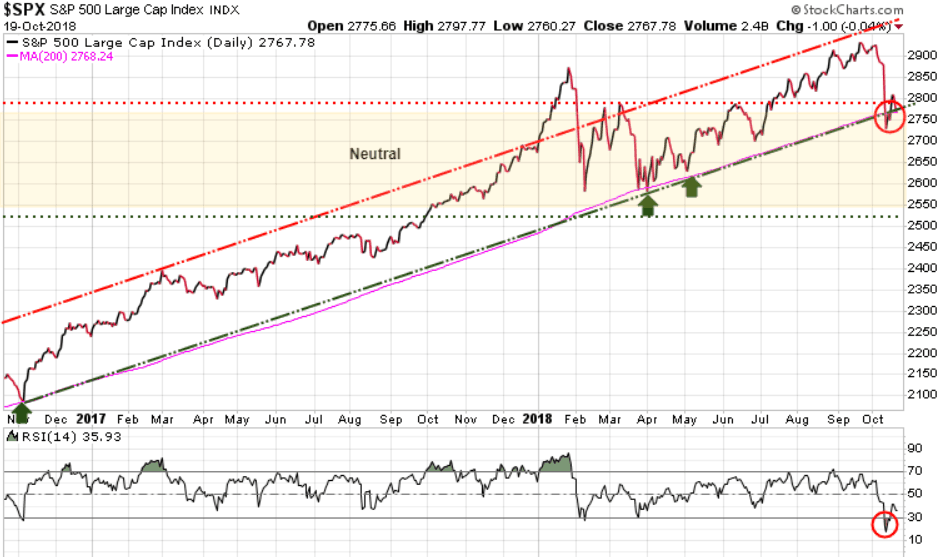

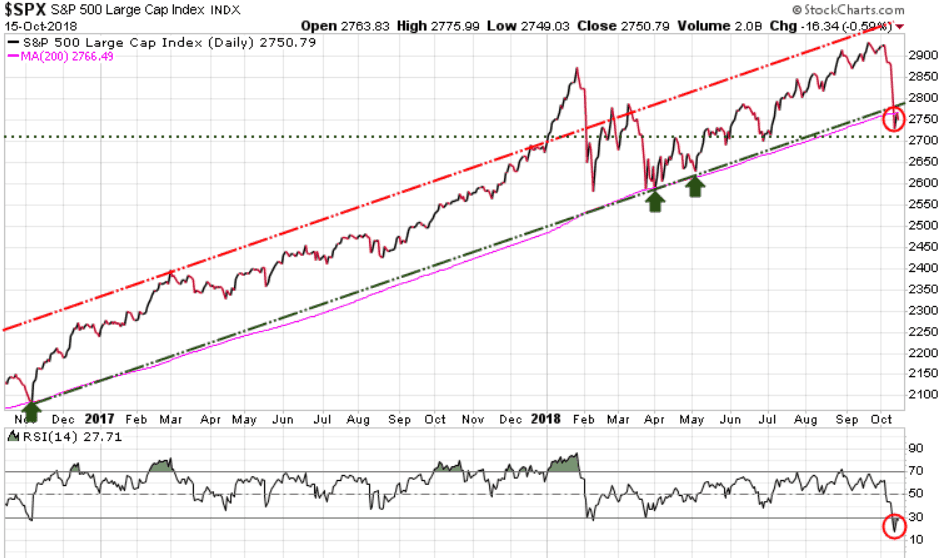

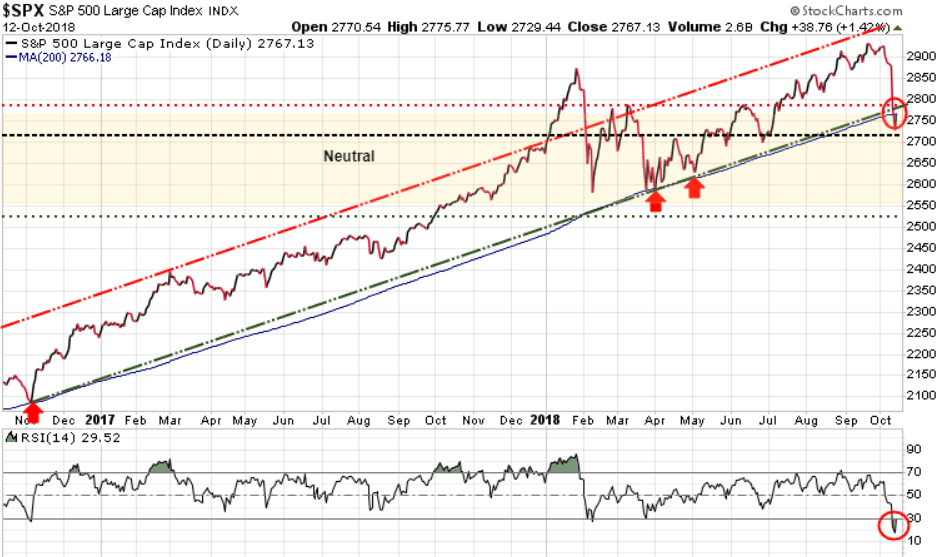

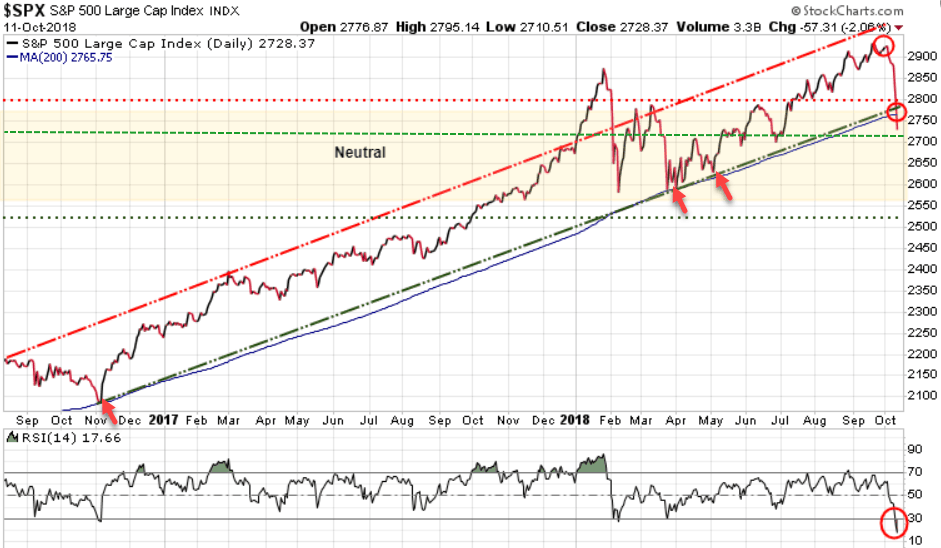

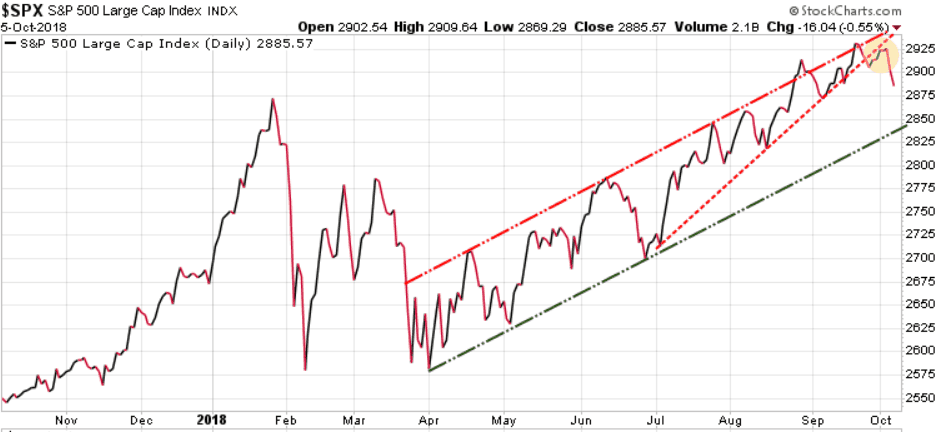

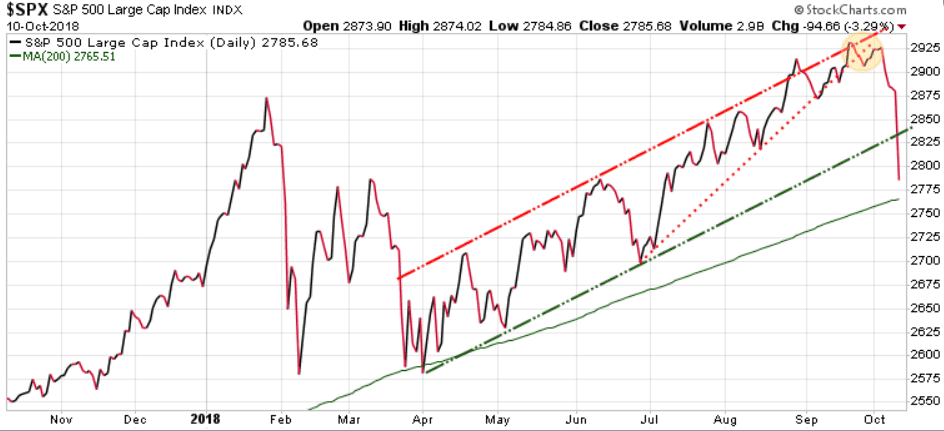

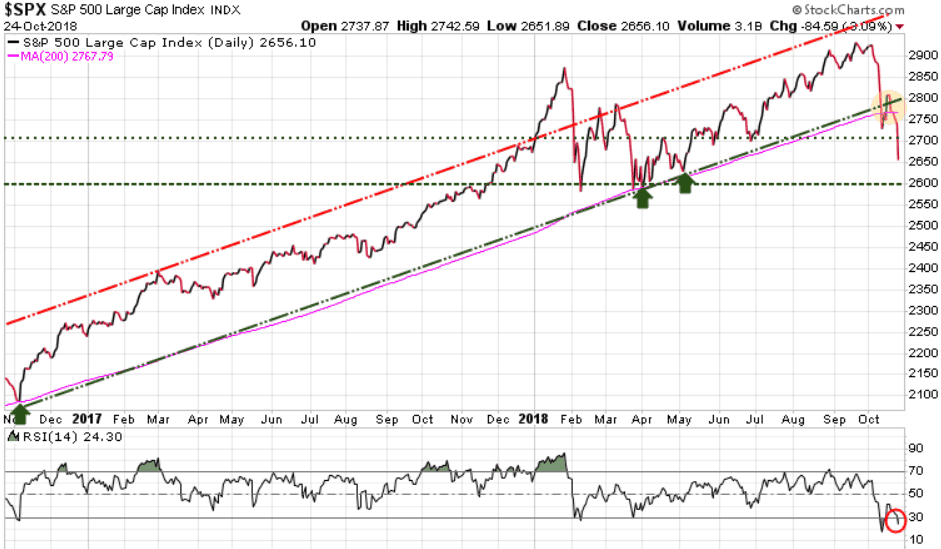

On a technical basis the S&P closed 111 points below its 200-day MA (pink line), which clearly bearish. It has also fallen definitively below its 2-year uptrend channel, also bearish.

Our next key support level is the late March low at 2600. Our yearly forecast target low for the S&P had a potential for 2535, then 2470. Both of these will become valid if we break the 2600 level.

Looking at the bottom of the following chart we can see that the Relative Strength Index (RSI) has dropped to 24.30 (red circle), and whenever we see a reading below 30, it is considered oversold. This does not guarantee a rally here, but it does set up for at least a bounce soon.

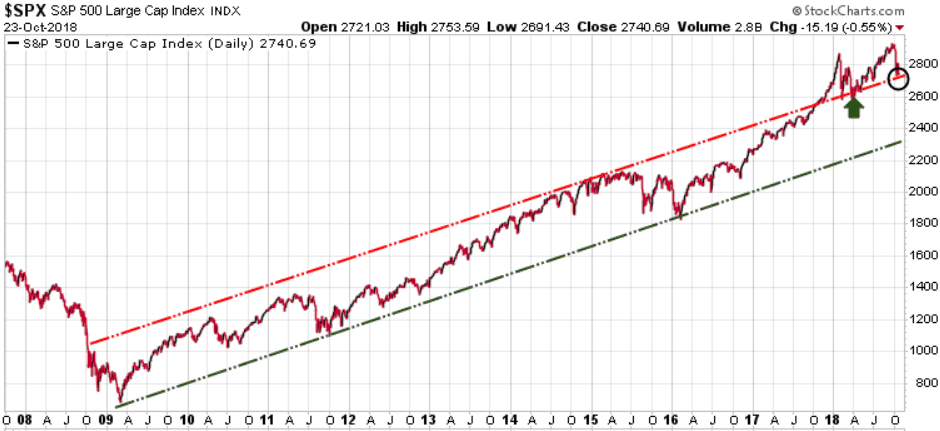

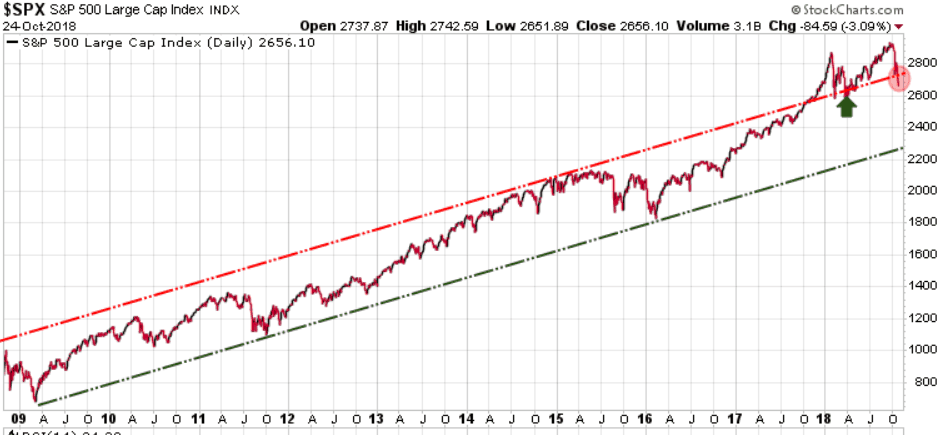

Looking at the bigger picture we see that the S&P has been trading above its 9+ year uptrend channel, although it has now fallen below the upper level of that channel. All this action is bearish, suggesting that the S&P will very possibility test the 2600 level. Given that markets decline much faster than they rise, we could see this support level hit this week, although the RSI suggests we see a bounce very soon.

Understand that this is still a long-term bull market and that corrections are to be expected along the way. This bull market has been so strong over the past two years it appears some investors forget that corrections can be a healthy part of the process, they provide buying opportunities. We will see if this is simply a healthy correction or if it is the start of a new bear market. Everyone has an opinion, we will simply watch the numbers.

Long-term trend is bullish

Immediate trend is bearish

Our current position is neutral

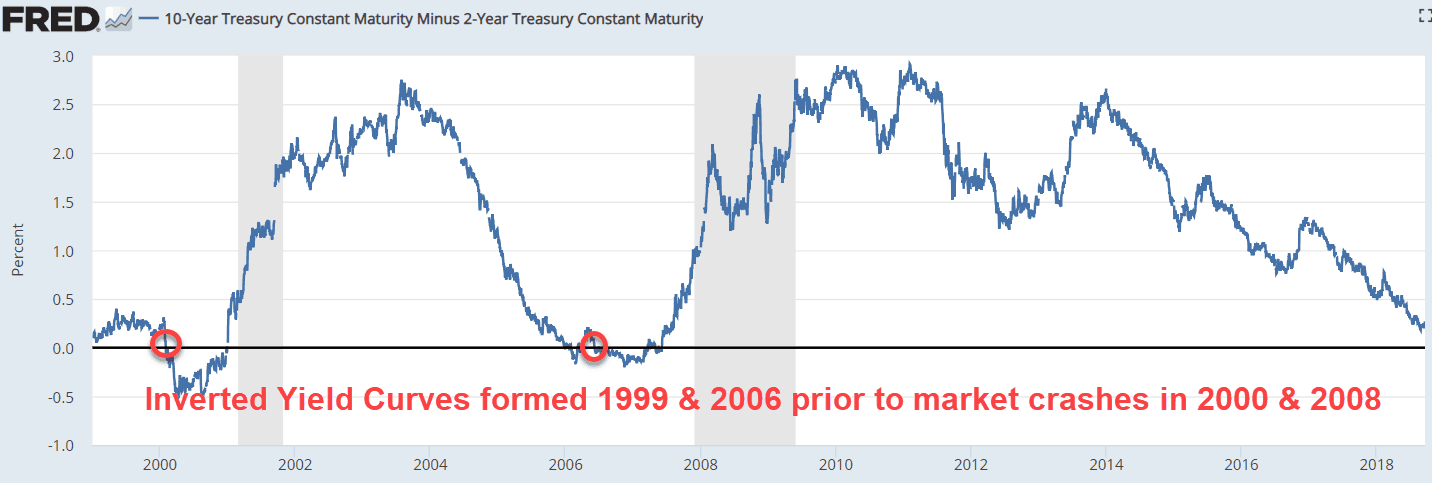

Again we note: Whether you believe that this market is going to run much higher, or believe that we are now heading for a big crash, you need to have an exit or hedging strategy. This bull market will end, whether it starts today, next month, next year, or 2-years from now. Every investor needs to have a strategy to protect your wealth against a serious downside move that is accompanied by recessions.

While we are currently neutral with offsetting long and short positions, our Trend Technical Trader (TTT) hedging service has a number of more aggressive short trades and those trades have gains of 21.16% (entered Sept.5/18), 52.77% (entered Sept 2/18), 45.52% (entered Oct 4/18), and 41.81% (entered Oct 4/18). All of these trades are simple click of the mouse actions, the same as trading any stock online. If you would like to subscribe to TTT, we are extending our Special Offer at $399.95, a $250 discount. Click Here to subscribe at this rate. It’s your money – take control!

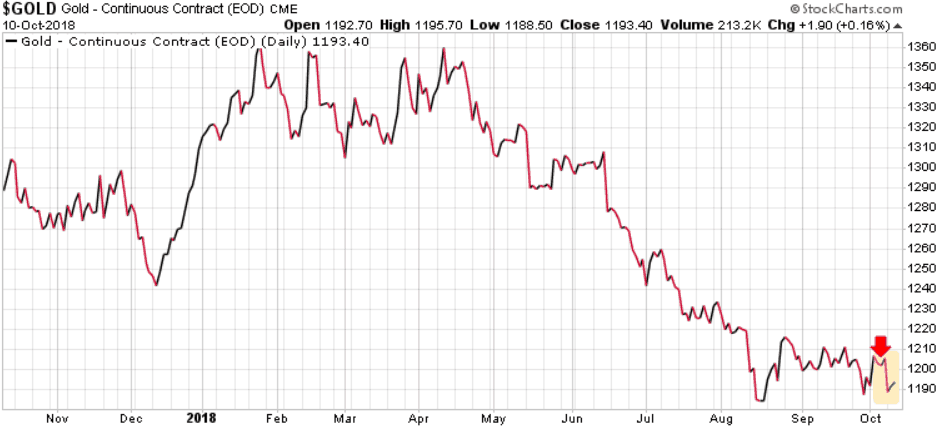

Gold:

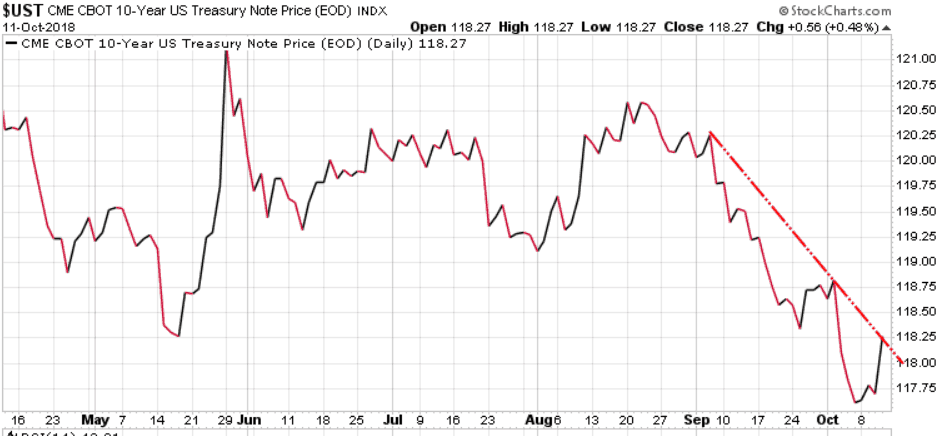

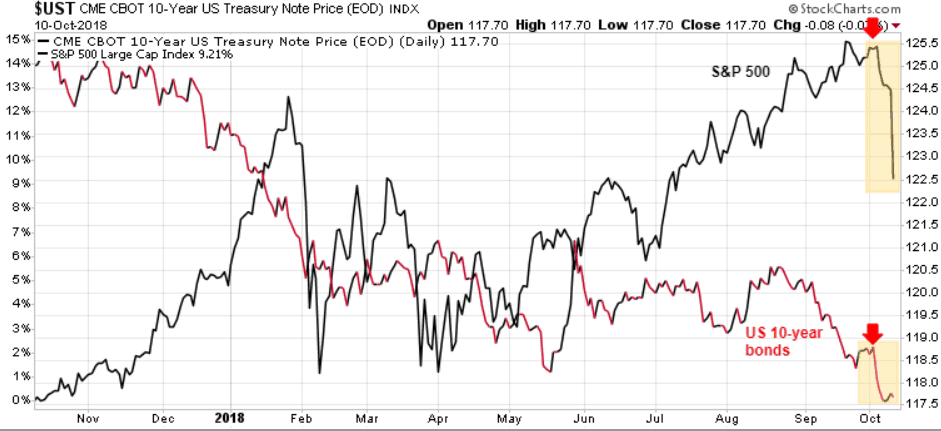

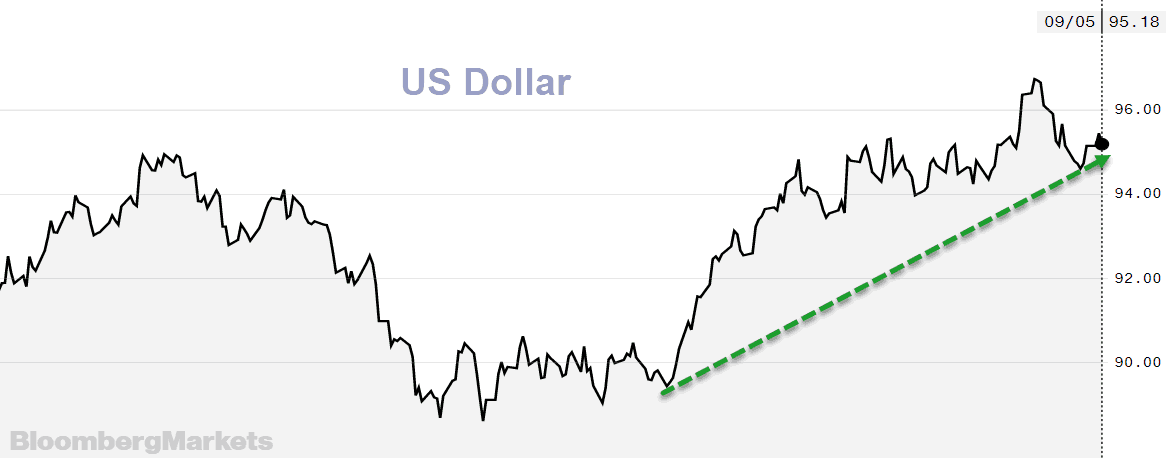

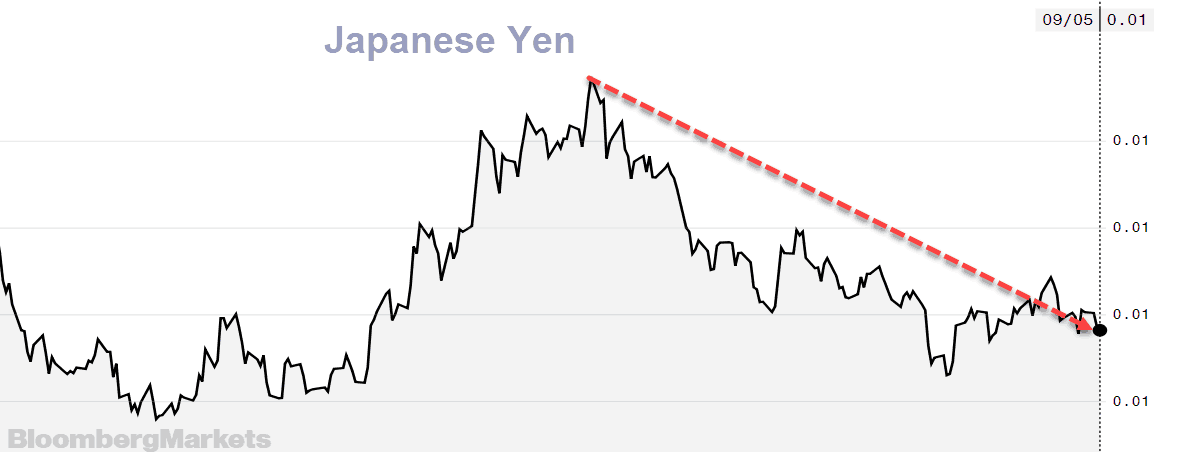

Gold was a big disappointment today, down 5.70, as it failed as a safe-haven play against a crashing equity market. The safe-haven winners today were US bonds, the US dollar, and to a lesser degree, the Japanese Yen.

Immediate trend is bullish

Long-term trend is bearish

Our current position is a buy

Stay tuned!