Trend Letter Updates

Today’s charts – December 2/21

From MarketWatch… Stocks finished higher for the first time in three sessions but for some bulls the downtrend may feel longer, amid a slide characterized at times by stomach-churning swings and white-knuckle climbs higher. Investors have been on edge because the omicron-inspired jitters have resulted in some erosion of upward trend lines for the main […]

Todays charts – November 30/21

(From CNN)… Stocks dropped on Tuesday as volatility resumed after a brief rebound earlier this week, with investors contemplating the impacts of a new coronavirus variant and new comments Federal Reserve Chair Jerome Powell. The S&P 500, Dow and Nasdaq declined. The S&P 500 dropped about 88 points, or 1.90% on Tuesday. US crude oil […]

Today’s charts

The discovery of a new coronavirus variant named Omicron triggered global alarm on Friday as countries rushed to suspend travel from southern Africa and traders are waiting to hear from health experts to determine if new government restrictions will come into play. Later in the day, the US banned all travelers from South Africa, Botswana, […]

Market Notes – October 18/21

The S&P 500 and Nasdaq ended higher on Monday, rising for a fourth straight day to add to gains after the S&P 500’s best week since July. Investors weighed concerns over elevated inflation against hopes that more companies will follow the lead of the big banks last week and post strong quarterly earnings results. The moves […]

Market update – September 28/21

Concerns over rising Treasury yields and sparring among Washington lawmakers over the debt ceiling and government funding weighed heavily on equities. The Nasdaq Tech index closed out Tuesday’s regular session lower by 2.8%, posting its biggest drop since March. The S&P 500 and Dow also fell sharply. The decline in technology stocks came as Treasury […]

Today’s Charts – September 20/21

Stocks slid Monday, with major indices tumbling by over 2% during the worst points of the afternoon session and the S&P 500 down 123 points at one point. Investors nervously eyed the potential ripple effects of the default of a major Chinese real estate company, as well as ongoing debates over the debt limit in […]

Today’s Charts – September 16/21

The latest set of US economic data out Thursday painted a more upbeat than anticipated picture of the US consumer. August retail sales posted a surprise increase as consumers turned back towards goods spending amid the latest wave of the Delta variant. And while weekly new jobless claims rose in the Labor Department’s latest report, […]

Market Notes – September 15/21

Wall Street ended in the green following a few wobbles in the morning. The economic data of the day was in line or better than expected, but other than that there wasn’t much in the way of catalysts for investors to get excited about. After a small sell-off to start the month, the S&P 500 […]

Money Talks Special Offers

Martin was the featured guest on Mike Campbell’s Money Talks on Saturday and offered their listeners some special offers. These offers are detailed below. Money Talks Special Offers. Note $100 from every new subscription goes the Special Olympics Trend Letter: Since start-up in 2002 Trend Letter has provided investors with a great track record, giving exceptionally accurate […]

Money Talks Charts

Martin was the guest on the Money Talks podcast on Saturday, and in the interview he gave their listeners two ‘off the grid’ stock picks. Below are the notes along with some charts from that interview. Some of the charts were updated on 09/05/21. If you wish to hear the interview click here. It starts […]

Market Notes – Aug 31/21

Wall Street’s main indexes hovered near record highs on Tuesday despite weakness in technology stocks, with the S&P 500 heading for a seventh straight month of gains as fears ebbed over near-term policy tightening by the Federal Reserve. The S&P 500 was down slightly for the day, but had a solid month in August, which […]

Market update July 19/21

Rising concerns about inflation and the resurgence of COVID-19 infections hammered Wall Street on Monday, with major benchmarks suffering their worst declines since May, even as quarterly earnings continue to reflect a strengthening economic rebound. Fears about broadly rising coronavirus cases drove the Nasdaq and S&P 500 to their biggest drop in nearly two months, […]

Market update – July 7/21

The S&P 500 index set another new record high today. Trading volume has exploded since the pandemic lockdowns and government handouts, and the explosion on volumes is being driven by retail investors. Note the rise in 2020, and then already in 2021, with only half the year in the books, volume is on pace to […]

Today’s charts

China crackdown and rising $US hit commodities The prices of commodities were falling sharply on Thursday, cutting into months of gains and weighing on equity markets, as China takes steps to cool off rising prices and the U.S. dollar strengthens. The decline in commodities was widespread, with futures prices for palladium and platinum falling more than 11% and 7%, […]

Market Update – June 16/21

The US Federal Reserve officials signaled that the pace of the U.S. economic recovery from the pandemic is bringing forward their expectations for how quickly they will reduce policy support. Chair Jerome Powell told a press conference Wednesday that officials had begun a discussion about scaling back bond purchases after releasing forecasts that show they […]

Market Update – May 19/21

Stocks US stocks closed mixed and Treasury yields rose as minutes showed Federal Reserve officials were cautiously optimistic about the US recovery at their April meeting, with some signaling they’d be open ‘at some point’ to discussing scaling back the central bank’s massive bond purchases. The S&P 500 fell for a third day, and 10-year […]

Headlines – May 14/21

Civil War in Israel? Read story People are panic buying houses as prices skyrocket around the world. Read story Fully vaccinated? You can ditch the mask, CDC says. Read story CN Rail is close to US$33B deal with K.C. Southern. Read story Greyhound Canada is permanently shutting down, ending almost a century of bus service. […]

Market Update – May 13/21

For the past couple of months, we have been highlighting how we do not have confirmation from all markets as to what direction they are heading. In particular, we want to look at the different action in the Dow Jones Industrial Average (blue chip stocks), and the Nasdaq (tech stocks). The Dow is testing its […]

Market Update – 05/12/21

The markets had a lot to contend with today. Inflation in April accelerated at its fastest pace in more than 12 years as the US economic recovery kicked into gear and energy prices jumped higher, the Labor Department reported Wednesday. The Consumer Price Index, which measures a basket of goods as well as energy and […]

Headlines – May 12/21

Investors spooked as consumer prices rise 4.2% in April. Read story Pipeline shutdown, panic-buying, force 1,000+ gas stations to run out of fuel. Read story Loonie hits highest level since 2015 amid commodity strength. Read story Line 5 shutdown will disrupt Canada’s energy security, Ottawa says, as Michigan threatens Enbridge if it defies order. Read […]

Trend Technical Trader Subscriber Only Updates

Nothing Found

Sorry, no posts matched your criteria

Trend Disruptors Updates

Coinbase to support ERC20 tokens – what it means

On March 26, Coinbase, the world’s largest crypto currency (CC) exchange, announced that they intend to support ERC20 based tokens. This announcement generated some excitement, both for technical aspects and investment prospects. Here is what COINBASE said:

“We’re excited to announce our intention to support the Ethereum ERC20 technical standard for Coinbase in the coming months. This paves the way for supporting ERC20 assets across Coinbase products in the future, though we aren’t announcing support for any specific assets or features at this time.”

Briefly, ERC20 is a technical standard used for Ethereum smart contracts, and ERC20 tokens have become a popular way for development teams to quickly build interoperable contracts/assets. An ERC20 token is one that is built to operate on top of the Ethereum blockchain, and there are hundreds of these tokens in existence. Which ones will ultimately succeed and make it on to the COINBASE exchange is a matter of speculation, however, by examining known parameters we can sharpen up the speculation quite a bit. Here are some of the known indicators:

- Coinbase has about 13 million users, making it the largest in the world, and it is clear that Coinbase believes in the Ethereum network

- Future tokens coming on to Coinbase will likely be ERC20, based on Ethereum, and this would increase market liquidity, creating a more stable environment for investors.

- Digital tokens historically increase in value when they get listed on Coinbase

- Coinbase has developed a framework for the kinds of tokens it will allow on its exchange, and the requirements include – decentralized network – open source code – be innovative and solve a problem – a working alpha or beta product – a good reputation and problem response rate – a clear road map – high market capitalization – quickly convertible to another asset.

Given all that, are there any current tokens that meet all the requirements? There are only a few that come close, loosely fitting these requirements, and there are none that meet 100% of these requirements. By carefully analyzing ERC20 tokens and owning the best of them before they hit Coinbase could easily lead to a tidy profit.

6 new recommendations for Trend Disruptors Premium subscribers

For Trend Disruptors Premium subscribers, check your inbox, as we have identified three ERC20 coins that we see as tokens with good prospects for a Coinbase listing. Note, that email will also have three technical stocks that we feel will benefit greatly from what we believe will be a generational change in wireless technology. That totals six new recommendations.

If you are not a subscriber to Crypto Trend Premium but are now ready to make a speculative investment into these disruptive technologies and want to receive all current and future recommendations from Trend Disrupotrs Premium, we are keeping our Early Bird Special offer to give our readers the opportunity to get started at a $175 discount, meaning you pay only $525.00. To take advantage of this special offer, click here

Stay Tuned!

As technology advances at a feverish pace, safety products are required

One of the many goals when crypto currency (CC) was first invented was to establish a secure digital system of transaction. The technology used was Blockchain, and still is. Blockchain systems were designed to be impervious to problems often found with online financial systems using older technology – – problems such as account hacking, counterfeit payment authentications, and web site phishing scams.

Blockchain itself runs on peer-to-peer global record-keeping networks (distributed ledgers) that are secure, cheap, and reliable. Transaction records all around the world are stored on blockchain networks, and because these records are spread out over the whole community of users, the data is inherently resistant to modification. No single piece of data can be altered without the alteration of all other blocks in the network, which would require the collusion of the majority of the entire network – – millions of watchdogs. BUT – what if a website looks like it is providing you a gateway to a legitimate crypto coin exchange or crypto wallet product, but is really a website designed to trick you into divulging information? You don’t have the security of Blockchain at all – you just have another phishing scam, and there is a need to be protected from all this.

MetaCert is a private company that says it is dedicated to keeping internet users safe, and its main security product can be used to protect enterprises from a range of malicious threats, and now they have a product designed to keep CC enthusiasts safe. This new product is called “Cryptonite” and it is designed to be installed as a browser add-on. Current browsers rely on SSL certificates that show users a small padlock in the browser address bar. Users have been told for years that SSL Certificates assure you that a website is authentic – not so fast – phishing sites use SSL Certificates too, so users can be fooled into thinking a website is legitimate when it is not. Once added to your web browser Cryptonite will show a shield next to the address bar. This shield will turn from black to green if a website is deemed to be “safe”. MetaCert says they have the world’s most advanced threat intelligence system with the world’s largest databases of classified URL’s for security.

Staying safe is always a good thing, but more safety products may be needed in future as technology marches forward, at an ever increasing pace. On the horizon is Quantum Computing (QC), which is showing great promise. QC is touted by many to be one of the biggest technological revolutions of the modern era. By harnessing the power of quantum mechanics, QC machines will be able to take on much more complex tasks, and to achieve speeds previously unattainable. Traditional computers are based on a binary model, using a system of switches that can be either on or off, represented with a 1 or a 0. QC’s are different in that their switches can be in both the on and off positions at the same time, which are called ‘superpositions.’ This ability to be in two simultaneous states is what makes QC’s so much faster. Google announced over two years ago that the quantum prototype they possess was 100 million times faster than any other computer in their lab. The development of this technology is pushing ahead at an increasingly fast rate. The first marketed quantum computer was produced in 2011 by the California based company D-Wave. D-Wave’s machine was equipped with a processor that contained 16 quantum computing units, called QUBITS. Since then, industry leaders like IBM and Microsoft have announced their own quantum programs.This trend will lead to an exponential scaling up of the number of QUBITS these new machines can handle over the next several years. While quantum computing holds the potential for significant advancements in many spheres, and for providing innovative solutions to some of the most complex problems, it will surely generate a need for improved security, as these machines will also have the power to assist hackers with their dastardly deeds. Protection and security will always be needed in the crypto currency space, same as with all other on-line spaces.

At Trend Disruptors, we will keep you up to date with new technologies, and investment strategies that lead to success.

Stay Tuned!

The key is to get in early

Clearly, the crypto world is still in its initial stages of development and adoption. The role of Trend Disruptors is to provide impartial information, so investors can better weigh the dangers and the future potential of this very volatile sector, one that we have labelled the “wild west.’ If you’re willing to accept the risks, you can look forward to serious profit opportunities.

Crypto currencies hold great promise for the future. They can revolutionize money, infusing discipline into monetary policy. Unfortunately, the crypto space also has a dark side. It suffers from loose standards, questionable operators, excessive hype, and occasional market crashes. Also, buying the actual crypto currencies can be a cumbersome process, and as noted below, governments are now stepping in, trying to figure out how they can take a chunk of that action as taxes, fees, or some yet to be created method of taking your money from you.

If buying the actual CCs is not your cup of tea, understand that over the next few years we expect that the majority of the recommendations in the Trend Disruptors Premium service will come from blockchain, and other technological advances that will change the way we do business, much the same way that the internet has revolutionized our lives.

Times change, technologies evolve. Ten years ago there were no mobile apps, or data clouds. Today we have robots, which are changing the way people do business, in everything from manufacturing to drones. In China, face-detecting systems can now authorize payments, provide access to facilities, and track the movements of every single person in a smart city. Soon we will be passengers in driverless buses and cars.

We will also see cloud-based AI services, which will make artificial intelligence tools available to a wide range of businesses. And even “Dueling Neural Networks”, a breakthrough in artificial intelligence that allows AI to create images of things it has never seen, giving AI a sense of imagination.

There will be some serious privacy, security, and other issues that will need to be addressed as we step into the next evolution of technology advances, but as an investor, each of these advancements gives you the opportunity to make massive gains. The key is to get in early with the right companies, in the right technological trend.

Be clear here, while some of the stocks we will be recommending in Trend Disruptors Premium will be known leaders in their field, other stocks will be unknown and unproven technology stocks that are not on the radar of the masses.

Many of these companies you’ve never heard of will be household names in just a few years.

If you would like to join us, as we ride the wave of the next technological trends, we have re-opened our Special Offer where you can subscribe to Trend Disruptors Premium and save $175 and pay only $525. Click here to take advantage of this offer.

————————————————————————

It’s tax time – are you ready for CC craziness?

Crypto currency (CC) investors have a lot to think about with the tax implications of buying and selling crypto coins. Many governments are still deliberating about how to get in on the action – in the form of taxation. They know there is big money at stake, and they know they are going broke, so they sure don’t want to miss out. There seems to be no simple answer that all governments can agree on. Should CC’s be treated as currency, as a commodity, as a security, as property, or some combination thereof?

For example, here is what’s happening in the USA. In 2014 the Internal Revenue Service (IRS) determined that “convertible virtual currency”, such as Bitcoin, will be treated as property. This decision means that purchases using CC’s are subject to capital gain (or loss) and investment tax treatment, with all the associated reporting requirements. Given that there are many retailers who now accept CC’s as payment, this means that the IRS requires everyone to do all this when spending their CC:

- record the amount of coins spent

- allocate the cost basis of the coins spent

- subtract the cost basis of the coins spent from the actual price paid

- report the difference to the IRS, and calculate the capital gain or loss, factoring in the date of when the coins were purchased

This all goes in your annual tax return, and you must pay the taxes owed, or claim the capital loss. All this work is generated by the consumer’s choice of “payment method”. Many analysts and commentators are calling this a prohibitive, crazy, quagmire. Can you imagine the nightmare if you purchased two cups of coffee every day, using Bitcoin as your payment method? You might need an army of accountants.

In the USA there are going to be other problems, as there are four departments that want to treat CC’s in their own special way:

- The Commodity Futures Trading Commission views CC’s as a commodity

- The Securities Exchange Commission (SEC) is treating “some” coins as a security

- The Treasury Department’s Financial Crimes Enforcement Network (FinCEN) has stated that “certain activities involving convertible virtual currency constitute money transmission”

- as shown above, the IRS insists on treating CC’s as property

So here we have four different, inconsistent categories for the same thing, which prompts us to remind you to carefully check what’s happening with the CC tax rules in your jurisdiction. We can’t promise you that it will make sense, or be easy to understand. It is another example of the “wild west” nature of this market space.

Stay Tuned!

Will crypto currency ever be stable?

Investors in crypto currency (CC) are a brave bunch, and are still relatively few in number. CC investor reluctance is based on several fears and misgivings, such as:

- extreme volatility

- unknown or unfavourable tax treatment by governments

- tenuous legality imposed by governments

- complex access to, & use of, brokerages for CC transactions

- complexity & lack of understanding of Blockchain technology

- short history of Blockchain technology & trust in it

We have in past articles discussed some of these issues, however, the extreme volatility issue has never had a proposed solution – until now. A group of famed economists & financial innovators have proposed the creation of “the first non-anonymous blockchain-based digital currency” … named SAGA (SGA). It is being developed by The Saga Foundation, a Swiss non-profit. The advisory board members have some very impressive credentials:

- Jacob Frenkel, former Governor of Bank of Israel, & Chairman, JP Morgan International

- Myron Scholes, economics Nobel laureate

- Dan Galai, co-developer of VIX, the leading measure of market volatility

- Leo Melamed, chairman emeritus of CME & pioneer in financial futures

Think of SAGA as a CC without those things that cause regulators, central bankers, & most people to be nervous – wrenching volatility – an ambiguous notion of value – anonymity. So, how could SAGA possibly work to contain the extremes of CC volatility?

To achieve low volatility & notional value SAGA will use some traditional finance methods, such as fractional reserves & deposit reserves. SGA will be pegged to the IMF’s Special Drawing Right, an international reserve asset that is a basket of currencies, dominated by the $US & the Euro. SGA’s money supply will be adjusted algorithmically, based on the size of its economy, so that when its economy expands a smart contract will increase SGA token supply. There will also be a “price band” that will act as another check on volatility.

SGA holders must complete “know your customer” & anti money laundering documents under Swiss national law, which will eliminate anonymity. This may seem contrary to some initial CC objectives, however, many CC exchanges already have strict customer identification measures, & are under some form of government control. Anonymity is a 2-sided coin, & mainstream investors almost always agree to being identified.

SAGA coin (SGA) sales are predicted to start in quarter 4 of 2018, & can be purchased with ETHER or bank transfers. We will monitor progress on the foundation’s website.

Another coin trying to achieve price stability is TETHER, whose makers claim is fully backed by $US reserves. There is about $2.3 billion worth of TETHER circulating in the CC markets, but it is unknown whether the cash reserves actually exist. TETHER has fired the auditor hired to verify their cash reserves claims, so there is suspicion. And there are other players in the “stable coin” market, such as BASECOIN and DAI Token, both trying algorithm-based methods to gain stability & credibility.

It remains to be seen if traditional financial processes will be successful in stabilizing any part of the CC market space – – we all know that these very same methods have led to crashes, failures, and massive bailouts in the past. Let Crypto Trend be your guide to the winning technology investments in this emerging market sector.

Will crypto become a safe-haven play?

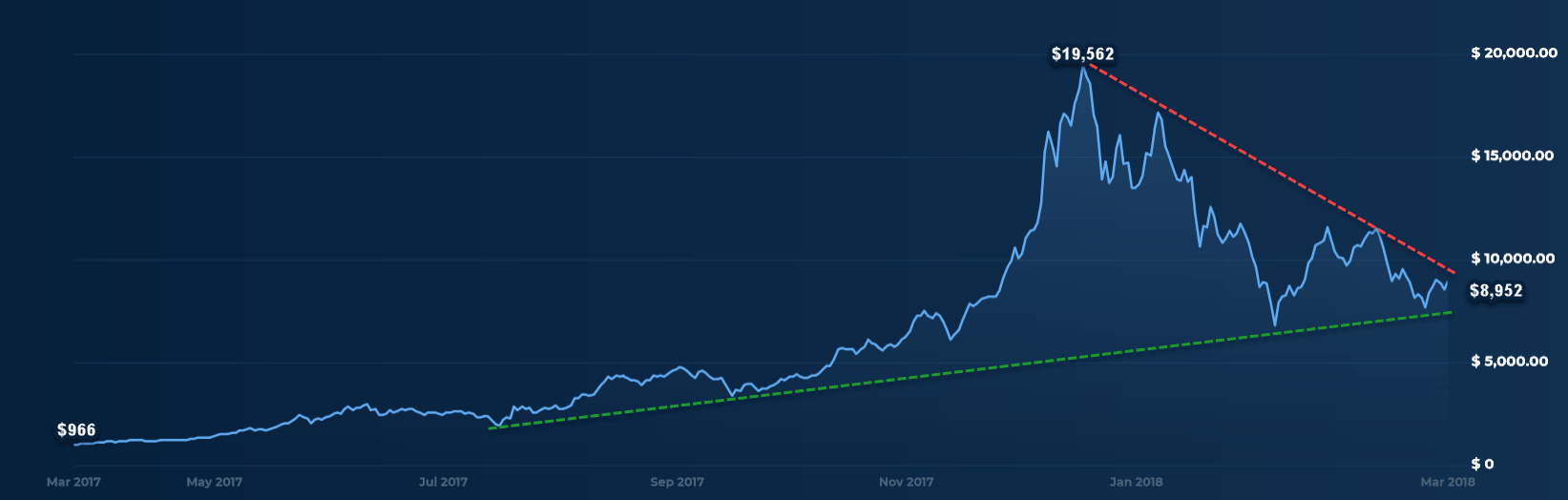

We have labeled the crypto sector as the ‘wild west’ for a good reason, it has displayed an enormous level of volatility. Looking at the following chart of bitcoin, we can see that within the last year we saw bitcoin rise over 1925% from March 2017 to mid-December, then decline 54% from that December high to today’s level at $8.952.

Bitcoin remains volatile today but has been trading in a tighter and tighter wedge pattern in the last two months, where we should get an idea of which direction it will move.

The more conservative equity markets have not been acting well since the highs in later January, with the S&P 500 down over 10% since that high. It’s not just trade war fears either, we also saw the Federal Reserve Bank of Atlanta recently lower its growth forecast from over 5% to under 2%. Also, tensions in the Middle East are heating up. All in all investors have been getting more and more concerned and have been moving their capital out of equities.

On a day where equity markets declined over 2% we saw bitcoin up .50%. It is still very early in the crypto sector, but it will be interesting to see if crypto ultimately becomes a safe-haven play.

Stay tuned!

What is YOUR government going to do about crypto?

Many nations are now actively considering what to do about crypto currencies (CC’s), as they do not want to miss out on tax revenue, and to some degree they think they need to regulate this market space for the sake of consumer protection. Knowing that there are scams and incidences of hacking and thievery, it is commendable that consumer protection is being thought of at these levels. The Securities Exchange Commission (SEC) came into being in the USA for just such a purpose and the SEC has already put some regulations in place for CC Exchanges and transactions. Other nations have similar regulatory bodies and most of them are working away at devising appropriate regulations, and it is likely that the “rules” will be dynamic for a few years, as governments discover what works well and what does not. Some of the benefits of CC’s are that they are NOT controlled by any government or Central Bank, so it could be an interesting tug-of-war for many years to see how much regulation and control will be imposed by governments.

The bigger concern for most governments is the potential for increasing revenue by taxing the profits being generated in the CC market space. The central question being addressed is whether to treat CC’s as an investment or as a currency. Most governments so far lean towards treating CC’s as an investment, like every other commodity where profits are taxed using a Capital Gains model. Some governments view CC’s only as a currency that fluctuates in daily relative value, and they will use taxation rules similar to foreign exchange investments and transactions. It is interesting that Germany has straddled the fence here, deciding that CC’s used directly for purchasing goods or services are not taxable. It seems a bit chaotic and unworkable if all our investment profits could be non-taxable if we used them to directly buy something – say a new car – every so often. Perhaps Germany will fine tune their policy or re-think it as they go along.

It is also more difficult for governments to enforce taxation rules given that there are no consistent global laws requiring CC Exchanges to report CC transactions to government. The global and distributed nature of the CC marketplace makes it almost impossible for any one nation to know about all the transactions of their citizens. Tax evasion already happens, as there are several countries that provide global banking services that are often used as tax havens, sheltering funds from taxation. By there very nature CC’s were born into a realm of scant regulation and control by governments, and that has both upsides and downsides. It will take time for governments to work through all this by trial and error – it is still all new and it is why we tout CC’s and Blockchain technology as “game changers”.

Trend Disruptors Premium

If you are ready to make a speculative investment into these disruptive technologies and want to receive all current and future recommendations from Trend Disruptors Premium, we are keeping our Early Bird Special offer to give our readers the opportunity to get started at a $175 discount, meaning you pay only $525.00. To take advantage of this special offer, click here

Stay tuned!

Acceptance and Volatility – are they related?

Governments and institutions all over the globe are increasingly paying attention to Crypto Currencies (CC’s) and the technology that underpins them all – Blockchain. Some of the attention is negative, but on balance, it is clear that more and more of the attention is positive, supportive, and exploitive. As the business and investment world becomes more aware of having a disruptive force in its midst, it becomes imperative to examine business processes in this new frontier and compare them to the relatively old, slow, and expensive processes they have now. New technologies need new investment capital to grow, and with such growth comes spurts, false starts, and controversy.

Developments in the world of CC’s and Blockchain are coming along fast and furious as governments and institutions make efforts to harness the technology, tax all profits, protect their investments, and protect their constituents and customers – – a complex balancing act that goes a long way in explaining why many seem to be going in different directions, and changing directions frequently. Here are a few of the latest developments that serve to illustrate that CC’s and Blockchain are gradually being accepted into the mainstream, but still grappling with regulation, control, and stability:

- Uzbekistan will publish its plans to regulate Bitcoin in September 2018, with a Blockchain “skill center” set to begin operation in July.

- Kazakhstan has signaled its desire to copy Singapore’s Blockchain permissiveness.

- Belarus has announced it wishes to create a hospitable environment for Blockchain, as an innovative financial transactions technology.

- Venezuela has created the “PETRO”, a CC created to raise cash as Venezuela approaches economic collapse. The hope is that it will be a way around sanctions that prevent Venezuela from raising money in the global bond markets. President Nicolas Maduro claims that the PETRO raised $735 million on its first day, a claim that has not been substantiated. Maduro sees the PETRO as “the perfect kryptonite to defeat SUPERMAN” – his analogy of the US imposed sanctions, thinking that this currency frees his country from the grip of banks and governments. Perhaps he does not see that the PETRO was initiated by a government – his.

- TD Canada Trust has become the first Canadian bank to join with some UK and US banks in banning the use of credit cards to purchase CC’s.

- South Korea is heading towards legalizing Bitcoin, indicating that it will be considering Bitcoin as a liquid asset. Being that South Korea is at the forefront of the CC marketplace, the impact of their decisions will be significant and global. Japan has already taken those steps, making Bitcoin trades more transparent, more regulated, and 100% legal.

- BlackRock, the world’s largest investment company, continues its bullish forecast for CC’s, saying it sees “wider use” in the future.

- Romeo Lacher, chairman of Switzerland’s stock exchange, believes there are a lot of upsides to releasing a crypto version of the Swiss franc, and his organization would be supportive, adding that he “doesn’t like cash.”

- China’s largest online and brick and mortar retailer JD.com has announced the first four startups for its Al Catapult Blockchain incubation program. The Beijing-based program, which has seen candidates from as far afield as Australia and the UK, aims to use the company’s vast Chinese infrastructure to develop new Blockchain and artificial intelligence applications.

With all of the global to and fro activity, it is clear that Blockchain is the disruptive technology of this era, and CC’s are just a facet of the possibilities enabled. Just like the Internet investment explosion of the 90’s, Blockchain and CC’s investments will have winners and losers, however, we do not want this to turn into the huge bubble that burst destructively with many early DOT COM investments in the 90’s. What we do want to see is a well reasoned approach to Blockchain developments and investments. Crypto Trend will serve as your guide in this young market space, providing well reasoned recommendations and appropriate cautions.

Volatility will continue to be the norm in this market space for some time, as we see increasing acceptance, innovation, and regulation. Failures will happen and successes will emerge, driving governments, institutions, investors, and innovators, to continually adjust their processes and their thinking. Volatility is normal and healthy at this stage.

Trend Disruptors Premium

If you are ready to make a speculative investment into these disruptive technologies and want to receive all current and future recommendations from Trend Disruptors Premium, we are keeping our Early Bird Special offer to give our readers the opportunity to get started at a $175 discount, meaning you pay only $525.00. To take advantage of this special offer, click here

Stay tuned!

Can government really shut down crypto currencies?

Crypto Currencies (CC’s) are making inroads into the daily lives of more and more people every week. While China has taken a contrarian stance, trying to curtail Crypto Coin marketplaces, most other countries are finding ways to embrace this market or at least consider positive ways to deal with it. Clearly, most governments around the world do NOT want to miss out on the CC market as a rich source of revenue, so it is surprising that China has chosen to head in an authoritarian direction, perhaps believing that strict controls and prohibitions will be better for them. History has taught us that prohibition does not work, especially when it provides the masses with something they really want – wine, beer, & spirits are still with us – under reasonable control worldwide.

Here is some of the latest evidence that CC’s are rapidly heading towards mainstream status in the investments marketplace:

- Many Daily News shows now include a market recap segment with a full screen on Crypto Currencies, typically right after the Commodities recap screen.

- Arizona, Wyoming, and Colorado are preparing to accept CC’s for tax payments.

- In January, KFC Canada launched a limited time offer of the “Bitcoin Bucket” of chicken – the first major restaurant organization to utilize CC’s.

- Two entrepreneurs in the UK have sold 50 new luxury apartments in Dubai for Bitcoin.

- The Canadian Securities Exchange (CSE) has proposed a new blockchain based system of clearing and settling the purchase and sale of securities, aiming to provide real-time clearing and settlement, with low costs and fewer errors, compared to conventional services.

- Ripple has an agreement with the Saudi Arabian Monetary Authority (SAMA) to support cross-border payment technology with banks in Saudi Arabia, to enable instant settlement of cross-border transactions, lowering barriers to trade and commerce.

- Western Union is testing transactions with the use of RIPPLE’s (XRP) blockchain based settlement system, anticipating faster, cheaper, and more accurate money transfers.

Of course there are some who fear the integration of traditional fiat currency systems with the newly minted virtual currency systems. One of those is Augustin Carstens, general manager of the Bank for International Settlements (BIS) who believes that Bitcoin is a bubble, a Ponzi scheme, a speculative mania, and an environmental disaster. He also believes that CC’s are used a lot for money laundering and other criminal activities. He therefore is recommending strict regulation by all Central Banks, as CC integration could threaten the stability of financial institutions.

We see that we still have a “wild west” range of opinions and views about the CC market space, but we note that there is more and more evidence that the mainstream media and governments at all levels are acknowledging CC’s as a significant part of the financial landscape, a part that cannot be ignored or stifled. We see the trend is toward having CC’s and Blockchain technology company stocks in a well balanced, forward looking investment strategy.

Investing in Blockchain & other new technologies

Even with all the wild swings in the crypto space, our Crypto Trend Premium portfolio is still up an average of 30.82% at the time of this writing. As the sector goes through its growing pains of weeding out the weaker players, just like in the internet boom, most of the of these players will fall by the way side, but in the end some real winners will emerge.

While there is a great deal of volatility in the crypto space, as an investor, you need to understand that the underlying blockchain technology is a disruptive technology that will impact a great many sectors. As highlighted in our February 3rd blog, there are currently over 36 industries that are heavily investing in blockchain technology today.

Remember, disruption doesn’t happen overnight. Blockchain technology is still in its infancy, and a lot of the actual technology has yet to be perfected. Blockchain technology will supplement traditional industries, making them more efficient. We are certain that blockchain will transform the banking industry.

As investors, we believe that as blockchain, 5G, and other new disruptive technologies mature, solid long-term gains will be realized for those who are bold enough to be early participants. We have evaluated dozens of blockchain and new tech companies and have a short-list that we are ready to pull the trigger on as soon as we see more stability in the general markets.

Thanks to the very timely warnings of both The Trend Letter and Trend Technical Trader for a global equity market pullback and/or correction, we have held off issuing any new recommendations until we get a BUY Signal for the general market, which could come anytime in the next few weeks.

If you are ready to make a speculative investment into these disruptive technologies and want to receive all current and future recommendations from Crypto TREND Premium, we are keeping our Early Bird Special offer to give our readers the opportunity to get started at a $175 discount, meaning you pay only $525.00. To take advantage of this special offer, click here

Stay tuned!

Visa says you can buy almost anything, except crypto currencies

The news this week is that several banks in the USA and the UK have banned the use of credit cards to purchase crypto currencies (CC’s). The stated reasons are impossible to believe – like trying to curtail money laundering, gambling, and protecting the retail investor from excessive risk. Interestingly, the banks will allow debit card purchases, making it clear that the only risks being protected are their own.

With a credit card you can gamble at a casino, buy guns, drugs, alcohol, pornography, everything and anything you desire, but some banks and credit card companies want to prohibit you from using their facilities to purchase crypto currencies? There must be some believable reasons, and they are NOT the reasons stated.

One thing that banks are afraid of is how difficult it would be to confiscate CC holdings when the credit card holder defaults on payment. It would be much more difficult than re-possessing a house or a car. A crypto wallet’s private keys can be put on a memory stick or a piece of paper and easily removed from the country, with little or no trace of its whereabouts. There can be a high value in some crypto wallets, and the credit card debt may never be repaid, leading to a declaration of bankruptcy and a significant loss for the bank. The wallet still contains the crypto currency, and the owner can later access the private keys and use a local CC Exchange in a foreign country to convert and pocket the money. A nefarious scenario indeed.

We are certainly not advocating this kind of unlawful behavior, but the banks are aware of the possibility and some of them want to shut it down. This can’t happen with debit cards as the banks are never out-of-pocket – the money comes out of your account immediately, and only if there is enough of your money there to start with. We struggle to find any honesty in the bank’s story about curtailing gambling and risk taking. It’s interesting that Canadian banks are not jumping on this bandwagon, perhaps realizing that the stated reasons for doing so are bogus. The fallout from these actions is that investors and consumers are now aware that credit card companies and banks really do have the ability to restrict what you can purchase with their credit card. This is not how they advertise their cards, and it is likely a surprise to most users, who are quite used to deciding for themselves what they will purchase, especially from CC Exchanges and all the other merchants who have established Merchant Agreements with these banks. The Exchanges have done nothing wrong – neither have you – but fear and greed in the banking industry is causing strange things to happen. This further illustrates the degree to which the banking industry feels threatened by Crypto Currencies.

At this point there is little cooperation, trust, or understanding between the fiat money world and the CC world. The CC world has no central controlling body where regulations can be implemented across the board, and that leaves each country around the world trying to figure out what to do. China has decided to ban CC’s, Singapore and Japan embrace them, and many other countries are still scratching their heads. What they have in common is that they want to collect taxes on CC investment profits. This is not too unlike the early days of digital music, with the internet facilitating the unfettered proliferation and distribution of unlicensed music. Digital music licensing schemes were eventually developed and accepted, as listeners were ok with paying a little something for their music, rather than endless pirating, and the music industry (artists, producers, record companies) were ok with reasonable licensing fees rather than nothing. Can there be compromise in the future of fiat and digital currencies? As people around the world get more fed up with outrageous bank profits and bank overreach into their lives, there is hope that consumers will be regarded with respect and not be forever saddled with high costs and unwarranted restrictions.

Crypto Currencies and Blockchain technology increase the pressure around the globe to make a reasonable compromise happen – – this is a game changer.

Crypto Trend Premium

If you are ready to make a speculative investment into these disruptive technologies and want to receive all current and future recommendations from Crypto TREND Premium, we are keeping our Early Bird Special offer to give our readers the opportunity to get started at a $175 discount, meaning you pay only $525.00. To take advantage of this special offer, click here.

Stay tuned!

36 major industries heavily investing in blockchain

For 2018, the markets started off in a mostly positive direction, and have now started heading in reverse. A correction is overdue, as discussed in recent editions of The Trend Letter. The Dow plunged over 665 points, posting the steepest weekly decline in over two years. As mainstream markets decline, investors immediately start re-assessing their risk tolerance, and Crypto Currency (CC) investors are re-assessing risk even more, given all the discussion about how volatile this market space can be. It is not the usual mainstream economic drivers causing the CC plunge – it is fear, which is wildly contagious across all investment categories. Markets are largely driven by human fear and greed, two emotions that cause most investors to be unsuccessful over the long term. Cold hard analysis, coupled with “smart” Buy/Sell strategies, removes emotion from your investment decisions and paves the way to success. Strong bull markets need to correct once in a while, to restore balance and set the stage for the next run up.

CC Exchanges can be significantly less nimble than the mainstream stock market exchanges; however, there are several CC Exchanges that accommodate BUY and SELL LIMIT orders. Using those facilities as part of an “Entrance and Exit” strategy is highly recommended.

The news in the CC markets throughout January was mainly focused on the declining prices of almost all the coins. CC price declines preceded the overall stock market decline and are a reaction to more and more national governments indicating that they want to either ban CC’s, or increase their means to control and tax them. With all the fear that is now being generated in the mainstream stock markets, this is a perfect storm wherein CC investors have multiple sources generating fear.

Welcome to the world of cryptos, where you can make a fortune in months, and see things crash even faster. Clearly, investing anything more than a small portion of your portfolio in cryptos is a risky proposition. But if you believe, as we do, that the concepts behind Bitcoin and other cryptos, specifically the blockchain distributed database – are sound, then it makes sense to invest in cryptos, and especially indirectly in the blockchain infrastructure that supports Crypto Currencies, a technology that is expanding into many other sectors.

Today, there are over 36 major industries heavily investing in blockchain technology to revolutionize their industry, by cutting or eliminating costs, and dramatically improving efficiency and transparency. We are talking about a wide spectrum of industries including:

- banking

- law enforcement

- messaging apps and ride hailing

- IoT (internet of things)

- cloud storage

- stock trading

- insurance

- healthcare

- elections

- global forecasting

- retail

- supply chain management

- gift cards and loyalty programs

- government and public records

- charity

- credit history

- wills and inheritances

- and many other industries

We believe that we have years of incredible change ahead of us before this market finally settles on a standard. Yes, we will see many cryptos come and go, but much like Amazon, Apple, Google, and Facebook, there will be a few giant winners.

Let Trend Disruptors be your guide to understanding and successfully investing in this new, exciting, and game changing technology.

Trend Disruptors Premium

Subscribers to Trend Disruptors Premium will soon see new recommendations in their inbox to capitalize on the blockchain technology, as well as the revolutionary 5G mobile network technology. We have held off on these new recommendations as we have adhered to The Trend Letter & Trend Technical Trader warnings of a global equity market pullback and/or correction. We have seen the Dow drop 4% this week, and the S&P 500 lose 3.8%, the worst declines in 2-years, so that caution was well warranted.

These recommendations will use BUY Stops, similar to those used in both The Trend Letter & Trend Technical Trader, so when you receive these recommendations, do not purchase these stocks until the stocks reach those BUY Stops.

If you are ready to make a speculative investment into these disruptive technologies and want to receive all current and future recommendations from Trend Disruptors Premium, we are keeping our Early Bird Special offer to give our readers the opportunity to get started at a $175 discount, meaning you pay only $525.00. To take advantage of this special offer, click here.

Stay tuned!

5G – the new era for mobile

As stated in our last update, we are increasing our scope to include discussion of new technologies, and those companies that benefit directly and indirectly from them. We will cover blockchain projects, and other projects and companies that are involved with today’s game changing technologies.

One of those game changers is 5G – the 5th generation of mobile communication networks, and it looks to be revolutionary. More than all previous network upgrades, 5G will take us to a completely NEW era in mobile technology. New phones will be needed in order to use 5G, and here’s what’s in store:

- more data and higher download speeds – 100 times faster than 4G

- reliance on cloud storage, reducing the need for and use of internal memory

- pervasive connectivity, to access the cloud from everywhere

- latency improvements resulting in 30x the responsiveness of 4G, reducing the need for memory buffers (RAM).

Given that hardware memory needs are reduced significantly, the pricing model for 5G phones could change from being based on hardware memory needs, to being based on cloud memory needs. The speed improvements alone should tempt us dramatically, and may lead to everyone buying new 5G phones.

We note that several companies are poised to benefit from new technologies like blockchain and 5G, as they are providers and developers of the enabling hardware, software, and firmware. There is even more technology expansion on the horizon, and we will be zeroing in on the companies that are in the best positions to harness all this activity and innovation, generating potential great returns for investors. We will include discussion of more emerging and expanding technologies in future editions of Crypto Trend.

Let Crypto Trend be your guide to successful investing in today’s world, where the speed of change continues to accelerate, being made possible by new and exciting technologies.

Crypto update

Another wild day in the world of crypto currencies as Coincheck, one of Japan’s largest crypto currency exchanges, was hacked and had 526 million of the crypto currency XEM ($400 m) stolen, Lon Wong, President of the NEM.io Foundation stated.

“As far as NEM is concerned, tech is intact. We are not forking. Also, we would advise all exchanges to make use of our multi-signature smart contract which is among the best in the landscape. Coincheck didn’t use them and that’s why they could have been hacked. They were very relaxed with their security measures,” Wong said.

Coincheck is looking into compensating its customers, its executives announced.

Just a note that even with all this volatility, the average return for our 5 recommendations is still 62% at the time of this writing.

As we have constantly stated, the crypto currencies are very volatile, and although they can produce massive gains, many of them may be worthless in the years ahead, much like most internet start-ups no longer exist today.

What today’s story highlights is that not all exchanges are the same, and if they do not use all the tools that blockchain provides, they are vulnerable to these kinds of attacks.

It is why we believe it is the underlying blockchain infrastructure and applications that will give subscribers to Crypto Trend Premium the best long-term gains. Our team is actively analyzing dozens of companies, looking to identify the ones that we believe could be real winners in this game changing technology. Announcements of new recommendations will be sent out to subscribers soon.

If you are ready to make a speculative investment into these disruptive technologies, and want to receive all current and future recommendations from Crypto TREND Premium, we are keeping our Early Bird Special offer open for a little longer, to give our readers the opportunity to get started at a $175 discount, meaning you pay only $525.00 . To take advantage of this special offer, click here.

Stay tuned!