Trend Letter Blogs

Money Talks charts – August 20/22

The Trend Letter’s Martin Straith was the featured guest on Mike Campbell’s Money Talks podcast on Saturday. In the interview Martin gives his views on what is driving the markets currently and where he sees things moving from here. Topics include the stock market trend, how the US dollar drives markets, and how he sees […]

Market Notes – July 27/22

This afternoon the Federal Reserve announced its latest policy, raising interest rates by 0.75% for the second consecutive month. Afterward, Fed Chair Jerome Powell answered a number of questions from the press gallery. First, Powell was asked whether he agrees with the White House that ‘we won’t be in a recession.’ He then replied… ‘We […]

Market Notes – June 17/22

For those wanting to jump in and ‘buy the dip’ be mindful of our constant warnings that ‘bear market rallies typically fail to make new highs, and instead often make new lows.’ According to Bank of America ‘The average peak to trough bear decline = 37.3%, average duration 289 days; history is no guide to […]

Market Notes – June 16/22

The S&P 500 dropped 123 points or 3.25% and is now close to testng the 50% Fibonacci retracement level from the rally from Mar’20 to Jan’22. Remember our warning all through this year… bear market rallies tend to be sucker rallies, usually failing to reach new highs, and instead make new lows. We are neutral […]

Market Notes – June 13/22

The S&P 500 dropped back into a bear market within the first 30 minutes of trading today. The index is now down over 20% from its January high, marking the lowest level since March 2021. The Dow plummeted 2.79% while the Nasdaq fell 4.8%. Recession fears are growing amid crippling inflation and people are pulling […]

Market Notes – June 10/22

US stocks sank Friday as investors digested two downbeat prints on the US economy. May data on inflation showed price increases unexpectedly accelerated last month, with consumer prices rising 8.6% year-over-year in May, the most since 1981. Consumer sentiment data released Friday morning came in at a record low, as inflation weighs on American households. The S&P […]

Market Notes – June 2/22

A major reason the equity markets had such a great run over the past decade has been thanks to the loose monetary policy of the Federal Reserve. And from August 2019, the Fed has increased its balance sheet 137%, from $3.76 trillion, to $8.92 trillion. That is more than all of the prior QE periods […]

Market Notes – May 18/22

In yesterday’s issue of Today’s Charts we warned that in bear markets there is a lot of volatility, with violent moves both up and down. Today we saw what a violent move down in stocks looks like. We also warned that most relief rallies in a bear market fail. It is another reminder to ensure you have […]

Market Notes – May 17/22

As noted in Sunday’s issue of the Trend Letter, after the big sell-off, we are now seeing a relief rally. This could last for days, weeks or even a couple of months, but be very careful because if we do not see higher-highs and higher-lows, then we are most likely to see the market turn […]

Market Notes – May 12/22

Stocks rebounded sharply in the final hour of trading, with the S&P 500 almost erasing a selloff that pushed it to the brink of a bear market earlier Thursday. The turnaround came as Federal Reserve Bank of San Francisco President Mary Daly told Bloomberg News that a 75-basis-point increase in rates is “not a primary consideration,” while […]

Market Notes – May 9/22

Global markets got hit hard today with investors refocusing on the Ukraine war, a global energy shock and the risk asthe Fed tries to fight the supply-driven inflation. “I’ve been in the markets for 25 years and I’ve never seen anything like this,” said Danielle DiMartino Booth, CEO and chief strategist for Quill Intelligence, a […]

Market Notes – April 28/22

US stocks ended sharply higher Thursday, led by technology shares as markets continued a comeback from steep losses earlier this week. This gain was in spite of the news that the US economy unexpectedly contracted at the start of 2022 for the first time in nearly two years as lingering supply chain imbalances, inflationary pressures, […]

Market Notes – April 26/22

Another rough day for stock markets globally. Most markets opened lower and after making a few feeble efforts to rally, they could not gain any traction. Lots of headwinds for the markets: inflation, central banks aggressively raising rates, Covid lockdowns in China, and the fear of escalation in the Russian-Ukraine war. Most of these markets […]

Market Notes – April 25/22

(AP News)…Elon Musk reached an agreement to buy Twitter for roughly $44 billion on Monday, promising a more lenient touch to policing content on the social media platform where he — the world’s richest person — promotes his interests, attacks critics and opines on a wide range of issues to more than 83 million followers. […]

Market Charts – April 13/22

Based on seasonality, most North American markets are in a strong period. Here we see the chart for the S&P 500, which is strong through to early May. The Toronto and Nasdaq charts look very similar. Gold is also in a very strong seasonal period, from mid-March right through to early June. The real returns […]

Market Notes – April 12/22

The market opened strong, but couldn’t hold the intraday gains. The S&P 500 continued to trade with lower highs and lower lows, and has now fallen through both the 50-DMA (red wavy line) and the 200-DMA (blue wavy line). The inflation numbers were the main problem for the markets, as US inflation came out at […]

Market Charts – April 11/22

Global stock markets fell on Monday, pulled lower by technology shares in Europe and on Wall Street, as US Treasury yields jumped ahead of inflation data that could prompt the Federal Reserve to tighten policy enough to slow a rebounding economy. The S&P 500 was down again Monday, losing 1.59%. The key here is that […]

Market Charts – April 8/22

Bond yields keep rising (bonds dropping), as the yield on the 10-year Treasury spiked to 2.72% today. The 10-year yield is now up 130% since November. When bond yields rise, so do mortgage rates. The US 30-year mortgage is now just under 5%, the highest rate since later 2018. One of the ‘events’ that is […]

Market Charts – April 7/22

Stocks ended higher for the first time in three days, shaking off volatility from earlier this week. Still, the S&P 500 was on track to post a weekly loss and end a three-week winning streak, if levels hold through Friday’s close. Fresh commentary from Federal Reserve officials remained in focus on Thursday, as another set […]

Market Charts – April 6/22

(From Yahoo Finance)… Conversations detailed in the March 15-16 Fed meeting minutes released Wednesday suggested policymakers will soon begin to unwind the central bank’s $9 trillion balance sheet, including $4 trillion in asset purchases amassed to calm markets after the pandemic hit in early 2020. The minutes also indicated many participants in the Federal Open […]

Trend Technical Trader Subscriber Only Blogs

Nothing Found

Sorry, no posts matched your criteria

Trend Disruptors Blogs

What’s the DL on VM ?

With so much computing hardware in use around the globe, it is only prudent to use all that hardware in the most efficient way possible, after all, the gear is not free and it all requires space and maintenance, also not free. One way to increase hardware efficiency is to use Virtual Machine (VM) technology, and in a nutshell VM is a way to run a virtual computer within an actual computer.

Virtual Machine(s) are typically files, often called images, that run separately from everything else on the computer. The VM’s can have their own operating system, can be used for beta testing new applications, can be used to inspect and test infected code, and any other operation that benefits from being on its own. VM’s can be “sandboxed” in the host computer, meaning that they cannot interact in any way with any other part of the computer, so there is no code / instruction that can escape to, or tamper with, the host hardware.

It is possible to run several VM’s inside the same computer as long as the hardware is robust enough. For servers, VM’s can run multiple operating systems side-by-side typically using “hypervisor” software to manage them. Desktop computers would typically use the host operating system to run the VM operating system in a program window. Each VM provides its own “virtual” hardware, such as CPU, memory, hard drives, network interfaces etc, and the virtual devices are mapped to the real hardware when it is safe and/or advantageous to do so.

VM’s can provide a safe environment for testing and development, trying things out that could be dangerous on an actual, non-sandboxed computer. A good way to perceive development on a VM is “what happens in the sandbox can be kept in the sandbox”. But there are more uses for VM that have significant benefits in the production environments of many businesses. Not everything in a VM has to be confined to the VM if pathways to business operations are developed and implemented carefully.

An example of using VM technology to achieve higher efficiency in computer operations is to dedicate VM’s to specific business operations, such as EMAIL, WEBSITE, and ACCOUNTING. If each of these business functions normally has a dedicated server, there may be unused capacity in each server dedicated to each function. Using VM technology, each of these business functions can be given it’s own protected space in the available servers, and by dynamically adjusting that space, computing resources can be more efficiently utilized. A certain amount of “intelligence” is built into the VM and host environments to ensure the most efficient deployment of all computing resources.

With VM technology, companies may be able to significantly reduce costs, by having fewer servers and/or desktop machines to get all the work done.

There are several companies making great progress in VM technology, and this market space is poised to experience large growth within the next 12 months. We just sent our TREND DISRUPTORS Premium subscribers a new recommendation in the VM space and have about 20 stocks we are monitoring closely for inclusion to our portfolio.

If you are not a subscriber to Trend Disruptors Premium but want to be, we are offering a special offer at $399.95, a $200 discount. The average return on our closed positions is 28%. Click the button below to subscribe. To read more about this service, click here.

Stay tuned!

Lights ON – Covid OFF ?

It’s a new year and the world’s fight against the COVID-19 pandemic is having it’s ups and downs, with new variants emerging, and new vaccines being tested. The efforts of the global bio-tech industry, and other industries, to combat COVID 19 continue to be enormous. Years ago there were early warnings about the potential for a deadly global virus infection. The warnings were mostly ignored, but now that this pandemic has been with us for a more than a year, with second and third waves taxing health care systems, governments and populations are taking it very seriously, trying to do more than ever to “prevent, prepare, and mitigate”.

There may be a light at the end of this dark tunnel, and perhaps there is a special light that will contribute to keeping us all safer as we negotiate the dark tunnel, and beyond. Researchers have known for some time that certain kinds of light can sanitize surfaces, liquids, and the air, but can these sanitizing light rays be used safely, and are they effective when it comes to the new coronavirus and its variants – all those that cause the COVID-19 disease? It has been known for many years that sanitizing light waves are present in the Ultra Violet (UV) light spectrum, but most UV rays are harmful to humans and have only been used in safely enclosed environments, with limited human exposure. In recent years, researchers have discovered that there are 3 different types of light in the UV spectrum:

- UVA – has the lowest amount of energy. We are exposed to UVA when in sunlight. Exposure to this light can cause skin ageing and damage.

- UVB – is in the middle of the UV energy range. A small portion is found in sunlight and this is the type of UV light that can cause sunburn and skin cancer.

- UVC – has the highest level of energy. In sunlight, most UVC is absorbed into the Earth’s ozone layer, so we have very low levels of natural exposure.

It is UVC that is most effective in killing germs (virus and bacteria) on surfaces, in the air, and in liquids. UVC kills germs by damaging molecules like nucleic acids and proteins, rendering the germ incapable of replicating and surviving. It’s great to kill off germs, but it is important when using UVC light to use it in a way that does not adversely affect humans. The human-safe form of UVC light is named “far-UVC”, using only wavelengths in the range of 207 to 222 nanometres (nm).

Recent developments include special UVC bulbs and lamps that can be used safely to disinfect. There is an LED version developed to produce human-safe UVC light, and there are other experimental UVC light bulbs that have a potential disinfection rate of 50 to 85% more than standard room ventilation. This light will kill off many germs, leading to a significant reduction in disease contraction and transmission. Disinfecting a room, air and surfaces, can be as easy as screwing in a UVC light bulb and giving it a little time to do its work. Researchers in Canada, UK, USA, and Europe are developing innovative UVC solutions for the world. These UVC light products can be installed to sanitize a room, a car, an airport, an operating theatre, an airplane etc. More uses are being devised every week, some utilizing mobile robots to cover large areas, and some installed as stand alone lamps or ceiling lights. The aim is to provide a sanitized environment in virtually all spaces where humans congregate, visit, work, play, or reside.

The aim of TREND DISRUPTORS is to discover, explore, and monitor scientific and technical developments, looking for the best and brightest ideas, so that we can publish useful, actionable, investment recommendations for our subscribers. We seek out companies using innovative technology to DISRUPT a market sector. As a general rule, our stock recommendations are speculative, and we advise caution, discretion, and thorough research. TREND DISRUPTORS strives to identify investment opportunities that can lead to success for the well informed investor. Stay tuned !

What’s ahead for investing in 2021? Will the Biden admin hurt equity stocks?

Over the next week we will be offering up our vision for what we see in the disruptor sectors of the markets and where we will be guiding our subscribers, looking to make some significant gains. Yes, there will be volatility, and yes, we will need to be nimble, but this is what we do.

For today, we want to have a look at what the administration change means for the equity markets, especially the technology sectors.

As we move on into 2021 there are certainly changes coming. The Trump administration is out, and the Biden team is moving in. No matter what your political slant, as investors, Trump was good news over the past four years. His administration made a number of changes that propelled the equity markets since 2016. That administration …

- Cut hordes of red tape, removing many regulations.

- Cut corporate and middle-class taxes.

- Renegotiated many trade agreements, in favour of the US.

- Brought a great deal of manufacturing back to the US.

There is no arguing the results for the economy. Unemployment in the US dropped to a 50-year low and for investors, the equity markets took off. Since Trump took office, the markets were up over 100%.

As we enter 2021, there is a whole new philosophy in the White House; we are going from a strong capitalist mindset to a strong socialist mindset. Biden himself is considered quite moderate versus many of the other Democrats, so it will be interesting to see how far they roll back the changes Trump put in.

But no matter who is in office, we see technology and biotechnology having an incredible year in 2021. We have breakthroughs happening in artificial intelligence and machine learning. We are in the early stages of bringing on neuromorphic computing, the most advanced computer science and information technology to the field of biotechnology. We will have extensive, inexpensive, effectively boundless computing power and storage.

We also have the implementation of ground-breaking wireless technology with 5G. Coming along with this is a complement of new technology applications that would have been impossible even just a few months ago. And the most exciting part is that this is all happening at the same time.

But if Biden does push through higher corporate and personal tax rates, which we expect he will, it will certainly have a negative impact on the economy, reducing consumption and most likely negatively impacting the stock markets. But then we saw the markets fly higher during the pandemic, so we will have to see where this goes.

Trend Disruptors is focused on hi-tech companies, those specializing in innovative technology, seeking to identify ideas that have the potential to DISRUPT a market sector and generate significant gains before the masses catch on. If a company offers a revolutionary product, service, or therapy, it won’t matter who is sitting in the White House, that stock will go higher.

If the Biden administration does raise corporate and personal taxes it will hit the general equity markets and we are likely to see some significant pull backs, if not an all-out correction. We have over 30 companies on our radar right now and if we do see a significant correction, it will present our subscribers with some great entry points in some very exciting, leading edge companies. We’ll be sure to keep subscribers posted when there is any action we need to take.

We started a new portfolio in November and it contains 7 open positions which are averaging +11.75% or +115% in annualized paper gains so far, not a bad start!

If you would like to join our growing group of subscribers, we are offering new subscribers an outstanding deal. Instead of the regular price of $599.95 for an annual subscription, you save $200 and pay only $399.95. Click here if interested.

For more information on Trend Disruptors, click here.

Stay tuned!

3 Blind Mice – maybe not?

In the realm of medicine, healthcare, and bio-science, there is a lot of room for knowledge advancement, simply because this broad field has a very large gap between “what we know” and “what we do not know”. This gap is more frustrating for society than most other scientific knowledge gaps because the bio-science gap can have an immediate, intimate, life and death consequence. It is not uncommon for family members and friends to become distraught, bewildered, and angry, that medical science does not yet have an answer or remedy for a particular malady affecting someone close to them. Scientific knowledge gaps can seem to be less consequential and immediately needed in other fields, like geology or astro-physics, but medical science is a crucial part of our everyday life, and the lack of complete knowledge can easily and often trigger an exaggerated emotional response. Humans are curious, so scientific research keeps moving forward, and on good days there are discoveries and breakthroughs that improve the human condition, helping us to reflect positively on the not-so-good days when we just do not have the answer – yet.

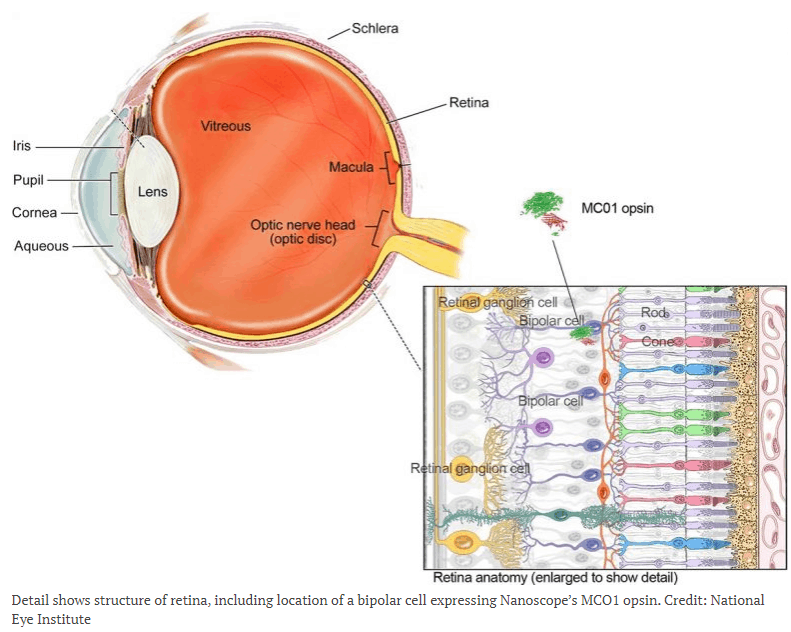

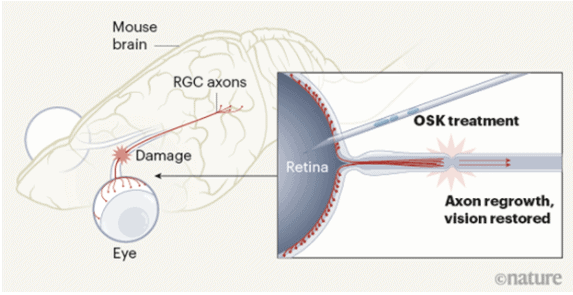

Blindness has never had a “cure”, however recent research using mice with retinal nerve damage has shown that with cell reprogramming, old cells or faulty cells can become “young” again and thus provide these mice with normal vision. The process involves resetting some of the thousands of markers that accumulate on DNA causing age related decline. The reprogrammed cells behave as if they are young cells, and go about repairing or replacing damaged tissue, restoring abilities that may have declined or disappeared over time – like eyesight. The research so far has only been carried out with mice, so it is not YET known if this approach will translate to humans or to other tissues and organs – but what if it does?

This looks like another major step forward in the quest to know more and accomplish more. The years old quest for a “fountain of youth” has been the stuff of mythology so far, but it is not that long ago that landing on the moon or breaking the sound barrier were considered impossible. As we age, our bodies go about adding, removing, and altering chemical groups such as methyls on DNA, now known as “epigenetic” changes. David Sinclair, a geneticist at Harvard Medical School has co-authored a “NATURE” study titled “Can you reverse the clock?” and asks the question “if epigenetic changes are a driver of ageing, can we reset the epigenome?” If the answer turns out to be YES, perhaps the fountain of youth is waiting for us just around the corner.

The objective of TREND DISRUPTORS is to discover, explore, and monitor scientific and technical developments, looking for the best and brightest ideas, so that we can publish useful, actionable, investment recommendations for our subscribers. We look for opportunities and seek out companies that utilize technology to be useful and profitable. As a general rule, our stock recommendations are speculative, and we advise caution, discretion, and thorough research.

TREND DISRUPTORS strives to identify investment opportunities that can lead to success for the well informed investor.

Stay tuned!

Vaccines – a way forward?

Our objective at Trend Disruptors is to identify and track technology developments that have the potential to “disrupt” market sectors, creating unique investment opportunities for our subscribers. The pandemic of 2020 has been a massively disruptive year on many fronts, with many businesses having to re-invent themselves, trying to remain profitable, to even remain viable. Covid-19 vaccines are almost here, and their development and deployment in the shortest time ever for any vaccine attests to the crucial role that technology plays in modern society. Vaccines have significantly reduced many diseases and infections over the years, and now advanced genetic engineering allows new and much faster vaccine development, by manipulating DNA, RNA, proteins, and sugars. Modern Vaccinology can tackle infectious and non-infectious disease, but some ancient infections, like malaria, and new ones, like HIV, are still with us because a safe and potent vaccine remains elusive for certain infections.

For investors, this year has been profoundly challenging, with markets reacting to business hardships due to lockdowns, business booms where pandemic conditions fostered growth and innovation, and loads of political rhetoric fostering doubt, division, and discord. Here we are in the weirdest of times, expecting that the winter of 2020 will be the darkest hour just before dawn, with Covid-19 vaccines ushering in this long awaited dawn. This years’ investment winners have been those companies that have been diligent in protecting against the virus while providing much needed goods and services. This is the year where online shopping, curbside pick-up, home delivery, and ICU’s (intensive care units) all have increased demand. Covid-19 vaccines are the latest addition to the goods and services to be provided, and the demand is huge.

Society often lurches forward because of disruptions, and most of the world’s population will grow to trust the new vaccines, if high level approvals are achieved and longer term experience piles up good results. Few of us will ever know exactly how a vaccine is built or how quantum computing works, but we all have a responsibility to be adequately and accurately informed about everything that affects our lives. Accurate information is crucial, and with so many sources these days, critical thinking skills are more valuable than ever. Investors need to have quality information to be equipped to take full responsibility for their financial well being.

The aim of TREND DISRUPTORS is to discover, explore, and monitor scientific and technical developments, looking for the best and brightest ideas. We publish relevant investment recommendations for our subscribers and publish blog articles discussing a variety of technology developments. As investors, we look for opportunities and seek out companies that utilize technology to be useful and profitable. As a rule, our stock recommendations are speculative and we advise caution, discretion, and thorough research.

TREND DISRUPTORS strives to identify investment opportunities that can lead to success for the well informed investor.

Stay tuned …

Can 5G work for me?

Many projects and ideas have been thrown off schedule with the Covid-19 pandemic, but progress is being made on implementing the latest cellular phone network – the fifth generation, euphemistically known as 5G. As well as the global pandemic, there are other concerns of a geo-political nature to be addressed, such as which countries will allow and trust Huawei equipment on the front end, or anywhere else in their 5G infrastructure. Everyone wants to have their data SECURE and kept out of foreign government hands, but allegations are easy and proof is hard, so the arguments continue. In the meantime, investors are trying to discern where the best opportunities are to purchase shares and get a good return in this market sector. Here we break down the 5G market sub-segments in a way that is understandable and actionable.

Front End: You will need a 5G Smartphone to get the full benefits of 5G, to get all that speed, low latency, enhanced security, and connection stability. There are many choices for buying a phone and we expect the market leaders to continue their dominance, so look for APPLE and SAMSUNG to stay near the top of the list, but there are others that have the potential to move up the list by offering equal or better products at a better price point. We also look for innovation from smaller players, and it only takes one new and popular feature to propel a product into the big leagues. Companies like Nokia, Huawei, LG, Motorola, and others have that potential. Supporting the manufacture of Smartphones are several component suppliers like chip fabricators Qualcomm, HiSilicon, and MediaTek.

Network and Other Infrastructure: This is a large sub-segment and includes the big players we all know and love – AT&T, Verizon, Bell, Century Link, Comcast, and Telus, as well as many smaller players like T-Mobile, Wind Mobile, regional nets, and many start-ups that appear and disappear quickly. There are also several large European players in this market, such as Vodaphone and Telekom who will have a large share of the global 5G market. We expect the leaders here to continue being the leaders, as long as they remain aggressive in their development and roll-out of the technology. Back end network technology companies have great profit potential, so we look at companies like Ceragon Networks and Huawei to fare well in this segment, even though Huawei faces strong headwinds on the geopolitical front. Construction of 5G networks includes the need for upgraded and/or new cell phone towers, so a company like American Tower has great potential.

The aim of TREND DISRUPTORS is to discover, explore, and monitor scientific and technical developments, looking for bright ideas that have the potential to “disrupt” a market sector. We publish relevant investment recommendations for our subscribers and publish blog articles discussing a variety of technology developments. As investors, we look for “disruptive” opportunities and seek out companies that utilize technology to be useful and profitable. As a rule, our stock recommendations are speculative and we advise caution and discretion and thorough research.

TREND DISRUPTORS strives to identify investment opportunities that can lead to success for the well informed investor.

Note: Trend Disruptor Premium (TDP) has recommended a number 5G related companies to Premium subscribers and is about to recommend a few more. TDP makes recommendations for disruptive companies in Artificial Intelligence (AI), Virtual Reality (VR), Augmented Reality (AR), 5G, Blockchain, and many other new technologies that we believe will have a profound impact on how the world conducts business going forward, similar to how the smartphone and internet re-shaped our lives.

These disruptive technologies are progressing at warp speed, so don’t miss your chance to get positioned early. Join our group of Premium subscribers and receive our next recommendation. And if you sign up before midnight Friday, November 20, you’ll only pay $399.95 for your TD Premium subscription. But hurry, because after Friday, the price will revert back to $599.95.

Stay tuned ….

Can we react better with THORIUM?

There have been few significant changes in the cleanliness of nuclear reactors since the first electricity generating reactor was brought onto the power grid in Obninsk, USSR, in 1954. The low carbon emissions from nuclear reactors make them one of the greener methods for generating electricity, and a good fit with the “green” initiatives envisioned for addressing climate change. Reducing carbon emissions and greenhouse gases are important parts of many comprehensive plans to mitigate human-caused climate change. Such plans include a broad range of “green” ways to generate electricity, such as solar panels, wind turbines, hydro electric dams, underwater tidal kites, ocean wave generators, and several other innovative ideas.

Today, nuclear reactors use Uranium as the fuel of choice, but there are downsides to using Uranium, and there are developments well underway to move away from Uranium, in favour of Thorium. The pros and cons of Thorium are many and can be explored in these main categories:

Efficiency: As a mineral, Thorium is far more plentiful than Uranium, therefore less expensive to locate and mine. However, the cost of the fuel is only a small portion of the overall cost of designing, building, and operating a nuclear reactor.

Effectiveness: In order to be effective in a nuclear reaction, Thorium must be converted to an isotope of Uranium (U233). This can be done fairly easily in a number of steps, and the reactor itself can assist in this conversion. The U233 fuel can be used successfully in most of the existing types of nuclear reactors, but reactors built specifically for Thorium are the more effective.

Safety: There have been three very serious nuclear accidents, 3-Mile Island, Chernobyl, & Fukushima. It is imperative to improve the safety record of nuclear reactors, as a small number of disasters can instill a high level of fear and trepidation that is hard to overcome. Next generation Thorium reactors are designed to be melt-down proof, with many safety improvements. The increased safety would be more a function of improved design over just switching to Thorium as the fuel.

Waste Management: There have been claims that Thorium waste is “better” than Uranium waste. While Thorium reactors produce a significantly smaller volume of waste, it is still dangerously radioactive for a long time. If storage space cost is an issue, the smaller volume of Thorium waste product may contribute to increased efficiency.

Nuclear Arms Proliferation: There are claims that U233 cannot be used to produce nuclear weapons, however, from a technical perspective it could be done.

Need for more reactors: In the USA, nuclear power is already the primary low carbon energy source for base-load electricity generation. Solar and wind power have an increasing place in the energy mix, as the transition away from fossil fuels accelerates. Unlike many other “green” sources, nuclear power is not intermittent, so it is available all the time without the need for energy storage (batteries).

In many countries, the updating and replacing of older nuclear reactors will be necessary in order to meet impending net-zero carbon emission targets Time will tell if all the factors discussed above prove to be enough of a benefit to switch from Uranium to Thorium as the fuel of choice for nuclear reactors. Already, the exploration of new fuels has sparked better design ideas for nuclear reactors, and this may be exactly what is needed to restore confidence in the technology, especially when it comes to safety.

The aim of TREND DISRUPTORS is to discover, explore, and monitor scientific and technical developments, looking for the brightest ideas – – those that have the potential to “disrupt” a market sector. We publish relevant investment recommendations for our subscribers and publish blog articles discussing a variety of technology developments. As investors looking for “disruptive” opportunities we will seek out companies that are using technology to be useful and profitable. As a rule, disruptive technology stock recommendations are speculative – we advise caution and thorough research.

TREND DISRUPTORS monitors technology and scientific developments, and identifies investment opportunities that can lead to success for the well informed investor.

Stay tuned …

Time to Evict the ZOMBIES?

The average human life span is clearly on the increase, with the United Nations predicting there will be 3.7 million people over 100 (centenarians) by the year 2050. Many developed countries are reporting more supercentenarians every year, they being people over the age of 110. Since 1900 the average human life expectancy has risen from 31 years to 72 years, more than a twofold increase. The oldest of all is in Japan – Kane Tanaka at 117 years old. Japan is a standout country for supercentenarians, having well over 100 of them. Given the increasing average life expectancy over the last century, and the development of life saving and life prolonging technology, is there truly a finite upper limit on how long a human can live? There are some who claim that there are people alive today who could reach the age of 1,000. That may seem far fetched at this point, but there is technology being developed to take us further down this road.

“Cellular Senescence” is a scientific theory that is growing in popularity and can be briefly described as a biological phenomenon where an organism’s cells stop dividing. “Senescence” is defined as the state of being or becoming old. Back in the 1960’s, scientist Leonard Hayflick postulated that human cells can divide 40 to 60 times before becoming senescent, and this is now referred to as the “Hayflick Limit”. When a cell no longer divides or replicates many biologists call it a “zombie” cell.

Much like the mythical zombie, these cells are not technically dead, but they no longer behave like young healthy cells – they are alive but they are physiologically useless. This may go a long way to explaining why certain afflictions become prevalent in older humans. The zombie cells are accumulating while healthy cells are becoming fewer and fewer. There are many age related diseases, such as dementia, osteoporosis, cataracts, cancer, hypertension, and arthritis. These and more may have a significant zombie cell causal relationship.

Also, zombie cells can generate harmful chemical signals that infect nearby healthy cells, thereby increasing the total number of senescent cells. It is easy to theorize that increased zombie cells can lead to problems, like reduced tissue repair, chronic inflammation, formation of cancer cells, cognitive degeneration, bone weakening, and other age related maladies. When we are relatively young our bodies can naturally remove senescent (zombie) cells, but as we age this natural shedding process slows down and zombie cells begin to accumulate. The situation can get especially dire when our Immune system cells become senescent and are unable to control the rapid spread of zombie cells.

Bio-technologists are striving to develop a solution to the zombie cell invasion of aging organisms, positing that aging can be treated much like any other disease. There is an emerging class of medicines named “senolytics” – molecules that selectively induce the true death of zombie cells, allowing them to then be flushed naturally from the organism. The idea is to kill zombies, then evict them from the body, which could make for a very interesting and uplifting ZOMBIE movie – or would ZOMBIES always be scary?

Here is a snip from the National Institutes of Health (NIH) National Library of Medicine:

“Senolytic drugs are agents that selectively induce apoptosis of senescent cells. These cells accumulate in many tissues with aging and at sites of pathology in multiple chronic diseases. In studies in animals, targeting senescent cells using genetic or pharmacological approaches delays, prevents, or alleviates multiple age-related phenotypes, chronic diseases, geriatric syndromes, and loss of physiological resilience. Among the chronic conditions successfully treated by depleting senescent cells in pre-clinical studies are frailty, cardiac dysfunction, vascular hyporeactivity and calcification, diabetes, liver steatosis, osteoporosis, vertebral disk degeneration, pulmonary fibrosis, and radiation-induced damage. Senolytic agents are at the point of being tested in proof-of-concept clinical trials. To do so, new clinical trials paradigms for testing senolytics and other agents that target fundamental aging mechanisms are being developed, since use of long-term endpoints such as life- or healthspan is not feasible. These strategies include testing effects on multi-morbidity, accelerated aging-like conditions, diseases with localized accumulation of senescent cells, potentially fatal diseases associated with senescent cell accumulation, age-related loss of physiological resilience, and frailty. If senolytics or other interventions that target fundamental aging processes prove to be effective and safe in clinical trials, they could transform geriatric medicine by enabling prevention or treatment of multiple diseases and functional deficits in parallel, instead of one-at-a-time.”

This area of research is still young and may prove to not be a viable treatment for humans, even when animal trials show promising results. Time will tell whether bio-scientists are making a winning investment here.

The aim of TREND DISRUPTORS is to discover, explore, and monitor scientific and technical developments, looking for the brightest ideas – – those that have the potential to “disrupt” a market sector. We publish relevant investment recommendations for our subscribers and publish blog articles discussing a variety of technology developments. The markets today are mired in uncertainty, but as investors looking for “disruptive” opportunities we will seek out companies that are using technology to be useful and profitable. Generally, disruptive technology stock recommendations are speculative and we advise caution and restraint.

TREND DISRUPTORS monitors technology and scientific developments, and identifies investment opportunities that can lead to success for the well informed investor.

Stay tuned!

Who’s leading the Charge?

Soon after the discovery of electricity there were many related discoveries and inventions that enabled the generation and storage of electricity. It was Ben Franklin who, in 1749, coined the word “battery”. However, it was the work of Luigi Galvani and Allesandro Volta that led to the first battery produced in 1800. Galvani noticed that a frog leg hanging on a brass hook would twitch when touching a scalpel to the hook, and thought that the source of the electricity was the frog leg, which he called animal electricity. Volta had a different theory about this phenomenon, which proved correct when he placed a wet salty cloth between plates of copper and zinc and attached wires to each plate, noticing that electricity was being produced. This, of course was the first “battery”, much as we envision them today.

Batteries work because of chemical reactions, and generally involve two different metals reacting in an electrolyte. In 1859, French physicist, Gaston Plante, developed the lead acid battery which is still used today to start our car engines. Lots of different battery compositions have been tried, but the next breakthrough came in 1980 when John Goodenough introduced the lithium ion battery, which is the current standard for the majority of our battery powered devices. These batteries can be sized and shaped for many purposes, but they do have a small risk of catching fire as happened with a few Samsung phones and other devices a short while ago. Battery improvements are needed, to increase safety, output, and longevity, so along comes John Goodenough again to develop the solid state battery.

The big change with solid state batteries is that the electrolyte, instead of being a liquid, is a solid, which is a huge advance. The solid state design has several advantages over liquid electrolyte designs, and the main ones are:

- more stable (much less likely to catch fire or explode)

- less costly to manufacture

- friendlier to the environment at the manufacturing level

- higher capacity for energy storage (batteries are often used to store power, as well as generate power)

- increased electrical output per cubic volume

- less weight and smaller size for equivalent output / storage

Given that we all have batteries in our life – in our cars, in our homes, in our electronic devices, and even sometimes in our bodies, then a better battery is likely to make our lives better too. As electric vehicles make further inroads they could have increased range, need fewer charging stops, and charge faster with solid state batteries. With the power to size ratio increasing we can envision batteries that are sized and shaped more effectively for small devices like pacemakers and hearing aids. There are many devices that could benefit from having a smaller, more powerful battery on board. Lithium-sulphur batteries are also being developed, however they cannot be made as small as solid state batteries.

There are many devices using batteries today and that number will increase dramatically as we move forward. The Internet of Things (IoT) already has an estimated 30 billion connected devices and the predictions are that we will reach 75 billion devices over the next five years, with all of them using sensors, timers, cameras etc. For the renewable energy sector solid state batteries offer a better and cheaper way to store energy generated by wind, sun, and waves. Cell phones will expand their range with more powerful batteries and they will go for longer times before needing a charge. Many healthcare devices could be improved by using solid state battery design to make them smaller, safer, and longer lasting. Electric vehicles may soon embrace solid state batteries, as Henrik Fisker (Fisker Inc.) is apparently only months away from putting the final design touches on a scalable solid state battery for his newest electric supercar, called “Emotion”. Clearly, the solid state battery has the potential to be disruptive in a large swath of human endeavours.

The aim of TREND DISRUPTORS is to discover, explore, and monitor scientific and technical developments, looking for the brightest ideas – – those that have the potential to “disrupt” a market sector. We publish relevant investment recommendations for our subscribers and publish blog articles discussing a variety of technology developments. The markets today are mired in uncertainty, but as investors looking for “disruptive” opportunities we will seek out companies that are using technology to be useful and profitable. Generally, disruptive technology stock recommendations are speculative and we advise caution and restraint.

TREND DISRUPTORS monitors technology and scientific developments, and identifies investment opportunities that can lead to success for the well informed investor.

Stay tuned!

5G – getting a good reception?

As each generation of cell phone networks is developed there is a leap-frog phenomenon with the technologies that enable them. Faster, more efficient networks depend on faster, more efficient components from end to end. There are many components in a cellular network, but one of the basic components is the antenna, and there is no lack of progress in developing advanced antennas to send and receive our cell phone signals faster and more reliably.

As far back as 1993 the MIMO (Multiple Input Multiple Output) antenna has been in use with many wireless networks. The idea is to use more than one antenna to transmit and receive a signal, addressing several issues with single antennas, such as noise, distortion, and speed. Antenna technology is very specialized and rightly deserves a prominent place in the design of all wireless networks. MIMO antennas are used in various wireless applications, such as Wi-Fi routers, body cams, handheld radios – anywhere that Radio Frequencies (RF) are used and need to be fast, efficient, and reliable.

When it comes to cell phones, we all expect and demand great performance. We want our data and voice signals to be clear and fast. Cellular network providers all vie for top spot by touting their network as the fastest, the most reliable, simply “THE BEST”. In order for those marketing messages to ring true there must be a high level of performance to back up the claims. MIMO technology has been in use and improved with each generation of cellular networks, and 5G is the latest iteration that will rely partly on the latest and greatest MIMO antennas.

MIMO technology is not simple to understand in detail, but the basic concepts of multiple antennas are something we all can grasp. Here are the basic concepts:

MIMO simultaneously transmits the exact same data as several signals through multiple antennas on a single radio channel. This antenna diversity improves signal quality and strength, as the receiving antennas recombine the data with excellent results in terms of noise reduction, interference reduction, and restoration of lost signals.

- The MIMO receiver takes into account a slight time difference between the reception of each transmitted signal, and this small amount of redundancy allows for noise reduction, restoration of lost signals or data packets, and reduction of interference.

- MIMO antennas also take advantage of bounced and reflected signals, and therefore do not have to rely on line of site, as single antenna systems do. This is very helpful in urban settings where line of site communication is difficult to achieve.

- MIMO antennas can be configured to use the millimeter wave form that uses high frequency radio bands where spectrum availability is larger than the radio bands licensed for 3G and 4G networks. They can also be configured with Network MIMO (coordinated signaling among multiple base stations) and Massive MIMO (large numbers of antennas ((hundreds)) at a base station). The various forms and configurations contribute to the dramatic increase in achievable speeds of 5G cellular networks.

5G networks are gaining ground quickly, as the world adapts to Covid-19 pandemic realities, and acknowledges the value of reliable high speed communications. MIMO antennas play a crucial part in making all our radio based networks better.

The goal of TREND DISRUPTORS is to discover, explore, and monitor scientific and technical developments, looking for the brightest ideas; those that have the potential to “disrupt” a market sector. We publish relevant investment recommendations for our subscribers and publish blog articles discussing technology developments. In the markets right now there is mostly uncertainty, with market indexes taking us on a roller coaster ride every day and every week. As investors looking for “disruptive” opportunities we will seek out companies that are using technology to be useful and profitable in the new reality of this global pandemic. Generally, disruptive technology stock recommendations are speculative and we advise caution and restraint.

TREND DISRUPTORS monitors technology and scientific developments, and identifies investment opportunities that can lead to success for the well informed investor.

Stay tuned …