Trend Letter Blogs

Market Notes – August 5/23

From Yahoo News: The stock market has soared so far this year, but expect the month of August to be lackluster if the past several decades are any guide. August is the second-worst month for the S&P 500 and Nasdaq, and the worst for the Dow Jones Industrial Average over the last 35 years, according […]

Market Notes – July 7/23

Wall Street’s main indexes ended lower on Friday in a seesaw session, as investors digested a US jobs report that showed weaker-than-expected growth and awaited more economic data and corporate earnings in the weeks ahead. The benchmark S&P 500 was solidly higher for most of the afternoon, but stocks sold off toward the end of […]

Why you should prepare your investment portfolio for an overbought market

We are providing this commentary to non-paid subscribers because we believe it is crucial for all investors to understand the current state of market sentiment. In our weekly issues of the Trend Letter, we regularly update various sentiment indicators to keep our subscribers well-informed about market trends and, equally importantly, investor sentiment. Based on our […]

Webinar video

Martin was the guest on Financial Advisor Bill Westmacott’s webinar with James Longstreet. Topics discussed were: Current market conditions How to identify trends in various sectors Debt concerns How was this serious inflation created? Will there be a recession and if so, how will it affect the average person and the markets? What should the […]

Market Notes – May 19/23

After receiving positive updates from retailers that reinforced the absence of an impending recession, the stock market surpassed the trading range that had confined it since February. This breakthrough triggered significant short covering and a surge of investment in the technology sector index, once again spearheaded by the mega-cap companies, as we have highlighted all […]

Market Notes – April 21/23

Stocks closed slightly higher on Friday afternoon as investors digested a final slate of corporate earnings and fresh economic data to close out the week. The S&P 500 rose 0.09%, while the Dow Jones Industrial Average rose 23.99 points, or 0.07%. The technology-heavy Nasdaq Composite rose 0.11%. All three major averages closed the week lower. The S&P […]

Market Notes – March 15/23

US stocks fell Wednesday as two economic prints showed a slowdown in the US economy in February, while fresh turmoil at Credit Suisse renewed investor concerns over the banking sector. The S&P 500 dropped 0.7%, while the Dow Jones Industrial Average lost 0.9%. Contracts with the technology-heavy Nasdaq Composite pared earlier losses and ended just […]

Market Notes – March 13/23

US stocks finished Monday mixed as volatile trading gripped Wall Street after federal banking regulators took aggressive actions to stem the fallout of Silicon Valley Bank’s failure. First Republic Bank led a decline in bank shares Monday that came even after regulators’ extraordinary actions Sunday evening to backstop all depositors in failed Silicon Valley Bank and Signature Bank and offer additional […]

Market Notes – March 1/23

Market Overview – March 1/23 US stocks finished mostly lower Wednesday to start March as key manufacturing data offered mixed results and two Federal Reserve officials suggested a more aggressive rate-hiking campaign in the coming months. The S&P 500 declined by 0.5%, while the Dow Jones Industrial Average was flat. Contracts on the technology-heavy Nasdaq Composite […]

Market notes – February 17/23

Note: The Trend Letter’s Martin Straith was interviewed on This Week In Money. To listen to the interview CLICK HERE. Martin’s interview starts at 41:50. US debt to rise to~$51.5 trillion in 10 years! There is a lot of noise in the US over the $31.4 trillion debt ceiling and how it may impact the […]

Market Notes – January 27/23

US stocks rallied on Friday, after slipping earlier at the open, as investors weigh in on fresh economic data including consumer spending data, a closely watched measure by the Federal Reserve. The S&P 500 added 0.2%, while the Dow Jones Industrial Average ticked up 0.08%. The technology-heavy Nasdaq Composite was up roughly 1%, closing out […]

Market Notes – January 20/23

Stocks rallied on Friday to finish the week strong after briefly losing the momentum of the January rally. The Dow Jones Industrial Average added 330.93 points, or 1%, to close at 33,375.49, while the S&P 500 advanced 1.89% to 3,972.61. Both indexes snapped a three-day losing streak. Meanwhile, the Nasdaq Composite rose 2.66%, with help […]

Market Notes – December 28/22

Global stocks are on pace for their worst drop since the 2008 financial crisis. Pessimism around the outlook for financial markets and the economy amid a backdrop of rising interest rates and fears a recession is underway have thrown a wrench in prospects for the seasonal year-end Santa Claus rally markets stocks typically experience at […]

Market Note – December 23/22

Stock indices finished today’s trading session in the green. The Dow Jones Industrial Average, the S&P 500, and the Nasdaq 100 gained 0.53%, 0.59%, and 0.27%, respectively. So far, a ‘Santa Claus‘ rally has been missing as the year begins to close. The failure at the 50-DMA (blue wavy line) has kept short-term downward pressure […]

Market Notes – November 25/22

See great Black Friday Specials at end of this post Stocks finished mixed during an uneventful, shortened day of trading on Black Friday. When the closing bell rang on Friday, the S&P 500 was down 0.03%, the Dow was up 0.45%, and the Nasdaq fell 0.52%. The US stock market closed at 1:00 p.m. ET on […]

Is this the start of a new bull market?

What a day in the markets. This morning, the US published its latest official inflation reading, and it came in better than Wall Street expectations for the first time since this whole inflation trend began. The market’s reaction was immediate, sending the S&P 500 up ~4% and the tech heavy Nasdaq up over 6%. And […]

Market Notes – October 28/22

US equities rallied Friday, as an earnings beat from Apple helped stocks push their way past a week of Wall Street misses for Big Tech. The S&P 500 gained 2.5%. The Dow Jones Industrial Average bounced more than 800 points, or 2.6%, to a two-month high, as it also notched a fourth-straight week of gains […]

Market update – October 7/22

Markets tanked again today after US employment data showed 263,000 new jobs, leaving the US labour market conditions very tight as the unemployment rate dropped to just 3.5%. This crushed any hopes the Federal Reserve will pivot anytime soon on its aggressive rate hiking path. As a result, the S&P 500 dropped 104.86 points or […]

This Week in Money Notes

Martin was the guest on This Week in Money with Jim Goddard and they covered a wide range of topics. Below are notes from that interview. To listen to the interview, click here. The interview starts at 13:30. Q. What is the market sentiment? Wow…how about frightful, panicked? We had the Fear/Greed index at Extreme […]

Market Charts – September 1/22

As noted to subscribers in Sunday’s issue of the Trend Letter, the the 50-DMA (blue wavy line) would be initial support for the S&P 500. We also noted that if that level did not hold it would open the door to retest the July lows (bottom green dashed horizontal line). After falling through the 50-DMA […]

Trend Technical Trader Subscriber Only Blogs

Nothing Found

Sorry, no posts matched your criteria

Trend Disruptors Blogs

Better on the Edge?

Technology trends are constantly and quickly evolving, and part of that evolution is certain technologies catching up to, or leapfrogging others. Such may be the case with Cloud Computing, with large developments already in place, such as Amazon Web Services (AWS), Microsoft Azure and Google Cloud Platform. The technology continues to grow, and is dominant at this time, but many businesses are becoming concerned with certain cloud computing shortcomings, like the latency in getting data to a data centre. Latency is caused by the time it takes for data to make the relatively long journey to the cloud and back from the cloud to where it is needed for processing. The cloud provides lots of affordable, well managed storage space and processing of non-time sensitive data. But some businesses require fast processing of time sensitive data in order to reduce decision making time in their systems, helping the business to maximize gains and minimize losses. Time is often critical in getting it right.

Edge computing relies on specialized devices located near the “edge” of the network, and these devices are designed to get the specific data they need very quickly, make a data processing decision, and deliver an immediate result. These devices may look like a PC, but their work is narrowly defined for a unique set of tasks. This quick processing by Edge computers can be a game saver in situations where speed is required, and Cloud Computing cannot match this speed. Edge computing can also be used very successfully in remote locations, where connectivity to large data centres is not feasible or is on a part time basis.

The Internet of Things (IoT) can especially benefit from Edge computing in ways that Cloud Computing cannot replicate, for instance, an IoT device may be reaching a Fail Point, and the device must be shut down immediately in order to prevent damage. An Edge device can make the shut down happen very quickly and prevent expensive damage to the IoT device. Meanwhile, the processing of IoT data and the high level management of the IoT device can continue on a cloud platform using data sent to the cloud before the shut down. Using Edge and Cloud computing together in this way can allow a business to get the best of both worlds. Cloud and Edge computing solutions are compatible, as they do not compete for the same job – each is good at what it does, and each will continue to grow.

The goal of TREND DISRUPTORS is to discover and monitor technical developments that have the potential to DISRUPT a market sector. We look for the best ideas, and generate actionable investment recommendations for subscribers. As a general rule, these recommendations are speculative, and we advise caution, discretion, and thorough research. We strive to identify investment opportunities that can lead to success for the well-informed investor.

Stay tuned!

Martin’s interview on Tokenization

The interview with Martin is only about 12 minutes, so if you are an investor and want to understand how decentralized finance and tokenization are changing the world, it is 12 minutes well spent.

If you don’t have time to listen to the whole broadcast (about an hour), you can go directly to Martin’s interview which starts at 30:45.

What about the Metaverse ?

It’s fairly new and it will be a game changer for some, but how much do you know about the Metaverse, and why is it important, as an investor, to know something about it? To start, we can describe what it is:

Metaverse – a collective virtual open space, created by the convergence of virtually enhanced physical and digital reality. It is physically persistent and provides enhanced immersive experiences. Here is a virtual world where people can meet and interact with each other on topics of mutual interest. Several technologies, like Augmented Reality (AR) and Virtual Reality (VR) are what can make the Metaverse an immersive experience that enriches whatever is being discussed, envisioned, and accomplished. Some examples of Metaverse experiences that are, or will be, possible are shopping, playing games, attending a concert, doing business, and posting notices and comments. It is a place other than normal reality, so you could do things in the Metaverse, but not all of it could be ported seamlessly into the real world. However, business decisions for instance, could be discussed and settled in a Metaverse meeting and then taken into the real world to be fully implemented. The possibilities for using the Metaverse are being explored and expanded as we speak.

Metaverse technology is unique and complex. It is device-independent and not owned by a single vendor. It is an independent virtual economy enabled by digital currencies and nonfungible tokens (NFT’s), needing several enabling technical capabilities like AR, VR, head mounted displays (HMD’s), the Internet of Things (IoT), 5G, and spatial technologies.

Think of a topic and there may soon be a Metaverse for that topic, where you can meet and interact with people interested in, or involved with, that topic. Metaverse is a new trend that may not be what everyone wants or needs, but it is very likely to be a trend that may be underestimated by some investors. So, even if you don’t use it, or ever want to use it, it may be a trend with great upside investment potential that investors could ignore at their peril. Discounting the Metaverse potential could mean missing out on disruptive and explosive investment opportunities. Don’t forget the miscalculations and slow take-off of cell phones and Smartphones. Now there was investment opportunity that we could have all profited from, even if we never use or own a mobile phone. Right now, there is no limit on ways the Metaverse may be used to great advantage, so ignoring it may not be a profitable investment bias. Even if you see no direct usage for yourself, remember that Facebook has rebranded as META, and members of the digital-first generations are quickly moving to metaverse gaming.

After the tech sector correction, many tech stocks on our watch list have dropped into or near our buy zones. We are working on the next batch of recommendations, which will be sent out to Premium subscribers soon.

The goal of TREND DISRUPTORS is to discover and monitor technical developments that have the potential to DISRUPT a market sector. We look for the best new ideas, so that we can generate actionable investment recommendations for subscribers. As a general rule, our recommendations are speculative, and we advise caution, discretion, and thorough research. We strive to identify investment opportunities that can lead to success for the well-informed investor.

Stay tuned!

Paving the way for RPA

The Industrial Revolution took place in the last century, and in this century it is being mirrored by the Technology Revolution, in the sense that jobs are changing, disappearing, or being automated. Artificial Intelligence (AI) can incorporate machine learning (ML) to analyze a job and “think” of the best or a better way to get it done, and also resolve problems along the way. However, there are some well defined repetitive jobs that can be automated with simpler programming than AI requires, and this is the expanding world of Robotic Processing Automation (RPA).

There are tasks in many industries that can benefit from using RPA. Tasks that are very repetitive, well defined, and/or tedious for humans, can be handed over to RPA bots. These bots may need a little human supervision to ensure problem free execution, but for the most part RPA can motor along with no help needed at all. Here are some examples of where RPA is being put to use today:

Financial Services: Opening accounts, high volume data entry, inquiry processing, customer research

Healthcare: Prescription management, insurance claim processing, payment cycles, patient records

Retail: Customer relationship management, order management, fraud detection, warehouse management

Insurance: Claims processing, policy management, regulatory compliance, underwriting tasks, form filling

In order for RPA to work well it does need some important design considerations, such as low-coding capabilities to facilitate fast development of automation scripts, effective integration with enterprise applications, the ability to administer and orchestrate tasks securely, and the ability to be monitored. Automation technology, like RPA, can also access information through legacy systems, integrating well with other applications through front-end integrations. This allows the automation platform to behave similarly to a human worker, performing routine tasks, such as logging in and copying and pasting from one system to another. While back-end connections to databases and enterprise web services also assist in automation, RPA’s real value is in its quick and simple front-end integrations.

The are several strong benefits to using RPA, such as:

- Cost savings, as many high-volume tasks are handled by RPA and staff can be re-assigned to higher priority work that actually requires human input. Efficiency and ROI are improved.

- Accuracy and compliance are improved as RPA reduces human error and provides a good audit trail

- Less coding, as low-code development can be much faster and cheaper

- Keep current systems, as RPA works on the presentation layer with no need for complicated system integrations.

- Staff morale, as RPA can relieve high-volume staff workloads and thus allow staff to focus on strategic decision making, resulting in enhanced job satisfaction.

There are some challenges that RPA can struggle with, such as operating in an environment where regulations and/or processes change frequently, making it difficult to scale up to enterprise-wide implementation. While RPA can reduce the need for certain job roles, it can also drive growth in new jobs that tackle more complex tasks, enabling staff to focus on higher-level strategy and creative problem-solving. Organizations will need to promote a culture of learning and innovation. The adaptability of a workforce will be important for successful outcomes in automation and digital transformation projects. By educating staff and investing in training programs, staff can be prepared for ongoing shifts in priorities. Training and innovation can pave the way for RPA.

The goal of TREND DISRUPTORS is to discover and monitor technical developments that have the potential to DISRUPT a market sector. We look for the best ideas, so that we can generate actionable investment recommendations for subscribers. As a general rule, our recommendations are speculative, and we advise caution, discretion, and thorough research. We strive to identify investment opportunities that can lead to success for the well-informed investor.

Stay tuned!

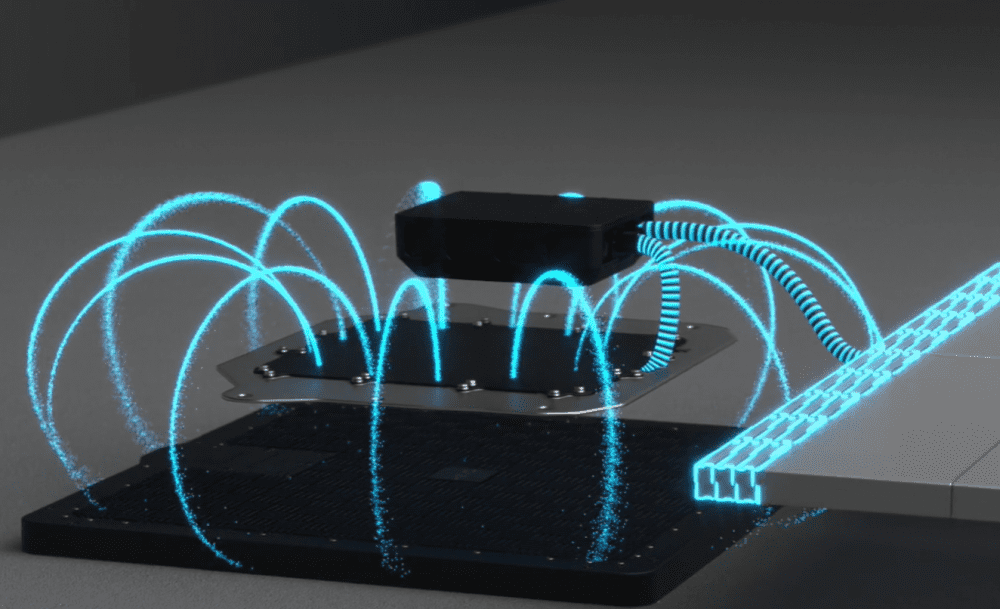

Can my EV be cable free ?

Many of us are familiar with electrical current induction when we charge our phones on a wireless charging pad. The technology relies on the phenomena of charging a coil of wire with alternating current, producing a magnetic field. An uncharged coil of wire entering that magnetic field will induce an electric current in the uncharged coil. This was discovered and demonstrated by Nicola Tesla back in 1891. As we know from charging our phones, the 2 coils need to be close together because the natural magnetic field produced by the inducing coil radiates in all directions and its energy diminishes very rapidly over distance – this is exactly why the induction coils needs to be very close together. We lay our phones directly on the charging pad, ensuring that the coil in the pad and the coil in the phone are very close to each other. Induction also demands that the coils be aligned with each other, which is why our phones need to be carefully aligned on the charging pad in order for wireless charging to work. We also note that induction produces heat, and that part of the phenomena is being used effectively in producing induction cook tops, which require magnetic cookware.

So, can the magic of induction be improved and scaled up to a point where the battery of an electric vehicle (EV) can be charged wirelessly? The answer is turning out to be yes. Researchers have been able to modify the natural shape of the magnetic field produced by the primary (inducer) coil and focus that magnetic field directly on the secondary (induction) coil. The key to achieving this is to precisely match the magnetic resonance of the 2 coils, altering resistance, inductance, and distributed capacitance. The result is that the magnetic field is more like a tunnel, focusing its energy on the secondary coil and producing a much stronger coupling of the 2 coils. It also turns out that this design does not require precise alignment of the coils. Given this research, developers of EV chargers may now have a technology that can be ramped up and not require perfect vehicle parking to achieve a workable alignment of the charging coils. This could also be the technology to enable charging vehicles on the move.

The race is now on to bring commercially viable wireless charging to the EV marketplace:

- Research is being conducted at the Oak Ridge National Laboratory in Tennessee, where they have developed a polyphase electromagnetic coil. They have recently licensed the technology to HEVO in Brooklyn New York, whose CEO claims that their hands-free charger has a surface power density of 1.5 megawatts per square metre, enabling very fast charging speed. HEVO envisions charging while driving on specially modified roads, even while driving at highway speeds. This will require the installation of a device on the underside of the vehicle, about the size of a pizza box, and it can operate with grid-to-battery efficiency of 90 to 96.5 %. The charging level can be up to 300 kW, which could facilitate powering a house through a vehicle-to-grid interface.

- WITRICITY has been developing magnetic resonance technology for a few years and have an interoperable standard and supporting infrastructure that could be used by any EV manufacturer. There is now an industry standard for the technology used by WITRICITY (SAE j2954). Their devices work in adverse conditions, like ice and snow, and can transmit through obstacles like asphalt and paving stones, with grid to battery efficiency levels between 90 and 93%. WITRICITY sees great potential for autonomous EV’s providing driverless taxi service, running in dedicated bus and taxi lanes with embedded wireless chargers. These vehicles could be “snacking” on power when travelling in these dedicated lanes or “feasting” while at rest in a taxi queue fitted with embedded chargers. There may be no need to ever charge up the EV battery as a separate operation.

- WAVE (Wireless Advanced Vehicle Electrification) is focused on extreme fast charging for the medium to heavy duty EV market sector, providing embedded chargers producing charging speeds of up to 1 megawatt. They are partnering with TESLA to provide wireless charging technology for the as yet unreleased range of TESLA semi trucks, leading to the construction of wireless charging highways wherever these trucks need to go.

So yes, your EV can be cable free, as there are vehicles on the way to provide it, such as the Genesis GV60 out of South Korea, and there should be choices for retrofitting current EV’s for wireless charging capability. The technology is here and availability is just around the corner.

The goal of TREND DISRUPTORS is to discover and monitor technical developments that have the potential to DISRUPT a market sector. We look for the best ideas, so that we can generate actionable investment recommendations for subscribers. As a general rule, our recommendations in this sector are speculative, and we advise caution, discretion, and thorough research. We strive to identify investment opportunities that can lead to success for the well informed investor.

Stay tuned!

WEB 3.0 – Can it Succeed ?

The internet has always been used as a tool for education, research, and the distribution of information, spawning the term “information highway” in its early days. Over the years it has evolved into a tool that can be manipulated and censored, giving rise to serious concerns about personal privacy, data ownership, monetization, and freedom. A few internet based companies have powerful ways to control what happens on the internet. We now have companies like Facebook, Google, and Amazon that wield tremendous power over the free exchange of ideas on the internet. The power to manipulate the internet through the banning of certain users, certain web sites, and reshaping internet search results is a power that is being tapped into by national governments and international advertisers. Most users see examples everyday of targeted advertising, and realize that their actions on the internet are being constantly analyzed and used in ways they may not appreciate. The most valuable resource for the big tech companies is User Data – it is the key to generating those huge profits, and the data owners (users) are certainly not sharing in those huge profits.

So what can be done to alter the course of internet freedom, manipulation, and data usage? Blockchain technology may provide an answer. What is being called WEB 3.0 is being developed to provide distributed processing and storage across thousands of computers around the world, all contributing to a new foundation for internet social media platforms and search facilities. The Blockchain foundation is widely distributed by design, which eliminates the choke points in the current WEB 2.0 foundation. These choke points facilitate widespread control and manipulation by a small number of large tech corporations, who will continue to be influenced, ordered, and incentivized. What is required is large scale adoption of new social media platforms and web search facilities on the Blockchain WEB 3.0 foundation, and that may not be easy given the number of users and advertisers committed to platforms and services in the control of large corporations like Facebook, Google, and Amazon. What may turn the tide is if a significant number of users demand to take back control of their data and start to earn a share in the profits that advertising can generate.

The promise of WEB 3.0 includes the concept of data portability, where a user can quit one platform and port all their data over to WEB 3.0 infrastructure, where there is the choice to opt in or out of data sharing. Opting in could generate advertising profits when user data and posts generate significant web traffic. The currencies used on WEB 3.0 would all be crypto tokens, and profits could be made via blockchain mining and opting to market your data to advertisers. Web 3.0 can integrate artificial intelligence (AI) in ways not seen before. For instance, instead of a Web 2.0 Search Engine merely generating a list of web sites, a query on Web 3.0 will invoke a “computational knowledge engine” to provide you with all the information you want on the queried subject. This will be like having SIRI, ALEXA, or BIXBY on steroids, where the system can decipher meanings and emotions, based on the user’s choice of words or other input.

Blockchain technology ensures that all data is secure and cannot be altered, as it is stored in multiple global locations, free from the grip of governments and the direct control of the tech giants. This would be much more in line with Net Neutrality and the free flow of information that the internet should provide. Just like today, not everyone will agree with what is being said on the internet, so it becomes the responsibility of each internet user to search out those sources of information that are trustworthy, factual, and reliable. Journalism used to provide that kind of trust and reliability, but with the internet giving everyone an easily accessible voice, it has come down to each individual to separate the good stuff from the rubbish.

The purpose of TREND DISRUPTORS is to discover and monitor scientific and technical developments that have the potential to DISRUPT a market sector. We look for the best ideas, so that we can generate actionable investment recommendations for our subscribers. As a general rule, our recommendations are speculative, and we advise caution, discretion, and thorough research. We strive to identify investment opportunities that can lead to success for the well informed investor.

Stay tuned !

Note: Subscriber to Trend Disruptors Premium will be receiving a new recommendation in the Web 3.0 space later this week. If you are not a subscriber but would like to receive this and all other recommendations, click the button below to access a $200 savings off the regular price.

Do I Need All These CODERS?

It was the best of times – programmers all learned how to write efficient computer programs in ASSEMBLER, or an interpretive language like BASIC, PASCAL, or FORTRAN. They used a fairly low level language that, when compiled, computers could execute quickly and flawlessly over and over. Bill Gates helped to write a whole operating system (DOS) using low level computer code, and some of that code is still being called up by WINDOWS to execute common routines. Over time, the number of finished and perfected computer routines increased, and it became easier to package a set of specific routines to form the heart of a business application, such as Payroll or Accounts Receivable. It also became easier to package business applications into an integrated system at the enterprise level.

Now that so many efficient computer routines have been written and proven over time, is there an ongoing need to have a staff of coders to write or re-write such routines? The answer seems to be no, as there are now platforms available that facilitate the development of complete business applications with little or no knowledge of computer code. Such development platforms are called either “no code” or “low code”, and both are generally referred to as LOW CODE APPLICATION PLATFORMs (LCAPs). While no coding expertise is required there is still detailed business and data flow knowledge required. It’s easy to envision increases in productivity, as LCAP applications can be up and running in a short time, but the larger savings may be in reducing the high cost of skilled coders. In the early days of computing and right up to the last few years, knowledgeable and experienced coders were in very high demand, and it has become increasingly costly to retain all the skill, knowledge, and experience that a coding staff possesses.

The LACPs allow corporations to develop enterprise level applications for every facet of their business. Many industries can benefit from LACPs application development, such as manufacturing, telecom, retail, education, insurance, and media. Applications can include product development, sales and marketing, risk management, engineering, and quality management, to name just a few. It is common for LCAPs to employ visual elements to assist “citizen” (non-coders) app developers in choosing the best templates and elements to design and optimize work and data flows.

We have seen early and successful adoption of other LCAP development tools, such as website development platforms where users simply select templates and elements for their website and construct their entire site with no coding required. With these platforms there is no need to know a markup language like HTML or any other programming language like C++, Java, Python, PHP, or PERL.

The market for LCAPs has great potential for growth, as more and more companies begin to realize that LCACP solutions can generate large savings in staffing as well as significant gains in the time required to develop and implement new applications. There will always be a need for skilled coders, even as the market for LCAPs increases. Gartner estimates that by 2023 over 50% of medium to large enterprises will have adopted an LCAP as one of their strategic application platforms. And Forbes called LCAP the most disruptive trend of 2021. ” So you can see why this is set to be one of the biggest revolutions in computing. It allows companies to put the power of coding into the hands its employees, without having to have a large team of high-skilled, high-priced coders.

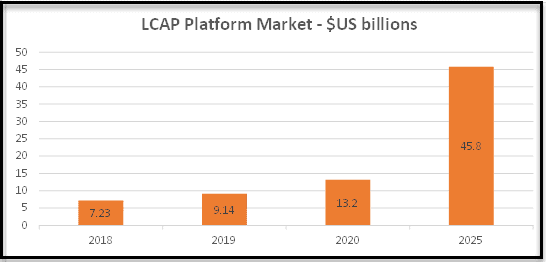

What kind of growth are we talking about? In 2018, the low-code developmental platform market was valued at around $7.23 billion. Last year it was $13.2 billion. But according to Markets and Markets analysis, it’s projected to grow by an incredible 246% by 2025; that’s in just four years!

Now you can see why this is set to be one of the biggest revolutions in computing. It allows companies to put the power of coding into the hands its employees, without having to have a large team of high-skilled, high-priced coders.

Subscribers to Trend Disruptors have just been sent a new recommendation to capitalize on this exciting new opportunity.

The aim of TREND DISRUPTORS is to discover and monitor scientific and technical developments that have the potential to DISRUPT a market sector. We look for the best ideas, so that we can generate actionable investment recommendations for our subscribers. As a general rule, our stock recommendations are speculative, and we advise caution, discretion, and thorough research. We strive to identify investment opportunities that can lead to success for the well informed investor.

Stay tuned!

If you are not a subscriber but would like to be, see below for some great Special Offers on all our services.

Trend Letter:

Since start-up in 2002 Trend Letter has provided investors with a great track record, giving exceptionally accurate information about where the markets are going, and it has explained in clear, concise language the reasons why. Using unique and comprehensive tools, Trend Letter gives investors a true edge in understanding current market conditions and shows investors how to generate and retain wealth in today’s climate of extreme market volatility.

A weekly publication covering global bonds, currencies, equities, commodities, & precious metals. Over the 20 years Trend Letter has been published, it has achieved an incredible average return of 65% on its closed trades.

Timer Digest says: “Trend Letter has been a Timer Digest top performer in our Bond and Gold categories, along with competitive performance for the intermediate-term Stock category.”

Technical Trader:

Trend Technical Trader (TTT) is a premier trading & hedging service, designed to profit in both up and down markets. Included is our proprietary Gold Technical Indicator (GTI).

TTT had another excellent year in 2020 averaging +27.3% per closed trade with an average holding time of 9.5 weeks, or +149% annualized overall.

Over the past 5 years TTT’s closed trades have averaged +40% annualized.

Trend Disruptors:

Disruptive technology trends will propel our future and the reality is that no industry will go untouched by this digital transformation. At the root of this transformation is the blurring of boundaries between the physical and virtual worlds. As digital business integrates these worlds through emerging and strategic technologies, entirely new business models are created.

Trend Disruptors is a service for investors seeking to invest in advanced, often unproven technology stocks on the cheap, with the objective to sell them when masses finally catch on. Covering Artificial Intelligence (AI), Virtual Reality (VR), Augmented Reality (AR), 5G, Quantum Computing & many more.

Trend Disruptors has realized average annualized gains of 178% over its 5 years of service.

Special Offers

| Service | Regular Price | Special Price | Saving | Subscribe |

|---|---|---|---|---|

| Trend Letter | $599.95 | 299.95 | $300 | Trend Letter $299.95 |

| Technical Trader | $649.95 | $324.95 | $325 | Trend Technical Trader $324.95 |

| Trend Disruptors | $599.95 | $299.95 | $300 | Trend Disruptors $299.95 |

| Better Deals | ||||

| Trend Letter + Technical Trader | $1,249.90 | $524.95 | $724.95 | Trend Letter + Technical Trader $524.95 |

| Trend Letter + Trend Disruptors | $1,199.90 | $503.95 | $695.95 | Trend Letter + Technical Trader $503.95 |

| Technical Trader + Trend Disruptors | $1,249.90 | $524.955 | $724.95 | Trend Disruptors + Technical Trader $524.95 |

| Best Deal | ||||

| Trend Suite: Trend Letter + Technical Trader + Trend Disruptors | $1,849.85 | $610.45 | $1,239.40 | Trend Suite TL =TTT + TD $610.45 |

Can CRISPR curb COVID ?

We have written before about the use and great potential of CRISPR, the gene editing tool that can be used to alter genes in beneficial ways. The technology can enable the editing of DNA sequences in human genes, aiming to improve the human condition, such as eliminating difficult diseases like cystic fibrosis and cancer.

CRISPR stands for “Clusters of Regularly Interspaced Short Palendromic Repeats” and acts like a pair of scissors to efficiently and accurately edit a gene sequence. The technology has been with us since 2017 and has sparked debate about the ethics of altering DNA, as there is ongoing resistance to genetically modified foods (GMO’s) believing that DNA modification is unnatural and therefore unhealthy. When it comes to disease eradication and control, CRISPR has the potential to deliver major victories, and may succeed in winning the ethics debates.

One of the latest CRISPR developments is the blocking of the SARS-CoV-2 virus in infected human cells. This has been accomplished by Australian researchers in a lab setting and they may soon be starting animal trials. The researchers have published a detailed article in the journal “Nature Communications”

The Australian team has used the CRISPR-Cas13b enzyme, binding it to the relevant RNA sequences on the novel coronavirus, which degrades the genome it needs to replicate inside human cells. The team had designed their CRISPR tool to recognize SARS-C0v-2, the virus responsible for Covid-19 disease. They say that once the virus is recognized, the CRISPR enzyme is activated and chops up the virus. The team targeted several parts of the virus, some that are stable and some that are highly changeable. This technique also succeeded in stopping viral replication in samples of variants of concern. This development holds the promise of an effective treatment for Covid-19, as well as curbing the spread of the virus and its mutations.

As we work our way through the Covid-19 pandemic, scientists discover more and more ways to fight the disease and prevent it. Effective treatments are still relatively scarce, but effective vaccines are a current reality and are not scarce in many countries. Our trust in science and technology is being challenged and eroded by misinformation every day, however, the promise and reality of human lives being saved and diseases being eradicated may serve to restore trust. CRISPR technology may have what it takes to deliver solid benefits and contribute to the betterment of the human condition worldwide.

The aim of TREND DISRUPTORS is to discover, explore, and monitor scientific and technical developments, looking for the best ideas, so that we can publish useful, actionable, investment recommendations for our subscribers. Our stock recommendations are generally speculative in nature, and we advise caution, discretion, and thorough research. TREND DISRUPTORS works hard to identify investment opportunities that can lead to success for the well informed investor.

Stay tuned !

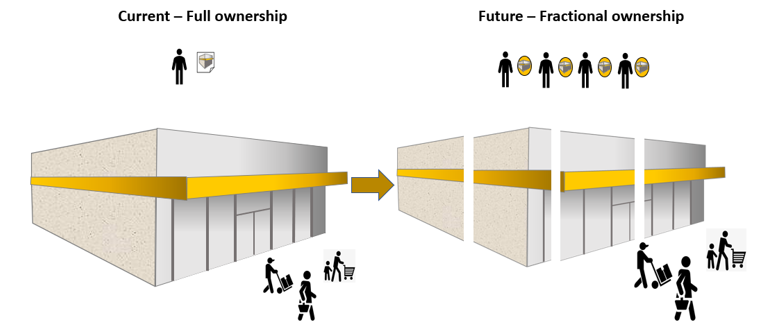

NFT – What’s in it for me ?

Non-Fungible Tokens (NFT’s) have been generating a lot of press lately, as there have been some very large buying and selling numbers bandied about, and some very well known names being associated with these digital assets. So what are they and how do they work?

To understand NFT’s you must start with knowing what non-fungible means. It is a term used widely in trade agreements to describe an asset that is unique, for instance, ancient Grecian Urns are all unique and will always have their own individual value. They cannot be bought and sold at a standard market price for ancient Grecian Urns, whereas a bushel of #1 USA Corn is not unique, it is “fungible” in that every bushel is bought and sold at the same prevailing market price for that grain. Assets managed on a Crypto Currency Blockchain are fungible, for instance, Bitcoins are all the same price at any point in time – not a one of them is unique.

The next thing to know is that NFT’s are digital TOKENS that confer ownership and authenticity of an asset. NFT’s use blockchain technologies, just like crypto currencies, to create, buy, sell, and trade digital properties. Blockchain is based on distributed databases that have many copies, and they have proven to be very secure and easily managed with sophisticated computers. NFT ownership is as reliable as BITCOIN ownership – it is the same technology managing both assets. There is no dispute or doubt about who owns the asset, and no doubt that the asset is the real thing, as it cannot be placed on the chain without being verified multiple times. Once placed on the chain it cannot be manipulated or stolen, as the data is not located on a central database, it is located on many widely distributed databases, making it virtually impossible to manipulate or steal.

Also like crypto currencies, NFT’s are managed through dedicated exchanges, where they manage all aspects of NFT’s, such as creation, buying, & selling. This is another market exchange where you will need to set up an account to get in on the action. The most common crypto currency platform used for NFT’s is Ethereum, but there are other digital currencies in play for NFT’s. Common types of items contained in NFT’s are works of original art, proprietary videos, tweets, GIFs, and sport trading cards. The list of NFT assets is growing rapidly, and has recently included houses and other valuable properties.

As an investment, an NFT is similar to buying a real work of art – the value is not in the holding, but in the re-selling of the asset, at a profit of course. Another way for investors to profit from the NFT craze is to invest in those companies providing the enabling software and infrastructure. There have been many Blockchain projects started, and each one takes us a little further down the road to making digital assets totally mainstream. We are at the point now where governments, who are all desperate to increase revenues, are considering developing their own digital currency and even outlawing the private providers of these assets, such as digital exchanges. When this happens governments will finally have first hand knowledge of all digital currency transactions, and be ready and able to tax them all. Once governments have a taste of that revenue stream, would it be much longer before they will want to tap into, or take over, the very lucrative NFT market?

The aim of TREND DISRUPTORS is to discover, explore, and monitor scientific and technical developments, looking for the best ideas, so that we can publish useful, actionable, investment recommendations for our subscribers. As a general rule, our stock recommendations are speculative, and we advise caution, discretion, and thorough research. TREND DISRUPTORS strives to identify investment opportunities that can lead to success for the well-informed investor. Stay tuned !

Note: A new recommendation was just sent out to subscribers. The previous recommendation is up over 20% in just 10 days. The portfolio is up 14% or 77% annualized. To subscribe, see below for some great Special Offers on all our services.

Trend Letter:

Since start-up in 2002 Trend Letter has provided investors with a great track record, giving exceptionally accurate information about where the markets are going, and it has explained in clear, concise language the reasons why. Using unique and comprehensive tools, Trend Letter gives investors a true edge in understanding current market conditions and shows investors how to generate and retain wealth in today’s climate of extreme market volatility.

A weekly publication covering global bonds, currencies, equities, commodities, & precious metals. Over the 20 years Trend Letter has been published, it has achieved an incredible average return of 65% on its closed trades.

Timer Digest says: “Trend Letter has been a Timer Digest top performer in our Bond and Gold categories, along with competitive performance for the intermediate-term Stock category.”

Technical Trader:

Trend Technical Trader (TTT) is a premier trading service, designed to profit in both up and down markets. Included is our proprietary Gold Technical Indicator (GTI).

TTT had another excellent year in 2020 averaging +27.3% per closed trade with an average holding time of 9.5 weeks, or +149% annualized overall.

Over the past 5 years TTT’s closed trades have averaged +40% annualized.

Trend Disruptors:

Disruptive technology trends will propel our future and the reality is that no industry will go untouched by this digital transformation. At the root of this transformation is the blurring of boundaries between the physical and virtual worlds. As digital business integrates these worlds through emerging and strategic technologies, entirely new business models are created.

Trend Disruptors is a service for investors seeking to invest in advanced, often unproven technology stocks on the cheap, with the objective to sell them when masses finally catch on. Covering Artificial Intelligence (AI), Virtual Reality (VR), Augmented Reality (AR), 5G, Quantum Computing & many more.

Trend Disruptors has realized average annualized gains of 178% over its 3 years of service.

Money Talks - Special Offers

| Service | Regular Price | Special Price | Saving | Subscribe |

|---|---|---|---|---|

| Trend Letter | $599.95 | $399.95 | $200 | |

| Technical Trader | $649.95 | $399.95 | $250 | |

| Trend Disruptors | $599.95 | $399.95 | $200 | |

| Better Deals | ||||

| Trend Letter + Technical Trader | $1249.90 | $699.95 | $549.95 | |

| Trend Letter + Trend Disruptors | $1199.90 | $699.95 | $499.95 | |

| Technical Trader + Trend Disruptors | $1249.90 | $699.95 | $549.95 | |

| Best Deal | ||||

| Trend Suite: Trend Letter + Technical Trader + Trend Disruptors | $1849.85 | $799.95 | $949.90 |

Hands Free ? – no, not really

There are many uses for biometric security measures, using scanners that recognize a person’s fingerprints, thumbprints, and iris, for example. Hand-held wands and full body scanners are quite commonplace in airports, and other locations where security is important for detecting and mitigating risk. Most of us accept the need for this technology, even though it may seem somewhat invasive. We live in a world where threats are more common, and most people are willing to give up an ounce of privacy to gain a pound of security. Biometric scanning technology has advanced a great deal in recent years, but can scanning technology do more than detect risk or provide secure access to a facility? Amazon thinks it can.

In 2019 Amazon developed a patented scanning technology that takes biometrics in another direction, where your palm serves as your credit card. The original scan of your palm, saved on a secure Amazon cloud server, becomes your verification for purchases on your Amazon credit account. The scan apparently includes many details of your palm, such as lines, creases, veins, bones and other structural features beneath the skin. The Amazon palm scan is proprietary and patented, so deep dive technical details are not available. Amazon is now testing the system in a Whole Foods store in Seattle, after successful use in several Amazon Go stores last year. This new payment system is named AMAZON ONE.

The union representing many Amazon workers claims that this technology is another way for Amazon to eliminate jobs, so job security is part of the discussion, but so is system security. Experts in cyber security point out some of the risks inherent with this system. First is the security of the cloud server, as a hack of the server could expose your palm scan, and lead to that scan being stolen and used nefariously. Other credit verification systems use “replaceable” items, so that if the item is ever compromised it can be replaced. For example, if your credit card is compromised, the card provider will cancel the compromised card and issue a new card with all new numbers, and most providers will guarantee no loss to you if the card is lost, stolen, or otherwise compromised. That’s a very solid system, but what can be done about a compromised palm print? Probably not much, seeing as we all want to keep our palms right where they are – no one is going to easily issue a new one for you. We all know about book and movie plots where thumbs, fingers, and eyes are “removed” from their owner in order to gain access to a facility secured with biometric scanners. The plots might get a little more bizarre now that palm scans are in the mix.

There are two main drivers for the Amazon One system – convenience, and the perceived need for contact-less purchase verification during a pandemic. The palm reader works by hovering your hand over the reader without touching anything, which meets the need for “no contact”. On the convenience side, this technology allows the customer to make a purchase, on credit, without carrying a credit card, or a wallet or purse to carry it in. We expect the “technology for the sake of convenience” debate to scale up a bit more, now with Amazon One to illustrate a point.

The aim of TREND DISRUPTORS is to discover, explore, and monitor scientific and technical developments, looking for the best and brightest ideas, so that we can publish useful, actionable, investment recommendations for our subscribers. These kinds of recommendations are speculative, and we advise caution, discretion, and thorough research. TREND DISRUPTORS strives to identify investment opportunities that can lead to success for the well informed investor. Stay tuned !