Trend Letter Updates

Market Charts – March 1/22

(From CNN)… March is looking a lot like January and February on Wall Street. That’s not good news for investors. The Dow fell nearly 600 points Tuesday, or 1.8%, one day after stocks capped off their second straight month of declines to start the year. The Dow managed to finish off its lows of the day though. The Nasdaq and S&P 500 were […]

Market Charts – February 28/22

Yesterday, the US and its allies ramped up their sanctions against Russia when they announced that certain Russian banks would be shut off from SWIFT. That’s a global messaging system used by banks worldwide to conduct their business and issue payments. It’s a key system when it comes to a country’s ability to participate in […]

Market Charts – February 24/22

The market was initially spooked by Moscow’s invasion against neighboring Ukraine early Thursday morning local time, using land, air and naval forces. The S&P 500 was down as much as 2.6% during the session but closed up 1.5% higher despite the outbreak of violence. As we had been highlighting, if the S&P 500 tests the 4200 level […]

Market Charts – February 23/22

(From Yahoo Finance)…Stocks extended losses on Wednesday after a steep sell-off during Tuesday’s trading day, which pushed the S&P 500 and Dow to their lowest settlements so far of 2022. The S&P 500 wiped out early advances to trade sharply lower in afternoon trading. The blue-chip index had also closed lower by just over 1% […]

Market Charts – February 22/22

The S&P 500 on Tuesday fell into a correction for the first time in two years, joining the Nasdaq Composite, as Russia sent troops into pro-Russian regions in Ukraine. The S&P 500 index SPX, closed at 4,304.76, below the correction level at 4,316.91, which would represent a 10% drop from its Jan. 3 record close. […]

Market Charts – February – 21/22

North American markets were closed today, but we wanted to give investors a heads up as we head into a new week of trading. As we have been highlighting the last couple of weeks, near-term support for the S&P 500 sits at 4300, then 4200 (green horizontal lines on chart). As Martin highlighted in his […]

Money Talks interview with Martin Straith

Martin was the guest on Michael Campbells’ Money Talks podcast this weekend. Topics included how to protect your investments and investing in Psychedelic therapies.

Market Charts – February 18/22

Stocks extended declines Friday to close a second straight week in negative territory with geopolitical tensions intensifying to contribute to a further risk-off tone in markets. The S&P 500 fell 0.71% to 4,348.97, building on a 2% loss in the previous session, while the Dow Jones index closed down 0.68% to 34,079.12 after erasing 1.8% […]

Market Charts – February 15/22

The S&P 500 closed higher by 1.6% in its first rise in four sessions. The jump came amid an announcement from Russia that it had pulled back troops near Ukraine and was seeking to continue diplomatic efforts with the West. However, President Joe Biden said during a news conference Tuesday afternoon that a Russian invasion […]

Market Charts – February 14/22

Stocks fell Monday as investors eyed the escalating threat of Russian invasion in Ukraine alongside ongoing concerns over inflation and an aggressive move toward policy tightening by the Federal Reserve. The S&P 500 came off session lows but still ended in the red to extend losses after last week’s roller-coaster sessions on Thursday and Friday. […]

Market Charts – February 11/22

(From Yahoo News)…Stocks added to Thursday’s losses as jitters over a swift tightening of financial conditions increased on the heels of a multi-decade high print on inflation. Fresh geopolitical concerns between Russia and Ukraine further weighed on stocks and sent oil prices soaring to a fresh seven-year high. The S&P 500, Dow and Nasdaq fell […]

Market Charts – February 10/22

Stocks sold off and yields climbed after the Bureau of Labor Statistics’ January Consumer Price Index (CPI) showed the biggest annual jump in inflation since 1982. The surging 7.5% jump in prices escalated calls for the Federal Reserve to raise interest rates more aggressively than previously expected and begin rolling assets off its balance sheet, in moves […]

Market Charts – February 8/22

The S&P 500 was up ~38 points today, but the markets are still quite nervous. Watch the 4600 level as near-term resistance as our model sees this as a key short-term resistance level and if we can’t push past this level we could see the market start to break down with a potential near-term low […]

Market Charts – February 7/22

Stock turned lower to close a choppy session at the start of another busy week for corporate earnings and fresh economic data, as investors continue to assess the Federal Reserve’s path forward for monetary policy. The S&P 500 declined after posting its best weekly rise of the year last week. The Dow traded little changed, […]

Market Charts – February 2/22

The S&P 500 managed to clock in another solid gain today, its fourth consecutive after the big sell-off in January. Better than expected earnings from Alphabet were the main driving force for today’s gains, but disappointing jobs data and a big earnings miss after the close from Meta (previously Facebook) could cause a setback tomorrow. […]

Market Charts – February 1/22

With all the chatter about inflation it is interesting that the Atlanta Fed’s first two forecasts for 2022 call for 0.1% growth, far below what mainstream economists are saying. The Atlanta Fed is unique in that their forecasting method only uses available data, and not projections for future data used by most other economic forecasts. […]

Market Charts – January 31/22

Since 1950, the market followed its January performance 85% of the time. As we can see on the chart, this January is a down month, suggesting the year will be a down year. But interestingly, in the previous two years the January performances were down, but the performance for the rest of the year were […]

Market Charts – January 27/22

The market continues to struggle making any gains and seems to still be very concerned with the US Fed plans to start tightening and raising rates. We continue to see wide volatility, with the market unable to hold intra-day gains, nor does it want to close on the lows. Intra-day we are seeing investors selling […]

Market Charts – January 25/22

Equity markets had another down day, unable to rally above yesterday’s close, suggesting the near-term bottom is not likely in just yet. Tomorrow is the Fed meeting where Powell will take questions from the press and he will likely try to calm the markets, but must also address the inflation problem. The Fed is really […]

Market Charts – January 24/22

In our last Trend Letter, we noted that the key support level for the S&P 500 was 4200 and if it hit that level, we could expect a solid rally. Today, the S&P 500 dropped close to that 4200 level at 4222, before rallying to close the day at 4410. Watch the 4435 (first red […]

Trend Technical Trader Subscriber Only Updates

Nothing Found

Sorry, no posts matched your criteria

Trend Disruptors Updates

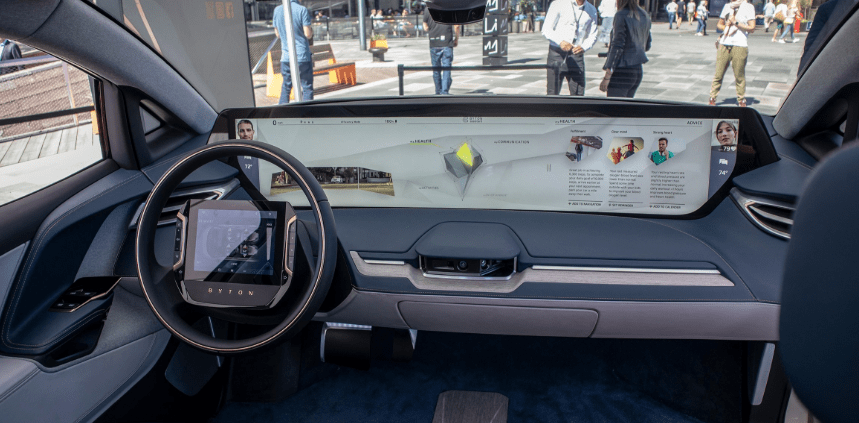

What’s up inside your car?

We have written quite a lot about disruptive technology in new cars, whether they are production models, prototypes, or drawing board concepts. As each new feature is unveiled, we usually hear some “WOWS” and also some skepticism until the feature is proven and accepted. Once accepted, the new feature can quickly move into the “must have” category. One current feature that is not well known is the “inward facing” camera, an innovation being considered by Cadillac, Tesla, Audi, and Volvo. At this point, no car has this feature activated. Clearly there are two sides to how this innovation will be viewed, and those two sides are becoming very familiar:

- this innovation is great because it gets to know me, help me, and make my life easier and more convenient

- this innovation is bad as it intrudes into my private space to discover, and potentially share or reveal, information that I consider to be private

By now, we should all be aware of the trade-offs that technology can often introduce into our lives. Given the success of products like GOOGLE Home and AMAZON Alexa, it’s very clear that the masses are buying the “convenience” aspects of technology, even though there are many who caution us about the loss of personal privacy and the dangers of your personal information being used against you, such as Identity Theft. There are ongoing developments in the “information privacy” arena, and those technologies could also provide investment opportunities which we will assess carefully. To get a sense of where we might be headed, click here.

So, what is it that an inward facing camera can possibly do, as it observes you and passes info along to all the vehicle systems? For starters it can positively identify who is in the vehicle, especially in the driver’s seat, and activate all the preferred settings of this driver. It could monitor the mood of the driver, and monitor health indicators, like glucose levels indicated in eye pupils. For mood alteration the system could activate appropriate settings for the drive to work, like music or podcasts to motivate and energize, and on the drive home from work, activate calming music or meditative mantras. If your health indicators go off the charts, the vehicle systems could notify your family, your doctor, the hospital, or 911 emergency services. There are also some simple convenience issues that a camera could help with, like notifying you that items such as your wallet, computer, or phone are being left behind as you exit the vehicle.

As ever, the driving force behind many of these innovations is to discover and collect information about you, and of course there are all those Privacy Policies that each privacy invader wants you to agree to. As mentioned above, the trade off is that they will give you some level of “convenience” and you will give them many personal insights about you and everyone else riding in your vehicle. Those personal insights will help them to advertise effectively and very soon try to sell you even more of the stuff they have designed, and will design, to make your life even more convenient.

If you want to see what vehicle technology may look like very soon, take a peek at the BYTON electric vehicle on display at the global technology conference in Las Vegas – a dashboard screen that is the size of seven I-Pads, a floating steering column screen for the driver, and a consul mounted screen for the passenger. EV interiors have never looked as dazzling as this.

Let Trend Disruptors be your guide to the future, as we continue to identify technology investment opportunities that can lead to financial success.

Stay Tuned!

Can Healthcare be better with AMAZON ?

Many industries and market sectors are, or are about to be, disrupted by the introduction of Artificial Intelligence (AI). Healthcare is a very large industry and market sector in most developed countries, often being the first or second largest national budget item. There are big dollars in play here. The healthcare digitization market is estimated to be worth about $300B annually and there are several health-information-technology companies already serving this market, like Cerner, Optum, Medidata, Epic, Viva, and IQVIA. So, is there room for a disruptive new kid on this block?

Amazon has announced a new service called Amazon Comprehend Medical. They made the announcement in November, and the objective is to help hospitals, insurers, and pharmaceutical companies analyze all the health record data they have. This service would use AI to sift through all medical data, structured and unstructured, to pull out information such as diagnoses, symptoms, and treatments. Amazon also thinks that AI analysis could be a big help in many areas, such as clinical decision support, revenue cycle management, clinical trial management, plus building population platforms and fulfilling privacy mandates. This has been tried before by some big players, like Microsoft’s Healthvault and Google Health, both failing to deliver much to the market so far. The stakes are high and it will be tricky for Amazon to tap into the health-IT space, where heavy hitters like Cerner and Optum have been laying the groundwork for many years already. Amazon may have to rely somewhat on existing customer recognition and trust in order to penetrate this market, and they may need to touch on many parts of the healthcare universe before gaining a foothold.

Amazon acquired PillPack in June, an online comprehensive pharmacy service, and has plans for a joint venture with JP Morgan and Berkshire Hathaway to supply hospitals with health equipment. This may serve to get a foot in the door and allow Amazon to enter and disrupt this market sector.

Several companies have a budding awareness of how AI can assist all Healthcare systems and the breadth and depth of ideas is impressive. These ideas include many groundbreaking possible deliverables, such as:

- Accurately predicting atrial fibrillation events

- Confirming that a specific treatment was effective for a specific condition in a specific patient

- Very early prediction and detection of diabetes

- Putting these new tools in doctor’s offices and hospitals for the immediate benefit of patients

- Presenting treatment options and plans based on AI analysis of all the data

- Earlier detection of specific health conditions, like cancer and eye disease

As these companies explore more of the capabilities of AI, the number of ideas and benefits will grow, however, there will be some interesting dynamics when health insurers look at the situation and have to decide whether or not to cover the cost of medical “predictions” or “ suggested new treatments”. No one is saying that Healthcare is simple – even the US President said “It’s an unbelievably complex subject. Nobody knew that Healthcare could be so complicated”

Let Trend Disruptors be your guide to the future, as we continue to identify technology investment opportunities that can lead to financial success.

Stay Tuned!

WAYMO versus UBER / LYFT – How Much?

As of right now GOOGLE / WAYMO has begun monetizing some of their self driving vehicles. Development of WAYMO self driving vehicles has been ongoing for over 10 years, and includes cars and trucks, as each is seen to have commercial potential. In four suburbs of Phoenix Arizona (about a 160 km zone) self driving WAYMO ONE taxis are now in operation. Generating revenue after all these years of development and testing is a significant milestone, and puts WAYMO ahead of rivals like GM’s Cruise Automation, and Uber Technologies. All players in this field will certainly want to attract and keep customers and begin to recoup the money invested in the technology so far.

So, how does a customer use the WAYMO ONE taxi service? First, you need to download the WAYMO ONE app and provide credit card details, and then you can use the app to notify the service of your needs, providing your location and a destination. Much like UBER and LYFT, the app will provide a price quote and a time for pick-up. The service is touted to be operating 24 hours a day, however, it is available now only to a few hundred residents who signed up last year, and the exact number of taxis in operation has not been revealed by WAYMO. For cost comparison, the WAYMO charge for a 15 minute ride (about 3 miles) is $7.60, whereas the comparable LYFT charge is $7.20.

At this time WAYMO ONE taxis include a human in the driver’s seat, to intervene only in emergencies, and there is the app or in-car console to link passengers to a WAYMO ONE agent for answering questions and documenting comments. Some report that the ride is a little slow and sometimes jerky. WAYMO works with passenger feedback to help refine all aspects of the WAYMO ONE taxi experience. Only a handful of other startups have monetized driverless technology, in small ways, such as Boston’s OPTIMUS RIDE that has contracts to provide driverless vehicle services in enclosed, low speed environments, like gated business parks and seniors facilities.

There are still significant challenges to making a buck in the autonomous vehicle space. All across the USA there are many laws and regulations that fail to provide a coherent framework for designing the vehicles or the software applications needed to put them to work on their own. Estimates are that over $1 billion has been spent on driverless technology, and over 10 million miles have been traveled. Still, everyone is proceeding with great caution, wanting to ensure that the early adopters have only safe and satisfying experiences, generating enthusiasm, curiosity, and confidence. Given all that, the sky seems to be the limit for this exciting, disruptive technology.

Let Trend Disruptors be your guide to the future, as we continue to identify technology investment opportunities that can lead to financial success.

Stay Tuned!

Are you ready for the Third Wave?

Market cycles tend to happen in waves, and technology companies have become a bigger and bigger part of recent market waves. Since about 1989, many tech companies have pushed their way into the top ranked firms in terms of capitalization, profits, and investment success. In the early days, it was just IBM and Microsoft. As internet developments matured there was much more success spread around, with the likes of Bing, Amazon, and Yahoo joining in. This was the First Wave, and it gave us the internet boom of the 1990’s and those wild boom and bust investments in the technology sector.

The first wave was exciting – a time of over-the-top speculation, but the innovations eventually caught on with consumers, in a very big way, and profits started to roll in, also in a very big way. This paved the way for a second wave.

The iPhone was the catalyst and poster child for the Second Wave, as tech companies are all striving to greatly improve their communication networks and the convenience of being constantly “in touch”. There are also great efforts being made for information to be more convenient, more personal, and more manageable. Making sense of all the available data is a huge challenge, as there has been a gigantic tidal wave of data produced recently. IBM estimates that 90% of the data in the world has been produced in the last 2 years, so how do we figure out what to read, what to believe, what to trust?

A part of the solution is to make the data more personal, so that systems get to know you, and vice versa. Examples include:

- NEST thermostats that learn when you are home or away, and what temperature you’re comfortable with when you are home

- Music systems like SPOTIFY and PANDORA that learn your listening preferences and help you discover new music you will probably like

- Trip planning websites that learn your travel adventure interests and devise specific trip plans just for you

- GOOGLE Home and Amazon Alexa / Echo devices that interact personally with you and make efforts to help you through your busy day

And then there are all those APPS that help us to manage our day, like UBER , LYFT, Weather Channel, or communicate with others via Snapchat, Instagram, Twitter etc. All are trying to lessen the effort and worry about everyday tasks, although there is a growing concern about the surrendering, stealing, and mismanagement of such a large amount of our personal information – advertisers, scammers, and governments want more of it every day. When technology does its job well, users benefit in that they spend less time managing tasks and chores and spend more time doing things they really like. As the Second Wave matures, innovations come along that assist and support us in decision making, critical thinking (information discernment), and time management. The Second Wave brings us a plethora of helpers that ease our everyday lives with small and useful touches.

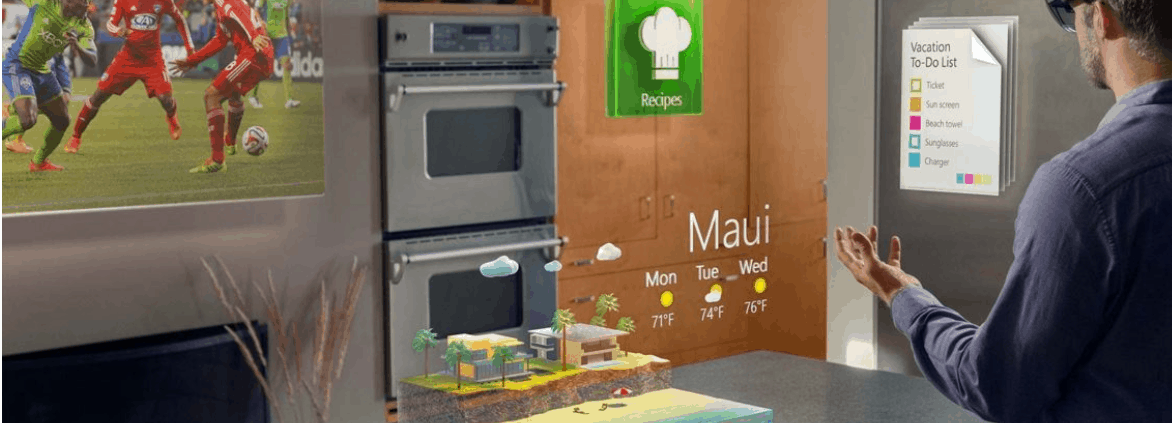

So what about the next wave – The Third Wave? We are now seeing this wave starting to form. Each wave starts with an innovative catalyst, leading to more innovation, speculation, and investment opportunities. There will be winners and losers along the way, but when the wave breaks, huge profits will be made by those who have the best information and analysis. A possible catalyst for starting this Third Wave is Augmented Reality (AR), with innovations that could transcend the iPhone and all Smartphones, making them obsolete. AR is different than Virtual Reality (VR) in that AR overlays graphics and images on top of the real world around you, something like the Pokemon Go game that became wildly popular on Smartphones a few years ago. AR is also the technology that fighter pilots use for the Heads-Up-Displays (HUD) in the cockpit of their jet fighters. If you put advanced AR capability into a pair of glasses, with voice, gesture, or eye movement controls, then every current Smartphone capability could be accomplished with a pair of glasses. Google glasses first appeared in 2013 and the project morphed into Google Glass Enterprise in 2017. Recently, a highly valued private company, Magic Leap, released an AR headset called Magic Leap One. These are first generation devices and have yet to achieve significant consumer adoption. Much like waves One and Two, Third Wave innovations can sound like science fiction, but we tend to always underestimate the speed of progress and the depth of amazing ideas and devices that are bound to change our lives.

The Trend Disruptors team analyzes new technologies and identifies the companies that stand out in terms of investment potential. These companies may be large or small. The best and most promising generate Trend Disruptors Premium recommendations. We are watching a broad range of companies and technologies, all striving to disrupt specific market segments and/or be part of the next wave.

Let Trend Disruptors be your guide to the future, as we continue to identify technology investment opportunities that can lead to financial success. Subscribe today for just $599.95 $399.95, a $200 savings. Click Here to subscribe at this special rate.

Stay Tuned!

How shall we communicate?

There are many ways to communicate, and big improvements are underway to dramatically increase the overall volume and speed of data communications. Starting with the volume of information to be communicated, there are several technologies that will potentially process more data at higher speeds than ever thought possible. Quantum computing is a holistically new way to solve difficult problems based on the principles of quantum physics. This is where high-end computing is heading, giving us a sense of how super computers, super data centres, and super cloud networks will look and operate. The research investment already tops $10b US, being led by USA, China, Australia, the European Union, and many other countries. Google, IBM, and Intel all want to transition the technology into commercial services and products, targeting applications in data analytics, logistics, engineering, and software automation. Today’s best quantum computing systems are being developed in research laboratories; however, they have not yet succeeded in justifying long-term growth or producing commercially viable products and services. Like many new technology developments, some will be in our hands tomorrow, some next week, some next decade. And some may not ever get off the test bench – that is the nature of disruptive technology.

One way or another the amount of data we will have at hand is going to increase and the ongoing challenge is to manage all that data effectively. Managing it requires effective storage and communication solutions. The preferred method for data storage is the cloud, and the preferred method for global data communications is satellite transmission. New technologies that can improve on the status quo will be in high demand. In the processing and storage field there are several developments that hold promise, such as new and more efficient enterprise database designs, and new cloud networking solutions, some based entirely on satellite networks. Amazon’s Web Services (AWS) segment needs all these new solutions in order to grow their business around the globe. As partnerships form to seamlessly integrate these services, global expansion becomes more efficient and a must-do for many multi-national corporations.

The Trend Disruptors team is watching new technologies and identifying the companies that stand out in terms of investment potential. These companies may be large or small, and some of the small start-ups will make the grade and succeed, either on their own or by being acquired by larger organizations. The best and most promising will generate Trend Disruptors recommendations. We are watching a broad range of companies and technologies, all striving to disrupt specific market segments and industries.

Let Trend Disruptors be your guide to the future, as we continue to identify technology investment opportunities that can lead to financial success.

Note we will be posting a couple of new recommendations this week to subscribers of Trend Disruptors Premium. If you would like to subscribe to Trend Disruptors Premium and receive all of the recommendations we are offering a discount rate of $399.95, a discount of $200. To take advantage of this special rate Click Here

Stay Tuned!

How “autonomous” will it get?

If you have a newer car, you may already be using features like adaptive cruise control, park in/out assist, lane control assist, pilot assist etc. These features typically use cameras, radar, and lasers to determine your situation, and then invoke artificial intelligence (AI) to “manage” your situation, such as applying the brakes, accelerating, and/or turning the steering wheel. All of these features move us along the road to more and more autonomous operation of a vehicle. So how far along that road are we going?

There are several major players in the autonomous vehicle field, and here is a sampling of what they are doing lately:

TESLA – they call it “Autopilot”, but the term is a little ambitious, as the driver should always be attentive and responsive in situations where the system gets into trouble. So much depends on there being reliable road and lane markings so the cameras can always “see” where you are and make appropriate decisions. If road markings are faded or non-existent, the system cannot function effectively. The latest version of TESLA “autopilot” includes the ability to link Navigation with Autopilot, giving it the ability to select and maneuver the correct highway entrances and exits. For TESLA cars without “autopilot” built in there is an aftermarket product that owners can install themselves to provide similar capabilities – – COMMA AI’s Open Pilot, paired with the EON Dashcam DevKit.

HONDA / GM – these two giants are teaming up to bring us the next generation of autonomous vehicles. Honda plans to invest $12b over 12 years in the GM subsidiary, “CRUISE”. Putting out a fleet of self driving versions of the Chevy Bolt EV is already in the GM/CRUISE plans. Partnering with Honda, they plan to develop fully autonomous vehicles, not based on any existing car. Initially targeting USA, the fully autonomous vehicles are planned with no steering wheel or pedals, prompting a re-think of laws and regulations.

GOOGLE / WAYMO – Started by GOOGLE in 2009 and spun off as WAYMO in 2016, these guys have the most autonomous miles under their belt, stating that their vehicles have gone over 9 million miles to date, and are adding about 25,000 more each day. They have an “early rider” program underway in Phoenix, Arizona on public streets. Based on WAYMO’s Safety Report, most of those miles have been quite safe. See the Report here: https://storage.googleapis.com/sdc-prod/v1/safety-report/Safety%20Report%202018.pdf

Also have a look at the WAYMO video here: https://waymo.com/tech/

Other major carmakers have jumped aboard, offering many of the popular autonomous features. Companies like Nissan, Hyundai, Volvo, and Toyota now highlight these features in their marketing, touting them as must-have “safety” features. Also driving these developments are other transportation industry giants, such as UBER, who see a great opportunity to increase profits by eliminating their need for drivers. Some analysts have predicted that if all vehicles began operating with advanced AI autonomous capabilities tomorrow, then traffic accidents, injuries, and deaths would be immediately reduced by over 90%. Given that there have been at least 2 deaths involving autonomous vehicles, it may be a while before the masses will totally accept these vehicles on the streets of their cities, let alone in their garage, ready for their family’s daily use.

As stated previously, the Trend Disruptors team will be analyzing new technologies such as autonomous vehicles, and identifying the companies that stand out in terms of investment potential. These companies may be large or small, but much like the internet boom of the 1990’s many of them will make the grade and succeed. The best and most promising of them all will generate Trend Disruptors recommendations. We will be watching a broad range of companies and technologies, expecting that there will be everything from small start-ups to large corporations, all striving to disrupt specific market segments and industries.

Let Trend Disruptors be your guide to the future, as we continue to identify technology investment opportunities that can lead to financial success.

Stay Tuned!

Alphabet/Google becoming AI Centric to secure foothold & dominate digital user experience

High Tech corporations have invested a lot in technologies that produce large amounts of revenue, and with the increasingly rapid advancements in technology, these corporations must invest even more in order to protect their rich revenue streams. A good example of a corporation reaching further and further into the future is Alphabet, the parent company of Google. Search engine and advertising are the cornerstones of Google revenue, and they want it to keep flowing, so Google /Alphabet has identified several areas they consider to be important in securing a high revenue future for themselves and their investors. Alphabet has spread projects and initiatives throughout Google and their other entities, and many of these initiatives point to the important role of AI in their future, and by extension, our future too.

At the heart of their strategy is the idea of being AI Centric. With this approach, they anticipate maintaining a leading role with their core business (search and advertising), as well as delving into areas where they see opportunities for improvement or disruption using an AI approach. Here is a brief overview of some of the newer areas Google / Alphabet hopes to fully capitalize on in future.

- Cloud Computing Services: Google wants to grow their share of the cloud market. They currently rank third, after Amazon and Microsoft, however they have been expanding their presence through a number of strategic investments, acquisitions, and internal initiatives, to better compete with rivals in this space. Currently, Google cloud business is growing at a faster pace than the competition. Products and services to watch are G Suite, a new chip called the EDGE TPU that can carry out machine learning processes on Internet of Things devices, and they have some cloud supported Blockchain projects on the go with strategic partners. An important aspect of Cloud computing is Security, and this too is a new area of focus for Google. As of January 2018 Google spun off Chronicle, to be the cybersecurity arm and work towards a ‘digital immune system”. Businesses are generating more and more information every day and will require more complex computers, and incremental computing infrastructure. Google believes this can be handled through the AI machine learning capabilities they are developing.

- Transportation and Logistics: Google /Alphabet anticipate opportunities to continue the disruption in this sector. Investments include LIME, a scooter company, as well as UBER, LYFT, and a few other ride hailing services. This sector also includes autonomous vehicles, causing serious disruption in the trucking industry, as well as with people moving vehicles. Alphabet has their WAYMO business arm, and their autonomous vehicle miles driven are the most in the world (8 million miles). WAYMO has said that they intend to use semi-autonomous trucks to deliver freight to its data centres in Atlanta. Google’s drone delivery company, Project Wing, has become an independent company under the Alphabet umbrella, and has completed some drone deliveries in Australia. Products and services like these all make use of AI technologies that Google / Alphabet are developing rapidly.

- Emerging Markets: Google continues to expand in India and SE Asia, two regions experiencing fast growth in internet usage. Google has participated in funding for an Indonesian ride-hailing company giant called GO-JEK, which is similar to UBER, but also provides food delivery services and a mobile payment platform. In India, Google has invested in a personal concierge and delivery service platform, and TEZ, a free mobile wallet that allows users to make payments directly from their bank account. This is all a big part of Google’s attempt to become an integral part of commerce in India. Despite historic setbacks and tensions, Google is also focused on China, making more investments in that country, such as com, China’s second largest e-commerce platform, and Chushou, a China-based gaming firm.

- Healthcare: Alphabet intends to advance healthcare effectiveness through better data processing using AI. Alphabet’s life science subsidiary, VERILY, concentrates on disease detection, a crucial part of effective health care. Google is leveraging its’ abilities in AI to improve healthcare data management, and their AI focused subsidiary, DeepMind, has an app called “STREAMS” that helps to detect kidney injuries based on lab results, so doctors can be alerted quickly via the mobile app and promptly escalate urgent cases.

AI is critical to Alphabet’s long-term outlook as it is the thread that runs through search and advertising, cloud computing, autonomous driving, healthcare, and many of the company’s other endeavors. This includes the exploding market for digital assistants and Smart Home products. Consumers can already choose among big competition, like Apple (SIRI) and Amazon (Alexa). Google wants to win this market, and every other market it delves into. We see that Google/Alphabet is on the leading edge of AI technology, making more and more investments to protect and expand their revenue streams. Many other industries will be affected by AI developments, and many will be in ways we have not yet imagined. The breadth and pace of tech change will continue to increase. Let Crypto Trend be your guide to the future, as we continue to identify technology investment opportunities that can lead to financial success.

Stay Tuned!

Will Artificial Intelligence be a threat, a boon, or both?

There is a case to be made for our current crop of emerging technologies to be called the Fourth Industrial Revolution (4IR), and as Trend Disruptors readers know, this crop includes Blockchain, 5G, and quantum computing. We also need to include a few others, to broaden our scope of disruptive technologies – – things like robotics, autonomous vehicles, and potentially the most disruptive technology of all, Artificial Intelligence (AI).

There are some (Neo-Luddites) who warn of the negative consequences of AI, and want to shun all AI development. Warnings and cautions are sometimes coming from credible sources, and often raise interesting questions. AI is so all encompassing that many questions need to be asked, and answered very carefully. Consider the following from billionaire hedge fund manager, Ray Dalio of Bridgewater Associates:

“I got a good question about how the proliferation of AI and algorithmic decision making will affect jobs and about the possibility of universal basic incomes eventually impacting humans’ ability to continue to derive meaning and self-purpose from work. My view is that algorithmic/automated decision making is a two edged sword that is improving total productivity but is also eliminating jobs, leading to big wealth and opportunity gaps and populism, and creating a national emergency. Largely as a result of it, capitalism is not working for the majority of Americans and is in jeopardy. Yet no one is seriously examining what to do about it. I don’t believe that transferring money to people who are unproductive is good for the people or the economy, unless there are no other good alternatives. I believe that it’s both far better and it’s possible to find ways for making most of these people productive. I think that a national emergency should be declared, a special commission created, and metrics established to come up with programs and measurements to make work improvements that more than pay for themselves and measure the changes that are taking place. I know of many cost effective ways that improvements that pay for themselves can be made and I’m sure that many others know of many more ways. Productivity is good for everyone. Unfortunately, it’s not available to everyone. That has to change. We need leadership that can bring that about. Unfortunately, it is more likely that nothing along these lines will be done and, in the next economic downturn, the haves and have-nots will be at each other’s’ throats, fighting over income redistributions rather than working together to make plans to make most people productive. For that reason, I’m worried about the health of capitalism and democracy.”

The concerns raised here affect pop culture, politics, and the whole financial world. Could it be that we come to a point where human usefulness runs out? Unlike the industrial revolutions of the past, AI may not just allow machines to outperform our physical abilities, but our mental abilities as well. These are sobering thoughts that will need careful analysis, answers, and management. Humans should have infinite control in terms of how our relationship with machines will be, with the ideal that AI will exist only and entirely to serve us. And we will need to determine how to distribute needed resources amongst ourselves in a fully autonomous society. AI is going to change the structure of humanity, and in the next decade the way many of us live and work will look entirely different.

We will need to fine tune our investing and wealth management strategies, to keep pace with all the disruptive forces coming our way – FAST !!.

At Trend Disruptors, we are keeping a sharp eye on several companies that are making moves in the emerging technology sphere. We strive to keep you up to date with the latest technology developments and related investment strategies that lead to success.

Stay Tuned!

Will Crypto prices bounce back?

For the past few weeks Crypto Currencies (CC’s) have been in a downturn, and the causes of the fall are myriad, and out of synch with the overall investment market. While downturns are not immediately profitable for investors, they are an indication that CC’s are every bit as susceptible to geopolitical market forces as any other investment. June was a particularly brutal month, with the CC market cap dropping about 41% – – a very strong reaction to world events, a stronger reaction than we saw in the mainstream equity markets. So is this the time to make an investment in CC’s , buying on the dip here? The bottom may be in if geo political events do not escalate or shift into even less stable territory. Markets do not like uncertainty or instability. As with Wall Street, a bounce back for CC’s will depend on there being more well defined, well reasoned, and less contentious political moves within nations with medium to large size economies. Currently, Wall Street has shrugged off most of the trade war news, and rightly so, as the size of all the new trade tariffs, so far, is small when compared to the overall size of global GDP’s.

As well as Market Cap, another factor to carefully watch with CC’s is Market Volume. Currently, Bitcoin volume is struggling to stay above $4 billion, which is significantly below the more often seen $7 to $10 billion, when Bitcoin prices were in the $10,000 to $12,000 range. In a period of geopolitical uncertainty, all markets reflect the understandably nervous feelings of investors. Many Bitcoin investors expect prices to rise substantially in Q4, and watching daily volumes is one way that we will see this coming, and alert our readers to a great investment opportunity if one emerges. Similar to the 2014 correction, the CC market will need to experience a period of stability and recovery before surging to previous high levels, and that could take another four to five months. In the meantime, politics and regulatory gyrations will certainly continue, which makes the CC market place both exciting and challenging.

At Crypto Trend, we strive to keep you up to date with the latest technology developments and investment strategies that lead to success.

Stay Tuned!

When will Cryptos & Blockchain really explode?

Crypto Currencies

Every day there is more news about what can, may, and should happen in the world of Crypto Currencies (CC’s) and Blockchain. There has been significant investment, research, and lots of chatter, but the coins and the projects are still not mainstream. They have not yet delivered the explosive changes envisioned. Many ideas are being discussed and developed, but none have delivered big game-changing results. What may be needed is for big industry players, like IBM, Microsoft, and the large financial services corporations to continue forging ahead in developing useful Blockchain applications – ones that the whole world can NOT live without.

Financial services are a ripe target for Blockchain projects because today’s banking systems are still based on archaic ideas that have been faithfully and painfully digitized, and because these systems are archaic, they are expensive to maintain and operate. Banks almost have a good reason to charge the high service fees they do – their systems are not efficient. These systems have many layers of redundant data, as everyone involved with a transaction has to have their version of the transaction details. And then there is the business of ensuring that there is a trusted third party to clear all these transactions – requiring even more versions of the same data. Blockchain technology holds out the promise of addressing these issues, as each transaction will be captured in just ONE block on the chain, and because it is a distributed database, security and integrity is built-in and assured. It may take some time to build up trust in these new systems, given that the verifiers of Blockchain transactions are not the traditional clearing houses that banks use and trust today. Trust by the banks in a new technology will take time, and even more time will be needed for that trust to trickle down to consumers.

Another company that may soon be ready to give CC’s and Blockchain a big boost is Amazon. It looks like Amazon is getting ready to launch their very own crypto currency. This is a company with revenues the size of a good-sized country, and they are in a position to issue a digital token that would be fully convertible with other CC’s, and fiat currencies too. A move like this would enable Amazon to:

- issue (AMAZON) coins to reward and incentivize developers on any of its platforms

- issue coins to consumers to use for in-app purchases

- issue coins to game players for in-game purchase of virtual goodies

- issue coins to regular customers as part of a loyalty programme

Amazon may have the ideal ecosystem of customers and partners to make this all happen. Worldwide they have about 300 million customer accounts, roughly the population of the USA, and they have 100,000 sellers on their platforms, with millions of items for sale. There is hardly a more mainstream company than Amazon, with a massive, vibrant economy all linked in. Amazon’s imminent entry into the world of CC’s may signal the adoption of blockchain technology by mainstream institutions on a large scale. What could be just around the corner if an AMAZON coin comes into play is the likes of a DISNEY Coin, a DELTA AIRLINES coin, a CARNIVAL CRUISES coin, a HOME DEPOT coin – you get the picture.

With Trend Disruptors, we strive to keep you up to date with the latest technology developments and investment strategies that lead to success.

Trend Disruptors Premium

On Friday our BUY signal was triggered for one of our favourite 5G companies. This is not one of the ‘wild west’ crypto coins, but a solid, very recognizable company that even pays a 4.80% dividend while we wait for the 5G revenues to build up. We rate this company as a strong buy today.

Our goal for Trend Disruptors & Trend Disruptors Premium is to help our subscribers understand and potentially reap great gains by being at the forefront of the coming disruptive technologies such as 5G, Artificial Intelligence, Virtual Reality, Augmented Reality, 5G, Blochchain, and of course the ‘wild west’ crypto world

If you are not yet a subscriber to Trend Disruptors Premium but are now ready to make a speculative investment into these disruptive technologies, we are re-opening our Special Offer to give our readers the opportunity to get started at a 25% discount, meaning you pay only $525.00. To take advantage of this special offer, click here

Stay Tuned!